Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you planning to gift a vehicle to someone in Idaho? If yes, transferring the car title is the first step towards completing the legal process. But, it can be a confusing and tedious task, especially if you’re not familiar with the state’s regulations. This guide will provide you with all the information you need to smoothly transfer the car title as a gift in Idaho. So, let’s dive in and make the gift-giving process hassle-free and enjoyable.

How to Transfer Car Title as a Gift in Idaho?

To transfer a car title as a gift in Idaho, follow these steps:

- Fill out the transfer section of the title certificate with the recipient’s information.

- Provide a written statement that the vehicle is a gift and the relationship between the giver and receiver.

- Submit the title certificate, statement, and $14 transfer fee to the Idaho Transportation Department.

How to Transfer Car Title as a Gift in Idaho

Step 1: Verify Ownership

To transfer the car title as a gift in Idaho, the first step is to verify the ownership of the vehicle. The owner of the vehicle must have a clear title with no liens or loans on it. If there is a loan on the vehicle, the lender must be notified and the loan must be paid off before the transfer can take place.

Once the ownership is verified, the next step is to fill out the necessary paperwork. The Idaho Transportation Department (ITD) requires a few different documents to transfer the title, including the title itself, a bill of sale, and an affidavit of gift.

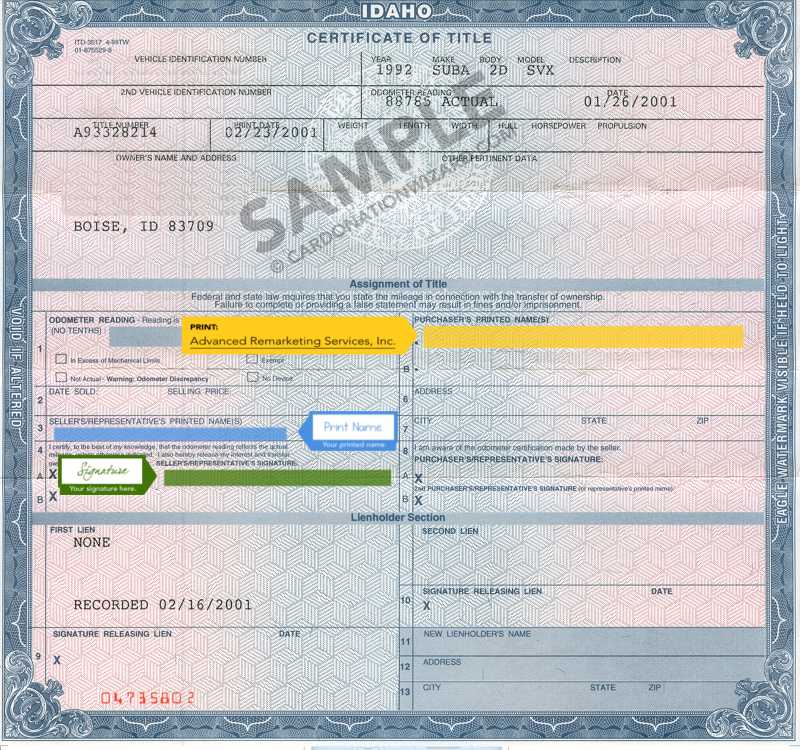

Step 2: Complete the Paperwork

To complete the paperwork, the donor (the person giving the car as a gift) must fill out the title with the recipient’s (the person receiving the car as a gift) information. The donor must also sign the title and the affidavit of gift. The affidavit of gift verifies that the vehicle is being given as a gift and not sold.

The recipient must then take the title, bill of sale, and affidavit of gift to the ITD for processing. The ITD will process the paperwork and issue a new title in the recipient’s name.

Step 3: Pay the Fees

In Idaho, there is a fee for transferring the title of a vehicle. The fee varies depending on the age of the vehicle and whether or not it is a gift. The recipient of the gift is responsible for paying this fee.

It’s important to note that if there are any outstanding fees or fines associated with the vehicle, they must be paid before the transfer can take place.

Benefits of Transferring a Car Title as a Gift

Transferring a car title as a gift can have several benefits. First, it can be a great way to help out a family member or friend who may be in need of a vehicle. It can also be a way to simplify the process of transferring ownership, as there is no money being exchanged.

Additionally, transferring a car title as a gift can help to reduce the tax burden for both the donor and the recipient. In Idaho, there is no sales tax on gifts, so the recipient will not have to pay any tax on the vehicle. The donor may also be able to claim a tax deduction for the gift.

Transferring a Car Title as a Gift vs Selling a Car

When deciding whether to transfer a car title as a gift or sell a car, there are several factors to consider. If the recipient is in need of a vehicle and the donor is in a position to give one, transferring the title as a gift may be the best option. It can also be a way to simplify the process of transferring ownership.

However, if the donor is looking to get some money for the vehicle, selling it may be a better option. Selling a car can also be a way to ensure that the recipient is able to afford the ongoing costs associated with owning a vehicle, such as insurance and maintenance.

Conclusion

Transferring a car title as a gift in Idaho can be a straightforward process as long as you have all of the necessary paperwork in order. By following the steps outlined above, you can help a family member or friend in need and potentially reduce your tax burden at the same time.

Contents

Frequently Asked Questions

Do you want to gift a car to someone in Idaho? Here are some frequently asked questions regarding transferring car title as a gift in Idaho.

What are the requirements to transfer car title as a gift in Idaho?

To transfer car title as a gift in Idaho, the gift giver needs to fill out the vehicle title with the recipient’s name and address, date of transfer, and gift statement. Both the gift giver and recipient need to sign the document. If the vehicle is less than 10 years old, a bill of sale with the selling price is also required. The recipient must then take the completed title and bill of sale to the county assessor’s office to register the vehicle and pay the necessary fees.

It’s important to note that the gift giver is responsible for any outstanding liens or debts on the vehicle. The gift giver should also keep a copy of the completed title for their records.

Can a gift transfer of a car be done online in Idaho?

No, the gift transfer of a car cannot be completed online in Idaho. The completed title and bill of sale, if applicable, must be taken to the county assessor’s office in person. Some counties may also require an emissions test or other inspections before the vehicle can be registered. It’s best to check with the county assessor’s office for their specific requirements.

The recipient of the gifted vehicle will also need to provide proof of insurance before the vehicle can be registered.

Is there a gift tax for transferring a car title in Idaho?

No, there is no gift tax for transferring a car title in Idaho. However, if the vehicle is sold in the future, the recipient may be responsible for paying sales tax on the selling price of the vehicle at that time.

It’s important to note that if the gift giver is a nonresident of Idaho, they may be subject to federal gift tax laws. It’s best to consult with a tax professional for advice in this situation.

What if the gifted vehicle has a lien on it?

If the gifted vehicle has a lien on it, the lien must be satisfied before the title can be transferred to the recipient. The gift giver is responsible for paying off any outstanding liens or debts on the vehicle before gifting it. The lienholder will then release the lien and provide a lien release document, which must be included with the completed title and bill of sale, if applicable.

If the lien is not satisfied, the recipient will not be able to register the vehicle in their name.

Can a minor receive a gifted vehicle in Idaho?

Yes, a minor can receive a gifted vehicle in Idaho. However, a minor cannot legally own a vehicle in Idaho until they are 18 years old. In this case, the recipient’s parent or legal guardian will need to sign the completed title and bill of sale, if applicable. The parent or legal guardian will also need to register the vehicle in their name until the minor turns 18 and can legally own the vehicle.

If the minor is 18 years or older, they can sign the completed title and bill of sale and register the vehicle in their name.

In conclusion, transferring a car title as a gift in Idaho can be a simple and straightforward process, as long as you follow the necessary steps. Firstly, make sure that the vehicle meets all the legal requirements and that you have all the necessary documents ready. Secondly, fill out the necessary forms and paperwork accurately and completely. Lastly, submit the forms and pay any required fees to complete the transfer process.

By taking these steps, you can ensure that the transfer of the car title as a gift is done legally and without any complications. With a little bit of effort and attention to detail, you can give the gift of a car to your loved one, and make their day a special one. So, transfer that car title as a gift in Idaho today and make someone smile!

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts