Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Have you recently gifted or received a gifted car in Florida? Congratulations! However, before you can hit the road, there are some important forms you need to fill out.

Florida has specific requirements when it comes to gifting a car, and it’s crucial to follow them to ensure a smooth transfer of ownership. In this article, we’ll go over the necessary forms you need to fill out and the steps you need to take to get your gifted car on the road. So, let’s get started!

When gifting a car in Florida, you need to transfer the title to the new owner. To do so, you will need to fill out the title transfer section on the title certificate. You will also need to submit a gift affidavit that includes the vehicle’s make, model, year, and VIN. Additionally, the new owner will need to register the car and pay the necessary fees at the local tax collector’s office.

What Forms Are Necessary for a Gifted Car in Florida?

If you are planning to gift a car in Florida, there are certain forms that you need to fill out to make the transfer of ownership legal. The process can be quite overwhelming, but with the right guidance, you can complete it with ease. In this article, we will discuss the necessary forms required for gifting a car in Florida.

1. Bill of Sale

The Bill of Sale is a legal document that acts as evidence of the transaction between the buyer and the seller. It contains the details of the car, such as the make, model, year, and VIN. In Florida, the Bill of Sale is not mandatory, but it is recommended to have one to avoid any future disputes. The Bill of Sale also includes the purchase price, date of sale, and the names and addresses of the buyer and seller.

When gifting a car, the Bill of Sale should state that the car is a gift and the amount paid for it is zero. It is important to have both parties sign the document and keep a copy for their records.

2. Title Transfer

The Title Transfer is a legal document that transfers the ownership of the car from the seller to the buyer. In Florida, the process can be completed online, in person, or by mail. When gifting a car, the process is similar to selling a car, except that the amount paid for the car is zero.

To transfer the title, the seller must sign the title and write “gift” in the sales price section. The buyer must also sign the title and fill out the application for title transfer. The application requires the buyer’s name, address, and driver’s license number.

3. Notice of Sale

The Notice of Sale is a document that notifies the Florida Department of Highway Safety and Motor Vehicles (DHSMV) that the car has been sold or transferred. It is required by law to submit the Notice of Sale within 30 days of the transaction.

When gifting a car, the seller must complete the Notice of Sale and submit it to the DHSMV. The buyer is not required to submit the document.

4. Registration

The Registration is a legal document that proves that the car has been registered with the DHSMV. In Florida, the registration process can be completed online, in person, or by mail.

When gifting a car, the registration process is similar to buying a car. The buyer must provide proof of insurance, the title, and the application for registration. The application requires the buyer’s name, address, and driver’s license number.

5. Sales Tax

In Florida, sales tax is not required when gifting a car. However, if the car was purchased from a dealer, the dealer is required to collect the sales tax.

When gifting a car, the Bill of Sale should state that the car is a gift and the amount paid for it is zero. If the car was purchased from a dealer, the dealer must provide a gift affidavit.

6. Emissions Inspection

In Florida, emissions inspections are not required for most vehicles. However, if the car is registered in certain counties, an emissions inspection may be required.

When gifting a car, the emissions inspection process is similar to buying a car. The buyer must have the car inspected and provide the certificate of inspection to the DHSMV.

7. Insurance

In Florida, insurance is mandatory for all cars. When gifting a car, the buyer must provide proof of insurance before registering the car.

8. Benefits of Gifting a Car

Gifting a car can have several benefits, such as avoiding sales tax and simplifying the transfer of ownership process. It is also a great way to show appreciation or support to a loved one.

Pros:

- Avoids sales tax

- Easy transfer of ownership

- Shows appreciation or support

Cons:

- May require additional paperwork

- May require emissions inspection

9. Gifting vs Selling a Car

Gifting a car is different from selling a car in several ways. When selling a car, the seller must pay sales tax and may receive payment for the car. When gifting a car, the seller does not pay sales tax and does not receive payment for the car.

Gifting a car can be a great option for people who want to transfer ownership without the hassle of paying sales tax or receiving payment.

10. Conclusion

Gifting a car in Florida requires several forms, such as the Bill of Sale, Title Transfer, Notice of Sale, Registration, and insurance. It is important to follow the proper procedures to make the transfer of ownership legal. Gifting a car can have several benefits, such as avoiding sales tax and simplifying the transfer of ownership process.

Contents

- Frequently Asked Questions

- What documents are required for a gifted car in Florida?

- What is the purpose of Form HSMV 82040?

- What is Form HSMV 82042 used for?

- Is a bill of sale required for a gifted car in Florida?

- How much does it cost to transfer the title of a gifted car in Florida?

- How To Gift A Vehicle To Someone Without Paying Taxes

Frequently Asked Questions

In Florida, gifted cars are subject to certain regulations and requirements. To ensure a smooth and hassle-free process, it is essential to understand the necessary forms and documents required for a gifted car. Here are some of the most frequently asked questions about the forms necessary for a gifted car in Florida.

What documents are required for a gifted car in Florida?

When gifting a car in Florida, the following documents are required:

1. A valid Florida driver’s license or identification card for both the donor and the recipient.

2. The vehicle’s title, properly signed and transferred to the recipient.

3. A bill of sale, if applicable.

4. Form HSMV 82040, the Application for Certificate of Title With/Without Registration.

5. Form HSMV 82042, the Statement of Non-Dealer Transfer of Motor Vehicle and Boat.

6. Form HSMV 82050, the Notice of Sale and/or Bill of Sale for a Motor Vehicle, Mobile Home, Off-Highway Vehicle, or Vessel.

7. Payment for the title transfer fee, sales tax, and registration fee (if applicable).

It is important to ensure that all the necessary documents are properly completed and submitted to the Florida Department of Highway Safety and Motor Vehicles (DHSMV) in a timely manner.

What is the purpose of Form HSMV 82040?

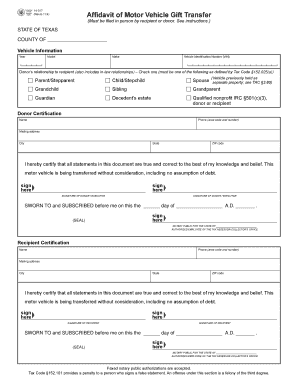

Form HSMV 82040, the Application for Certificate of Title With/Without Registration, is the primary form required for the transfer of ownership of a gifted car in Florida. This form is used to apply for a new certificate of title and registration, if applicable, for the gifted vehicle. The form requires information about the vehicle, the donor, and the recipient, as well as the transfer of ownership details.

It is important to ensure that this form is properly completed and signed by both the donor and the recipient, as well as notarized, if required. This form must be submitted to the DHSMV along with the other required documents and fees.

What is Form HSMV 82042 used for?

Form HSMV 82042, the Statement of Non-Dealer Transfer of Motor Vehicle and Boat, is used to confirm that the transfer of ownership of a gifted car in Florida is a non-dealer transaction. This form is required for all non-dealer transfers of ownership, including gifted vehicles.

The form requires information about the vehicle, the donor, and the recipient, as well as the transfer of ownership details. It must be signed by both the donor and the recipient, and notarized, if required. This form must be submitted to the DHSMV along with the other required documents and fees.

Is a bill of sale required for a gifted car in Florida?

A bill of sale is not required for a gifted car in Florida, but it is recommended. A bill of sale is a legal document that confirms the transfer of ownership and provides details about the vehicle, the donor, and the recipient. It can be used as proof of ownership and can help prevent any future disputes or issues.

If a bill of sale is used for a gifted car in Florida, it must be properly completed and signed by both the donor and the recipient. It is not a substitute for the other required forms and documents, but rather an additional document that can help ensure a smooth and successful transfer of ownership.

How much does it cost to transfer the title of a gifted car in Florida?

The cost to transfer the title of a gifted car in Florida varies based on several factors, including the vehicle’s weight, the recipient’s county of residence, and whether or not the vehicle is registered. However, as of 2021, the basic title transfer fee is $75.25, and the registration fee varies based on the vehicle’s weight and the recipient’s county of residence.

In addition to these fees, sales tax may also be due based on the fair market value of the gifted vehicle. It is important to check with the DHSMV or a local tax collector’s office to confirm the exact fees and requirements for transferring the title of a gifted car in Florida.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, owning a gifted car in Florida requires a few necessary forms to be completed. Firstly, the title transfer form, also known as the HSMV 82040, must be filled out and signed by both the donor and the recipient. This form serves as proof of ownership and is required by the Florida Department of Highway Safety and Motor Vehicles.

Secondly, a bill of sale is also required to document the transfer of ownership and the value of the gifted vehicle. This form should include the names of both parties, the date of the transfer, and the vehicle’s make, model, and VIN number.

Finally, the recipient of the gifted car must also complete the registration process by submitting the title transfer form, bill of sale, proof of insurance, and payment of any applicable fees to the Florida Department of Highway Safety and Motor Vehicles. Once all the necessary forms are submitted and the fees are paid, the recipient will receive a new registration and title for their gifted car.

Overall, the process of gifting a car in Florida may require a few forms, but it is a relatively straightforward process. By completing the necessary paperwork and submitting it to the appropriate authorities, you can ensure a smooth and legal transfer of ownership for your gifted vehicle.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts