Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you considering donating your old car to charity? Not only is it a generous act, but it could also provide you with a tax deduction. However, you may be wondering how much you can actually deduct on your taxes for a qualified vehicle donation. In this article, we’ll explore the guidelines for determining the value of your donated vehicle and the maximum deduction you can claim on your tax return. So, let’s dive in and find out how you can maximize your contribution and save money on your taxes.

You can deduct the fair market value of your vehicle on your taxes if you donate it to a qualified charitable organization. If the charity sells the vehicle, you can only deduct the amount of the sale. However, if the charity uses the vehicle for its mission, you can deduct the fair market value. Make sure to get a receipt from the charity, and if the deduction exceeds $500, you’ll need to fill out IRS Form 8283.

How Much Can You Deduct on Qualified Vehicle Donation?

Donating vehicles to charity is a great way to give back to the community and get a tax deduction at the same time. But how much can you deduct on a qualified vehicle donation? Here’s what you need to know.

1. Fair Market Value

The amount you can deduct on a qualified vehicle donation is based on the fair market value of the vehicle. This is the price that the vehicle would sell for on the open market.

If the charity sells the vehicle, you can deduct the fair market value up to $500. If the charity keeps and uses the vehicle, you can deduct the fair market value up to $5,000. And if the charity sells the vehicle for more than $500, you can deduct the actual sale price.

2. Deductible Expenses

In addition to the fair market value of the vehicle, you can also deduct any expenses related to the donation, such as the cost of towing or transporting the vehicle to the charity.

Benefits:

– You get to give back to the community by donating a vehicle to charity.

– You can get a tax deduction for the fair market value of the vehicle.

– You can deduct any expenses related to the donation.

VS:

– If the charity sells the vehicle for less than the fair market value, you may not be able to deduct the full amount.

– If you don’t itemize your deductions on your taxes, you won’t be able to take advantage of the tax deduction.

3. Qualified Charities

To qualify for a tax deduction, you must donate the vehicle to a qualified charity. This is a charity that is recognized by the IRS as a tax-exempt organization.

Before donating your vehicle, make sure to check that the charity is qualified. You can do this by searching for the charity on the IRS website or by calling the IRS directly.

Benefits:

– You can be sure that your donation is going to a legitimate charity.

– You can get a tax deduction for your donation.

VS:

– If the charity is not qualified, you won’t be able to get a tax deduction.

– You may not be comfortable donating to a charity that you don’t know much about.

4. Condition of the Vehicle

The condition of the vehicle can also affect the amount that you can deduct on a qualified vehicle donation. If the vehicle is in good condition and can be used by the charity, you may be able to deduct more than if the vehicle is in poor condition and needs to be sold for scrap.

Before donating your vehicle, make sure to assess its condition and determine what the fair market value is.

Benefits:

– You can get a higher tax deduction if the vehicle is in good condition.

– The charity may be able to use the vehicle to help those in need.

VS:

– If the vehicle is in poor condition, you may not be able to deduct as much.

– The charity may not be able to use the vehicle and may need to sell it for scrap.

5. Documentation

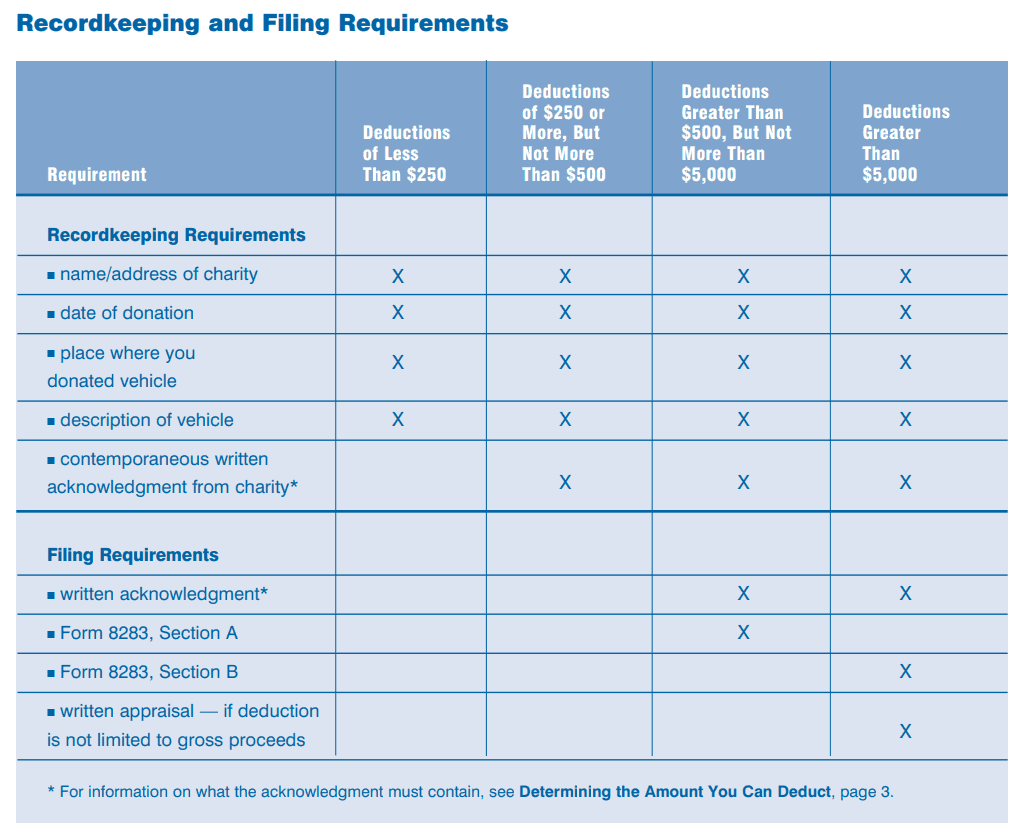

To claim a tax deduction for a qualified vehicle donation, you will need to have documentation of the donation. This includes a receipt from the charity showing the date of the donation, the name and address of the charity, and a description of the vehicle.

If the fair market value of the vehicle is more than $500, you will also need to file Form 8283 with your tax return.

Benefits:

– You can be sure that you have the documentation you need to claim the tax deduction.

– You can avoid any issues with the IRS by having proper documentation.

VS:

– You will need to keep track of the documentation and make sure that you have it when it’s time to file your taxes.

– If you don’t have proper documentation, you may not be able to claim the tax deduction.

6. Timing

You can claim a tax deduction for a qualified vehicle donation in the year that the donation is made. However, if you donate the vehicle on December 31st, you will need to make sure that the charity receives the donation by that date in order to claim the deduction for that tax year.

Benefits:

– You can plan your donation for the best tax benefits.

– You can make sure that the charity receives the donation in a timely manner.

VS:

– If the charity doesn’t receive the donation by December 31st, you may need to wait until the following tax year to claim the deduction.

– You may need to plan ahead to make sure that the donation is made in time for the tax year.

7. Alternatives to Donation

If you’re not sure about donating your vehicle to charity, there are other options to consider. You could sell the vehicle and donate the proceeds to charity, or you could trade in the vehicle and donate the trade-in value to charity.

Benefits:

– You can still give back to the community without donating your vehicle.

– You can choose an option that works best for you.

VS:

– You may not get as large of a tax deduction if you sell the vehicle or trade it in.

– You may need to spend extra time and effort on selling or trading in the vehicle.

8. State-Specific Rules

In addition to federal tax rules, there may be state-specific rules that affect how much you can deduct on a qualified vehicle donation. Make sure to check with your state’s tax agency to see if there are any additional rules or restrictions.

Benefits:

– You can be sure that you’re following all of the rules and regulations in your state.

– You can avoid any issues with your state’s tax agency.

VS:

– You may need to spend extra time researching and understanding your state’s tax rules.

– Your state’s rules may limit the amount that you can deduct on a qualified vehicle donation.

9. Professional Help

If you’re unsure about how much you can deduct on a qualified vehicle donation, it may be helpful to seek out professional help. A tax professional or financial advisor can help you understand the rules and regulations and make the best decisions for your situation.

Benefits:

– You can get expert advice on how to maximize your tax benefits.

– You can avoid any mistakes or issues with your tax return.

VS:

– You will need to pay for the services of a tax professional or financial advisor.

– You may need to spend extra time finding the right professional for your needs.

10. Conclusion

Donating a vehicle to charity can be a great way to give back to the community and get a tax deduction at the same time. The amount that you can deduct on a qualified vehicle donation is based on the fair market value of the vehicle, any deductible expenses, and the condition of the vehicle.

Make sure to donate to a qualified charity, keep proper documentation, and plan ahead for the best tax benefits. And if you’re unsure about how to proceed, consider seeking out professional help.

By following these guidelines, you can make the most of your qualified vehicle donation and give back to those in need.

Contents

- Frequently Asked Questions

- 1. What is a qualified vehicle donation?

- 2. How much can I deduct for a qualified vehicle donation?

- 3. What documentation do I need to claim a deduction for a qualified vehicle donation?

- 4. Can I claim a deduction for a vehicle that I donate to a family member?

- 5. Are there any limits on the amount I can deduct for a qualified vehicle donation?

Frequently Asked Questions

Donating a vehicle to a qualified organization can be a great way to support a favorite cause while also receiving a tax deduction. However, it’s important to understand how much you can actually deduct on your taxes. Here are some common questions and answers about the deduction for qualified vehicle donations.

1. What is a qualified vehicle donation?

A qualified vehicle donation is a donation of a car, truck, boat, or other vehicle to a qualified charitable organization. The organization must be recognized by the IRS as a tax-exempt organization eligible to receive tax-deductible charitable contributions. It’s important to note that donations to individuals, political organizations, and most foreign organizations are not tax-deductible.

When you make a qualified vehicle donation, you may be able to deduct the fair market value of the vehicle on your tax return. However, there are some restrictions on how much you can claim as a deduction.

2. How much can I deduct for a qualified vehicle donation?

The amount you can deduct for a qualified vehicle donation depends on several factors, including the fair market value of the vehicle, how the organization uses the vehicle, and how the organization sells the vehicle. Generally, if the organization sells the vehicle, you can deduct the sales price or the fair market value of the vehicle, whichever is less.

However, if the organization uses the vehicle for its own purposes (such as delivering meals to the elderly), you can usually deduct the fair market value of the vehicle. In some cases, if the vehicle is in poor condition or has a low market value, you may only be able to deduct a nominal amount.

3. What documentation do I need to claim a deduction for a qualified vehicle donation?

To claim a deduction for a qualified vehicle donation, you will need to obtain a written acknowledgement from the organization that received the vehicle. This acknowledgement should include your name and taxpayer identification number, the vehicle identification number, a description of the vehicle, and a statement indicating whether the organization provided any goods or services in exchange for the donation.

If the organization sells the vehicle, it should also provide you with a statement indicating the sales price of the vehicle. You should keep all documentation related to the donation, including the acknowledgement and any receipts or bills of sale.

4. Can I claim a deduction for a vehicle that I donate to a family member?

No, you cannot claim a deduction for a vehicle that you donate to a family member or other individual. To claim a deduction, the vehicle must be donated to a qualified charitable organization.

However, if the individual is in financial need and the donation is intended to help meet that need, you may be able to claim a deduction for the donation as a gift to the individual. In this case, you should consult with a tax professional to determine the appropriate way to claim the deduction.

5. Are there any limits on the amount I can deduct for a qualified vehicle donation?

Yes, there are limits on the amount you can deduct for a qualified vehicle donation. If the organization sells the vehicle, you can deduct the sales price or the fair market value of the vehicle, whichever is less. If the organization uses the vehicle for its own purposes, you can usually deduct the fair market value of the vehicle.

However, regardless of the fair market value of the vehicle, you cannot deduct more than the amount that the organization actually receives from the sale of the vehicle. In addition, if you claim a deduction of more than $500 for the donation, you will need to complete and attach IRS Form 8283 to your tax return.

In conclusion, qualified vehicle donations can be a great way to support a charitable cause and receive a tax deduction at the same time. As long as the donation is made to an eligible organization and the appropriate documentation is obtained, the donor can deduct the fair market value of the vehicle. It’s important to keep in mind that there are certain limitations and requirements that must be met in order to claim the deduction, so it’s always a good idea to consult with a tax professional before making a donation.

Overall, making a qualified vehicle donation can be a win-win situation for both the donor and the charitable organization. Not only does the donation provide much-needed support for the organization, but it also allows the donor to receive a tax deduction for their contribution. By taking the necessary steps to ensure that the donation meets the requirements set forth by the IRS, donors can feel good about their decision to give back to their community while also taking advantage of potential tax benefits.

In the end, it’s important to remember that the rules and regulations surrounding vehicle donations can be complex and confusing. However, by doing your research, seeking professional advice, and following the guidelines set forth by the IRS, you can ensure that your donation is not only impactful but also tax-efficient. So if you’re considering making a vehicle donation, take the time to understand the process and requirements involved, and you’ll be well on your way to making a positive difference in the lives of others while also enjoying the benefits of a potential tax deduction.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts