Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Donating a car is a great way to give back to your community and make a positive impact on someone’s life. In Arkansas, there are many organizations that accept car donations and use them to help individuals in need. However, the process of donating a car can seem daunting, especially for those who have never done it before.

If you’re considering donating a car in Arkansas, this guide will give you all the information you need to make the process as smooth and stress-free as possible. From finding a reputable charity to getting a tax deduction, we’ll cover everything you need to know to make your car donation a success. So let’s get started and learn how you can make a difference in someone’s life by donating your car in Arkansas!

- Choose a charity that accepts car donations in Arkansas.

- Contact the charity and provide them with your car’s details.

- Arrange a date and time for the charity to pick up your car.

- Sign the necessary paperwork and hand over the car’s title.

- Get a receipt for your donation for tax purposes.

How to Donate Car in Arkansas?

Donating a car in Arkansas is a great way to support charitable organizations and make a positive impact in your community. However, the process can seem daunting if you’re not familiar with it. In this article, we’ll guide you through the steps of donating a car in Arkansas and provide you with tips to ensure a smooth and successful donation.

1. Choose a Reputable Charity

The first step in donating a car in Arkansas is to choose a reputable charity to donate to. Look for a charity that aligns with your values and has a mission you support. You can research charities online through websites like Charity Navigator or GuideStar to ensure they are legitimate and use donations effectively.

Once you’ve found a charity you want to support, contact them to confirm they accept car donations. Some charities have specific requirements for the vehicles they accept, such as age or condition, so it’s important to check beforehand.

2. Gather Vehicle Information

Before donating your car, gather all the necessary vehicle information. This includes the make, model, year, and VIN number. You’ll also need the car’s title and registration, which must be in your name.

If you’ve lost the title, you can request a replacement from the Arkansas Department of Finance and Administration. You’ll also need to provide proof of ownership, such as a bill of sale or registration, and pay a fee.

3. Determine the Value of Your Car

The IRS allows you to claim a tax deduction for the value of your car donation. To determine the value, use a reputable online valuation tool like Kelley Blue Book or NADA Guides. You can also contact a local car dealer or appraiser for an estimate.

It’s important to note that if your car is valued at more than $500, you’ll need to complete IRS Form 8283 and include it with your tax return.

4. Arrange for Pickup or Drop-Off

Once you’ve chosen a charity and gathered all the necessary information, arrange for pickup or drop-off of your car. Many charities offer free towing services for donated cars, so be sure to ask if this is an option.

If you prefer to drop off the car yourself, make sure to get a receipt from the charity for your donation. This will be necessary for tax purposes.

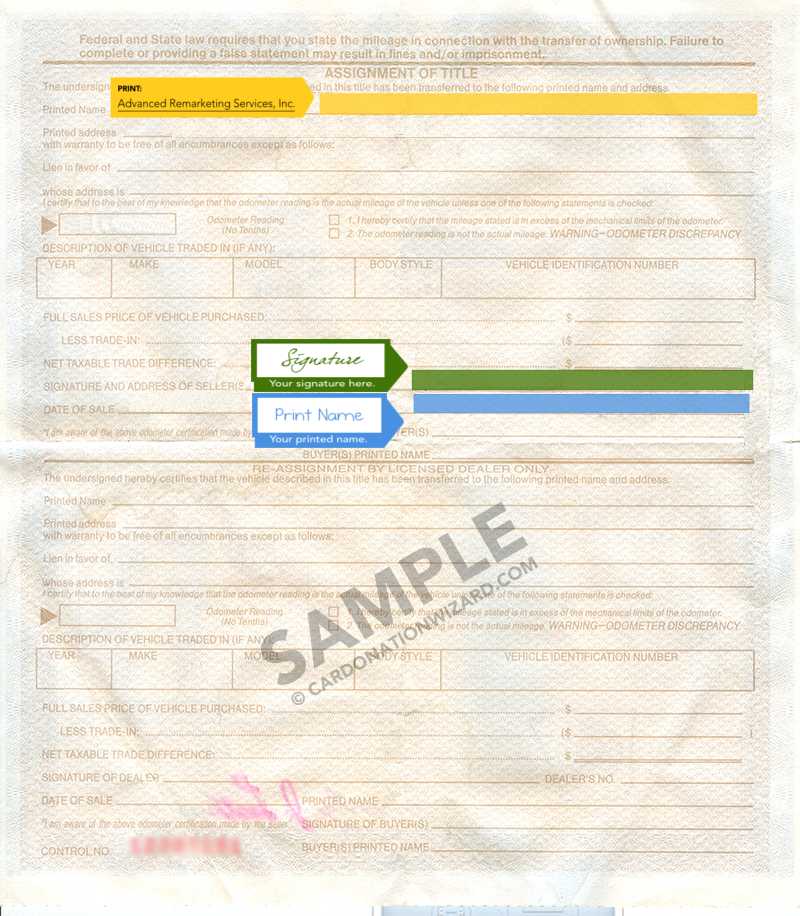

5. Transfer Ownership

When you donate your car, you’ll need to transfer ownership to the charity. Fill out the back of the title with the charity’s name and address, and sign and date it. If there are multiple owners listed on the title, all owners must sign.

You should also remove the license plates from the car and cancel the registration with the Arkansas Department of Finance and Administration.

6. Follow Up with the Charity

After you’ve donated your car, follow up with the charity to confirm they received it and to ask for a receipt. This will be necessary for your tax records.

If the charity plans to sell your car, ask for documentation of the sale price. This will be necessary for tax purposes.

7. Benefits of Donating a Car in Arkansas

Donating a car in Arkansas has several benefits. First and foremost, it allows you to support a charitable organization and make a positive impact in your community. It also provides a tax deduction, which can help reduce your tax bill. Additionally, donating a car is an environmentally friendly way to dispose of a vehicle that you no longer need.

8. Donating vs. Selling Your Car

If you’re considering getting rid of an old car, you may be wondering whether it’s better to donate or sell it. While selling your car may provide more immediate financial benefits, donating it can have a greater impact on your community and provide valuable tax deductions.

When you donate your car, you’re supporting a charitable organization that can use the funds to provide services to those in need. Additionally, you can claim a tax deduction for the value of your car, which can help reduce your tax bill.

9. Frequently Asked Questions

– What charities in Arkansas accept car donations?

A: There are many charities in Arkansas that accept car donations, including Goodwill Industries, the American Cancer Society, and the Make-A-Wish Foundation.

– Is it possible to donate a car that doesn’t run?

A: Yes, some charities accept cars that don’t run. However, they may have specific requirements for the condition of the car, so it’s important to check beforehand.

– How much can I claim as a tax deduction for my car donation?

A: The IRS allows you to claim the fair market value of your car as a tax deduction. If your car is valued at more than $500, you’ll need to complete IRS Form 8283 and include it with your tax return.

10. Conclusion

Donating a car in Arkansas is a great way to support a charitable organization and make a positive impact in your community. By following these steps and working with a reputable charity, you can ensure a smooth and successful donation process. Remember to gather all the necessary information, arrange for pickup or drop-off, and follow up with the charity for a receipt. And don’t forget to take advantage of the tax deductions available for your donation.

Contents

- Frequently Asked Questions

- 1. How do I donate my car in Arkansas?

- 2. What are the benefits of donating my car in Arkansas?

- 3. Are there any restrictions on the types of cars that can be donated in Arkansas?

- 4. How do I determine the value of my donated car for tax purposes?

- 5. Can I donate a car that is not registered in Arkansas?

Frequently Asked Questions

1. How do I donate my car in Arkansas?

Donating your car in Arkansas is easy! You can start by finding a reputable charity or non-profit organization that accepts car donations. Once you have identified a charity, you can visit their website or call them to initiate the donation process. Typically, you will need to provide information about your car, including the make, model, year, and condition. Some charities may also ask for documentation, such as the car’s title or registration.

After you have provided all of the necessary information, the charity will schedule a time to pick up your car. In some cases, you may be able to drop off your car at a designated location. Once the charity has received your car, they will typically sell it and use the proceeds to fund their programs and services.

2. What are the benefits of donating my car in Arkansas?

Donating your car in Arkansas can provide a number of benefits. First, you will be able to support a charity or non-profit organization that is doing important work in your community. Second, you may be eligible for a tax deduction based on the value of your car. This can help reduce your tax bill and provide additional financial benefits. Finally, donating your car can be a convenient and hassle-free way to get rid of an old or unwanted vehicle.

Overall, donating your car is a great way to give back to your community and support a worthy cause. If you are interested in donating your car, be sure to research different charities and organizations to find one that aligns with your values and goals.

3. Are there any restrictions on the types of cars that can be donated in Arkansas?

In general, most charities and non-profit organizations in Arkansas will accept a wide range of car donations. However, there may be some restrictions on the types of cars that can be donated. For example, some charities may only accept cars that are in good condition and can be sold at auction. Others may only accept cars that meet certain safety or emissions standards.

Before donating your car, be sure to check with the charity or organization to see if there are any restrictions on the types of cars they accept. This will help ensure that your donation is put to good use and that you are able to support a charity that aligns with your values.

4. How do I determine the value of my donated car for tax purposes?

If you plan to claim a tax deduction for your car donation, you will need to determine the fair market value of your car. This value is typically based on the price that a willing buyer would pay for your car in its current condition. You may be able to estimate the value of your car using online tools or by consulting with a professional appraiser.

It is important to keep accurate records of your car donation, including the fair market value of your car and any documentation provided by the charity or non-profit organization. This will help ensure that you are able to claim any tax deductions for your donation.

5. Can I donate a car that is not registered in Arkansas?

In general, most charities and non-profit organizations in Arkansas will accept car donations from out-of-state donors. However, there may be some additional requirements or paperwork involved in donating a car that is not registered in Arkansas.

Before donating a car that is not registered in Arkansas, be sure to check with the charity or organization to see if there are any additional requirements or restrictions. This will help ensure that your donation is processed smoothly and that you are able to support the charity or non-profit organization of your choice.

In conclusion, donating a car in Arkansas is a great way to make a positive impact on your community while also getting rid of an unwanted vehicle. By following the simple steps outlined in this guide, you can ensure that your donation goes smoothly and that you receive the maximum tax benefit allowed by law.

Remember to do your research and choose a reputable charity that aligns with your values and interests. Be sure to gather all necessary documentation, including the vehicle title and registration, and keep records of your donation for tax purposes.

By donating your car in Arkansas, you can make a difference in the lives of those in need and contribute to a better future for your community. Thank you for considering this meaningful way to give back.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts