Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you looking to donate your car in Oregon? Not only is it a generous act, but it can also lead to a tax deduction. However, understanding the deduction process can be confusing. In this article, we will break down the process of car donation deductions in Oregon and provide you with all the information you need to make an informed decision. So, let’s dive in and explore the world of car donations and tax deductions in Oregon!

If you donate a car in Oregon, you can claim a tax deduction for the fair market value of the vehicle. However, the deduction amount can’t exceed the selling price of the car if the charity sells it. If the charity uses the car for its operations or gives it to a needy individual or family, you can claim a deduction for the full fair market value of the car.

Contents

- What Is the Deduction for Donating a Car in Oregon?

- How Does the Deduction for Donating a Car Work in Oregon?

- What Are the Benefits of Donating a Car in Oregon?

- How Does Donating a Car in Oregon Compare to Selling It?

- What Are the Requirements for Donating a Car in Oregon?

- Can You Donate a Car Without a Title in Oregon?

- What Happens to Donated Cars in Oregon?

- How to Choose a Charity to Donate Your Car to in Oregon?

- Conclusion

- Frequently Asked Questions

What Is the Deduction for Donating a Car in Oregon?

Donating a car to a charity is a noble act that not only helps the community but also provides tax benefits to the donor. In Oregon, the deduction for donating a car is a bit different from other states. If you are planning to donate your car in Oregon, then it is essential to know how the deduction works.

How Does the Deduction for Donating a Car Work in Oregon?

When you donate a car in Oregon, you can claim a tax deduction for the fair market value of the vehicle. However, there are a few conditions that you need to meet to claim the deduction. Firstly, the charity you donate your car to must be a qualified organization recognized by the IRS. Secondly, you must itemize your deductions on your tax return to claim the donation.

The fair market value of the vehicle is determined by the charity you donate to. If the charity sells your car, it will send you a Form 1098-C within 30 days of the sale that states the amount it received for the vehicle. You can claim a deduction for that amount on your tax return.

What Are the Benefits of Donating a Car in Oregon?

Donating a car in Oregon has several benefits. Firstly, it helps the community by supporting charitable causes. Secondly, it provides tax benefits to the donor. You can claim a deduction for the fair market value of the vehicle, which can significantly reduce your tax liability. Additionally, donating a car is an easy way to get rid of an unwanted vehicle while doing some good for the community.

How Does Donating a Car in Oregon Compare to Selling It?

When deciding whether to donate or sell your car, there are a few factors to consider. If you sell your car, you will receive cash that you can use for any purpose. However, you will have to deal with the hassle of finding a buyer, negotiating a price, and completing the sale. Additionally, if your car is old or in poor condition, it might be challenging to find a buyer.

On the other hand, when you donate your car to a qualified charity in Oregon, you get the satisfaction of knowing that you are helping a good cause. Additionally, you can claim a tax deduction for the fair market value of the vehicle, which can be significant. Donating a car is also an easy way to get rid of an unwanted vehicle without the hassle of selling it.

What Are the Requirements for Donating a Car in Oregon?

To donate a car in Oregon, you need to meet a few requirements. Firstly, the charity you donate to must be a qualified organization recognized by the IRS. You can check the IRS website to see if a charity is qualified. Secondly, the vehicle you donate must be in good condition. Charities typically do not accept vehicles that are in poor condition or require significant repairs.

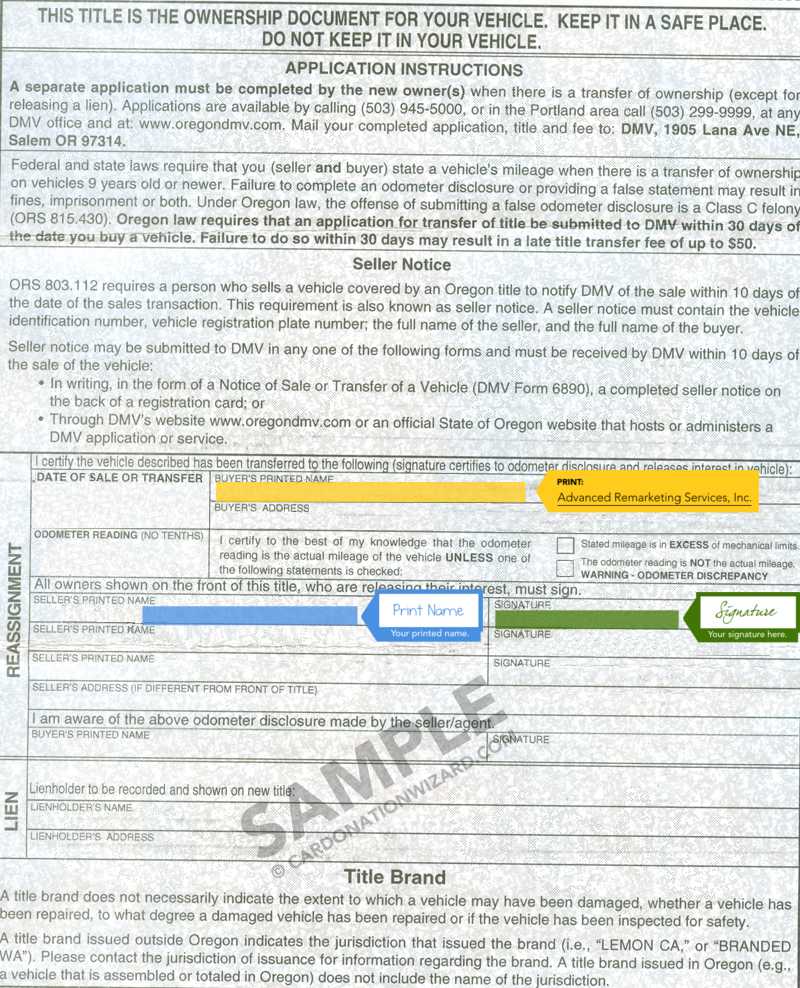

Additionally, you need to transfer the title of the vehicle to the charity. This involves signing over the title to the charity and notifying the DMV of the transfer. The charity will typically handle the paperwork for you, but you should confirm this before donating your car.

Can You Donate a Car Without a Title in Oregon?

In Oregon, you cannot donate a car without a title. The title is proof of ownership, and the DMV requires it to transfer ownership of the vehicle. If you have lost your title, you can apply for a replacement from the DMV. However, this can take some time, so it is best to start the process early if you plan to donate your car.

What Happens to Donated Cars in Oregon?

When you donate a car to a qualified charity in Oregon, the charity will typically sell the vehicle to raise funds for its programs. If the car is in good condition, the charity might use it for its operations. However, this is rare, and most charities sell donated cars.

After the sale, the charity will send you a Form 1098-C within 30 days of the sale that states the amount it received for the vehicle. You can claim a tax deduction for that amount on your tax return.

How to Choose a Charity to Donate Your Car to in Oregon?

Choosing the right charity to donate your car to in Oregon can be challenging. You want to make sure that your donation goes to a reputable organization that uses the funds effectively. You can research charities online to see how they use their funds and what their programs are.

Additionally, you can check if the charity is registered with the Oregon Department of Justice. The department maintains a database of charities that are registered to solicit donations in Oregon. You can also ask for recommendations from friends and family or consult with a tax professional.

Conclusion

Donating a car in Oregon is a great way to support charitable causes while receiving tax benefits. You can claim a deduction for the fair market value of the vehicle, which can significantly reduce your tax liability. Additionally, donating a car is an easy way to get rid of an unwanted vehicle without the hassle of selling it. However, you need to make sure that you donate to a qualified charity and meet the requirements for claiming the deduction.

Frequently Asked Questions

Donating a car to charity is a great way to give back to your community and receive a tax deduction. If you’re considering donating a car in Oregon, you may be wondering what kind of deduction you can expect. Here are five common questions and answers about the deduction for donating a car in Oregon.

1. How much can I deduct for donating a car in Oregon?

The amount you can deduct for donating a car in Oregon depends on the fair market value of the car. If the charity sells the car, you can deduct the sale price or fair market value, whichever is less. If the charity keeps the car and uses it for its own purposes, you can deduct the fair market value of the car.

It’s important to note that if the car is worth more than $500, you’ll need to include Form 1098-C with your tax return to claim the deduction. You’ll also need to have documentation from the charity that includes the date of the donation, the charity’s name and address, and a description of the car.

2. Can I donate any type of car?

Most charities accept donations of cars, trucks, and other vehicles, regardless of their condition. However, some charities may not accept certain types of cars, such as those that are inoperable or have significant damage. Before donating a car, it’s best to check with the charity to make sure it can accept your vehicle.

It’s also important to note that if the car is worth $5,000 or more, you’ll need to have the car appraised to determine its fair market value. You’ll also need to include a copy of the appraisal with your tax return.

3. Can I donate a car if I still owe money on it?

Yes, you can donate a car if you still owe money on it. However, you’ll need to pay off the loan before you can donate the car. If you owe more on the car than it’s worth, you may be able to negotiate with the lender to accept less than the full amount owed.

It’s also important to note that if you donate a car that you’ve owned for less than a year, the deduction you can claim is limited to the price the charity sells the car for, even if it’s worth more than that amount.

4. What happens to the car after I donate it?

After you donate a car, the charity will typically sell it to raise funds for its programs. In some cases, the charity may keep the car and use it for its own purposes. If the charity sells the car, it will provide you with a receipt that includes the sale price of the car.

If the charity keeps the car, it will provide you with a receipt that includes the fair market value of the car. It’s important to keep this receipt for your records, as it will be necessary when you file your tax return.

5. Can I choose which charity to donate my car to?

Yes, you can choose which charity to donate your car to. However, it’s important to make sure that the charity is a qualified 501(c)(3) organization. You can check the IRS’s website to see if a charity is qualified.

It’s also a good idea to research the charity before making a donation. Look for information about the charity’s programs, how it uses donations, and its financial health. You can also check with organizations like Charity Navigator or Guidestar to get more information about the charity.

In conclusion, donating a car in Oregon can have a significant impact on both the donor and the recipient. By donating a car, you can enjoy tax deductions and contribute to a worthy cause. It is important to research and choose a reputable charity organization to ensure your donation is put to good use.

Furthermore, donating a car can help make a positive difference in the lives of those in need. Your vehicle can be used to help transport individuals to work, medical appointments, and other important destinations. This can be a life-changing experience for those who may not have access to reliable transportation otherwise.

Overall, if you are considering donating a car in Oregon, it is a decision that can bring many benefits. From tax deductions to making a positive impact on someone’s life, donating a vehicle is a great way to give back to your community and help those in need.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts