Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you planning to gift a car to someone in Connecticut? If so, you may be wondering if taxes are involved. The answer is yes, but it’s not as straightforward as you might think. In this article, we’ll explore the ins and outs of gifting a car in Connecticut and the tax implications that come with it. So, whether you’re the giver or the receiver, keep reading to learn more about this important topic.

Yes, you do pay taxes on a gifted car in Connecticut. According to the Connecticut Department of Revenue Services, the recipient of a gifted vehicle must declare the fair market value of the vehicle as taxable income on their state income tax return. The fair market value can be determined by using resources such as Kelley Blue Book or NADA Guides. The donor is also responsible for filing a gift tax return with the Internal Revenue Service (IRS) if the value of the vehicle is above the annual exclusion limit.

Contents

- Do You Pay Taxes on a Gifted Car in Connecticut?

- Frequently Asked Questions

- Question 1: Do I need to pay taxes on a car that was gifted to me in Connecticut?

- Question 2: Can I avoid paying taxes on a gifted car in Connecticut?

- Question 3: Who is responsible for paying the taxes on a gifted car in Connecticut?

- Question 4: What happens if I don’t pay the taxes on a gifted car in Connecticut?

- Question 5: How can I ensure that I am following the regulations for gifting a car in Connecticut?

- How To Gift A Vehicle To Someone Without Paying Taxes

Do You Pay Taxes on a Gifted Car in Connecticut?

Gifted cars can be a great way to receive a vehicle without the burden of a car loan or down payment. However, many people wonder if they are required to pay taxes on a gifted car in Connecticut. In this article, we will explore the rules and regulations surrounding gifted cars in Connecticut and how they may affect your taxes.

What is Considered a Gifted Car in Connecticut?

A gifted car is a vehicle that is given to another person without any exchange of money or other compensation. In Connecticut, gifted cars are subject to the same sales and use taxes as a vehicle that is purchased from a dealership. The sales tax rate in Connecticut is 6.35% and is based on the fair market value of the vehicle at the time of the transfer. If the vehicle is a used car, the fair market value is determined by the retail value listed in a nationally recognized used car pricing guide.

It is important to note that a gifted car in Connecticut is only exempt from sales and use tax if the gift is between immediate family members. Immediate family members include spouses, parents, children, siblings, grandparents, and grandchildren. If the gift is not between immediate family members, the recipient will be required to pay sales and use tax on the fair market value of the vehicle.

How to Transfer a Gifted Car in Connecticut

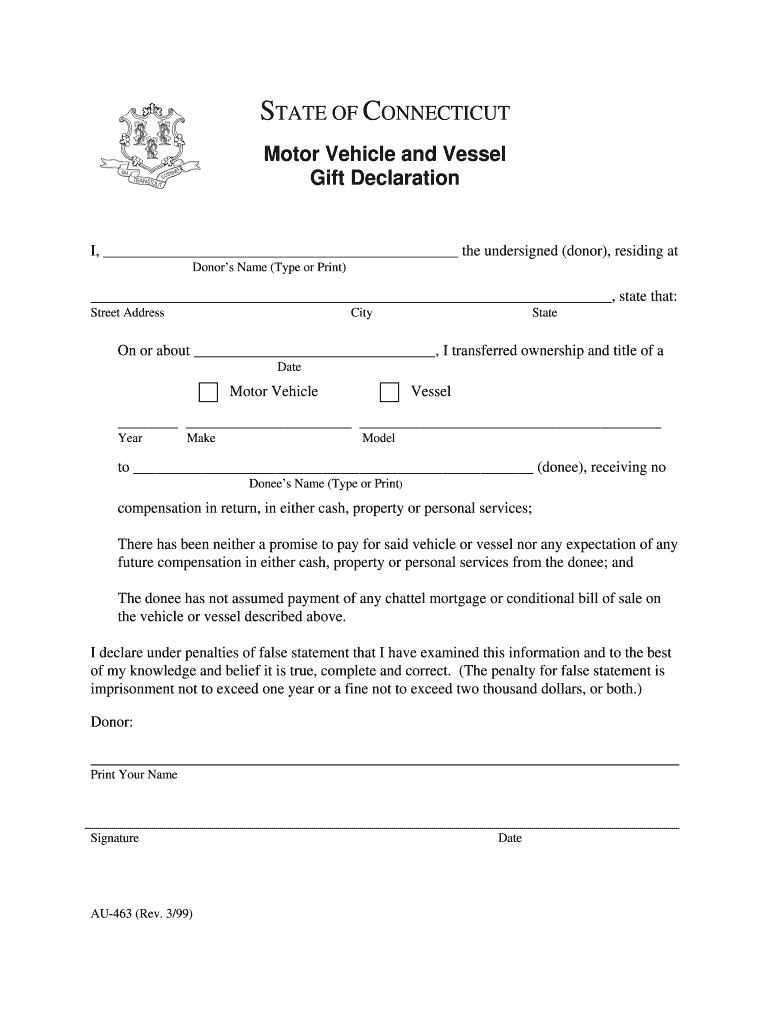

Transferring a gifted car in Connecticut requires several steps. The first step is to complete the transfer of ownership on the vehicle’s title. The person giving the gift will need to sign the title over to the recipient and include a completed Bill of Sale. The recipient will then need to bring the signed title, Bill of Sale, and a completed Application for Registration and Title to the DMV. The DMV will process the paperwork and issue a new title and registration for the vehicle.

It is important to note that the recipient of the gifted car will need to provide proof of insurance and pay any required taxes and fees at the time of registration. If the vehicle is not registered within 60 days of the transfer, the recipient may be subject to penalties and fines.

Benefits of Gifting a Car in Connecticut

Gifting a car in Connecticut can have several benefits. First, it can be a great way to help a family member or friend who may not have the means to purchase a vehicle on their own. Second, it can save the recipient money on a down payment or car loan. Third, if the gift is between immediate family members, the recipient may be able to avoid paying sales and use tax on the vehicle.

Gifting a Car vs Selling a Car

When deciding whether to gift a car or sell a car, there are several factors to consider. If you are selling a car, you will receive money in exchange for the vehicle. This can be beneficial if you need the money or want to use it towards the purchase of a new vehicle. However, selling a car can also be time-consuming and may require you to negotiate with potential buyers.

If you are gifting a car, you will not receive any money in exchange for the vehicle. However, gifting a car can be a great way to help out a family member or friend. It can also be a way to avoid paying sales and use tax on the vehicle if the gift is between immediate family members.

Conclusion

If you are considering gifting a car in Connecticut, it is important to understand the rules and regulations surrounding gifted cars. While gifts between immediate family members are exempt from sales and use tax, all other gifts are subject to the same taxes as a purchased vehicle. By following the proper steps to transfer ownership of the vehicle and registering it with the DMV, you can ensure a smooth and legal transfer of the gifted car.

Frequently Asked Questions

Are you wondering if you need to pay taxes on a gifted car in Connecticut? Here are some frequently asked questions and their answers to help you understand the regulations.

Question 1: Do I need to pay taxes on a car that was gifted to me in Connecticut?

Yes, you need to pay taxes on a car that was gifted to you in Connecticut. The state considers a gifted car to be a taxable item, and you will need to pay taxes on its fair market value. The tax rate is currently 6.35% for cars valued at $50,000 or less.

To determine the fair market value, you can use resources such as Kelley Blue Book or NADA Guides. If the car is worth more than $50,000, the tax rate increases to 7.75%, and there may be additional fees and taxes to pay.

Question 2: Can I avoid paying taxes on a gifted car in Connecticut?

No, you cannot avoid paying taxes on a gifted car in Connecticut. However, there are some exceptions to the rule. For example, if the car was gifted to you by your spouse or a charitable organization, you may be exempt from paying taxes. Additionally, if the car was gifted to you by someone who is not a resident of Connecticut, you may be able to avoid paying taxes, but you will need to provide proof of the gift and the giver’s residency.

It’s important to note that attempting to avoid paying taxes by undervaluing the car or providing false information is illegal and can result in penalties and fines.

Question 3: Who is responsible for paying the taxes on a gifted car in Connecticut?

The recipient of the gifted car is responsible for paying the taxes in Connecticut. When you register the car with the DMV, you will need to provide proof of the gift and pay the appropriate taxes and fees. If you are unsure of the amount you owe, you can contact the DMV or a tax professional for assistance.

It’s important to note that if the giver of the gift pays the taxes on your behalf, it may still be considered a taxable event, and you may need to report it on your tax return.

Question 4: What happens if I don’t pay the taxes on a gifted car in Connecticut?

If you don’t pay the taxes on a gifted car in Connecticut, you may face penalties and fines. Additionally, you may be unable to register the car or renew your registration until the taxes are paid. It’s important to pay the taxes promptly to avoid any legal or financial consequences.

If you are unable to pay the full amount owed, you may be able to set up a payment plan with the DMV or seek assistance from a tax professional.

Question 5: How can I ensure that I am following the regulations for gifting a car in Connecticut?

To ensure that you are following the regulations for gifting a car in Connecticut, you should consult with a tax professional or the DMV. They can provide guidance on the amount of taxes you need to pay and any exemptions or exceptions that may apply. Additionally, it’s important to keep accurate records of the gift and the transaction to avoid any potential issues in the future.

By following the regulations and paying the appropriate taxes, you can avoid any legal or financial consequences and enjoy your new gifted car with peace of mind.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, receiving a gifted car in Connecticut is a great gesture, but it is important to understand that it may have tax implications. Although the state does not impose a gift tax, you may still be responsible for paying sales tax on the fair market value of the vehicle. It is important to research and understand the tax laws in Connecticut to avoid any surprises in the future.

Furthermore, it is always a good idea to consult with a tax professional or the Connecticut Department of Revenue Services to ensure that you are following all the tax laws correctly. This will not only help you avoid penalties and fines but also give you peace of mind knowing that you have done everything correctly.

In conclusion, while receiving a gifted car is a great opportunity, it is crucial to understand the tax implications to avoid any unforeseen financial burdens. By doing your research and consulting with professionals, you can ensure that you are following all the regulations and make the most out of your gift.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts