Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Do you have an old car sitting around that you no longer need or want? Instead of letting it take up space in your driveway, garage, or yard, consider donating it to a charitable organization in Ohio. Not only will you be freeing up space, but you’ll also be helping out a worthy cause and potentially even getting a tax deduction.

But how exactly do you donate a car in Ohio? It may seem like a daunting process, but it’s actually quite simple. In this guide, we’ll walk you through the steps to ensure that your car donation goes smoothly and benefits the organization of your choice. So, let’s get started!

- Choose a charity that accepts car donations in Ohio.

- Contact the charity to schedule a pickup or drop off of your vehicle.

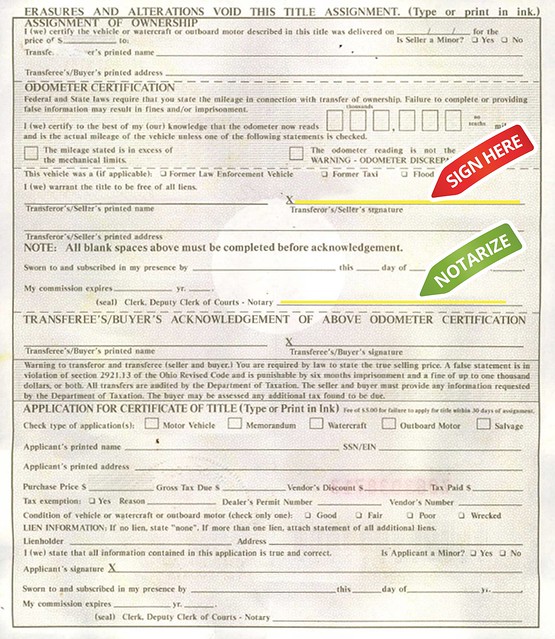

- Complete and sign over the title to the charity.

- Obtain a receipt for your donation for tax purposes.

Donating Your Car in Ohio: A Step-by-Step Guide

Donating your car to a charity in Ohio is a great way to help others and get rid of an unwanted vehicle. Not only can you give back to your community, but you can also receive a tax deduction for your donation. Here’s everything you need to know about how to donate a car in Ohio.

1. Choose a Reputable Charity

The first step in donating your car is to choose a reputable charity. Look for charities that are registered as 501(c)(3) organizations with the IRS. This designation ensures that your donation will be tax-deductible.

You can check the Ohio Attorney General’s website to see if a charity is registered to solicit donations in Ohio. You can also research charities on websites like Charity Navigator or the Better Business Bureau’s Wise Giving Alliance.

2. Check the Charity’s Requirements

Once you’ve chosen a charity, check their requirements for accepting car donations. Some charities may only accept cars that are in good condition, while others may accept cars that need repairs.

You should also ask the charity if they will arrange for the car to be towed, or if you need to arrange for the towing yourself.

3. Prepare Your Car for Donation

Before donating your car, you should prepare it for donation. Remove all personal items from the car and clean it inside and out. Make sure you have all the necessary paperwork, including the car title and registration.

You should also make a copy of your car title, as you’ll need to give this to the charity when you donate your car.

4. Donate Your Car

Once you’ve found a charity and prepared your car, it’s time to donate your car. You can either drop the car off at the charity’s location or arrange for the charity to pick up the car.

If you’re dropping the car off, make sure to get a receipt from the charity. If the charity is picking up the car, they should provide you with a receipt when they take the car.

5. Get a Tax Deduction

After donating your car, you can claim a tax deduction for the donation. The amount of the tax deduction will depend on the value of your car and the charity’s policies.

You should receive a tax receipt from the charity within 30 days of donating your car. If you don’t receive a receipt, contact the charity to request one.

6. Benefits of Donating Your Car

Donating your car in Ohio has several benefits. First, you can help a charity that’s doing important work in your community. Second, you can get rid of an unwanted car without having to sell it or pay for towing.

Finally, you can receive a tax deduction for your donation, which can help lower your tax bill.

7. Donating vs. Selling Your Car

When deciding whether to donate or sell your car, consider the benefits of each option. Selling your car can help you get more money, but it can also be time-consuming and stressful.

Donating your car is a great way to give back to your community and can provide you with a tax deduction. Plus, you don’t have to worry about finding a buyer or negotiating a price.

8. Frequently Asked Questions

-Can I donate a car that doesn’t run?

Yes, many charities will accept cars that don’t run. However, you should check with the charity before donating to make sure they’re able to accept your car.

-How much can I claim for a tax deduction?

The amount of your tax deduction will depend on the value of your car and the charity’s policies. You should receive a tax receipt from the charity within 30 days of donating your car.

-How do I choose a reputable charity?

Look for charities that are registered as 501(c)(3) organizations with the IRS. You can also research charities on websites like Charity Navigator or the Better Business Bureau’s Wise Giving Alliance.

9. Conclusion

Donating your car in Ohio is a great way to help others and get rid of an unwanted vehicle. By following these steps, you can ensure that your donation goes to a reputable charity and that you receive a tax deduction for your donation.

Remember to choose a reputable charity, prepare your car for donation, and get a tax receipt from the charity. Donating your car can provide you with several benefits, including helping your community, getting rid of an unwanted car, and receiving a tax deduction.

10. Resources

-Ohio Attorney General’s Charitable Registration Search: https://www.ohioattorneygeneral.gov/CharitableRegistration/Search.aspx

-Charity Navigator: https://www.charitynavigator.org/

-Better Business Bureau’s Wise Giving Alliance: https://www.give.org/

Frequently Asked Questions

If you are planning to donate your car in Ohio and want to know the procedure, here are some frequently asked questions that might help you.

1. What is the process of donating a car in Ohio?

The process of donating a car in Ohio is quite easy. All you need to do is find a reputable charity or a non-profit organization that accepts car donations. Once you have found the right organization, you can contact them and provide them with the necessary information about your car. They will then schedule a pickup time and location for your vehicle. On the scheduled day, their representative will come to pick up your vehicle, and you will receive a receipt for your donation.

It is important to note that you should have the title of the car with you when you donate it. If you do not have the title, you can contact the Ohio Bureau of Motor Vehicles to get a duplicate copy.

2. Are there any tax benefits of donating a car in Ohio?

Yes, there are tax benefits of donating a car in Ohio. If you donate your car to a qualified charitable organization, you can claim a tax deduction for the fair market value of your car. However, it is important to keep in mind that the amount of the tax deduction will depend on the value of your car and your tax situation.

You should also make sure that the organization you are donating to is a qualified charitable organization. You can check the IRS website to see if the organization is eligible for tax-deductible donations.

3. What types of vehicles can be donated in Ohio?

Most charities and non-profit organizations in Ohio accept all types of vehicles, including cars, trucks, SUVs, boats, and motorcycles. However, it is always a good idea to check with the organization before donating to make sure that they accept the type of vehicle you want to donate.

It is also important to note that the vehicle should be in good working condition, or at least be repairable. If the vehicle is not in good condition, the organization may not be able to accept it.

4. Can I donate a car if I have lost the title?

If you have lost the title of your car, you can still donate it in Ohio. However, you will need to obtain a duplicate title from the Ohio Bureau of Motor Vehicles. You can either visit their office in person or apply for a duplicate title online.

Once you have the duplicate title, you can proceed with the donation process as usual.

5. How long does it take to donate a car in Ohio?

The time it takes to donate a car in Ohio depends on the organization you choose to donate to. Some organizations may be able to pick up your car within a few days, while others may take up to a week or more. It is always a good idea to contact the organization beforehand and ask about their pickup schedule.

Once the organization picks up your car, you will receive a receipt for your donation. The tax deduction process may take a few weeks, depending on your tax situation.

In conclusion, if you are looking to donate your car in Ohio, there are several options available to you. You can choose to donate to a local charity or a national organization that accepts car donations. By doing so, you can not only benefit the organization but also receive a tax deduction for your donation.

It is important to do your research and choose a reputable organization that will use your donation in a way that aligns with your values. Make sure to gather all necessary documentation and follow the proper procedures for transferring ownership of your vehicle.

By donating your car in Ohio, you can make a positive impact on your community and feel good about giving back. Don’t hesitate to reach out to organizations and ask any questions you may have about the donation process. Thank you for considering donating your car to a worthy cause.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts