Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Have you ever wondered what documents are needed to gift a car in Texas? Transferring ownership of a vehicle can be a complex process, but with the right information and forms, it can be a smooth transaction.

If you’re considering gifting a car in Texas, there are certain forms and steps you’ll need to take to ensure a legal transfer of ownership. In this article, we’ll guide you through the necessary paperwork and provide you with helpful tips to make the process as simple as possible.

To gift a car in Texas, you will need to complete a Texas title transfer form. This form can be obtained from the Texas Department of Motor Vehicles or downloaded online. You will also need to provide a signed gift declaration, proof of insurance, and a safety inspection certificate. Both the donor and the recipient must sign the title transfer form, and the recipient must pay any applicable fees.

What Forms Are Needed to Gift a Car in Texas?

Gifting a car in Texas can be a great way to show someone you care, but it’s important to follow the right steps to ensure that the transfer of ownership is legal and secure. To gift a car in Texas, you’ll need to complete several forms and submit them to the Department of Motor Vehicles (DMV). Here are the forms you’ll need and why they’re important.

Form 130-U: Application for Texas Title and/or Registration

The first form you’ll need to complete when gifting a car in Texas is Form 130-U. This form is used to transfer the title and registration of the vehicle to the new owner. It includes important information such as the make, model, and VIN of the car, as well as the names and addresses of both the current and new owners.

To complete this form, both the current and new owners will need to sign and date it. The current owner will also need to provide their signature and date of sale, as well as the sale price of the vehicle. Once completed, this form should be submitted to the DMV along with any required fees.

Form VTR-271: Vehicle Transfer Notification

Another important form to complete when gifting a car in Texas is Form VTR-271. This form is used to notify the DMV of the transfer of ownership and to remove the current owner’s liability for the vehicle. It should be completed and submitted within 30 days of the date of sale.

To complete this form, both the current and new owners will need to provide their names, addresses, and signatures. The current owner will also need to provide the date of sale and the sale price of the vehicle. Once completed, this form should be submitted to the DMV along with any required fees.

Bill of Sale

While a bill of sale is not strictly required to gift a car in Texas, it can be a helpful document to have in case of any disputes or questions about the transfer of ownership. A bill of sale is a legal document that outlines the details of the sale, including the names and addresses of both the current and new owners, the make and model of the vehicle, the sale price, and the date of sale.

To create a bill of sale, you can use a template or create your own document. Both the current and new owners should sign and date the document, and each should keep a copy for their records.

Other Considerations

In addition to completing the necessary forms, there are a few other things to keep in mind when gifting a car in Texas. First, make sure that the vehicle is in good condition and that all necessary repairs have been made before transferring ownership. This will help to ensure that the new owner is satisfied with the car and that there are no issues with the transfer of ownership.

You should also consider whether the new owner will need to register the vehicle in their name and obtain new plates. If so, they will need to visit the DMV in person and provide proof of insurance and identification.

Benefits of Gifting a Car in Texas

Gifting a car in Texas can be a great way to show someone you care, but it also has several benefits from a legal and financial perspective. For example, gifting a car can help to reduce your taxable estate and can be a way to transfer assets to loved ones without incurring gift taxes.

Additionally, gifting a car can be a way to avoid the hassle and expense of selling a vehicle. By gifting the car, you can transfer ownership quickly and easily without having to worry about advertising the vehicle, negotiating a price, or dealing with potential buyers.

Gifting vs. Selling a Car in Texas

While gifting a car in Texas can be a great option for many people, it’s important to understand the differences between gifting and selling a vehicle. When you sell a car, you will typically receive payment in exchange for the title and registration of the vehicle. This can be a good option if you need the money from the sale or if you want to ensure that you receive fair market value for the car.

On the other hand, gifting a car can be a way to transfer ownership without receiving payment. This can be a good option if you want to help a family member or friend who needs a car, or if you simply want to transfer ownership without any financial exchange. Keep in mind that gifting a car may have different tax implications than selling a car, so it’s important to consult with a tax professional before making any decisions.

Conclusion

Gifting a car in Texas can be a great way to show someone you care, but it’s important to follow the right steps to ensure that the transfer of ownership is legal and secure. By completing the necessary forms and considering the benefits and drawbacks of gifting a car, you can make sure that the process goes smoothly and that everyone involved is satisfied with the outcome.

Contents

- Frequently Asked Questions

- What forms are needed to gift a car in Texas?

- Do I need to have the car inspected before gifting it in Texas?

- Can I gift a car to a family member without paying taxes in Texas?

- What if I am gifting a car to someone who is not a family member?

- Can I gift a car if there is a lien on the title?

- How To Gift A Vehicle To Someone Without Paying Taxes

Frequently Asked Questions

When gifting a car in Texas, it is important to have all the necessary forms in place to ensure a smooth transfer of ownership. Here are some common questions and answers about the forms needed to gift a car in Texas.

What forms are needed to gift a car in Texas?

When gifting a car in Texas, there are a few forms that must be completed to transfer the ownership of the vehicle. First, the current vehicle owner must complete a Texas title transfer form (Form 130-U) and sign it in the presence of a notary public. The new owner must then take this form to the county tax office to transfer the title into their name.

In addition to the title transfer form, the new owner will also need to complete a vehicle registration application (Form VTR-130-U). This form will require the new owner to provide their personal information, as well as information about the vehicle, such as the make, model, and VIN number. The new owner will also need to provide proof of insurance and pay any applicable fees.

Do I need to have the car inspected before gifting it in Texas?

Yes, any vehicle being registered in the state of Texas must pass a safety inspection before it can be registered. This applies whether the vehicle is being gifted or sold. The safety inspection must be completed within 90 days of the registration date. Once the safety inspection is passed, the new owner can then take the necessary forms and proof of insurance to the county tax office to register the vehicle in their name.

It is important to note that the safety inspection is not the same as an emissions inspection. Emissions inspections are only required in certain counties in Texas, and only for vehicles that are more than two years old.

Can I gift a car to a family member without paying taxes in Texas?

Yes, under Texas law, you can gift a car to a family member without paying taxes on the transaction. To qualify for this exemption, the recipient of the gift must be a spouse, parent, child, or sibling of the donor. The recipient must also provide proof of their relationship to the donor, such as a birth certificate or marriage license.

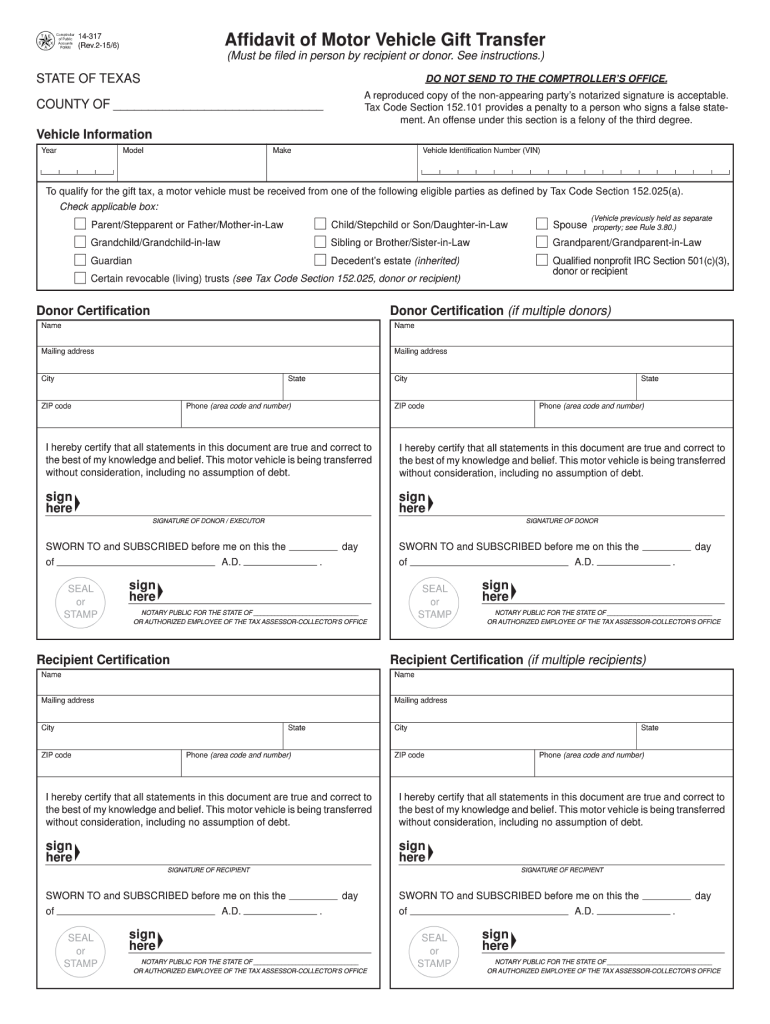

The donor must also complete a gift affidavit (Form 14-317) and have it notarized. This form must be presented to the county tax office along with the other necessary forms to transfer the title and register the vehicle in the recipient’s name.

What if I am gifting a car to someone who is not a family member?

If you are gifting a car to someone who is not a family member, you will need to pay taxes on the transaction. In Texas, the tax rate on a vehicle gift is 6.25% of the vehicle’s fair market value. The donor will need to complete a gift affidavit (Form 14-317) and have it notarized, and the new owner will need to provide proof of insurance and pay any applicable fees.

The new owner will also need to take the necessary forms to the county tax office to transfer the title and register the vehicle in their name. They will need to pay the applicable sales tax at that time.

Can I gift a car if there is a lien on the title?

If there is a lien on the title of the vehicle you are gifting, you will need to contact the lienholder to get their permission to transfer the title. If they agree to the transfer, they will need to complete a lien release form (Form VTR-266) and sign it in the presence of a notary public.

Once the lien is released, the donor can then complete the title transfer form (Form 130-U) and have it notarized. The new owner will need to take the necessary forms to the county tax office to transfer the title and register the vehicle in their name.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, giving a car as a gift in Texas involves a few essential forms that need to be completed correctly. The first is the gift declaration form, which confirms that the vehicle is being given as a gift and not sold. Secondly, the title transfer form will need to be filled out to transfer the ownership of the vehicle to the recipient. Finally, be sure to obtain a bill of sale as proof of the transaction.

While the process of gifting a car in Texas may seem overwhelming, completing the necessary forms correctly is crucial. Failure to do so could result in legal issues down the line. By ensuring that all the necessary forms are completed accurately and submitted on time, you will be able to give the gift of a car with ease and confidence.

In summary, gifting a car in Texas involves completing several forms to transfer ownership and confirm the gift. It is essential to ensure that all the information provided is accurate, and the forms are submitted on time. Following these steps will ensure a smooth transaction and a happy recipient.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts