Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you looking to donate your car in Kentucky but don’t know where to start? Donating your car can be a great way to give back to your community and help those in need. However, the process can be overwhelming, and it’s essential to know the steps to ensure a smooth and successful donation. In this article, we will guide you through the process, including what you need to know before donating, how to choose a charity, and the steps involved in donating your car in Kentucky. So, let’s get started and make a difference in someone’s life today!

- Choose a charity that accepts car donations in Kentucky.

- Contact the charity and provide details about your car.

- Arrange for the charity to pick up your car or drop it off at a designated location.

- Sign over the title of the car to the charity.

- Get a receipt for your donation to claim a tax deduction.

Donating a Car in Kentucky: A Step-by-Step Guide

1. Research Charitable Organizations

When you decide to donate your car in Kentucky, the first step is to research charitable organizations. Look for reputable charities that accept car donations and have a good track record of using the proceeds for their programs. You can search online or ask for recommendations from friends and family.

Once you have a list of potential organizations, do some research to find out more about them. Check their ratings on charity watchdog websites like Charity Navigator or GuideStar, and read reviews from donors. You can also call the organization and ask questions about their donation process and how they use the funds.

Benefits of Donating to a Charitable Organization

– You can support a cause you believe in.

– You can get a tax deduction for your donation.

– You can avoid the hassle of selling your car.

Donating to a Charity vs. Selling Your Car

When it comes to getting rid of an old car, you have two options: selling it or donating it to a charity. While selling your car may seem like a faster way to get rid of it, donating it to a charity can have several benefits. For example, you can support a cause you care about, get a tax deduction for your donation, and avoid the hassle of selling your car.

2. Check the Eligibility Requirements

Before you donate your car, you need to make sure it meets the eligibility requirements of the charitable organization. Typically, charities accept cars that are in good working condition, but some may also accept cars that need repairs or are not running.

You should also check if the charity accepts car donations from out-of-state donors and if they have any restrictions on the make, model, or age of the car.

Eligibility Requirements for Car Donations

– The car must be in good working condition or need minor repairs.

– The car must have a clear title and registration.

– The charity must accept car donations from out-of-state donors.

– There may be restrictions on the make, model, or age of the car.

3. Get a Valuation of Your Car

To claim a tax deduction for your car donation, you need to know the fair market value of your car. You can use online valuation tools like Kelley Blue Book or NADA Guides to get an estimate of your car’s value. You can also get a professional appraisal to get a more accurate value.

Benefits of Getting a Car Valuation

– You can claim a tax deduction for your car donation.

– You can get an estimate of your car’s value for insurance purposes.

– You can negotiate a better price if you decide to sell your car instead of donating it.

4. Prepare Your Car for Donation

Before you donate your car, you need to prepare it for pickup. Remove all personal items from the car, including your registration, insurance, and license plates. Clean the car and remove any trash or debris. Make sure you have all the keys and documents for the car.

If your car is not running or needs repairs, you should inform the charity in advance. They may be able to arrange for a tow truck or provide assistance with repairs.

How to Prepare Your Car for Donation

– Remove all personal items from the car.

– Clean the car and remove any trash or debris.

– Remove the license plates and registration.

– Make sure you have all the keys and documents for the car.

5. Schedule a Pickup

Once you have chosen a charity and prepared your car for donation, you need to schedule a pickup. Most charities offer free pickup services for car donations. They will schedule a time and date for the pickup and provide you with a receipt.

Benefits of Free Pickup Services

– You don’t have to worry about transporting the car.

– You can save time and money on towing fees.

– You can get a receipt for your donation.

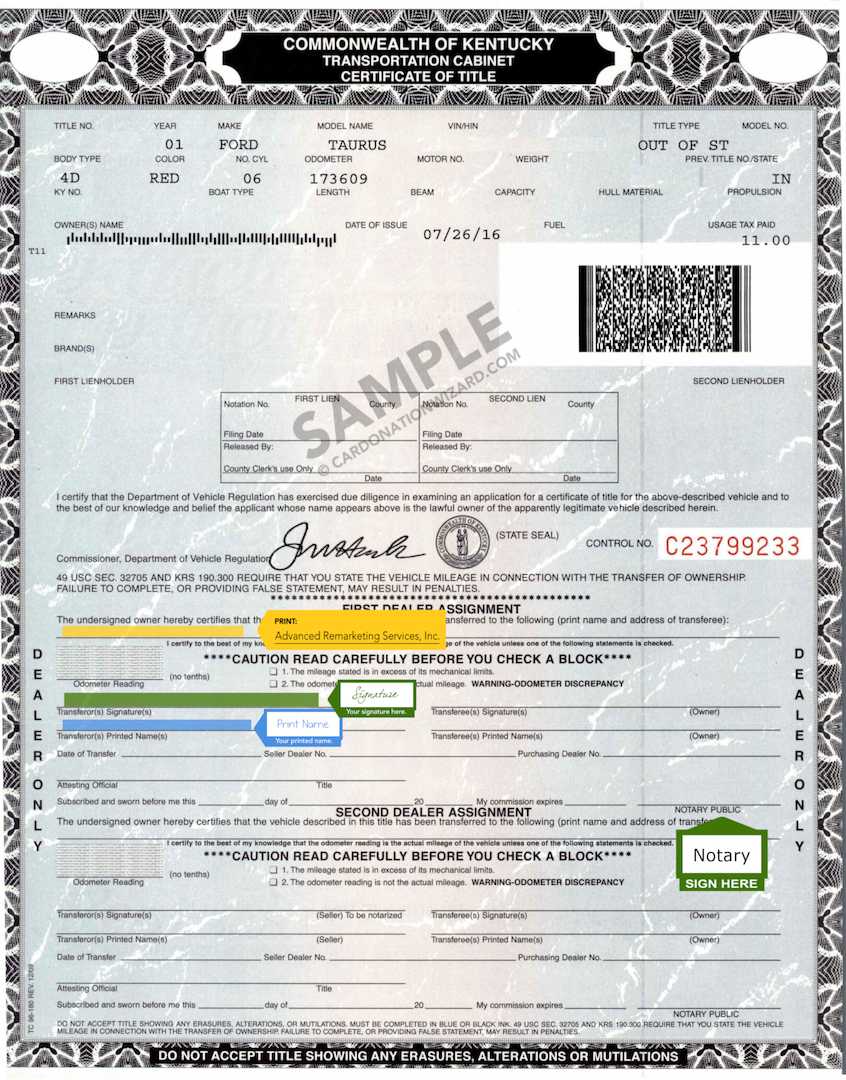

6. Sign the Title Over to the Charity

When the charity arrives to pick up your car, you need to sign the title over to them. Make sure you have the title and registration for the car, and sign it over to the charity. You should also fill out any additional paperwork required by the charity or the state.

What You Need to Sign Over Your Car Title

– The car title and registration.

– A bill of sale or donation form from the charity.

– Any additional paperwork required by the charity or the state.

7. Get a Donation Receipt

After you have signed over the title to the charity, they will provide you with a donation receipt. This is an important document that you will need when you file your taxes. The receipt should include the name and address of the charity, the date of the donation, and a description of the car.

What to Do with Your Donation Receipt

– Keep the receipt in a safe place.

– Use it to claim a tax deduction for your donation.

– Attach it to your tax return when you file your taxes.

8. Claim Your Tax Deduction

When you donate your car to a charitable organization in Kentucky, you can claim a tax deduction for the fair market value of the car. The amount of the deduction will depend on the value of the car and your tax bracket.

To claim your tax deduction, you will need to file Form 8283 with your tax return. You should also attach the donation receipt you received from the charity.

How to Claim Your Tax Deduction

– Determine the fair market value of your car.

– File Form 8283 with your tax return.

– Attach the donation receipt from the charity.

9. Follow Up with the Charity

After you have donated your car, you should follow up with the charity to make sure they have received the donation and to thank them for their work. You can also ask for a report on how the proceeds from your donation were used.

Benefits of Following Up with the Charity

– You can ensure that your donation was received.

– You can get a report on how your donation was used.

– You can build a relationship with the charity for future donations.

10. Spread the Word

Once you have donated your car to a charitable organization, you can spread the word and encourage others to do the same. Share your experience on social media, write reviews of the charity, and encourage your friends and family to donate their cars as well.

Benefits of Spreading the Word

– You can raise awareness for the charity and their cause.

– You can inspire others to donate their cars.

– You can build a community of donors who support the same cause.

Contents

Frequently Asked Questions

Donating your car to charity is a great way to give back to your community and make a difference in the lives of others. However, the process can be confusing, especially if you’ve never donated a car before. Here are some frequently asked questions about how to donate a car in Kentucky.

Q: What do I need to donate my car in Kentucky?

To donate your car in Kentucky, you will need to provide the title of the vehicle, as well as any other relevant documentation, such as registration and proof of insurance. You will also need to fill out a release of liability form, which transfers ownership of the vehicle to the charity. If you have any questions about what documentation is required, you should contact the charity or organization you plan to donate to.

It’s important to note that if the value of your car is more than $500, you will need to fill out IRS Form 8283, which is used to document non-cash charitable donations.

Q: What types of organizations can I donate my car to in Kentucky?

In Kentucky, you can donate your car to a wide variety of organizations, including charities, non-profit organizations, and religious institutions. Some common organizations that accept car donations include Goodwill Industries, the Salvation Army, and the American Cancer Society. Before donating your car, it’s important to research the organization to ensure they are reputable and will use your donation in a way that aligns with your values.

You can also donate your car to a local school or college, which may use the vehicle for educational purposes, such as teaching students how to repair cars.

Q: Can I donate a car that doesn’t run?

Yes, many organizations in Kentucky accept car donations that don’t run. However, it’s important to note that the value of the car will likely be lower if it is not in working condition. Some organizations will sell the car for parts, while others may repair it and sell it to raise funds for their programs.

Before donating a car that doesn’t run, you should contact the organization to find out if they have any specific requirements or restrictions.

Q: Will I get a tax deduction for donating my car in Kentucky?

Yes, if you donate your car to a qualified charitable organization in Kentucky, you may be eligible for a tax deduction. The amount of the deduction will depend on the value of the car, as well as other factors, such as the income tax bracket you are in. If the value of the car is more than $500, you will need to fill out IRS Form 8283.

It’s important to keep all documentation related to your car donation, including the title transfer and any receipts or letters from the charity, in case you are audited by the IRS.

Q: How long does it take to donate a car in Kentucky?

The process of donating a car in Kentucky can vary depending on the organization you donate to and the time of year. In general, you should plan for the process to take a few days to a week. This includes filling out the necessary paperwork, arranging for the car to be picked up or dropped off, and transferring the title of the vehicle.

Some organizations may offer expedited services if you need to donate your car quickly. However, you should always allow enough time to ensure the process is completed correctly and all necessary documentation is completed.

In conclusion, donating a car in Kentucky is a simple and effective way to help those in need. By following the necessary steps and selecting a reputable charity, you can make a significant impact in your community while also receiving a tax deduction.

Not only does donating a car benefit those in need, but it also benefits the environment. By recycling and repurposing the car, you are helping to reduce waste and promote sustainability.

Overall, donating a car in Kentucky is a win-win situation. You are able to give back to your community and make a positive impact while also receiving a tax deduction and promoting environmental responsibility. So, consider donating your car today and do your part in making a difference.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts