Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you planning on gifting a car to a family member or friend in Illinois? If so, you may be wondering how many times you can do so without facing any legal issues. The laws surrounding gifting cars in Illinois can be confusing, but don’t worry, we’ve got you covered. In this article, we’ll discuss how many times you can gift a car in Illinois and what you need to know to stay on the right side of the law.

In Illinois, there is no limit to the number of times you can gift a car. However, the receiver of the gifted car must be prepared to pay the required title and registration fees to transfer ownership. Additionally, if the gift is from a parent to a child, the child may be exempt from paying the state’s use tax.

Contents

- How Many Times Can You Gift a Car in Illinois?

- Frequently Asked Questions

- How many times can you gift a car in Illinois?

- Do I need to pay taxes if I gift a car to a family member in Illinois?

- Can I gift a car to someone who lives out of state?

- What documents do I need to transfer a car as a gift in Illinois?

- What if the car being gifted is not paid off?

- How To Gift A Vehicle To Someone Without Paying Taxes

How Many Times Can You Gift a Car in Illinois?

If you are living in Illinois and want to gift a car to someone, you might be wondering how many times you can do so. The answer is simple, but there are some important details you need to know. In this article, we will discuss the rules and regulations related to gifting a car in Illinois.

Gift Tax in Illinois

Illinois is one of the few states that does not impose a gift tax. This means that you can gift a car to someone without worrying about paying any tax on it. However, you need to be aware of the federal gift tax laws, which apply to all states. According to the federal law, you can gift up to $15,000 per year to an individual without having to pay any gift tax. If you are married, you and your spouse can gift up to $30,000 per year to an individual without incurring any tax liability.

If you are gifting a car to a family member or a friend, you need to fill out the necessary paperwork, including the title transfer and registration. You will also need to pay the required fees, which vary depending on the type of vehicle and the county you are in.

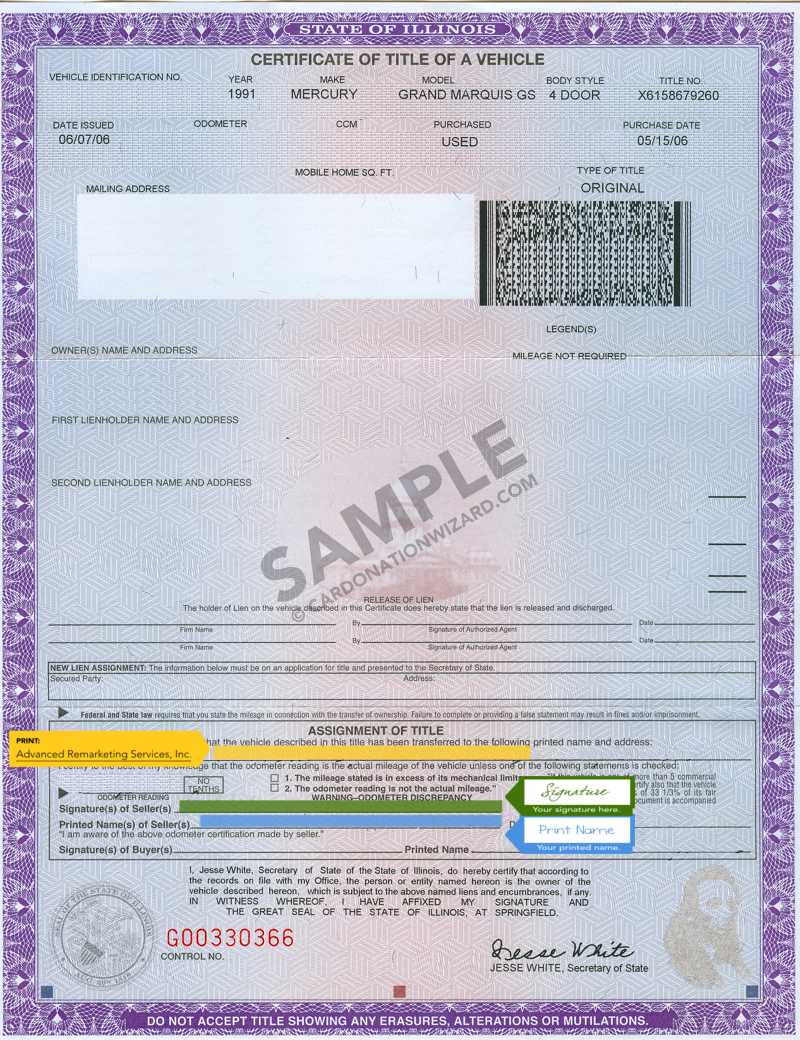

Transferring the Title

When you gift a car to someone, you need to transfer the title to their name. The process is relatively simple, but you need to make sure you follow the correct steps. Here is what you need to do:

- Fill out the “Assignment of Title” section on the back of the title certificate.

- Make sure the buyer signs and dates the “Application for Title and Registration” form.

- Provide the buyer with a signed copy of the “Bill of Sale”.

- Submit the completed paperwork and fees to the Illinois Secretary of State.

Once the transfer of title is complete, the new owner can register the car in their name and obtain new license plates.

Gifting a Car vs. Selling a Car

If you are thinking about gifting a car instead of selling it, there are some benefits and drawbacks to consider. Here is a comparison of gifting a car vs. selling a car:

Benefits of Gifting a Car

- No sales tax or gift tax to pay

- You can help out a family member or friend in need

- You can avoid the hassle of selling a car

Benefits of Selling a Car

- You can get cash for the car

- You can sell the car “as-is”, without any liability for repairs

- You can avoid any potential legal issues if the new owner gets into an accident

In conclusion, gifting a car in Illinois is a simple and straightforward process. You can gift a car to someone without having to pay any gift tax, and the process of transferring the title is relatively easy. However, you need to make sure you follow the correct steps and fill out the necessary paperwork. If you are considering gifting a car, make sure you weigh the benefits and drawbacks of gifting vs. selling before making a decision.

Frequently Asked Questions

Transferring a car as a gift is a common practice in Illinois. However, there may be rules and regulations that need to be followed. Here are some frequently asked questions about gifting a car in Illinois.

How many times can you gift a car in Illinois?

In Illinois, there is no limit to the number of times a car can be gifted. However, the recipient will need to pay the necessary taxes and fees to transfer the title and register the car in their name. Additionally, the donor should keep proper documentation of the transfer for their records.

It is important to note that gifting a car does not exempt the recipient from paying taxes and fees. The value of the car will be assessed and the recipient will need to pay the appropriate taxes and fees based on that value.

Do I need to pay taxes if I gift a car to a family member in Illinois?

Yes, if you gift a car to a family member in Illinois, they will still need to pay taxes and fees to transfer the title and register the car in their name. The value of the car will be assessed and the recipient will need to pay the appropriate taxes and fees based on that value.

However, if the car is gifted to a spouse, parent, child, stepchild, or grandchild, the taxes and fees may be reduced or waived. It is important to check with the Illinois Secretary of State’s office for specific details.

Can I gift a car to someone who lives out of state?

Yes, you can gift a car to someone who lives out of state. However, the recipient will need to follow the rules and regulations of their own state when transferring the title and registering the car in their name. It is important to check with the recipient’s state Department of Motor Vehicles for specific details.

Additionally, if the car is being gifted to someone in another country, there may be additional rules and regulations that need to be followed. It is important to check with the appropriate authorities in both the United States and the recipient’s country for specific details.

What documents do I need to transfer a car as a gift in Illinois?

When transferring a car as a gift in Illinois, the donor should provide the recipient with a signed and dated title, a completed Application for Vehicle Transaction(s) (Form VSD 190), and a tax form (Form RUT-50). The recipient will also need to provide proof of insurance and pay the necessary taxes and fees to transfer the title and register the car in their name.

It is important to keep proper documentation of the transfer for both the donor and recipient’s records.

What if the car being gifted is not paid off?

If the car being gifted is not paid off, the recipient will need to assume responsibility for the remaining balance on the loan or financing. It is important to check with the lender to ensure that the transfer of ownership does not violate any loan agreements. The donor and recipient should also consider drafting a written agreement outlining the terms of the transfer.

If the car is being leased, the recipient may need to assume responsibility for the remaining lease payments.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, the number of times you can gift a car in Illinois ultimately depends on the specific circumstances of each situation. While there is no limit to how many cars you can gift, there are certain factors to consider such as taxes, title transfers, and insurance.

If you are considering gifting a car, it is important to do your research and understand the legal requirements and potential costs involved. This can help ensure a smooth transfer process and prevent any unexpected complications or expenses down the line.

Overall, gifting a car can be a generous and thoughtful gesture, but it is important to make sure you are fully informed and prepared before making any decisions. By taking the time to understand the process and requirements, you can ensure a successful and stress-free gift transfer experience.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts