Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you planning to surprise someone with a car as a gift in Ohio? If so, you might be wondering if it’s possible to do so legally. The good news is that it is possible to gift a car in Ohio, but there are some specific requirements you need to follow to ensure a smooth and hassle-free transaction. In this article, we’ll explore the rules and regulations surrounding gifting a car in Ohio, so you can make an informed decision and give your loved ones the ultimate gift.

Can You Gift a Car in Ohio?

If you’re thinking about gifting a car to a family member, friend, or someone in need, you might be wondering if it’s possible to do so in Ohio. The answer is yes, but there are certain steps you need to take to ensure the transfer of ownership is legal and properly documented. Here’s what you need to know.

Step 1: Determine the Value of the Car

Before you can gift a car in Ohio, you need to know its fair market value. This will help you determine if you need to pay a gift tax or not. If the car is worth less than $4,000, you won’t have to pay any gift tax. If it’s worth more than $4,000, you’ll need to pay a tax based on the value of the car.

The Benefits of Gifting a Car in Ohio

Gifting a car can be a great way to help someone in need, such as a family member who needs reliable transportation or a friend who can’t afford to buy a car. It’s also a way to avoid the hassle and expense of selling a car privately. By gifting the car, you can transfer ownership without having to go through the process of advertising, negotiating, and completing paperwork.

Gifting vs Selling a Car

While selling a car can be a good option if you’re looking to make some money, gifting a car can be a better option if you’re looking to help someone out or avoid the hassle of selling. When you sell a car, you’ll need to negotiate with potential buyers, advertise the car, and complete paperwork. Gifting a car, on the other hand, is a simpler process that can help you transfer ownership quickly and easily.

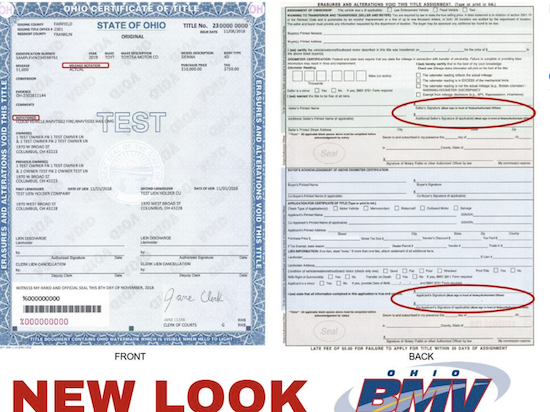

Step 2: Complete the Title Transfer

To gift a car in Ohio, you’ll need to complete a title transfer. This involves filling out the back of the title with the recipient’s name and address, as well as signing and dating it. You’ll also need to provide the odometer reading and any lienholder information if applicable. Once the title is complete, you can give it to the recipient.

Benefits of a Proper Title Transfer

Completing a proper title transfer is essential when gifting a car in Ohio. It ensures that the new owner is legally responsible for the car and can obtain insurance and register the car in their name. It also protects you from any liability in case the car is involved in an accident or other legal issue.

What to Do If There’s a Lien on the Car

If there’s a lien on the car, you’ll need to contact the lienholder to release the lien before transferring the title. This can involve paying off any outstanding debt or negotiating with the lender to release the lien. Once the lien is released, you can complete the title transfer as normal.

Step 3: Obtain a Bill of Sale

While a bill of sale isn’t required in Ohio, it’s a good idea to obtain one when gifting a car. This document provides proof of the transaction and can help protect both parties in case of any legal issues. The bill of sale should include the names and addresses of both parties, the date of the transaction, the make and model of the car, and the purchase price (if applicable).

How a Bill of Sale Can Protect You

By obtaining a bill of sale, you can protect yourself from any legal issues that may arise after the transfer of ownership. This document provides proof of the transaction and can help establish that the car was gifted rather than sold. It can also help protect you from any liability in case the car is involved in an accident or other legal issue.

What to Include in a Bill of Sale

When creating a bill of sale, be sure to include all relevant information, such as the names and addresses of both parties, the make and model of the car, and the purchase price (if applicable). You should also include a statement indicating that the car is being gifted rather than sold, and that the recipient accepts the car in its current condition.

Step 4: Notify the DMV

After completing the title transfer and obtaining a bill of sale, you’ll need to notify the Ohio Bureau of Motor Vehicles (BMV) of the transfer of ownership. This can be done by completing a Notice of Transfer or Release of Liability form online, by mail, or in person at a BMV office.

Why You Need to Notify the DMV

Notifying the DMV of the transfer of ownership is important because it ensures that the car is properly registered in the new owner’s name. It also protects you from any liability in case the car is involved in an accident or other legal issue. Additionally, it can help you avoid any future fines or penalties that may be assessed if the car is not properly registered.

How to Notify the DMV

To notify the DMV of the transfer of ownership, you’ll need to complete a Notice of Transfer or Release of Liability form. This can be done online, by mail, or in person at a BMV office. You’ll need to provide the recipient’s name and address, as well as the make and model of the car and the date of the transfer.

Conclusion

Gifting a car in Ohio is a great way to help someone in need or avoid the hassle of selling a car privately. By following these steps, you can ensure that the transfer of ownership is legal and properly documented. Remember to determine the value of the car, complete the title transfer, obtain a bill of sale, and notify the DMV of the transfer of ownership. With these steps complete, you can gift a car with confidence and peace of mind.

Frequently Asked Questions

Can You Gift a Car in Ohio?

Yes, you can gift a car in Ohio. However, there are certain steps you need to follow to ensure a smooth transfer of ownership. First, the donor needs to sign the title over to the recipient. This can be done at a title office or online. The recipient will also need to fill out a transfer of ownership form and pay any applicable fees.

It’s important to note that the recipient will be responsible for paying sales tax on the fair market value of the car. This is calculated based on the current value of the car, regardless of what was paid for it. The recipient will also need to have valid car insurance before driving the car on Ohio roads.

Do You Need a Notary to Gift a Car in Ohio?

No, you do not need a notary to gift a car in Ohio. However, the title transfer must be completed correctly and signed by both the donor and the recipient. If there are any mistakes on the title or the transfer of ownership form, the process may be delayed or rejected.

It’s recommended to have the title transfer done at a title office to ensure that everything is completed correctly. The recipient should also bring a valid form of identification, such as a driver’s license or passport.

What Documents Do You Need to Gift a Car in Ohio?

To gift a car in Ohio, you will need the original title signed over to the recipient, a transfer of ownership form, and payment for any applicable fees. The recipient will also need to provide proof of insurance before driving the car on Ohio roads.

If the title is lost or damaged, the donor will need to apply for a duplicate title before completing the transfer of ownership. It’s recommended to complete the transfer of ownership at a title office to ensure that everything is done correctly.

Do You Have to Pay Taxes When Gifting a Car in Ohio?

Yes, the recipient of a gifted car in Ohio is responsible for paying sales tax on the fair market value of the car. This is calculated based on the current value of the car, regardless of what was paid for it.

The recipient will need to provide proof of the fair market value of the car, such as a bill of sale or appraisal. The sales tax can be paid at a title office or online. It’s important to note that the recipient will not be able to register the car until the sales tax has been paid.

Is There a Gift Tax on Cars in Ohio?

There is no gift tax on cars in Ohio. However, the recipient of a gifted car is responsible for paying sales tax on the fair market value of the car. This is calculated based on the current value of the car, regardless of what was paid for it.

The recipient will need to provide proof of the fair market value of the car, such as a bill of sale or appraisal. The sales tax can be paid at a title office or online. It’s important to note that the recipient will not be able to register the car until the sales tax has been paid.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, gifting a car in Ohio is a relatively straightforward process. With the right documentation and careful attention to the legal requirements, you can transfer ownership of your vehicle to a family member, friend, or anyone you choose to gift it to. Remember to obtain a notarized title and bill of sale, and be aware of any applicable taxes and fees.

It is important to note that gifting a car is not the same as selling a car. If you are considering gifting a car, take time to understand the legal implications and requirements involved. Consulting with a legal professional or the Ohio Bureau of Motor Vehicles can help ensure a smooth and legal transfer of ownership.

Ultimately, gifting a car can be a generous and meaningful gesture for the recipient, but it is important to approach the process with care and attention to detail. With the right preparation and guidance, you can gift a car in Ohio with confidence and ease.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts