Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

If you’re looking to gift a car in Vermont, you may be wondering what the process looks like. Luckily, Vermont has clear guidelines on how to transfer ownership of a vehicle as a gift, so you can ensure that the process goes smoothly.

Whether you’re giving a car to a family member or a friend, it’s important to understand the steps involved in transferring ownership. In this article, we’ll walk you through the requirements for gifting a car in Vermont, so you can confidently navigate the process and give the gift of a vehicle to someone special.

Can You Gift a Car in Vermont?

If you’re looking to give someone a vehicle as a gift in Vermont, you may be wondering whether it’s possible to do so legally. The good news is that it is possible to gift a car in Vermont, but there are certain steps you need to take to ensure that the transfer of ownership is done properly. In this article, we’ll look at the requirements for gifting a car in Vermont and provide you with all the information you need to know.

What Are the Requirements for Gifting a Car in Vermont?

To gift a car in Vermont, you’ll need to follow the same process as if you were selling the vehicle. This means that you’ll need to complete a few key steps:

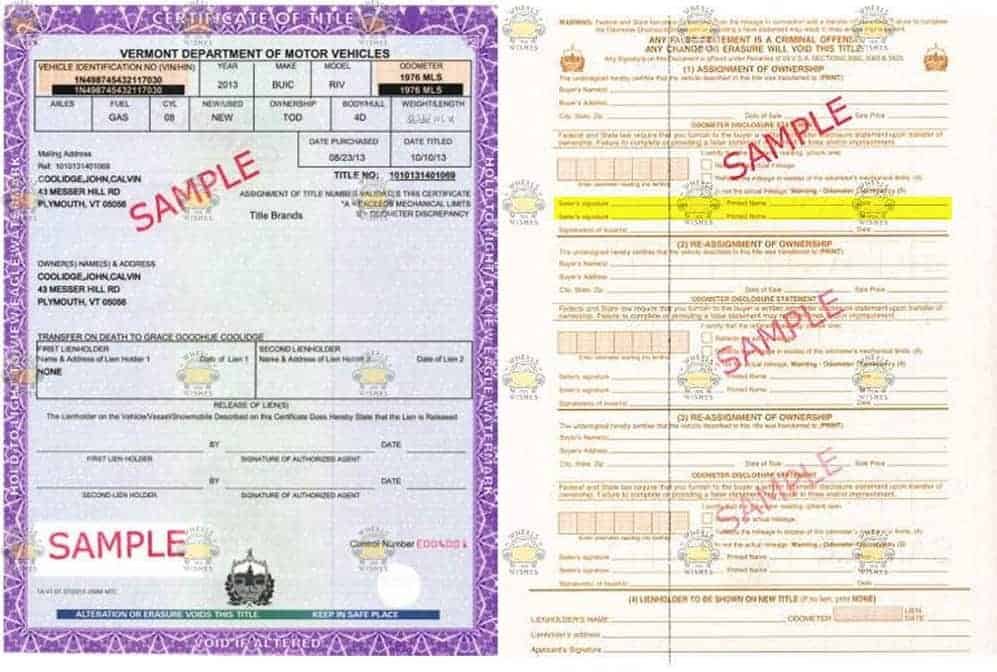

Step 1: Transfer the Title

The first step in gifting a car in Vermont is to transfer the title of the vehicle to the recipient. To do this, the owner of the vehicle will need to sign the title over to the recipient and fill out the necessary paperwork. The recipient will then need to take the title to the DMV to have it transferred into their name.

Step 2: Get a Bill of Sale

In addition to the title, you’ll also need to provide the recipient with a bill of sale. This document will serve as proof of the transaction and should include information about the vehicle, such as the make, model, year, and VIN.

Benefits of Gifting a Car in Vermont

Gifting a car in Vermont can be a great way to help out a family member, friend, or loved one who may not be able to afford a vehicle on their own. It’s also a good option if you have a car that you no longer need or use and want to give it to someone who will put it to good use.

One of the main benefits of gifting a car in Vermont is that it can be a tax-efficient way to transfer ownership of a vehicle. When you gift a car, you won’t have to pay any sales tax on the transaction, which can save you a significant amount of money.

Gifting a Car vs. Selling a Car

If you’re trying to decide whether to gift a car or sell it, there are a few factors to consider. One of the main advantages of gifting a car is that it can be a more cost-effective option, as you won’t have to pay any sales tax on the transaction. However, if you’re looking to make some money from the sale of your vehicle, selling it may be the better option.

Another factor to consider is the relationship you have with the recipient. If you’re gifting a car to a family member or friend, it can be a way to help them out and show your support. On the other hand, if you’re selling the car to a stranger, you’ll need to be more cautious and make sure you’re getting a fair price for the vehicle.

Conclusion

Gifting a car in Vermont can be a great way to help out someone in need or get rid of a vehicle you no longer want or need. However, it’s important to follow the proper steps to ensure that the transfer of ownership is done legally and efficiently. By transferring the title and providing a bill of sale, you can gift a car in Vermont with confidence and ease.

Contents

- Frequently Asked Questions

- Can I gift a car to someone in Vermont?

- What do I need to do to gift a car to a family member?

- What do I need to do to gift a car to someone else?

- Do I need to pay taxes on a gifted car in Vermont?

- What happens if the gifted car is not registered within 30 days?

- How To LEGALLY Title Any Classic Car, Truck Or Motorcycle Using The Vermont Loophole

Frequently Asked Questions

Here are some common questions and answers about gifting a car in Vermont:

Can I gift a car to someone in Vermont?

Yes, you can gift a car to someone in Vermont. However, the process can be a bit complicated depending on your situation. If you are giving the car to a family member, you will need to fill out a gift form and provide proof of ownership. If you are giving the car to someone else, you will need to transfer the title and register the car in their name.

It is important to note that you cannot gift a car to avoid paying taxes or registration fees. If the car has a market value of more than $15,000, the recipient will need to pay a gift tax. Additionally, if the car is not registered within 30 days of the gift, a late fee will apply.

What do I need to do to gift a car to a family member?

If you are gifting a car to a family member in Vermont, you will need to fill out a gift form and provide proof of ownership. The gift form can be obtained from the Vermont Department of Motor Vehicles website or in person at a DMV office. You will need to provide your name, address, and relationship to the recipient, as well as information about the car, including the make, model, year, and VIN number.

You will also need to provide proof of ownership, such as the car’s title or a bill of sale. Once you have completed the gift form and gathered the necessary documents, you can submit them to the DMV to transfer the ownership of the car to the recipient.

What do I need to do to gift a car to someone else?

If you are gifting a car to someone who is not a family member, you will need to transfer the title and register the car in their name. To transfer the title, you will need to fill out the appropriate forms and provide proof of ownership, such as the car’s title or a bill of sale.

You will also need to provide the recipient with a bill of sale and a copy of the title, as well as any other necessary documents, such as a lien release or power of attorney. Once the title has been transferred, the recipient will need to register the car in their name and pay any applicable taxes and fees.

Do I need to pay taxes on a gifted car in Vermont?

If the car has a market value of more than $15,000, the recipient will need to pay a gift tax. The tax is calculated based on the car’s fair market value and the relationship between the giver and the recipient. For example, if the car is gifted to a spouse, there is no tax. If the car is gifted to a non-relative, the tax rate is 6% of the fair market value.

It is important to note that you cannot gift a car to avoid paying taxes or registration fees. If you are caught doing so, you may be subject to fines and penalties.

What happens if the gifted car is not registered within 30 days?

If the gifted car is not registered within 30 days of the gift, a late fee will apply. The late fee is $10 per month, up to a maximum of $100. It is important to make sure that the recipient registers the car in their name as soon as possible to avoid these fees.

If the car is not registered within 90 days of the gift, the DMV may revoke the registration and require the recipient to apply for a new title and registration.

How To LEGALLY Title Any Classic Car, Truck Or Motorcycle Using The Vermont Loophole

In conclusion, gifting a car in Vermont is possible but requires some important steps to be taken. It is important to note that the process of transferring ownership of a vehicle can be complicated and requires careful attention to detail to ensure that everything is done legally and correctly.

If you are considering gifting a car in Vermont, it is important to consult with the Vermont Department of Motor Vehicles to understand the specific requirements and regulations that must be followed. This will ensure that the transfer of ownership is done properly and that any potential legal issues are avoided.

Overall, while gifting a car in Vermont may seem like a straightforward process, it is important to take the necessary steps to ensure that everything is done properly. By following the guidelines and regulations set forth by the Vermont Department of Motor Vehicles, you can ensure that the transfer of ownership is done legally and that the recipient of the gift is able to enjoy their new vehicle with peace of mind.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts