Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

If you’re looking to gift a car to someone in Tennessee, you may be wondering if it’s possible and what the process entails. The good news is that it is possible to gift a car in Tennessee, but there are some specific steps you need to follow to ensure the transfer of ownership is legal and smooth.

Before you hand over the keys, you’ll need to make sure you have all the necessary paperwork in order and understand the tax implications of gifting a car. In this article, we’ll dive into the details of gifting a car in Tennessee and provide you with the information you need to make the process as seamless as possible.

Contents

- Can You Gift a Car in Tennessee?

- Frequently Asked Questions

- Q: Can I gift a car to anyone in Tennessee?

- Q: Do I need to notify the Tennessee DMV when gifting a car?

- Q: Do I need a bill of sale when gifting a car in Tennessee?

- Q: Can I gift a car that has a lien on it?

- Q: What if I’m gifting a car to someone who lives out of state?

- How To Gift A Vehicle To Someone Without Paying Taxes

Can You Gift a Car in Tennessee?

Gifting a car is a great way to show someone that you care, but is it legal in Tennessee? The answer to this question is yes, but there are certain steps that you need to follow to ensure that the gift is legal and binding. In this article, we will discuss the process of gifting a car in Tennessee and the legal requirements that you need to meet.

Legal Requirements for Gifting a Car in Tennessee

Gifting a car in Tennessee is legal, but there are a few legal requirements that you need to meet. First, the car must be fully paid off, and there should be no liens on the vehicle. If you still owe money on the car, you cannot gift it until the loan is paid off. Additionally, the person who is receiving the gift must have a valid driver’s license.

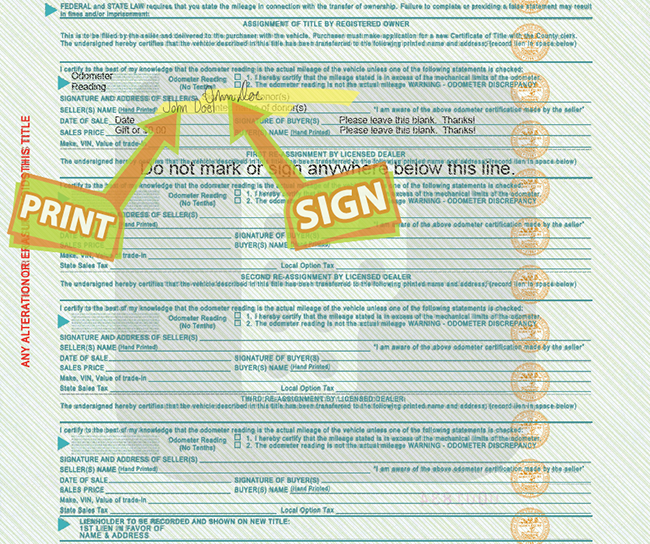

To transfer ownership of the vehicle, you need to sign over the car’s title to the recipient. The title must be completely filled out, including the seller’s name, the buyer’s name, and the vehicle’s odometer reading. You will also need to complete a Bill of Sale, which is a document that outlines the terms of the sale, including the purchase price and any conditions of the sale.

Steps to Gifting a Car in Tennessee

If you want to gift a car in Tennessee, you need to follow these steps:

1. Pay off any outstanding loans on the vehicle.

2. Complete the car’s title, including the odometer reading.

3. Complete a Bill of Sale that outlines the terms of the sale.

4. Sign over the title to the recipient.

5. Submit the necessary paperwork to the Tennessee Department of Revenue.

Once you have completed these steps, the recipient will be the legal owner of the vehicle. Keep in mind that there may be other fees and taxes that you need to pay, such as sales tax or registration fees.

Benefits of Gifting a Car

Gifting a car can be a great way to show someone that you care, and it can also have financial benefits. If you gift a car to a family member or friend, you may be able to avoid paying sales tax on the transaction. Additionally, if the recipient is in need of a car, gifting a vehicle can be a great way to help them out without having to spend a lot of money.

Gifting a Car vs. Selling a Car

If you are trying to decide between gifting a car and selling a car, there are a few things to consider. Gifting a car can be a great option if you want to help out a friend or family member, or if you want to avoid paying sales tax on the transaction. However, if you are trying to get the most money for your car, selling it may be a better option.

When you sell a car, you can set your own price and negotiate with potential buyers to get the best deal. Additionally, if you sell your car to a dealership, you may be able to get a trade-in value that you can put towards a new vehicle. However, selling a car can be time-consuming and may require more paperwork than gifting a car.

Conclusion

Gifting a car in Tennessee can be a wonderful way to show someone that you care, but it is important to follow the legal requirements to ensure that the gift is binding. If you are interested in gifting a car, make sure that the vehicle is fully paid off and that the recipient has a valid driver’s license. Additionally, make sure that you complete all of the necessary paperwork and submit it to the Tennessee Department of Revenue.

Frequently Asked Questions

When it comes to gifting a car in Tennessee, there are certain regulations and procedures that must be followed. Here are some frequently asked questions about gifting a car in Tennessee.

Q: Can I gift a car to anyone in Tennessee?

A: Yes, you can gift a car to anyone in Tennessee as long as they meet the state’s requirements for vehicle ownership. The recipient of the gift must be at least 18 years old and must have a valid driver’s license or state-issued ID. Additionally, the recipient must be able to provide proof of insurance before the vehicle can be transferred into their name.

It’s important to note that if you are gifting a car to a family member, you may be eligible for a gift tax exclusion. This means that you can gift up to a certain amount without having to pay taxes on the gift. However, it’s always best to consult with a tax professional to determine your specific situation.

Q: Do I need to notify the Tennessee DMV when gifting a car?

A: Yes, you will need to notify the Tennessee Department of Revenue, Division of Motor Vehicles within 15 days of gifting a car. You will need to complete a form and provide information about the vehicle, the recipient, and the gift giver. Additionally, you will need to provide proof of insurance and a copy of the recipient’s driver’s license or state-issued ID.

The DMV will then transfer the vehicle into the recipient’s name and issue new license plates and registration. It’s important to note that there may be fees associated with this transfer, so be sure to check with the DMV for the most up-to-date information.

Q: Do I need a bill of sale when gifting a car in Tennessee?

A: Yes, it’s recommended that you have a bill of sale when gifting a car in Tennessee. While it’s not required by the state, a bill of sale can help protect both the gift giver and the recipient by providing documentation of the transaction. The bill of sale should include information about the vehicle, the gift giver, the recipient, and the terms of the gift.

Additionally, the bill of sale should be signed and dated by both the gift giver and the recipient. It’s always a good idea to keep a copy of the bill of sale for your records.

Q: Can I gift a car that has a lien on it?

A: Yes, you can gift a car that has a lien on it in Tennessee, but you will need to follow certain procedures. If the car has a lien, the lienholder will need to be notified of the gift and will need to provide documentation that the lien has been released. Once the lien has been released, the gift giver can transfer the vehicle to the recipient.

It’s important to note that if the lien has not been released, the recipient will not be able to register the vehicle in their name until the lien has been satisfied. This can be a lengthy process, so it’s best to address any liens before gifting a car.

Q: What if I’m gifting a car to someone who lives out of state?

A: If you’re gifting a car to someone who lives out of state, you will need to follow the procedures for transferring a vehicle out of state. This will typically involve providing the recipient with the necessary paperwork to register the vehicle in their state of residence.

Additionally, you will need to notify the Tennessee DMV of the transfer and provide proof that the vehicle has been registered in the recipient’s state. This can be a complex process, so it’s best to consult with the DMV for guidance.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, gifting a car in Tennessee can be a great way to transfer ownership of a vehicle. However, it’s important to follow the state’s guidelines to ensure a smooth and legal transaction.

By completing the necessary paperwork, obtaining a bill of sale, and transferring the title, you can avoid any potential issues down the road. Additionally, it’s important to remember that there may be tax implications for both the giver and receiver of the gift.

Overall, gifting a car can be a generous and thoughtful gesture, but it’s important to take the necessary steps to ensure a successful transfer of ownership. With proper planning and execution, you can make the process of gifting a car in Tennessee a positive experience for everyone involved.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts