Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you planning to gift a motor vehicle to a family member or friend? If so, it’s important to know how to properly fill out the Affidavit of Motor Vehicle Gift Transfer. This legal document is required by many states and ensures that the transfer of ownership is legal and valid.

Filling out the Affidavit of Motor Vehicle Gift Transfer may seem daunting, but with a little guidance, it can be a simple process. In this article, we’ll provide step-by-step instructions on how to fill out the form accurately and efficiently. So, let’s get started and make sure your gift transfer goes smoothly!

To fill out an Affidavit of Motor Vehicle Gift Transfer, follow these steps:

- Download the form from your state’s DMV website.

- Fill out the donor’s information, including their name, address, and signature.

- Fill out the recipient’s information, including their name, address, and relationship to the donor.

- Fill out the vehicle information, including the make, model, year, and VIN.

- Sign and date the form.

How to Fill Out Affidavit of Motor Vehicle Gift Transfer?

If you are gifting a motor vehicle to a family member or friend, you will need to fill out an Affidavit of Motor Vehicle Gift Transfer. This document is required to transfer the ownership of the vehicle to the recipient. Filling out the affidavit can seem daunting, but it is a straightforward process. In this article, we will walk you through the steps to fill out the Affidavit of Motor Vehicle Gift Transfer.

Step 1: Obtain the Affidavit of Motor Vehicle Gift Transfer form

The Affidavit of Motor Vehicle Gift Transfer form can be obtained from your state’s Department of Motor Vehicles (DMV) or downloaded from their website. Ensure that you have the latest version of the form as states frequently update their forms. You can also get the form from your state’s DMV office, and it is often available in kiosks or self-help centers.

Once you have the form, it is essential to read the instructions carefully before filling it out. The instructions will provide you with a clear understanding of the information required and how to fill out the form correctly.

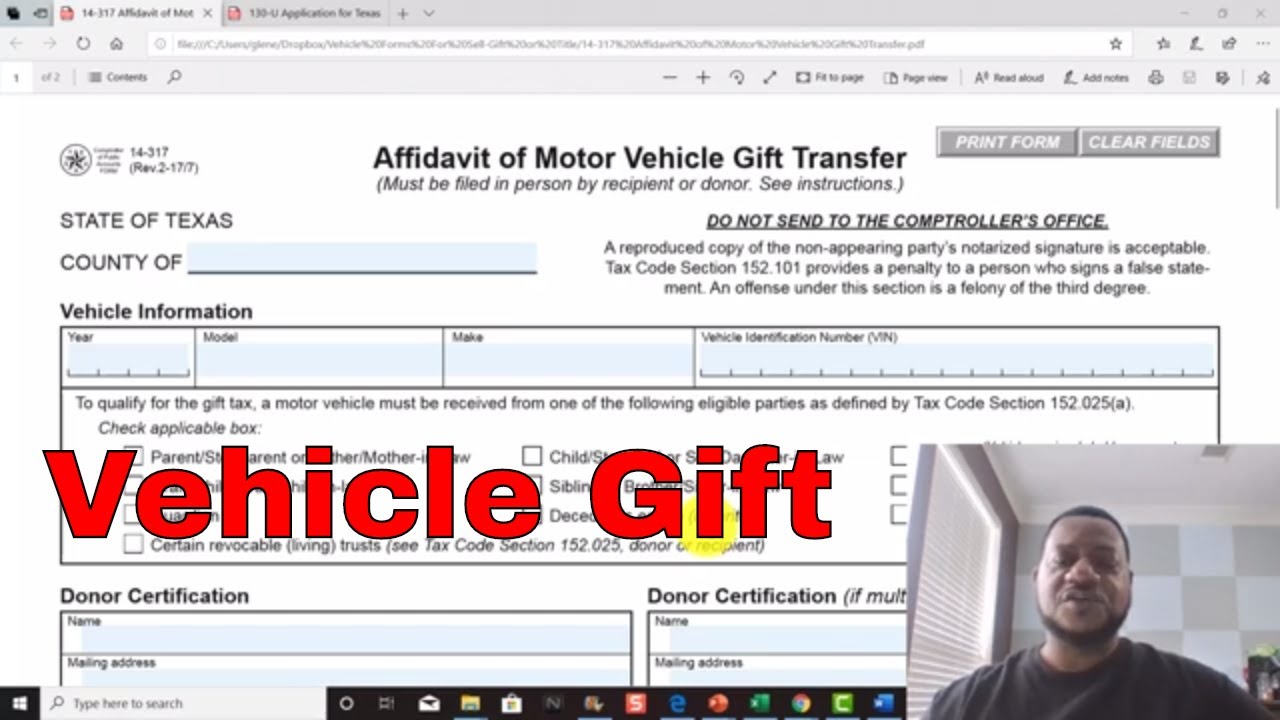

Step 2: Provide Vehicle Information

The next step is to provide information about the vehicle being gifted. This information includes the make, model, year, and Vehicle Identification Number (VIN). Ensure that the information provided is accurate and matches the vehicle’s documents.

If you are unsure about any of the vehicle’s information, you can check the registration certificate or car title. These documents will have all the necessary details about the vehicle.

Step 3: Provide Recipient Information

The recipient’s information is required to transfer the vehicle’s ownership to them. This includes the recipient’s full name, address, and phone number. If the recipient has a driver’s license, provide the driver’s license number and state of issuance.

Step 4: Provide Gift Information

In this section, you will need to provide the date of the gift and the relationship between the donor and the recipient. The relationship is essential as it determines whether the recipient is exempt from paying sales tax or not.

Step 5: Sign and Date the Affidavit

Once you have completed all the sections, sign and date the affidavit. Ensure that the signature matches the signature on the vehicle’s documents. If the vehicle has multiple owners, ensure that all owners sign the affidavit.

Step 6: Submit the Affidavit to the DMV

After completing the affidavit, submit it to the DMV along with any other required documents, such as the vehicle’s registration certificate or car title. The DMV will process the affidavit, and the recipient will receive the new registration certificate or car title.

Benefits of Filling Out an Affidavit of Motor Vehicle Gift Transfer

Filling out an Affidavit of Motor Vehicle Gift Transfer has several benefits, such as:

- It allows the recipient to avoid paying sales tax on the vehicle.

- It ensures that the vehicle’s ownership is transferred correctly.

- It protects the donor from any liability associated with the vehicle.

Affidavit of Motor Vehicle Gift Transfer vs. Selling a Vehicle

Gifting a vehicle through an Affidavit of Motor Vehicle Gift Transfer is different from selling a vehicle. When selling a vehicle, the seller receives payment for the vehicle, while gifting a vehicle does not involve any payment. Additionally, when selling a vehicle, the buyer is required to pay sales tax, while the recipient of a gifted vehicle may be exempt from paying sales tax.

In conclusion, filling out an Affidavit of Motor Vehicle Gift Transfer is a simple process that requires providing accurate information about the vehicle and the recipient. By completing the affidavit, you ensure that the vehicle’s ownership is transferred correctly and protect yourself from any liability associated with the vehicle.

Contents

- Frequently Asked Questions

- What is an affidavit of motor vehicle gift transfer?

- What information do I need to fill out the affidavit of motor vehicle gift transfer?

- What is a gift letter and do I need one?

- What are the consequences of not filling out the affidavit of motor vehicle gift transfer?

- Can I fill out the affidavit of motor vehicle gift transfer online?

Frequently Asked Questions

Here are some common questions and answers about how to fill out an affidavit of motor vehicle gift transfer.

What is an affidavit of motor vehicle gift transfer?

An affidavit of motor vehicle gift transfer is a legal document used to transfer ownership of a vehicle from one person to another without payment. It is usually used when a vehicle is given as a gift to a family member or friend. The affidavit must be completed accurately and signed by both the giver and the receiver of the vehicle.

The affidavit includes information about the vehicle, including the make, model, year, and vehicle identification number (VIN). It also includes information about the giver and receiver of the vehicle, as well as the date of the transfer. The affidavit must be submitted to the Department of Motor Vehicles (DMV) in order to complete the transfer of ownership.

What information do I need to fill out the affidavit of motor vehicle gift transfer?

You will need to provide information about the vehicle, including the make, model, year, and VIN. You will also need to provide your name and contact information, as well as the name and contact information of the person receiving the vehicle. You will need to sign the affidavit and have it notarized.

If you are the person receiving the vehicle, you will need to provide proof of insurance and a valid driver’s license. The DMV may also require additional documentation, such as a bill of sale or a gift letter, depending on the state where you live.

What is a gift letter and do I need one?

A gift letter is a document that confirms that a vehicle was given as a gift and that no money was exchanged. Some states require a gift letter in addition to the affidavit of motor vehicle gift transfer. The gift letter should include information about the giver and receiver of the vehicle, as well as the make, model, year, and VIN of the vehicle. It should also include a statement that the vehicle was given as a gift and that no money was exchanged.

You should check with your state’s DMV to determine if a gift letter is required.

What are the consequences of not filling out the affidavit of motor vehicle gift transfer?

If you do not fill out the affidavit of motor vehicle gift transfer, you may be held liable for any accidents or violations committed by the person who received the vehicle. The DMV may also assess fees or penalties for failing to transfer ownership of the vehicle in a timely manner.

In some cases, you may also be held responsible for any outstanding debts or taxes associated with the vehicle.

Can I fill out the affidavit of motor vehicle gift transfer online?

Many states now allow you to fill out the affidavit of motor vehicle gift transfer online. You will need to provide the same information as you would on a paper form, and you may need to upload additional documentation, such as proof of insurance or a gift letter.

Check with your state’s DMV to see if online filing is available and if there are any additional requirements or fees associated with using this option.

In conclusion, filling out an Affidavit of Motor Vehicle Gift Transfer can seem like a daunting task, but with the right information, it can be done seamlessly. Remember to gather all necessary information and documentation before starting the process, and to pay close attention to the details on the form.

It’s important to note that the process and requirements may vary by state, so be sure to research the specific guidelines for your location. Additionally, if you have any questions or concerns, don’t hesitate to contact your local DMV or seek assistance from a legal professional.

By following these tips and taking the necessary steps, you can ensure a smooth and successful transfer of your motor vehicle gift. Don’t let the process overwhelm you – with a little preparation and patience, you can get it done in no time.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts