Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you planning to gift a car to your loved ones in Ohio? While it is a thoughtful gesture, you may be wondering how many times you can do it legally. The rules and regulations for gifting a car in Ohio can be confusing, but don’t worry, we’ve got you covered. In this article, we will discuss the laws surrounding car gifting in Ohio and answer all your questions to ensure a smooth and hassle-free process. So, let’s dive in and learn more about how many times you can gift a car in Ohio.

According to Ohio laws, there is no limit to the number of times you can gift a car to a family member or friend. However, the recipient of the gifted car must meet the state’s eligibility requirements for car ownership, including having a valid driver’s license and car insurance. Additionally, both the giver and the receiver must complete and sign the required paperwork to transfer ownership of the vehicle properly.

How Many Times Can You Gift a Car in Ohio?

What is a Car Gift?

When you transfer the ownership of your vehicle to another person as a gift, it is known as a car gift. The process of gifting a car is similar to selling it, except that there is no exchange of money. In Ohio, gifting a car involves transferring the title to the recipient, just like in other states. However, before you gift a car, it is important to know how many times you can do it.

Can You Gift a Car More Than Once?

Yes, you can gift a car more than once in Ohio. However, it is important to note that there are certain restrictions to consider. In Ohio, you can gift a car to anyone as many times as you wish, as long as you follow the state’s guidelines for transferring ownership.

Transferring Ownership of a Gifted Car

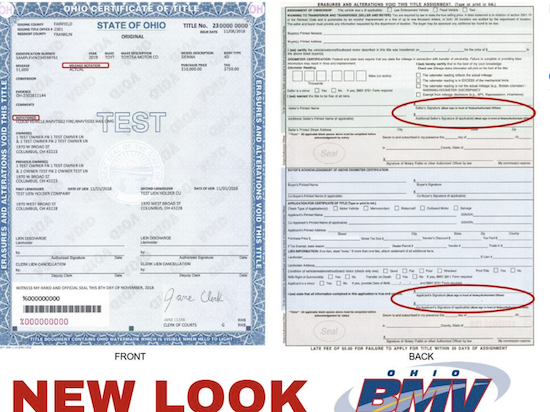

To transfer the ownership of a gifted car in Ohio, the recipient needs to visit the local Bureau of Motor Vehicles (BMV) office. The recipient needs to provide the following documents:

- The original title signed by the person who is gifting the car

- A completed Application for Certificate of Title

- A valid Ohio driver’s license or state ID card

- The proper fee for titling and registration

Benefits of Gifting a Car

There are several benefits to gifting a car, including the following:

1. No Sales Tax

When you gift a car, you don’t have to pay sales tax on the transaction. This can save you a significant amount of money, especially if the car is valuable.

2. No Hassles

Gifting a car is a simple and hassle-free process. You don’t have to worry about advertising the car, finding a buyer, negotiating a price, or transferring the funds.

3. Helping a Friend or Family Member

Gifting a car can be a great way to help out a friend or family member who needs a vehicle. It can also be a way to show your appreciation or gratitude.

Gifting a Car vs. Selling a Car

While both gifting and selling a car have their advantages, there are some key differences to consider.

1. Tax Implications

When you sell a car, you may have to pay capital gains tax on any profit you make. However, when you gift a car, you don’t have to worry about taxes.

2. Legal Implications

Selling a car involves signing a contract and transferring the title. If there are any issues with the car after the sale, the buyer may have legal recourse. However, when you gift a car, you are not legally responsible for any issues with the car.

3. Emotional Implications

Gifting a car can be a way to show your love and appreciation for someone. It can also be a way to help someone who may not be able to afford a car.

Conclusion

In Ohio, you can gift a car to anyone as many times as you wish, as long as you follow the state’s guidelines for transferring ownership. Gifting a car can be a simple and hassle-free process, and it can save you money on sales tax. Whether you choose to gift a car or sell it, it is important to consider the tax, legal, and emotional implications of each option.

Contents

- Frequently Asked Questions

- Question 1: How many times can you gift a car in Ohio?

- Question 2: Do you need to pay sales tax when gifting a car in Ohio?

- Question 3: What documents do you need to gift a car in Ohio?

- Question 4: Can you gift a car to someone who doesn’t have a driver’s license in Ohio?

- Question 5: What happens if you gift a car without transferring the title in Ohio?

- How To Gift A Vehicle To Someone Without Paying Taxes

Frequently Asked Questions

Ohio is one of the states in the US that allows gifting of a car. However, there are certain rules and regulations that you need to follow to ensure that the process is legal and hassle-free. Here are some frequently asked questions about gifting a car in Ohio.

Question 1: How many times can you gift a car in Ohio?

In Ohio, you can gift a car as many times as you want. However, there are certain factors that you need to consider before gifting a car. For instance, if you gift a car to a family member, you don’t have to pay sales tax. But if you gift a car to a friend or anyone who is not a family member, you will have to pay sales tax. Additionally, you need to make sure that you transfer the title of the car to the recipient’s name to avoid any legal issues in the future.

It’s also important to note that if you gift a car to someone who lives in another state, you need to follow that state’s rules and regulations regarding car gifting. For instance, some states may require the recipient to pay sales tax even if the car was gifted to them.

Question 2: Do you need to pay sales tax when gifting a car in Ohio?

If you gift a car to a family member in Ohio, you don’t have to pay sales tax. However, if you gift a car to a friend or anyone who is not a family member, you will have to pay sales tax. The amount of sales tax you need to pay depends on the value of the car. You can calculate the sales tax using Ohio’s sales tax calculator or by contacting your local BMV office.

It’s important to note that if you don’t pay the required sales tax, the recipient of the car may face legal issues in the future. Therefore, it’s best to follow the rules and regulations set by the Ohio Department of Taxation when gifting a car.

Question 3: What documents do you need to gift a car in Ohio?

When gifting a car in Ohio, you need to transfer the title of the car to the recipient’s name. To do this, you need to fill out the “Assignment of Title” section on the title certificate and sign it in front of a notary public. Additionally, you need to provide a bill of sale that includes the purchase price of the car, the date of the sale, and the names and addresses of the buyer and seller.

If the car is less than 10 years old, you also need to provide an odometer disclosure statement that shows the current mileage of the car. Finally, you need to pay any applicable sales tax and transfer fees at your local BMV office.

Question 4: Can you gift a car to someone who doesn’t have a driver’s license in Ohio?

Yes, you can gift a car to someone who doesn’t have a driver’s license in Ohio. However, the recipient of the car will need a valid driver’s license or state ID card to register the car in their name. Additionally, they will need to provide proof of insurance before they can legally drive the car on Ohio roads.

If the recipient of the car doesn’t have a driver’s license or state ID card, they can still transfer the title of the car to their name. However, they will need to provide a valid form of ID, such as a passport or birth certificate, to complete the transfer process.

Question 5: What happens if you gift a car without transferring the title in Ohio?

If you gift a car without transferring the title to the recipient’s name in Ohio, you could face legal issues in the future. For instance, if the recipient gets into an accident or is cited for a traffic violation, you could be held liable for any damages or fines. Additionally, if the recipient sells the car without transferring the title to their name, you could be held liable for any legal issues that arise from the sale.

Therefore, it’s important to transfer the title of the car to the recipient’s name as soon as possible after gifting the car. This will ensure that the recipient is the legal owner of the car and can legally drive it on Ohio roads.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, gifting a car in Ohio can be a great way to show your love and appreciation to your family members or friends. However, it’s important to keep in mind that there are certain rules and regulations that you need to follow.

Firstly, you can gift a car as many times as you want in Ohio, as long as you comply with the state’s laws and regulations. Secondly, it’s important to make sure that you transfer the ownership of the vehicle to the recipient’s name, and that you properly document the transaction.

Lastly, if you have any doubts or questions about gifting a car in Ohio, it’s always a good idea to consult with an attorney or a DMV representative. By following the rules and regulations, you can ensure that your gift is legally valid and that the recipient can enjoy their new car without any issues.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts