Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you planning to gift your car to someone in Texas? If so, you may need to transfer the car title to their name. This process can seem daunting, but with the right knowledge and guidance, it can be a smooth and straightforward process. In this article, we will guide you through the steps required to transfer a car title in Texas as a gift, so you can ensure that the process is completed correctly and legally.

How to Transfer Car Title in Texas Gift?

Transferring a car title in Texas can be a bit confusing, especially if you are gifting or receiving the car. In this article, we will discuss the steps you need to take to transfer a car title in Texas as a gift.

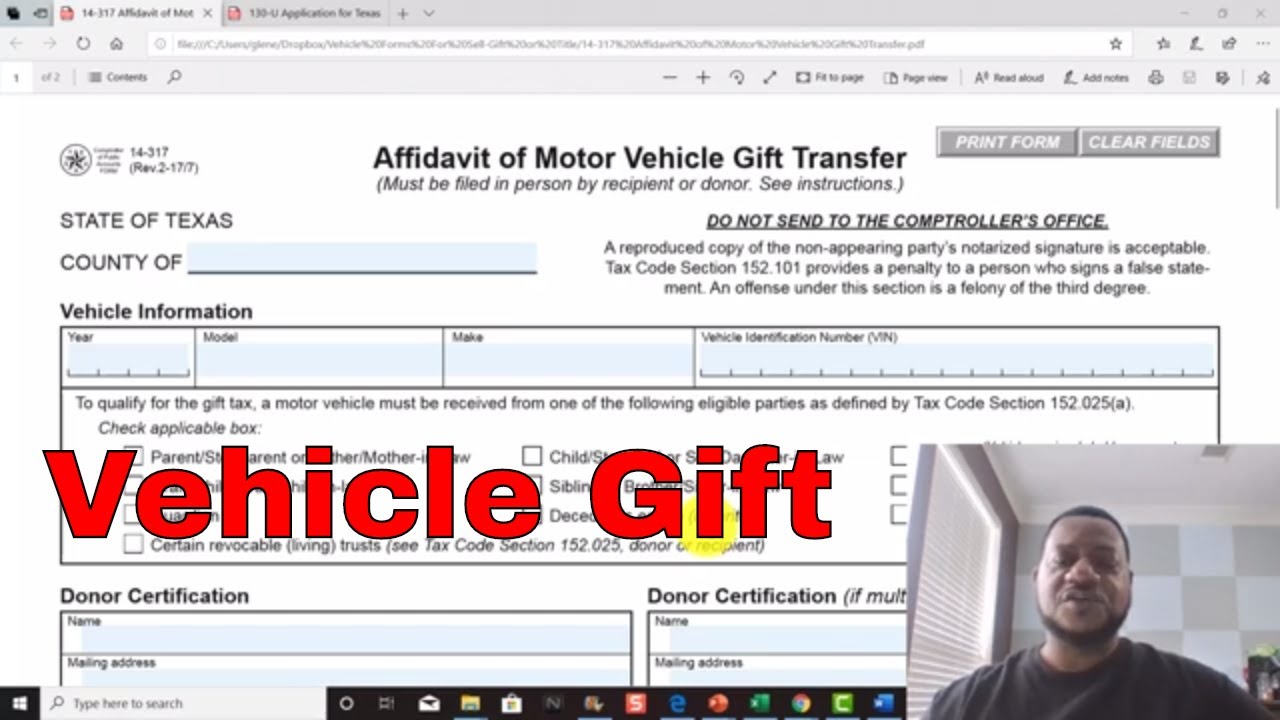

Step 1: Fill Out the Title Transfer Forms

The first step in transferring a car title in Texas is to fill out the appropriate forms. You will need to fill out the Application for Texas Title and/or Registration (Form 130-U) and the Texas Motor Vehicle Transfer Notification (Form VTR-346).

On the Form 130-U, you will need to indicate that the transfer is a gift and provide the recipient’s information. On the Form VTR-346, you will need to provide the donor’s information and indicate that the transfer is a gift.

Step 2: Get the Car Inspected

Before the transfer can be completed, the car must pass a safety inspection. This inspection can be done at any certified Texas Department of Public Safety inspection station.

Once the car has passed inspection, you will receive a Vehicle Inspection Report (VIR) that you will need to keep for your records.

Step 3: Complete the Title Transfer

Once you have filled out the appropriate forms and the car has passed inspection, you can complete the title transfer. You will need to take the following documents to your local county tax office:

– The completed Form 130-U

– The completed Form VTR-346

– The Vehicle Inspection Report (VIR)

– Proof of insurance

– The current title

At the county tax office, you will need to pay the appropriate fees and taxes. The fees can vary depending on the county, so be sure to check with your local office for the exact amount.

Step 4: Register the Car

After the title transfer is complete, you will need to register the car with the Texas Department of Motor Vehicles (DMV). You will need to provide the following documents:

– The new title

– Proof of insurance

– The registration application (Form VTR-130-U)

– The Vehicle Inspection Report (VIR)

Once you have submitted the necessary documents and paid the registration fees, you will receive your new registration sticker and license plates.

Benefits of Gifting a Car Title in Texas

Gifting a car title in Texas can have several benefits. Firstly, it can be a great way to show someone that you care about them. Secondly, it can help you avoid paying sales tax on the car. In Texas, there is no sales tax on gifts, so you can save money by gifting the car instead of selling it.

Gift vs. Sale: Which is Better?

Deciding whether to gift or sell a car in Texas can be a difficult decision. While gifting a car can help you avoid paying sales tax, it also means that you won’t receive any money for the car.

Selling the car, on the other hand, can be a good option if you need the money. However, you will need to pay sales tax on the sale, which can be a significant amount depending on the value of the car.

Ultimately, the decision to gift or sell a car in Texas will depend on your specific situation and needs.

Conclusion

Transferring a car title in Texas as a gift can be a bit confusing, but by following the steps outlined in this article, you can ensure that the process goes smoothly. Whether you decide to gift or sell the car, be sure to follow all of the necessary steps to avoid any legal issues or complications.

Frequently Asked Questions

Here are some common questions and answers about transferring a car title in Texas as a gift:

What is a car title transfer?

A car title transfer is a legal process that officially changes the ownership of a vehicle. When you transfer a car title in Texas, you are transferring the legal ownership of the vehicle from one person to another. This process is necessary if you are buying or selling a vehicle, giving a vehicle as a gift, or inheriting a vehicle from someone.

To transfer a car title in Texas, you will need to fill out the appropriate forms and pay the necessary fees. You will also need to provide proof of insurance and a valid driver’s license or state ID.

Can I transfer a car title as a gift?

Yes, you can transfer a car title in Texas as a gift. If you are giving a vehicle to someone as a gift, you will need to fill out the appropriate forms and pay the necessary fees, just as you would if you were buying or selling a vehicle. You will also need to provide a written statement indicating that the vehicle is a gift, along with the fair market value of the vehicle.

In addition, the recipient of the gift will need to fill out a gift tax form and pay any applicable taxes on the fair market value of the vehicle. It is important to note that the gift tax is based on the fair market value of the vehicle, not the sale price or the amount of money that was exchanged.

What documents do I need to transfer a car title as a gift?

When transferring a car title in Texas as a gift, you will need to provide several documents, including the title certificate, a completed application for Texas title and/or registration, and a written statement indicating that the vehicle is a gift. You will also need to provide proof of insurance and a valid driver’s license or state ID.

If you are the recipient of the gift, you will need to fill out a gift tax form and pay any applicable taxes on the fair market value of the vehicle. In addition, you may need to provide proof of residency and a completed application for Texas title and/or registration.

How much does it cost to transfer a car title as a gift in Texas?

The cost to transfer a car title as a gift in Texas varies depending on several factors, including the age of the vehicle, the county in which you live, and the type of vehicle. Generally, you can expect to pay a transfer fee, a registration fee, and any applicable taxes or fees.

If you are the recipient of the gift, you may also need to pay a gift tax based on the fair market value of the vehicle. The gift tax rate in Texas is 6.25% of the fair market value, or $10, whichever is greater.

How long does it take to transfer a car title as a gift in Texas?

The length of time it takes to transfer a car title as a gift in Texas depends on several factors, including the county in which you live and the time it takes to process your paperwork. Generally, you can expect the process to take anywhere from a few days to several weeks.

To expedite the process, it is important to make sure that all of your paperwork is complete and accurate before submitting it. This can help to avoid delays and ensure that your title transfer is processed as quickly as possible.

In conclusion, transferring a car title as a gift in Texas is a straightforward process that requires attention to detail and adherence to certain requirements. By following the steps outlined in this article, you can ensure that the transfer is completed smoothly and efficiently.

First, make sure that you have all the necessary documents, including the title certificate, gift affidavit, and any other required forms. Double-check that all information is accurate and up-to-date to avoid any potential issues.

Second, submit the required documents and fees to the Texas Department of Motor Vehicles as soon as possible. This will ensure that the transfer process is initiated promptly and that you can avoid any delays or complications.

Finally, keep in mind that the process may take some time, so be patient and follow up with the DMV if necessary. With these tips in mind, you can transfer a car title as a gift in Texas with ease and confidence.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts