Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

If you’re planning to gift a motor vehicle to someone in Texas, you might be wondering if there’s a gift tax involved. The good news is that Texas doesn’t have a gift tax, but there are still some things you should know before you hand over the keys.

Firstly, it’s important to understand that while Texas doesn’t have a gift tax, the Internal Revenue Service (IRS) still has rules regarding gifts that apply to all states. Additionally, depending on the value of the vehicle, you may need to provide documentation or pay fees when transferring the title. In this article, we’ll explore the details of gifting a motor vehicle in Texas and what you need to know to ensure a smooth transaction.

Yes, Texas imposes a gift tax on the transfer of a motor vehicle. The gift tax is based on the fair market value of the vehicle and is typically paid by the person receiving the gift. However, some exemptions may apply, such as gifts between spouses or to a charity. It’s important to consult with a tax professional for guidance on your specific situation.

Contents

- Is There a Gift Tax for Texas Motor Vehicle?

- Frequently Asked Questions

- Is there a gift tax for Texas motor vehicle?

- How is the gift tax assessment calculated in Texas?

- Can the gift tax assessment be avoided in Texas?

- Is the gift tax assessment deductible on federal income tax returns?

- What is the deadline for paying the gift tax assessment in Texas?

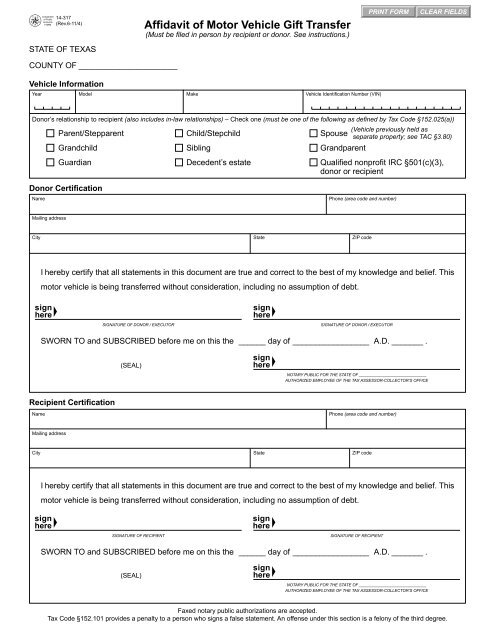

- Gift a vehicle without paying sales tax – Gift Tax $10 – Form 14-317 – Save Tax Money

Is There a Gift Tax for Texas Motor Vehicle?

Giving a motor vehicle as a gift can be a kind gesture, but it can also come with unexpected tax implications. If you’re giving a car as a gift in Texas, you may be wondering if there’s a gift tax that you need to be aware of. In this article, we’ll explore the gift tax laws in Texas and what you need to know before giving a motor vehicle as a gift.

Understanding the Gift Tax in Texas

When it comes to giving a gift in Texas, the state does not have a gift tax. This means that you won’t be required to pay any gift tax to the state of Texas when giving a motor vehicle as a gift. However, it’s important to note that there are still federal gift tax laws that you need to be aware of.

Under federal law, you are allowed to give up to $15,000 per year to an individual without having to pay gift tax. If the value of the gift exceeds $15,000, you’ll need to file a gift tax return with the IRS. However, you won’t actually owe any gift tax until you’ve given away more than $11.58 million in your lifetime.

Transferring Ownership of a Motor Vehicle in Texas

Giving a motor vehicle as a gift in Texas also requires that you transfer ownership of the vehicle to the recipient. To do this, you’ll need to fill out the necessary paperwork and pay a fee to the Texas Department of Motor Vehicles. The fee for transferring ownership of a motor vehicle in Texas is $28, but may vary depending on the county you’re in. It’s important to note that the recipient of the gift will also be responsible for paying the necessary taxes and fees associated with registering the vehicle.

To transfer ownership of a motor vehicle in Texas, you’ll need to provide the following documents:

- Vehicle title

- Application for Texas Title and/or Registration (Form 130-U)

- Bill of sale or vehicle gift letter

- Proof of insurance

- Vehicle inspection report (if applicable)

The Benefits of Giving a Motor Vehicle as a Gift

Giving a motor vehicle as a gift can be a generous and thoughtful gesture. It can also come with some benefits, such as:

- Tax deductions: If you donate a vehicle to a qualified charitable organization, you may be able to claim a tax deduction on your federal income tax return.

- Reduced insurance costs: If the recipient of the gift is a family member, they may be able to add the vehicle to their existing insurance policy at a lower rate than if they were to purchase a new vehicle.

- Eliminating the hassle of selling the vehicle: Giving a vehicle as a gift can eliminate the need to sell the vehicle, which can save time and hassle.

Gift Tax vs. Inheritance Tax

It’s important to note that gift tax and inheritance tax are not the same thing. While gift tax applies to the giver of the gift, inheritance tax applies to the recipient of an inheritance. In Texas, there is no inheritance tax. However, if you receive an inheritance from someone who lived in a state that does have an inheritance tax, you may be required to pay taxes on the inheritance.

Conclusion

Giving a motor vehicle as a gift in Texas can be a wonderful gesture. While there is no gift tax in Texas, it’s important to be aware of federal gift tax laws and the process for transferring ownership of a vehicle. By following the necessary steps and understanding the potential benefits, you can give a gift that is both thoughtful and practical.

Frequently Asked Questions

Is there a gift tax for Texas motor vehicle?

Yes, there is a gift tax for Texas motor vehicle. In Texas, the gift tax is called the “gift tax assessment” and is applicable when a vehicle is given as a gift to another individual. The gift tax assessment is calculated based on the fair market value of the vehicle at the time of the gift.

However, there are some exceptions to the gift tax assessment. If the gift is given to a spouse, parent, or child, then the gift tax assessment does not apply. Additionally, if the gift is given to a nonprofit organization, the gift tax assessment does not apply.

How is the gift tax assessment calculated in Texas?

The gift tax assessment in Texas is calculated based on the fair market value of the vehicle at the time of the gift. The fair market value is the price that a willing buyer would pay and a willing seller would accept for the vehicle, with neither party being under any compulsion to buy or sell.

The gift tax assessment rate in Texas is 6.25% of the vehicle’s fair market value. For example, if the fair market value of the gifted vehicle is $10,000, then the gift tax assessment would be $625.

Can the gift tax assessment be avoided in Texas?

Yes, the gift tax assessment can be avoided in Texas. One way to avoid the gift tax assessment is by transferring the vehicle as an inheritance rather than as a gift. Inheritance transfers are not subject to the gift tax assessment in Texas.

Another way to avoid the gift tax assessment is by transferring the vehicle to a spouse, parent, or child. Transfers to immediate family members are exempt from the gift tax assessment in Texas.

Is the gift tax assessment deductible on federal income tax returns?

No, the gift tax assessment is not deductible on federal income tax returns. The gift tax assessment is a state tax and is not deductible as a charitable contribution or as a state and local tax deduction on federal income tax returns.

However, if the gifted vehicle is donated to a qualified charitable organization, the donor may be eligible for a federal income tax deduction. The amount of the deduction will depend on the fair market value of the vehicle at the time of the donation.

What is the deadline for paying the gift tax assessment in Texas?

The deadline for paying the gift tax assessment in Texas is 30 days from the date of the gift. If the gift tax assessment is not paid within the 30-day deadline, penalties and interest may accrue.

It is important to note that the responsibility for paying the gift tax assessment falls on the donor, not the recipient of the gifted vehicle. The recipient is not responsible for paying the gift tax assessment in Texas.

Gift a vehicle without paying sales tax – Gift Tax $10 – Form 14-317 – Save Tax Money

In conclusion, it is important to understand the gift tax laws in Texas before transferring ownership of a motor vehicle. While Texas does not have a specific gift tax, there are still federal gift tax laws that may apply. It is important to consult with a tax professional or attorney to understand the tax implications and requirements for gifting a motor vehicle in Texas.

Overall, gifting a motor vehicle can be a thoughtful and generous gesture, but it is important to be aware of any potential tax implications. By taking the time to understand the gift tax laws in Texas and seeking the advice of a professional, you can ensure that your gift is given with intention and without any unexpected financial consequences.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts