Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you planning to gift a vehicle to a loved one in Missouri? That’s a great idea! However, before you hand over the keys, you need to complete a Missouri car title as a gift. This process can seem daunting, but with a little guidance, it can be completed easily and without stress.

In this article, we’ll provide you with a step-by-step guide on how to complete a Missouri car title as a gift. We’ll walk you through the necessary paperwork, outlining the information you need to provide, and the steps you need to take to ensure a smooth transfer of ownership. By the end of this article, you’ll be equipped with everything you need to know to gift a vehicle to someone in Missouri.

How to Complete a Missouri Car Title as Gift?

To complete a Missouri car title as a gift, follow these steps:

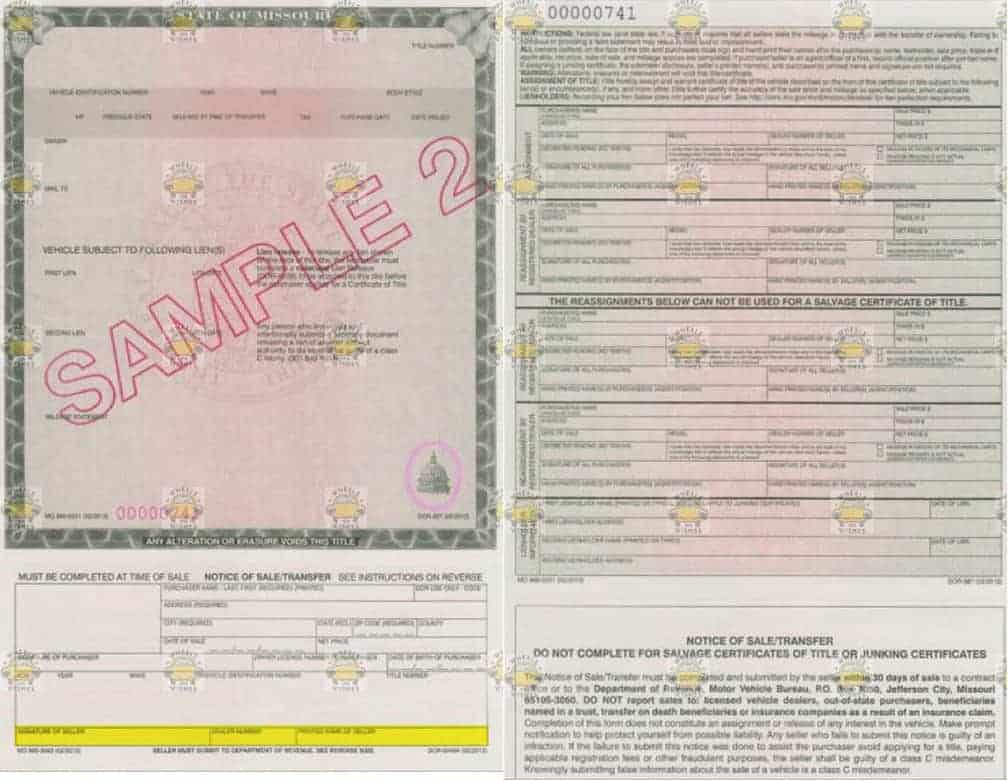

- Fill out the “Assignment of Title” section on the back of the car title.

- Include the recipient’s name and address in the “Buyer” section.

- Write “Gift” in the “Purchase Price” section.

- Submit the title to the Missouri Department of Revenue for processing.

How to Complete a Missouri Car Title as Gift?

Giving a car as a gift can be a thoughtful gesture, but it involves some paperwork. If you’re planning to give a car as a gift in Missouri, you’ll need to complete a car title transfer. Here’s how you can complete a Missouri car title as a gift:

1. Check the Vehicle’s Title

Before you can transfer the car title to the recipient, you need to ensure that the car’s title is in good standing. The title should have no liens or outstanding debts. If there are any issues with the title, you’ll need to resolve them before transferring the car to prevent any legal complications.

Once you’ve confirmed that the title is clear, you can move on to the transfer process.

2. Complete the Gift Affidavit

In Missouri, you’ll need to complete a gift affidavit to transfer the car title. This form is available on the Missouri Department of Revenue website. Fill out the form with the car’s make, model, VIN, and the name and address of the recipient. Be sure to sign the form and have it notarized before submitting it.

3. Gather Required Documents

To complete the title transfer, you’ll need the following documents:

– The original car title

– The gift affidavit

– A safety inspection certificate (if the car is over 5 years old)

– A lien release (if applicable)

Make sure you have all the necessary documents before heading to the Missouri Department of Revenue.

4. Visit the Missouri Department of Revenue

Once you have all the required documents, visit the Missouri Department of Revenue to complete the title transfer. You’ll need to bring the documents and pay the necessary fees. The fees vary depending on the car’s value and age.

5. Update Your Insurance

After completing the title transfer, you’ll need to update your insurance policy to reflect the change in ownership. Make sure to provide the recipient’s information to your insurance company and remove the car from your policy.

6. Benefits of Gifting a Car

Gifting a car can be a generous act that can benefit both the giver and the recipient. For the giver, it can be a way to reduce their taxable income by taking advantage of the annual gift tax exclusion. For the recipient, it can be a way to save money on a car purchase and avoid paying sales tax.

7. Considerations for the Recipient

If you’re the recipient of a gifted car, there are a few things to consider. First, you’ll need to update your insurance policy to cover the car. You’ll also need to register the car in your name and pay the necessary fees. Finally, you may need to pay taxes on the car’s value, depending on your state’s laws.

8. Gifting vs. Selling a Car

When deciding whether to gift or sell a car, there are a few factors to consider. If the car has sentimental value or you want to reduce your taxable income, gifting may be the best option. However, if you need to raise cash or the recipient isn’t interested in the car, selling may be the better choice.

9. Conclusion

Gifting a car in Missouri involves completing a car title transfer and gift affidavit. Make sure to gather all the necessary documents and visit the Missouri Department of Revenue to complete the transfer. Remember to update your insurance policy and consider the tax implications for both the giver and recipient.

10. FAQs

Q: Do I need to pay taxes on a gifted car in Missouri?

A: In Missouri, you don’t need to pay sales tax on a gifted car, but you may need to pay taxes on the car’s value if it exceeds a certain threshold.

Q: Can I gift a car if there’s a lien on the title?

A: If there’s a lien on the car’s title, you’ll need to pay off the lien before gifting the car. This ensures that the recipient receives a clear title.

Contents

- Frequently Asked Questions

- Q: What information do I need to complete a Missouri car title as a gift?

- Q: Do I need to pay any fees when completing a Missouri car title as a gift?

- Q: How do I fill out the gift affidavit on the Missouri car title?

- Q: Can I complete a Missouri car title transfer as a gift online?

- Q: What happens after I complete a Missouri car title transfer as a gift?

- How To Gift A Vehicle To Someone Without Paying Taxes

Frequently Asked Questions

When gifting a car in Missouri, completing the car title transfer process correctly is crucial. Here are some commonly asked questions about how to complete a Missouri car title as a gift.

Q: What information do I need to complete a Missouri car title as a gift?

When completing a car title transfer as a gift in Missouri, you will need the following information:

- The current owner’s name and address

- The recipient’s name and address

- The vehicle identification number (VIN)

- The odometer reading (if the vehicle is less than 10 years old)

It’s important to ensure that all information is accurate and up-to-date to avoid any issues with the car title transfer process.

Q: Do I need to pay any fees when completing a Missouri car title as a gift?

Yes, you will need to pay a gift tax when transferring a car title as a gift in Missouri. The gift tax is based on the fair market value of the vehicle and is calculated by the Missouri Department of Revenue. You will also need to pay a title transfer fee and a registration fee.

It’s important to note that the gift tax is the responsibility of the person gifting the vehicle, not the recipient.

Q: How do I fill out the gift affidavit on the Missouri car title?

The gift affidavit on the Missouri car title is a section that needs to be completed when gifting a vehicle. To fill out the gift affidavit, you will need to provide the following information:

- The date of the gift

- The relationship between the current owner and the recipient

- The reason for the gift

- A statement of the vehicle’s fair market value

It’s important to fill out the gift affidavit accurately and completely to avoid any delays in the car title transfer process.

Q: Can I complete a Missouri car title transfer as a gift online?

No, you cannot complete a car title transfer as a gift online in Missouri. You will need to visit a Missouri Department of Revenue office in person or send in the necessary documents by mail to complete the car title transfer process.

It’s important to ensure that you have all the necessary documents and information before visiting a Missouri Department of Revenue office to avoid any delays in the process.

Q: What happens after I complete a Missouri car title transfer as a gift?

After you complete a car title transfer as a gift in Missouri, the recipient will become the new owner of the vehicle. The recipient will need to register the vehicle with the Missouri Department of Revenue and obtain new license plates.

It’s important to keep a copy of all relevant documents and information related to the car title transfer process for your records.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, completing a Missouri car title as a gift is a simple process that requires careful attention to detail. By following the steps outlined in this guide, you can ensure that the transfer of ownership is done correctly and legally. Remember to gather all necessary paperwork and signatures, and to double-check all information before submitting the title to the Missouri Department of Revenue.

It is important to note that gift transfers are subject to taxes and fees, so be prepared to pay these costs when completing the title. However, the process can be well worth it to give the gift of a car to a loved one or friend.

Overall, completing a Missouri car title as a gift can be a rewarding experience that brings joy to both the giver and the recipient. With a little bit of planning and patience, you can successfully transfer ownership of a vehicle and make someone’s day. So go ahead and get started on the process today – you won’t regret it!

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts