Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you looking to gift a car to someone in Texas? It’s a wonderful gesture, but the process can be overwhelming. From paperwork to legal requirements, there is a lot to consider before handing over the keys. Don’t worry, we’ve got you covered. In this guide, we’ll walk you through everything you need to know about how to gift a car in Texas. Whether you’re a seasoned car owner or a first-time gift giver, our step-by-step instructions and expert tips will ensure a stress-free and successful transfer of ownership. So, let’s get started!

- Fill out and sign the Texas title certificate with the donor’s name as the seller and the recipient’s name as the buyer.

- Complete the Application for Texas Title and/or Registration (Form 130-U).

- Include a $10 gift tax on the title transaction.

- Submit the forms and payment to your county tax office.

- Remove the license plates and registration sticker from the car and give them to the recipient.

How to Gift a Car in Texas?

Are you looking to gift a car to a loved one in Texas? It’s a generous gesture, but there are a few things you need to know to make sure the process goes smoothly. In this article, we’ll take you through the steps of gifting a car in Texas, including the necessary paperwork, fees, and other important details.

Step 1: Gather the Required Documents

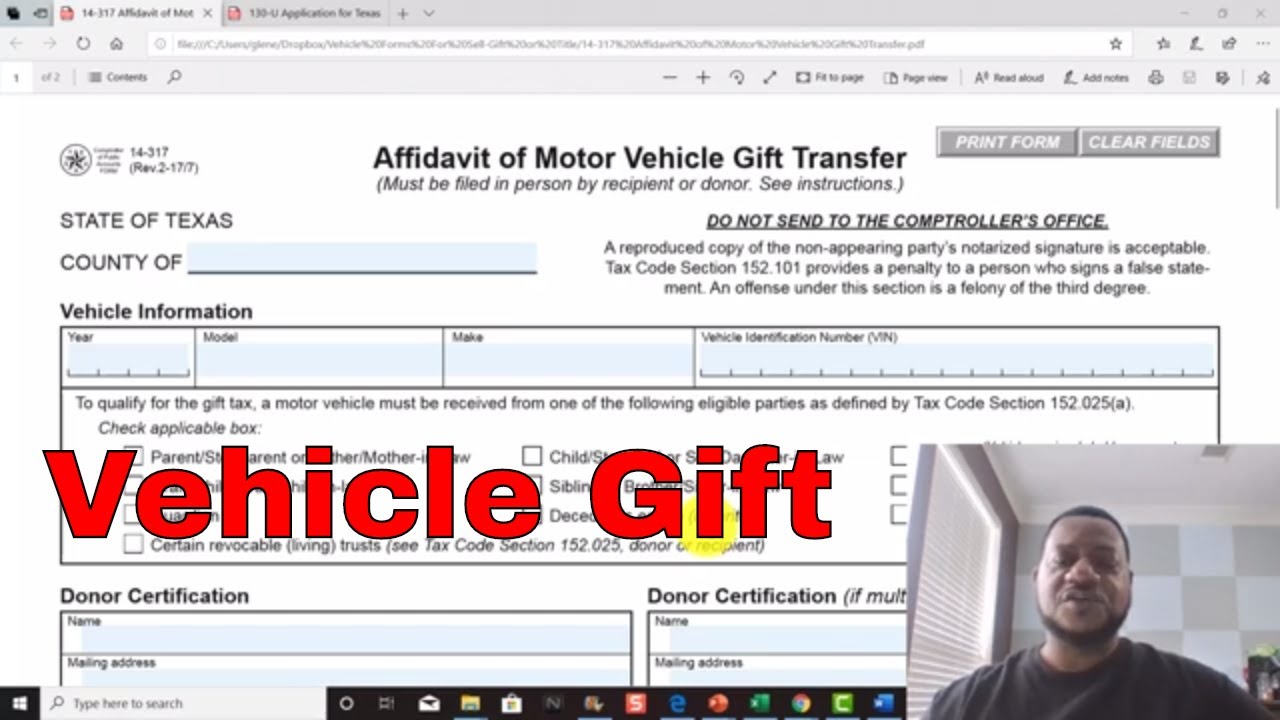

To gift a car in Texas, you’ll need to gather a few important documents. These include the vehicle title, a signed and notarized Bill of Sale, and a Gift Tax Form 14-317. If the vehicle is less than 10 years old, you’ll also need to provide a Vehicle Identification Number (VIN) Inspection Report.

Once you have all the necessary documents, you’ll need to take them to your local Texas Department of Motor Vehicles (DMV) office to transfer ownership of the vehicle.

Step 2: Complete the Required Paperwork

Before you can transfer ownership of the vehicle, you’ll need to complete the required paperwork. This includes filling out the Application for Texas Title and/or Registration form, as well as the Gift Tax Form 14-317.

Make sure to fill out all the required fields on these forms completely and accurately. Any mistakes or missing information could delay the transfer process.

Step 3: Pay the Required Fees

To transfer ownership of the vehicle, you’ll need to pay certain fees. These include a title application fee, a registration fee, and any applicable sales tax. You’ll also need to pay a gift tax if the vehicle is worth more than $10,000.

The exact fees you’ll need to pay will depend on the value of the vehicle and other factors. Check with your local DMV office to get an accurate estimate of the fees you’ll need to pay.

Step 4: Transfer Ownership of the Vehicle

Once you have all the necessary paperwork and have paid the required fees, you’ll be ready to transfer ownership of the vehicle. You’ll need to sign the title over to the recipient, and they’ll need to sign the Application for Texas Title and/or Registration form.

You’ll also need to provide the recipient with a copy of the Bill of Sale and Gift Tax Form 14-317. Make sure to keep a copy of these documents for your records.

Step 5: Register the Vehicle

After the transfer of ownership is complete, the recipient will need to register the vehicle with the Texas DMV. They’ll need to provide the title, Application for Texas Title and/or Registration form, and proof of insurance.

Make sure the recipient understands the importance of registering the vehicle promptly. Failure to do so can result in fines and other penalties.

Benefits of Gifting a Car in Texas

Gifting a car in Texas can be a great way to show your love and appreciation for a friend or family member. It’s also a way to transfer ownership of a vehicle without the hassle and expense of selling it.

By gifting a car, you can avoid paying sales tax on the transaction, as long as the vehicle is worth less than $10,000. You’ll also be able to avoid the time and expense involved in advertising and selling the vehicle.

Gifting a Car vs. Selling a Car

If you’re considering gifting a car in Texas, you may be wondering how it compares to selling a car. While both options have their pros and cons, gifting a car can be a simpler and more cost-effective option.

When you sell a car, you’ll need to advertise it, show it to potential buyers, and negotiate a price. You’ll also need to pay sales tax on the transaction, which can be a significant expense.

By gifting a car, you can avoid all these hassles and expenses. You’ll also be able to give a valuable gift to someone you care about.

Conclusion

Gifting a car in Texas can be a generous and thoughtful gesture. By following the steps outlined in this article, you can make sure the process goes smoothly and the recipient is able to enjoy their new vehicle without any complications. Remember to gather all the necessary documents, complete the required paperwork, pay the required fees, transfer ownership of the vehicle, and register the vehicle promptly.

Frequently Asked Questions

Here are some commonly asked questions about gifting a car in Texas:

Can I gift a car to someone in Texas?

Yes, you can gift a car to someone in Texas. However, there are certain steps you need to follow to ensure that the transfer of ownership is legal and valid. First, both the giver and receiver need to fill out and sign the appropriate sections of the vehicle’s title certificate. The receiver will also need to register the vehicle with the Texas Department of Motor Vehicles within 30 days of the gift.

It’s important to note that the receiver will be responsible for paying any applicable taxes and fees associated with the gift. Additionally, if the vehicle is less than 10 years old, the receiver will need to provide a valid vehicle inspection certificate before registering the vehicle.

Do I need to pay taxes on a gifted car in Texas?

Yes, the receiver of a gifted car in Texas is responsible for paying the state’s motor vehicle sales tax. The tax is based on the vehicle’s sales price or its fair market value, whichever is higher. The receiver will need to provide proof of the gift, such as a signed and notarized affidavit, to avoid paying taxes on the vehicle’s full market value.

It’s important to note that if the giver and receiver are immediate family members, such as spouses, children, or siblings, they may be exempt from paying taxes on the gift. However, they will still need to provide proof of the gift to the Texas Department of Motor Vehicles.

What documents do I need to gift a car in Texas?

To gift a car in Texas, you will need to complete and sign the vehicle’s title certificate. The certificate must be signed by both the giver and receiver, and it must include the vehicle’s make, model, year, and vehicle identification number (VIN). In addition, the receiver will need to provide a completed Application for Texas Title and/or Registration and proof of insurance.

If the vehicle is less than 10 years old, the receiver will also need to provide a valid vehicle inspection certificate before registering the vehicle with the Texas Department of Motor Vehicles.

Can I gift a car without a title in Texas?

No, you cannot gift a car without a title in Texas. The title certificate is the legal document that proves ownership of the vehicle, and it must be transferred to the receiver in order for the gift to be valid. If the title has been lost, stolen, or damaged, the giver will need to apply for a replacement title before gifting the vehicle.

If the title has a lien on it, the giver will need to have the lienholder release the lien before transferring ownership of the vehicle to the receiver.

What is the penalty for not transferring a car title in Texas?

In Texas, failing to transfer a car title within 30 days of a sale or gift can result in a penalty of up to $250. Additionally, if the receiver of the vehicle is involved in an accident or traffic violation before the title has been transferred, the giver may still be held liable for any damages or fines incurred.

It’s important to complete the title transfer process as soon as possible to avoid any potential legal or financial issues down the road.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, gifting a car in Texas can be a thoughtful and generous act, but it comes with certain legal obligations. Make sure you follow the steps outlined by the Texas Department of Motor Vehicles to ensure a smooth transfer of ownership. Remember to obtain all the necessary documents, including the title transfer form and a gift affidavit. Keep in mind that if the car is worth more than $15,000, you may need to pay a gift tax.

Ultimately, gifting a car can be a wonderful way to show someone you care, but it’s important to do it right. Taking the time to gather all the necessary paperwork and follow the proper procedures will ensure that the gift is truly appreciated and enjoyed for years to come.

So, if you’re thinking of gifting a car in Texas, be sure to do your research and consult with the DMV or a legal professional if you have any questions. With a little bit of planning and preparation, you can give a truly memorable gift that will be cherished for a lifetime.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts