Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you planning to register a gifted car in Tennessee? Congratulations on your new ride! However, registering a gifted car can be a bit tricky, and you may have many questions about the process. Don’t worry, we’re here to help! In this guide, we’ll walk you through the steps you need to take to register your gifted car in Tennessee. From the required documents to the fees you need to pay, we’ve got you covered. So, let’s get started!

If someone gifts you a car in Tennessee, you’ll need to transfer the car title into your name and register the vehicle. To do this, follow these steps:

- Get the car title signed by the previous owner.

- Bring the signed title and proof of identification to your local county clerk’s office.

- Pay the required fees for titling and registration.

- Get insurance coverage for the vehicle.

- Finally, display your new license plates on the gifted car.

How to Register a Gifted Car in Tennessee?

If you have received a gifted car in Tennessee, congratulations! However, you must also complete the necessary steps to register the vehicle in your name. The process may seem daunting, but with a clear understanding of the requirements and steps involved, you can complete the registration process with ease.

Step 1: Gather Required Documents

The first step to registering a gifted car in Tennessee is to gather all necessary documents. You will need the following:

– The car’s title signed over to you by the previous owner

– A completed Application for Certificate of Title and Registration of a Vehicle form

– Your driver’s license or state ID

– Proof of insurance

– Payment for registration fees and applicable taxes

It is important to note that if the vehicle is less than 10 years old, you will also need a completed Odometer Disclosure Statement.

Step 2: Complete the Application for Certificate of Title and Registration of a Vehicle Form

Once you have gathered all the necessary documents, you will need to complete the Application for Certificate of Title and Registration of a Vehicle form. This form requires information about the vehicle, such as the make, model, and year, as well as your personal information as the new owner.

Step 3: Provide Proof of Insurance

Before you can register the gifted car in Tennessee, you must provide proof of insurance. The state requires that all registered vehicles have liability insurance coverage. You will need to provide the insurance company’s name, policy number, and effective dates on the registration form.

Step 4: Pay Registration Fees and Taxes

Once you have completed the necessary forms and provided proof of insurance, you will need to pay the registration fees and applicable taxes. The amount will vary depending on the vehicle’s age, weight, and value.

Step 5: Submit the Required Documents

After completing all necessary forms, providing proof of insurance, and paying the fees and taxes, you will need to submit the documents to the Tennessee Department of Revenue. You can do this in person at a county clerk’s office or by mail.

Benefits of Registering a Gifted Car in Tennessee

Registering a gifted car in Tennessee has several benefits. It allows you to legally drive the vehicle on the state’s roads and highways, and it ensures that the vehicle is properly insured in the event of an accident. Additionally, registering the car in your name provides proof of ownership, which can be important if you need to sell the vehicle in the future.

Registering a Gifted Car vs. Purchasing a Car

Registering a gifted car is similar to registering a purchased car in Tennessee. However, if you purchase a car, you will also need to provide a bill of sale and pay sales tax on the purchase price. With a gifted car, you do not need to pay sales tax, but you must provide documentation proving that the car was a gift.

Conclusion

Registering a gifted car in Tennessee may seem overwhelming, but by following these steps and gathering the necessary documents, the process can be completed quickly and easily. Remember to provide proof of insurance, pay the required fees and taxes, and submit all required documents to the Tennessee Department of Revenue. Once completed, you can enjoy the benefits of legally driving your gifted car on the state’s roads and highways.

Contents

- Frequently Asked Questions

- Q: What is the process for registering a gifted car in Tennessee?

- Q: What is a gift affidavit?

- Q: Are there any taxes associated with registering a gifted car in Tennessee?

- Q: Can I register a gifted car online in Tennessee?

- Q: Can I drive a gifted car without registering it in Tennessee?

- How To Gift A Vehicle To Someone Without Paying Taxes

Frequently Asked Questions

Registering a gifted car in Tennessee can be a bit confusing. Here are some frequently asked questions and their answers to help guide you through the process.

Q: What is the process for registering a gifted car in Tennessee?

A: To register a gifted car in Tennessee, you will need to bring the following documents to your local county clerk’s office: a completed Application for Certificate of Title, the car’s current title, a gift affidavit, and proof of insurance. The gift affidavit should include the car’s make, model, and year, as well as the names and addresses of both the giver and the recipient. The recipient will also need to pay the standard registration fees and any applicable taxes.

It is important to note that the recipient of the gifted car must register it within 30 days of receiving it, or they may face penalties and fines.

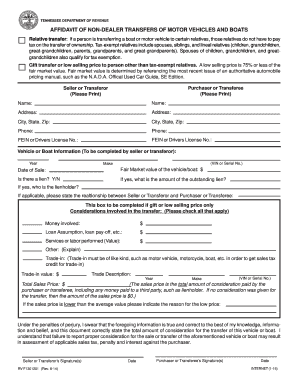

Q: What is a gift affidavit?

A: A gift affidavit is a legal document that verifies the transfer of ownership of a car from one person to another as a gift. In Tennessee, the gift affidavit must be notarized and signed by both the giver and the recipient. It should include the car’s make, model, and year, as well as the names and addresses of both parties.

The gift affidavit is necessary for registering a gifted car in Tennessee and should be submitted along with the Application for Certificate of Title and the car’s current title.

Q: Are there any taxes associated with registering a gifted car in Tennessee?

A: Yes, there may be taxes associated with registering a gifted car in Tennessee. The recipient of the gifted car will need to pay a gift tax based on the car’s value. The tax rate varies depending on the value of the car and the county in which the recipient lives. Additionally, the recipient will need to pay the standard registration fees.

It is important to note that if the car was gifted to a family member, the gift tax may be waived. However, the recipient will still need to provide proof of the relationship to the giver.

Q: Can I register a gifted car online in Tennessee?

A: No, you cannot register a gifted car online in Tennessee. The recipient of the gifted car must visit their local county clerk’s office in person to register the car. They will need to bring the necessary documents, including the completed Application for Certificate of Title, the car’s current title, a gift affidavit, and proof of insurance. The recipient will also need to pay the standard registration fees and any applicable taxes in person.

It is important to note that the recipient must register the gifted car within 30 days of receiving it, or they may face penalties and fines.

Q: Can I drive a gifted car without registering it in Tennessee?

A: No, you cannot legally drive a gifted car without registering it in Tennessee. The recipient of the gifted car must register it within 30 days of receiving it, or they may face penalties and fines. Additionally, the recipient must have proof of insurance before driving the car.

It is important to note that driving an unregistered car can lead to legal and financial consequences, including fines and the impoundment of the car.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, registering a gifted car in Tennessee requires several steps, but the process can be straightforward if you follow the right steps. First, make sure that you have all the necessary paperwork, such as the title and the gift affidavit. Then, you need to visit the county clerk’s office to pay the required fees and submit the paperwork. Finally, you will need to obtain a new license plate and registration sticker.

It is essential to note that the requirements for registering a gifted car may vary from state to state, so it’s important to check your state’s specific requirements. Additionally, it’s always a good idea to consult with a professional or the local DMV to ensure that you are completing the process correctly.

Overall, registering a gifted car can be a hassle-free process if you take the time to gather all the necessary documents and follow the proper steps. By doing so, you can ensure that you are legally able to drive your new car on the roads of Tennessee.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts