Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

If you’re planning to gift or receive a car in Rhode Island, you might be wondering how many times this is allowed. Gift-giving is a common practice, but it’s important to know the rules and regulations surrounding vehicle transfers in Rhode Island to avoid any legal issues. In this article, we’ll explore the laws governing car gifting in Rhode Island, so you can make informed decisions about transferring ownership of a vehicle.

There is no limit to the number of times you can gift a car in Rhode Island. However, you must follow the proper procedures for transferring ownership of the vehicle each time it is gifted. This includes completing the necessary paperwork and paying any required fees. Additionally, the recipient of the gifted car must meet all eligibility requirements for registering the vehicle in Rhode Island.

Contents

- How Many Times Can You Gift a Car in Rhode Island?

- Frequently Asked Questions

- Can I gift a car to my family member more than once in Rhode Island?

- Do I need to pay taxes on a gifted car in Rhode Island?

- How many cars can I gift in Rhode Island?

- Can I gift a car to someone who lives out of state?

- Do I need to have insurance on a gifted car in Rhode Island?

- How To Gift A Vehicle To Someone Without Paying Taxes

How Many Times Can You Gift a Car in Rhode Island?

Gifting a car is a great way to show your appreciation or love for someone, and in Rhode Island, you can gift a car as many times as you want. However, before you do so, there are a few things you should know to make the process as smooth as possible. Here is everything you need to know about gifting a car in Rhode Island.

What is a Car Gift Transfer?

A car gift transfer is when the owner of a car transfers ownership to someone else as a gift. This means that the recipient of the car does not have to pay for the car, but they will be responsible for any taxes and fees associated with registering the car in their name. In Rhode Island, the process for gifting a car is relatively simple, but there are a few steps you need to take to ensure that everything is done correctly.

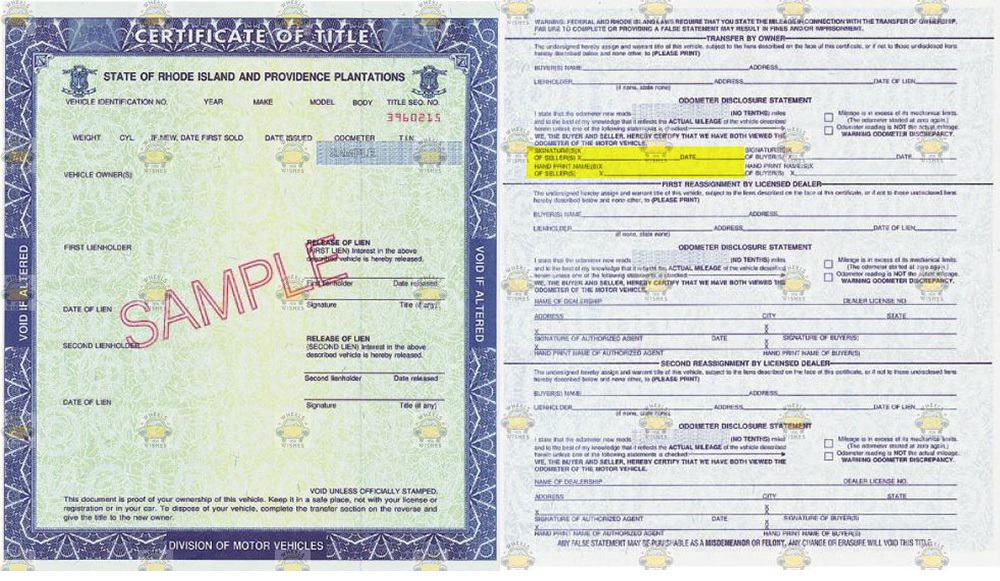

First, the owner of the car needs to sign the back of the title, just like they would if they were selling the car. However, instead of writing a sale price, they should write “gift” in the sale price section. They should also write the name and address of the person they are gifting the car to in the buyer section of the title. Once this is done, the recipient can take the title to the DMV to register the car in their name.

Who Can Gift a Car in Rhode Island?

In Rhode Island, anyone can gift a car to someone else as long as they are the legal owner of the car. This means that if you have a car in your name and you want to gift it to someone else, you can do so without any issues. However, if you are not the legal owner of the car, you cannot gift it to someone else.

If you are gifting a car to a family member, such as a child or a spouse, you may want to consider adding them to your insurance policy. This will ensure that they are covered in case of an accident, and it will also make it easier for them to register the car in their name.

What Are the Benefits of Gifting a Car in Rhode Island?

Gifting a car in Rhode Island has several benefits. First, you can show your appreciation or love for someone by giving them a car. Second, the recipient of the car does not have to pay for the car, which can be a significant financial burden lifted off their shoulders. Finally, gifting a car can be a great way to get rid of a car that you no longer need or want.

However, there are some things you should consider before gifting a car. For example, if the car is old or has a lot of miles on it, it may not be the best gift for someone who needs a reliable car to get to work or school. You should also consider the recipient’s financial situation before gifting a car, as they will be responsible for any taxes and fees associated with registering the car in their name.

Can You Gift a Car to a Non-Resident of Rhode Island?

Yes, you can gift a car to a non-resident of Rhode Island as long as the car is registered in Rhode Island. However, the recipient of the car will need to register the car in their home state once they receive it. This means that they will be responsible for any taxes and fees associated with registering the car in their home state.

If you are gifting a car to someone who lives in another state, you should make sure that the car meets the emissions and safety standards in their state. You should also check with their DMV to find out what the requirements are for registering a car in their state.

What Are the Fees Associated with Gifting a Car in Rhode Island?

In Rhode Island, there are several fees associated with gifting a car. First, there is a $51 fee for transferring the title. There is also a sales tax of 7% on the fair market value of the car. However, if the car is more than 7 years old, the sales tax is calculated based on the purchase price or the fair market value, whichever is less.

The recipient of the car will also need to pay a registration fee, which varies depending on the weight of the car. For cars weighing less than 3,500 pounds, the registration fee is $31.50. For cars weighing between 3,501 and 4,000 pounds, the fee is $57.50. For cars weighing between 4,001 and 5,000 pounds, the fee is $87.50. For cars weighing between 5,001 and 6,000 pounds, the fee is $120.50.

Gift a Car vs. Sell a Car: Which is Better?

Deciding whether to gift a car or sell a car depends on your personal situation. If you have a car that you no longer need or want, gifting it to someone else can be a great way to show your appreciation or love for them. However, if you need the money from selling the car, selling it may be the better option.

If you are considering gifting a car, you should also consider the recipient’s financial situation. If they cannot afford to pay the taxes and fees associated with registering the car in their name, gifting the car may not be the best option.

Conclusion

Gifting a car in Rhode Island is a great way to show your appreciation or love for someone. However, before you do so, you should make sure that you understand the process and the fees associated with gifting a car. If you have any questions, you can contact the Rhode Island DMV for more information.

Frequently Asked Questions

Are you wondering how many times you can gift a car in Rhode Island? Here are some common questions and answers to help you understand the process.

Can I gift a car to my family member more than once in Rhode Island?

Yes, you can gift a car to a family member more than once in Rhode Island. However, you will need to follow the same process as you did the first time you gifted a car, which includes completing the necessary paperwork and paying any required fees.

Additionally, it’s important to note that if you gift a car to the same family member multiple times within a certain timeframe, it may raise red flags with the Department of Motor Vehicles and could potentially lead to an investigation.

Do I need to pay taxes on a gifted car in Rhode Island?

Yes, you will need to pay taxes on a gifted car in Rhode Island. The amount of taxes owed will be based on the fair market value of the car at the time of the gift. You can check with the Rhode Island Division of Taxation for more information on the current tax rates.

It’s important to make sure that you properly document the gift and pay the required taxes to avoid any penalties or legal issues down the road.

How many cars can I gift in Rhode Island?

There is no limit to the number of cars you can gift in Rhode Island. However, if you are gifting a large number of cars or engaging in multiple car transactions, it’s a good idea to consult with an attorney or financial advisor to ensure that you are following all applicable laws and regulations.

Additionally, if you are gifting cars for business purposes, you may need to obtain certain licenses or permits to operate legally in Rhode Island.

Can I gift a car to someone who lives out of state?

Yes, you can gift a car to someone who lives out of state in Rhode Island. However, you will need to follow the same process as you would if the recipient lived in Rhode Island, including completing the necessary paperwork and paying any required fees.

It’s also a good idea to check with the recipient’s state of residence to ensure that they are following all applicable laws and regulations related to car gifting.

Do I need to have insurance on a gifted car in Rhode Island?

Yes, you will need to have insurance on a gifted car in Rhode Island. The recipient of the gift will need to obtain insurance coverage before they can legally operate the vehicle on the roads.

It’s important to make sure that the recipient obtains adequate insurance coverage to protect themselves and others in the event of an accident or other incident.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, gifting a car in Rhode Island is a straightforward process. However, it’s important to keep in mind that you can only gift a car twice in a calendar year. If you exceed this limit, you will need to transfer the ownership of the vehicle and pay the associated fees.

It’s also crucial to ensure that you follow all the necessary steps when gifting a car, such as completing the necessary paperwork and notifying the Rhode Island Division of Motor Vehicles. This will help to ensure that the transfer of ownership is legal and that you avoid any potential complications down the line.

Overall, if you’re considering gifting a car in Rhode Island, it’s essential to do your research and follow the proper procedures. By doing so, you can ensure that the process is smooth and hassle-free, and that both you and the recipient are satisfied with the outcome.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts