Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Giving or receiving a vehicle as a gift is always an exciting experience. But, before you hit the road, it’s essential to understand the tax implications of gifting a vehicle in Texas. Texas is known for having one of the highest tax rates in the country, and the taxes on gifted vehicles are no exception. In this article, we’ll explore what taxes you can expect to pay when gifting or receiving a vehicle in Texas. So, buckle up, and let’s dive in!

In Texas, when a vehicle is gifted to another person, the recipient must pay a $10 Gift Tax. Additionally, if the vehicle is being transferred between family members, there may be exemptions available for certain taxes. However, if the vehicle is being sold, the recipient will be responsible for paying the standard Texas sales tax, which is 6.25% of the sales price or the standard presumptive value, whichever is higher.

Contents

- Understanding the Taxes on a Gifted Vehicle in Texas

- Frequently Asked Questions

- What taxes do I need to pay on a gifted vehicle in Texas?

- What documents do I need to provide when receiving a gifted vehicle in Texas?

- Can I transfer the license plates from my old vehicle to a gifted vehicle in Texas?

- What happens if I do not pay the required taxes on a gifted vehicle in Texas?

- Can I receive a refund for the taxes I paid on a gifted vehicle in Texas?

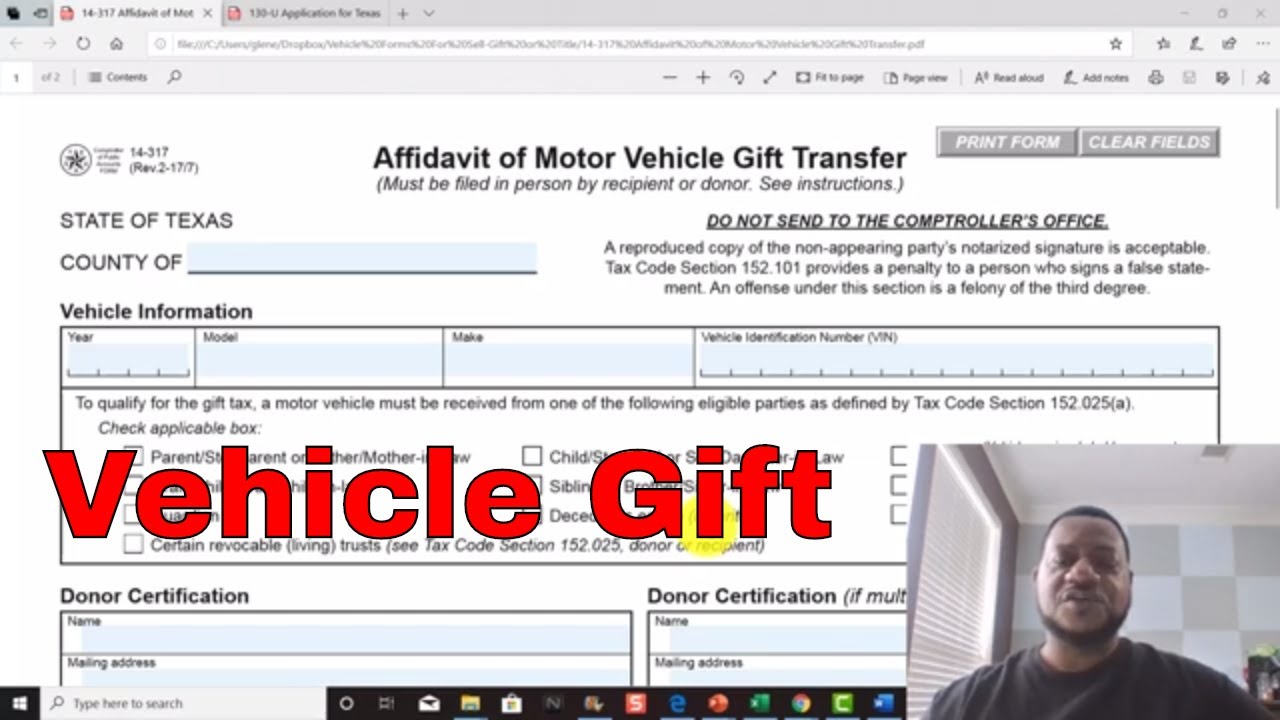

- Gift a vehicle without paying sales tax – Gift Tax $10 – Form 14-317 – Save Tax Money

Understanding the Taxes on a Gifted Vehicle in Texas

Definition of a Gifted Vehicle

A gifted vehicle is a vehicle that is transferred from one individual to another without any monetary compensation. This means that there is no exchange of money between the parties involved in the transaction. A gifted vehicle can be given to a family member or a friend, and it can also be donated to a charity organization.

It is important to note that a gifted vehicle is not the same as a vehicle that is sold for a nominal price. In Texas, if a vehicle is sold for less than its fair market value, it is still considered a sale, and the appropriate taxes and fees must be paid.

Tax Exemptions for Gifted Vehicles

In Texas, there are certain exemptions that apply to gifted vehicles. If the vehicle is gifted between family members, such as a parent and a child, or between spouses, no taxes are due on the transfer. Similarly, if the vehicle is gifted to a charitable organization, no taxes are due.

However, if the vehicle is gifted to a friend or any other individual who is not a family member, taxes must be paid on the fair market value of the vehicle. The taxes are based on the county where the vehicle is registered, and they can range from 6.25% to 8.25% of the vehicle’s value. Additionally, there may be a title transfer fee that must be paid to the Texas Department of Motor Vehicles.

Calculating Taxes on Gifted Vehicles

The taxes on a gifted vehicle are calculated based on the fair market value of the vehicle. The fair market value is determined by the Texas Department of Motor Vehicles, and it is based on the average retail value of the vehicle. The taxes are then calculated based on the tax rate in the county where the vehicle is registered.

For example, if the fair market value of a gifted vehicle is $20,000, and the tax rate in the county where the vehicle is registered is 6.25%, the taxes due on the transfer would be $1,250.

Benefits of Gifting a Vehicle

- Gifting a vehicle can be a great way to help out a family member or a friend who may be in need of a car.

- It can also be a way to support a charitable organization that is doing important work in the community.

- Gifting a vehicle can also be a way to avoid paying taxes on the sale of a vehicle, which can save you money in the long run.

Gifting vs Selling a Vehicle

When deciding whether to gift or sell a vehicle, there are several factors to consider. If you sell a vehicle, you will receive money in exchange for the vehicle, which can be used to purchase a new vehicle or for other expenses. However, you will also be required to pay taxes on the sale, which can be a significant expense.

On the other hand, if you gift a vehicle, you will not receive any money in exchange for the vehicle. However, you may be able to save money on taxes, especially if you are gifting the vehicle to a family member or a charitable organization.

Transferring Ownership of a Gifted Vehicle

When transferring ownership of a gifted vehicle, there are several steps that must be taken. The first step is to complete the title transfer process with the Texas Department of Motor Vehicles. This involves completing the appropriate forms and paying any required fees.

Once the title transfer process is complete, the new owner of the vehicle will need to register the vehicle with the Texas Department of Motor Vehicles. This involves paying any applicable taxes and fees, and obtaining new license plates and registration stickers.

Conclusion

Gifting a vehicle can be a great way to help out a family member or a friend, or to support a charitable organization. However, it is important to understand the tax implications of a gifted vehicle, and to follow the appropriate procedures for transferring ownership of the vehicle. By following these steps, you can ensure a smooth and hassle-free transfer of ownership.

Frequently Asked Questions

When you receive a gifted vehicle in Texas, you may be wondering what taxes you need to pay. Here are some common questions and answers regarding taxes on gifted vehicles in Texas.

What taxes do I need to pay on a gifted vehicle in Texas?

In Texas, there is no gift tax. However, if you receive a gifted vehicle, you will need to pay sales tax on the fair market value of the vehicle. The sales tax rate in Texas is 6.25%, but local taxes may also apply. You can calculate the sales tax using the fair market value of the vehicle, which is determined by the county tax assessor’s office.

It is important to note that if the person gifting you the vehicle is a nonresident of Texas, you may need to pay additional fees and taxes. It is recommended that you consult with a tax professional or the Texas Department of Motor Vehicles for more information.

What documents do I need to provide when receiving a gifted vehicle in Texas?

When receiving a gifted vehicle in Texas, you will need to provide several documents to the Texas Department of Motor Vehicles. These documents include a signed and notarized title transfer form, an application for Texas title and registration, and proof of insurance. You will also need to pay the applicable sales tax and registration fees.

If the vehicle is more than 25 years old, you may be exempt from the title transfer fee. Additionally, if the vehicle is a gift from an immediate family member, you may be exempt from paying the gift tax.

Can I transfer the license plates from my old vehicle to a gifted vehicle in Texas?

In Texas, you may be able to transfer your license plates from your old vehicle to a gifted vehicle. However, the eligibility for plate transfer will depend on several factors, such as the type of vehicle and the status of your registration. You should contact the Texas Department of Motor Vehicles for more information on transferring license plates.

If you cannot transfer your license plates, you will need to obtain new plates and registration for the gifted vehicle. This process will require you to provide the necessary documents and pay the applicable fees and taxes.

What happens if I do not pay the required taxes on a gifted vehicle in Texas?

If you do not pay the required taxes on a gifted vehicle in Texas, you may face penalties and fines. Additionally, you may not be able to register the vehicle or obtain license plates until the taxes and fees are paid in full.

If you are unsure about the taxes and fees that apply to your gifted vehicle, it is recommended that you consult with a tax professional or the Texas Department of Motor Vehicles for guidance.

Can I receive a refund for the taxes I paid on a gifted vehicle in Texas?

If you paid taxes on a gifted vehicle in Texas, you may be eligible for a refund under certain circumstances. For example, if you later find out that the fair market value of the vehicle was lower than the amount you paid taxes on, you may be able to request a refund for the difference.

To request a refund, you will need to provide documentation that supports your claim, such as a professional appraisal or a bill of sale. It is recommended that you consult with a tax professional or the Texas Department of Motor Vehicles for more information on requesting a refund for taxes paid on a gifted vehicle.

Gift a vehicle without paying sales tax – Gift Tax $10 – Form 14-317 – Save Tax Money

In conclusion, the taxes on a gifted vehicle in Texas can be a bit confusing. It is important to understand that the tax amount will depend on various factors such as the relationship between the donor and the recipient, the value of the vehicle, and the location of the transaction. However, there are ways to reduce the tax burden, such as transferring the vehicle as part of an inheritance or using a gift tax exemption.

Before gifting a vehicle or accepting a gifted vehicle, it is recommended to consult with a tax professional or the Texas Department of Motor Vehicles to ensure that all the necessary taxes and paperwork are handled correctly. Failure to do so could result in penalties and legal issues.

Overall, while taxes on a gifted vehicle in Texas can be complex, with the right knowledge and guidance, it is possible to navigate the process smoothly and enjoy the gift of a new vehicle without any unexpected financial surprises.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts