Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you considering donating your vehicle to a charity? If so, you may have heard the term “in-kind donation” thrown around. But what exactly does that mean, and is a vehicle donation considered an in-kind donation? In this article, we’ll explore the definition of in-kind donations and whether or not your vehicle donation fits the bill.

Yes, a vehicle donation is considered an in-kind donation. In-kind donations are non-monetary contributions of goods or services, and a vehicle donation falls under this category. When you donate a vehicle, the charity can either use it for their own purposes or sell it to raise funds. In either case, the value of the vehicle is considered an in-kind donation and can be tax-deductible for the donor.

Is a Vehicle Donation an In-Kind Donation?

Donating a vehicle to a charitable organization can be a noble and generous act. It can be a great way to give back to society while also getting rid of a vehicle that you no longer need. However, many people are confused about whether a vehicle donation is considered an in-kind donation. In this article, we will explore the difference between a vehicle donation and an in-kind donation.

What is an In-Kind Donation?

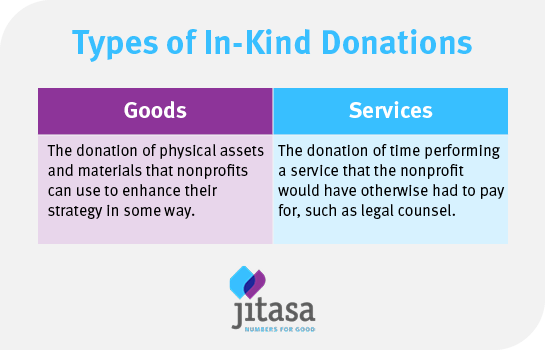

An in-kind donation is a non-monetary donation made to a charitable organization. This type of donation can include items such as clothing, food, furniture, and other goods. In-kind donations are typically tax-deductible and can be a great way to give back to society without giving money.

When you make an in-kind donation, you are giving something of value to a charitable organization. The organization can then use the donated goods to further its mission and help those in need. In-kind donations can be a great way to support a cause that you are passionate about.

What is a Vehicle Donation?

A vehicle donation is a donation of a vehicle to a charitable organization. This type of donation can include cars, trucks, boats, and other types of vehicles. Vehicle donations are typically tax-deductible and can be a great way to get rid of a vehicle that you no longer need while also supporting a charitable cause.

When you donate a vehicle, the charitable organization can either use the vehicle for its own purposes or sell it to raise funds for its programs. Either way, your donation can make a difference in the lives of others.

Is a Vehicle Donation Considered an In-Kind Donation?

While a vehicle donation is a type of non-monetary donation, it is not considered an in-kind donation. In-kind donations typically refer to donations of goods or services, while vehicle donations are a separate category.

However, vehicle donations are still tax-deductible and can be a great way to support a charitable cause. When you donate a vehicle, you are still giving something of value to a charitable organization and helping to further its mission.

The Benefits of Vehicle Donations

There are several benefits to donating a vehicle to a charitable organization. First and foremost, your donation can make a difference in the lives of others. The charitable organization can use the vehicle to further its mission or sell it to raise funds for its programs.

In addition, donating a vehicle can be a great way to get rid of a vehicle that you no longer need. You can avoid the hassle of selling the vehicle yourself and may even be able to get a tax deduction for your donation.

Vehicle Donations vs. Cash Donations

When it comes to charitable giving, there are many options available. While vehicle donations are a great way to support a charitable cause, they are not the only option. Cash donations can also be a great way to support a cause that you are passionate about.

One benefit of cash donations is that they are typically tax-deductible to a greater extent than vehicle donations. In addition, cash donations can be used immediately by the charitable organization to further its mission.

How to Donate a Vehicle

If you are interested in donating a vehicle to a charitable organization, there are several steps that you can take. First, research charitable organizations that accept vehicle donations. Make sure that the organization is reputable and that your donation will be put to good use.

Next, contact the organization to find out what the donation process entails. You may need to provide information about the vehicle, such as its make, model, and condition. The organization may also need to arrange for the vehicle to be picked up.

Conclusion

While a vehicle donation is not considered an in-kind donation, it is still a great way to support a charitable cause. By donating a vehicle, you can make a difference in the lives of others while also getting rid of a vehicle that you no longer need. If you are interested in donating a vehicle, be sure to research reputable charitable organizations and follow the donation process carefully.

Frequently Asked Questions

Is a Vehicle Donation an In-Kind Donation?

Yes, a vehicle donation is considered an in-kind donation. In-kind donations are donations of goods or services instead of money. When you donate a vehicle, you are giving a physical item rather than a cash donation. The value of the vehicle is then determined and recorded as an in-kind donation.

It’s important to note that the value of the vehicle is not the same as the amount of money the charity will receive when it is sold. The charity will typically sell the vehicle and use the proceeds to fund their programs and services. The value of the donation is based on the fair market value of the vehicle at the time of the donation.

What Are the Benefits of Donating a Vehicle?

Donating a vehicle can have several benefits. First, it allows you to support a cause that you care about. Many charities accept vehicle donations, so you can choose a charity that aligns with your values. Second, donating a vehicle can provide you with a tax deduction. The value of the vehicle donation can be deducted from your taxable income, which can lower your tax bill. Third, donating a vehicle can be an easy way to get rid of a vehicle that you no longer want or need.

Before you donate your vehicle, be sure to research the charity to make sure it is reputable and that your donation will be used effectively. You should also determine the fair market value of the vehicle to ensure that you receive the appropriate tax deduction.

What Types of Vehicles Can I Donate?

You can donate many different types of vehicles, including cars, trucks, motorcycles, boats, and RVs. Some charities may also accept other types of vehicles, such as airplanes or farm equipment. The condition of the vehicle may also vary. Some charities will accept vehicles that are not in working condition, while others may only accept vehicles that are in good condition.

Before you donate your vehicle, be sure to check with the charity to ensure that they accept the type of vehicle you want to donate. You should also check to see if there are any restrictions on the condition of the vehicle.

How Do I Donate a Vehicle?

The process of donating a vehicle will vary depending on the charity you choose. In general, you will need to provide some basic information about the vehicle, such as the make, model, and year. You will also need to provide the vehicle’s title and registration information. Once you have provided this information, the charity will typically make arrangements to pick up the vehicle.

Before you donate your vehicle, be sure to research the charity to ensure that it is reputable and that your donation will be used effectively. You should also determine the fair market value of the vehicle to ensure that you receive the appropriate tax deduction.

How Is the Value of My Vehicle Donation Determined?

The value of your vehicle donation is determined based on the fair market value of the vehicle at the time of the donation. The fair market value is the price that a willing buyer would pay and a willing seller would accept for the vehicle, when neither is under any compulsion to buy or sell and both have reasonable knowledge of the relevant facts.

If the charity sells the vehicle for more than $500, you will receive a Form 1098-C from the charity within 30 days of the sale. This form will provide you with the information you need to claim your tax deduction. If the charity sells the vehicle for less than $500, you can claim the fair market value of the vehicle at the time of the donation.

In conclusion, donating a vehicle can be a great way to support a cause or charity that you care about. While some people may consider it an in-kind donation, technically it falls under the category of a non-cash charitable contribution. However, the most important thing is that your donation can make a difference in the lives of those in need, whether it be through funding programs or directly providing transportation for those who lack it. So, if you have a vehicle that you no longer need, consider donating it to a worthy cause and make a positive impact in your community.

Furthermore, donating a vehicle can also have financial benefits for the donor. Depending on the value of the vehicle and the organization it is donated to, the donor may be eligible for a tax deduction. However, it is important to follow the proper procedures and documentation to ensure that the donation is valid and eligible for tax benefits.

Overall, a vehicle donation may not technically be considered an in-kind donation, but it can still be a valuable way to support a charity or cause. By donating a vehicle, you can make a positive impact and potentially receive financial benefits as well. So, if you are considering donating a vehicle, do some research on organizations in your area and make a difference in the lives of others.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts