Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you thinking of gifting a car to a friend or family member in Rhode Island? You might be wondering if it’s legal or how to go about it. Well, good news! Rhode Island allows car gifting, but there are a few things you need to know before transferring ownership.

Firstly, it’s important to understand the state’s requirements for car gifting. This includes completing the necessary paperwork, paying any applicable fees, and following specific guidelines for transferring the title. In this article, we’ll break down the process and answer some common questions about gifting a car in Rhode Island. So, let’s get started!

Can You Gift a Car in Rhode Island?

If you are looking to give or receive a car as a gift in Rhode Island, there are certain steps that you need to take to make the process legal and hassle-free. In this article, we will explore the rules and regulations involved in gifting a car in Rhode Island, as well as the benefits and drawbacks of doing so.

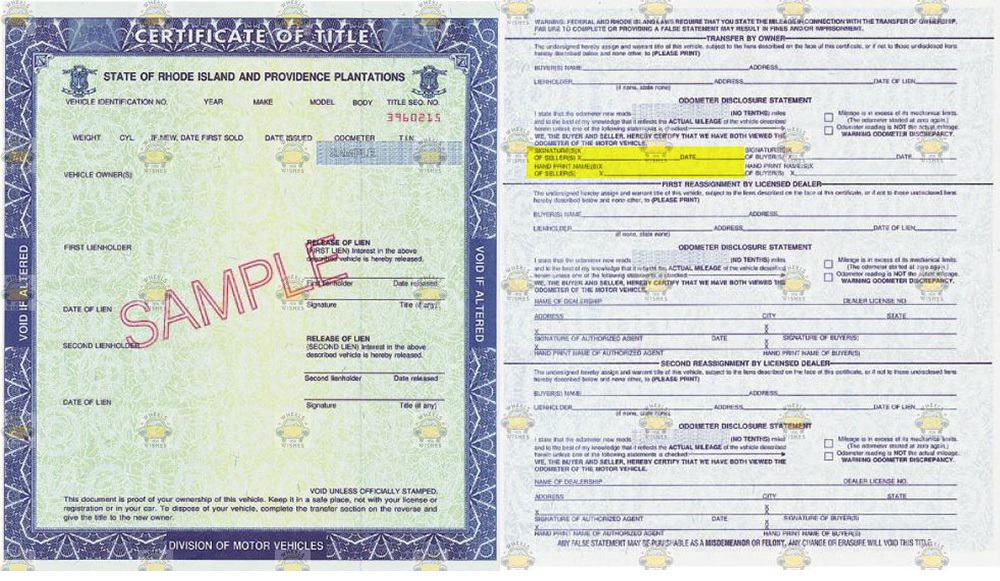

Step 1: Obtain a Title Transfer

The first step in gifting a car in Rhode Island is to obtain a title transfer. The title is the legal document that proves ownership of the vehicle, and it must be signed over to the new owner in order for the transfer to be complete. To obtain a title transfer, both the giver and the receiver must fill out the necessary paperwork at the Rhode Island Division of Motor Vehicles (DMV). The giver must sign the title over to the receiver and provide a bill of sale, which should include the make, model, year, and VIN of the vehicle, as well as the purchase price and date of sale.

Once the paperwork is complete, the receiver must take it to the DMV and pay the necessary fees to transfer the title and register the vehicle in their name. It is important to note that Rhode Island requires the payment of a use tax on all vehicles that are gifted, even if no money changes hands.

Step 2: Consider the Tax Implications

As mentioned above, Rhode Island requires the payment of a use tax on all vehicles that are gifted. The tax rate is 7% of the fair market value of the vehicle, as determined by the Rhode Island DMV. This means that if you are giving or receiving a car that is worth $10,000, you will need to pay a use tax of $700.

It is also important to note that gifting a car may have implications for your federal and state income taxes. Depending on the value of the vehicle, you may need to report the gift on your tax return and pay gift taxes. Be sure to consult with a tax professional before gifting a car to ensure that you are complying with all applicable tax laws.

Step 3: Consider the Insurance Implications

When gifting a car in Rhode Island, it is important to consider the insurance implications. The receiver of the gift will need to obtain their own insurance policy for the vehicle, as the giver’s policy will not cover them. Additionally, the receiver may need to provide proof of insurance when registering the vehicle with the DMV.

If you are the giver of the gift, you will need to contact your insurance company to remove the vehicle from your policy. This will prevent any confusion or legal issues down the line.

Benefits of Gifting a Car

There are several benefits to gifting a car, including:

- Avoiding the need to sell the car and deal with potential buyers

- Lowering the taxable value of your estate if you are considering estate planning

- Helping out a family member or friend who may be in need of a car

Drawbacks of Gifting a Car

There are also some drawbacks to gifting a car, including:

- The need to pay the use tax and potentially gift taxes

- The potential for increased insurance premiums for the receiver of the gift

- The need to go through the title transfer and registration process

Gifting a Car vs. Selling a Car

When deciding whether to gift or sell a car, there are several factors to consider. Selling a car may be a better option if you are looking to get the maximum value for the vehicle, as you can negotiate the price with potential buyers. However, gifting a car may be a better option if you want to help out a family member or friend who may not be able to afford a car on their own.

Ultimately, the decision to gift or sell a car comes down to your personal circumstances and priorities. Be sure to consider all of the factors involved before making a decision.

Conclusion

Gifting a car in Rhode Island can be a great way to help out a family member or friend in need, but it is important to follow the proper steps to ensure that the transfer is legal and hassle-free. By obtaining a title transfer, considering the tax and insurance implications, and weighing the benefits and drawbacks of gifting a car, you can make an informed decision about whether gifting a car is the right choice for you.

Frequently Asked Questions

Can you gift a car in Rhode Island?

Yes, you can gift a car in Rhode Island. However, there are certain steps you need to follow to ensure that the gift is legally recognized. The first step is to sign the title over to the recipient with the gift designation box checked. You will also need to provide a bill of sale and a gift letter stating that you are giving the car as a gift.

It is important to note that the recipient of the gift will be responsible for paying any applicable taxes and fees associated with the transfer of ownership. Additionally, the recipient must be eligible to register the vehicle in Rhode Island, which includes having a valid driver’s license and proof of insurance.

Do I need to pay taxes on a gifted car in Rhode Island?

Yes, you may need to pay taxes on a gifted car in Rhode Island. The amount of tax owed will depend on the fair market value of the vehicle and the relationship between the giver and recipient. If the recipient is a close family member, such as a spouse, parent, or child, the transfer may be exempt from taxes. However, if the recipient is not a close family member, they may be subject to a tax based on the fair market value of the vehicle.

It is important to consult with the Rhode Island Division of Motor Vehicles or a tax professional to determine the exact amount of tax owed and to ensure that all necessary paperwork is filed correctly.

What documents do I need to gift a car in Rhode Island?

To gift a car in Rhode Island, you will need to sign the title over to the recipient with the gift designation box checked. You will also need to provide a bill of sale and a gift letter stating that you are giving the car as a gift.

The gift letter should include the names and addresses of both the giver and the recipient, the date of the gift, a description of the vehicle, and a statement declaring that the gift is being given without any expectation of payment or compensation.

Can I gift a car to someone out of state?

Yes, you can gift a car to someone out of state. However, the transfer of ownership process may differ depending on the state in which the recipient resides. It is important to research the requirements for transferring ownership in the recipient’s state and to ensure that all necessary paperwork is completed correctly.

Additionally, if the recipient is located in a state that requires emissions or safety inspections, the vehicle may need to be inspected before it can be registered.

What should I do if I lost the title to a car I want to gift?

If you lost the title to a car you want to gift in Rhode Island, you will need to apply for a duplicate title before you can transfer ownership. To do so, you will need to complete an Application for Title and Registration and submit it to the Rhode Island Division of Motor Vehicles.

You will also need to provide proof of ownership, such as a copy of the registration or a bill of sale, as well as pay a fee for the duplicate title. Once you have obtained the duplicate title, you can then follow the steps for gifting a car in Rhode Island as outlined above.

Rhode Island BUYER Title Transfer Instructions

In conclusion, gifting a car in Rhode Island is possible, but it requires following specific steps and completing necessary paperwork. First, the donor needs to transfer the title to the recipient and complete a bill of sale. Then, the recipient needs to bring the paperwork to the DMV to register the car in their name. It’s important to note that there may be taxes and fees associated with this process, so it’s best to do research beforehand.

Overall, gifting a car can be a thoughtful and generous gesture, but it’s important to make sure all legal requirements are met to avoid any complications or issues down the line. By following the necessary steps and completing the paperwork correctly, both the donor and recipient can enjoy a smooth and successful transfer of ownership. So, if you’re considering gifting a car in Rhode Island, make sure to do your due diligence and take the proper steps to ensure a seamless process.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts