Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you a resident of Connecticut who has received a gifted vehicle recently? You might be wondering whether you need to pay taxes on it or not. In Connecticut, the answer is not so straightforward, and it depends on a few factors.

Firstly, if the person who gifted you the vehicle is a close family member, such as a parent or spouse, then you may not need to pay any taxes on it. However, if the person is not a close family member, then you may be liable to pay a gift tax. Let’s dive deeper into the rules and regulations surrounding gifted vehicles and taxes in Connecticut.

Contents

- Do You Pay Taxes on Gifted Vehicle in Connecticut?

- Frequently Asked Questions

- Do you pay taxes on gifted vehicle in Connecticut?

- How are taxes on gifted vehicles in Connecticut calculated?

- What documents do I need to provide when registering a gifted vehicle in Connecticut?

- Can I transfer license plates from my old vehicle to a gifted vehicle in Connecticut?

- What if the gifted vehicle was previously registered in another state?

- How To Gift A Vehicle To Someone Without Paying Taxes

Do You Pay Taxes on Gifted Vehicle in Connecticut?

When it comes to receiving a gifted vehicle in Connecticut, you may be wondering if you are required to pay taxes on it or not. The answer is not a straightforward one as it depends on a variety of factors. In this article, we will explore whether or not you need to pay taxes on a gifted vehicle in Connecticut.

Transferring Ownership of a Gifted Vehicle

If you have received a gifted vehicle in Connecticut, the first step is to transfer ownership of the vehicle into your name. This requires a few steps, including obtaining a bill of sale and a title transfer form from the previous owner. Once you have all the necessary paperwork, you can head to the Connecticut Department of Motor Vehicles to complete the transfer process.

It is important to note that the transfer process must be completed within 60 days of receiving the gifted vehicle. If you fail to do so, you may be subject to penalties and fines.

Gift Tax vs. Sales Tax

One of the main factors that determine whether or not you need to pay taxes on a gifted vehicle in Connecticut is whether or not the gift is considered a gift tax or sales tax. A gift tax is a tax on the transfer of property from one person to another without receiving anything in return. In Connecticut, there is no gift tax, which means you do not need to pay taxes on the gifted vehicle.

However, if the gift is considered a sales tax, you may be required to pay taxes on the vehicle. This can happen if the gift is given in exchange for services or if the gift is given with the expectation of receiving something in return.

Other Factors to Consider

Aside from gift tax and sales tax, there are other factors that may influence whether or not you need to pay taxes on a gifted vehicle in Connecticut. For example, if the gifted vehicle is worth more than $15,000, you may be required to pay a federal gift tax. Additionally, if you plan on registering the vehicle out of state, you may be subject to that state’s tax laws.

If you are unsure whether or not you need to pay taxes on a gifted vehicle in Connecticut, it is recommended that you speak with a tax professional or contact the Connecticut Department of Revenue Services for further guidance.

Benefits of Gifting a Vehicle

While there may be some confusion around whether or not you need to pay taxes on a gifted vehicle in Connecticut, there are still many benefits to gifting a vehicle. For example, gifting a vehicle can be a way to help out a family member or friend who may not have the means to purchase a vehicle on their own. Additionally, gifting a vehicle can help you avoid the hassle of selling a vehicle and dealing with potential buyers.

Gifting vs. Selling a Vehicle

When it comes to deciding whether to gift or sell a vehicle, there are pros and cons to both options. Gifting a vehicle can be a great way to help out a loved one, but it may not be the best option if you are looking to recoup some of the vehicle’s value. Selling a vehicle, on the other hand, can be a more financially sound decision but may require more time and effort on your part.

| Gifting a Vehicle | Selling a Vehicle |

|---|---|

| Help out a loved one | Recoup some of the vehicle’s value |

| Avoid the hassle of selling a vehicle | May be a more financially sound decision |

Conclusion

In conclusion, whether or not you need to pay taxes on a gifted vehicle in Connecticut depends on a variety of factors. If the gift is considered a gift tax, you do not need to pay taxes on the vehicle. However, if the gift is considered a sales tax or if other factors come into play, you may be required to pay taxes on the vehicle. If you are unsure whether or not you need to pay taxes on a gifted vehicle, it is recommended that you speak with a tax professional or contact the Connecticut Department of Revenue Services for further guidance.

Frequently Asked Questions

Do you pay taxes on gifted vehicle in Connecticut?

Yes, you may have to pay taxes on a gifted vehicle in Connecticut. Even if you receive a vehicle as a gift, the state of Connecticut considers it a taxable transaction. This means that you will be required to pay taxes based on the fair market value of the vehicle at the time it was gifted to you.

However, there are some exceptions to this rule. If the vehicle was gifted to you by a family member, you may be able to avoid paying taxes on it. Additionally, if the vehicle was gifted to you by a non-profit organization, you may also be exempt from paying taxes.

How are taxes on gifted vehicles in Connecticut calculated?

The amount of taxes you will need to pay on a gifted vehicle in Connecticut is based on the fair market value of the vehicle at the time it was gifted to you. This means that you will need to have the vehicle appraised to determine its value.

Once the value has been determined, you will be required to pay taxes based on the current tax rate in Connecticut. The tax rate varies depending on the town or city in which you reside. You may also be required to pay additional fees, such as registration and title fees.

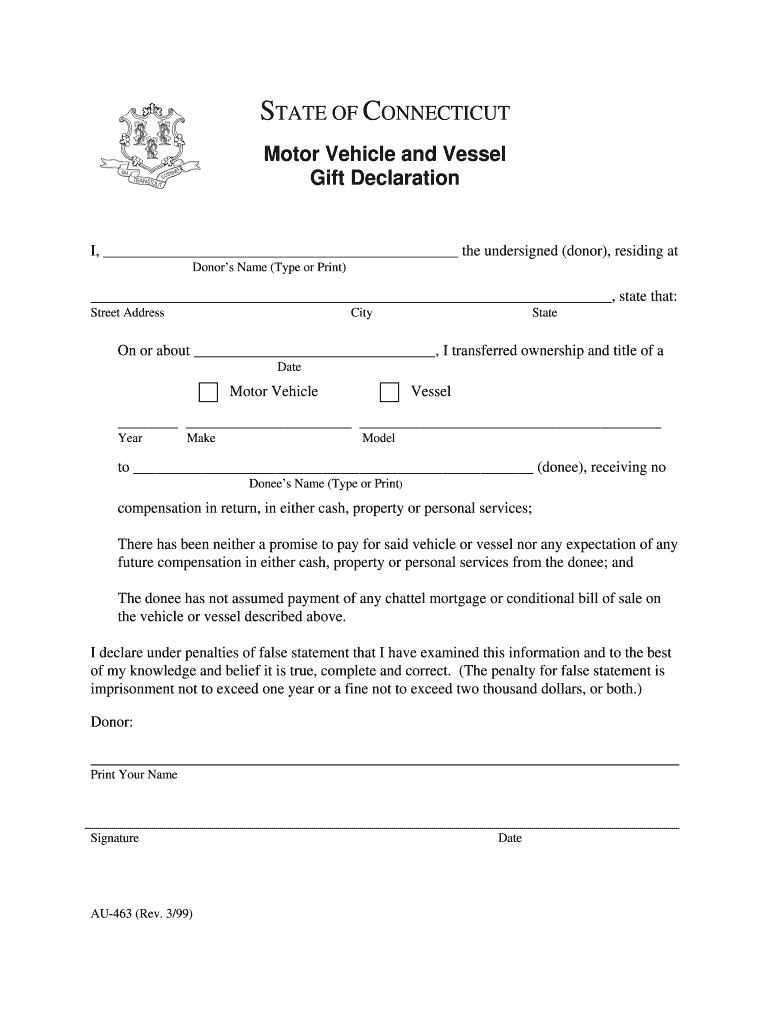

What documents do I need to provide when registering a gifted vehicle in Connecticut?

When registering a gifted vehicle in Connecticut, you will need to provide several documents. These include:

– A completed Application for Registration and Title (Form H-13B)

– The vehicle’s title, signed over to you by the previous owner

– A bill of sale, if the vehicle was not a gift

– Proof of insurance

– A valid Connecticut driver’s license or state ID

You will also need to pay the applicable fees and taxes at the time of registration.

Can I transfer license plates from my old vehicle to a gifted vehicle in Connecticut?

Yes, you may be able to transfer license plates from your old vehicle to a gifted vehicle in Connecticut. However, there are certain requirements that must be met in order to do so.

First, the license plates must be registered in your name. Additionally, the gifted vehicle must be of the same type and weight class as your old vehicle. You will also need to provide proof of insurance and pay any applicable fees.

What if the gifted vehicle was previously registered in another state?

If the gifted vehicle was previously registered in another state, you will need to provide additional documentation when registering it in Connecticut. This may include:

– The vehicle’s out-of-state title

– A completed VIN verification form

– Proof of emissions testing, if applicable

– Any other documents required by the Connecticut Department of Motor Vehicles

You may also be required to pay additional fees and taxes, depending on the value of the vehicle and the state from which it was registered.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, the answer to the question of whether you need to pay taxes on gifted vehicles in Connecticut is yes. The state has specific laws and regulations in place that require the recipient of a gifted vehicle to pay taxes on it. While this may seem like an added expense, it’s important to remember that these taxes help support important state programs and services.

It’s worth noting that the amount of taxes you’ll need to pay can vary depending on a number of factors, including the value of the vehicle and your relationship to the person who gifted it to you. To ensure that you’re meeting all of your tax obligations, it’s a good idea to consult with a tax professional or the Connecticut Department of Revenue Services.

Ultimately, while paying taxes on a gifted vehicle may not be the most exciting thing in the world, it’s an important part of being a responsible citizen and contributing to the well-being of your community. By understanding the laws and regulations around this issue and taking the necessary steps to fulfill your obligations, you can ensure that you’re doing your part to keep Connecticut running smoothly.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts