Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

If you’re looking to give a car as a gift in North Dakota, you may be wondering if it’s possible and what the process entails. Fortunately, it is possible to gift a car in North Dakota, but there are certain requirements and steps you must follow to ensure a smooth transfer of ownership. In this article, we will explore the process of gifting a car in North Dakota, including the necessary paperwork and potential pitfalls to avoid. So, if you’re considering gifting a car to a loved one or friend, read on to learn everything you need to know.

Can You Gift a Car in North Dakota?

Giving a car as a gift in North Dakota may seem like a complicated process, but it is relatively simple compared to other states. Before you decide to give a car to someone in North Dakota, you should be aware of the legal requirements, the necessary paperwork, and the potential tax implications.

Legal Requirements for Gifting a Car in North Dakota

To gift a car in North Dakota, the vehicle must have a clear title, and the person receiving the car must be at least 16 years old with a valid driver’s license. The donor and the recipient must fill out the necessary paperwork to transfer ownership of the vehicle.

If the car is gifted to a family member, there is no sales tax, but if the car is gifted to a friend or anyone outside the family, sales tax must be paid on the fair market value of the vehicle. It is also essential to ensure that the car’s insurance is current and that the recipient is added to the policy.

Necessary Paperwork for Gifting a Car in North Dakota

To gift a car in North Dakota, the donor and the recipient must fill out the following paperwork:

- The title of the vehicle: The donor must sign the title and transfer ownership to the recipient.

- Bill of Sale: A bill of sale is not required in North Dakota, but it is recommended to have one to document the transfer of ownership and the purchase price.

- Odometer Disclosure Statement: The donor must provide an odometer disclosure statement to the recipient to document the car’s mileage at the time of the transfer of ownership.

- Registration and License Plate: The recipient must register the vehicle in their name and obtain new license plates.

Benefits of Gifting a Car in North Dakota

Gifting a car in North Dakota can be an excellent way to help out a family member or friend in need. It can also be a way to get rid of a car that is no longer needed without having to go through the hassle of selling it.

Another benefit of gifting a car in North Dakota is that there is no sales tax if the car is gifted to a family member. This can save the donor a significant amount of money compared to selling the car and paying sales tax on the transaction.

Gifting a Car vs. Selling a Car in North Dakota

Gifting a car in North Dakota is generally more straightforward than selling a car. When selling a car, the seller must find a buyer, negotiate a price, and ensure that all the paperwork is correctly filled out.

When gifting a car, the donor can give the car to anyone they choose without having to worry about finding a buyer or negotiating a price. Additionally, gifting a car can be a more generous and personal gesture than selling a car.

However, if the car is gifted to someone outside the family, sales tax must be paid on the fair market value of the vehicle, which can be a significant expense.

Conclusion

Gifting a car in North Dakota can be a straightforward process as long as you follow the legal requirements and fill out the necessary paperwork. It can be a great way to help out a family member or friend in need, and it can also be a more personal and generous gesture than selling a car.

Before you decide to gift a car in North Dakota, make sure you are aware of the potential tax implications and ensure that the recipient has a valid driver’s license and insurance. With proper planning and preparation, gifting a car can be a rewarding experience for both the donor and the recipient.

Contents

- Frequently Asked Questions

- Can you gift a car in North Dakota?

- Do you need to pay taxes when gifting a car in North Dakota?

- Can you gift a car to a family member in North Dakota?

- What documents are needed to gift a car in North Dakota?

- Is it better to sell or gift a car in North Dakota?

- North Dakota Title Transfer: SELLER INSTRUCTIONS

Frequently Asked Questions

Can you gift a car in North Dakota?

Yes, you can gift a car in North Dakota. However, the process is not as simple as just signing the title over to the recipient. The state requires specific documentation to be filled out and filed with the Department of Transportation (DOT) to transfer ownership of the vehicle.

The person gifting the vehicle (the donor) must provide a notarized statement of gift, signed by both the donor and recipient. Additionally, the recipient must provide proof of insurance and pay any applicable fees associated with the transfer of ownership.

Do you need to pay taxes when gifting a car in North Dakota?

Yes, you do need to pay taxes when gifting a car in North Dakota. The state requires that the recipient pay sales tax on the fair market value of the vehicle. The tax rate is currently 5% for cars and light trucks, and 4% for motorcycles.

The recipient can either pay the tax at the time of transfer or within 30 days of the transfer. Failure to pay the required tax can result in penalties and interest being added to the amount owed.

Can you gift a car to a family member in North Dakota?

Yes, you can gift a car to a family member in North Dakota. The state does not have any restrictions on who the donor can gift the vehicle to, as long as the proper documentation is filed with the DOT and any applicable fees and taxes are paid.

However, it is important to note that the recipient will still need to meet all of the state’s requirements for registering and insuring the vehicle in their name, regardless of their relationship to the donor.

What documents are needed to gift a car in North Dakota?

To gift a car in North Dakota, the donor must provide a notarized statement of gift, signed by both the donor and recipient. The statement must include the make, model, and year of the vehicle, as well as the vehicle identification number (VIN).

In addition to the statement of gift, the recipient must provide proof of insurance and pay any applicable fees and taxes associated with the transfer of ownership. The recipient will also need to provide a completed application for title and registration, which can be obtained from the DOT.

Is it better to sell or gift a car in North Dakota?

Whether it is better to sell or gift a car in North Dakota depends on your individual circumstances. If you are looking to get money for the vehicle, selling it may be the better option. However, if you are looking to help out a friend or family member, gifting the car may be the way to go.

It is important to note that if you sell the car, you will need to pay taxes on the sale price. If you gift the car, the recipient will need to pay taxes on the fair market value of the vehicle.

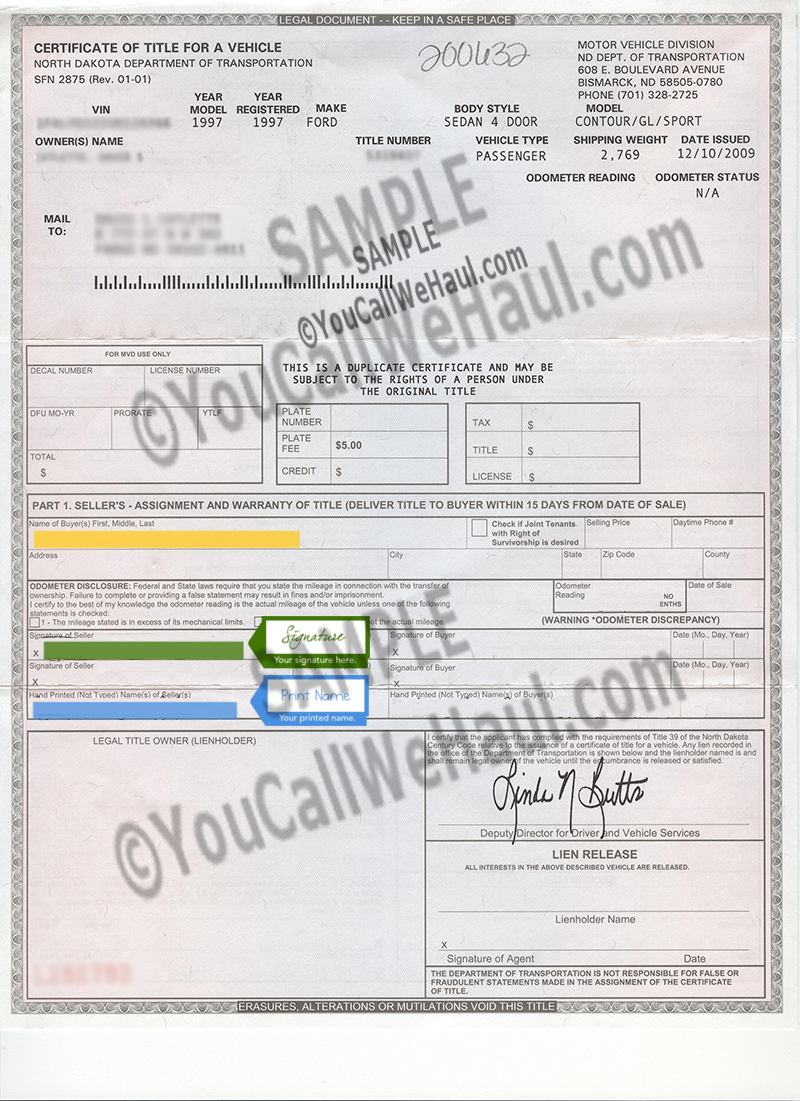

North Dakota Title Transfer: SELLER INSTRUCTIONS

In conclusion, gifting a car in North Dakota is possible and relatively easy to do. However, it is important to follow the state’s guidelines to ensure a smooth transfer of ownership. By providing the necessary documentation and following the steps outlined by the North Dakota DMV, you can successfully gift a car to a friend, family member, or loved one.

Remember, gifting a car can be a great way to show someone you care or to help them out in a time of need. Whether you’re giving a car to a family member who needs reliable transportation or gifting a vehicle to a loved one as a token of appreciation, it’s important to understand the legal requirements and procedures involved.

Overall, gifting a car in North Dakota can be a rewarding experience, but it’s important to take the necessary steps to ensure a successful transfer of ownership. By following the guidelines provided by the state DMV and working with a trusted attorney or legal professional, you can give the gift of a car with confidence and peace of mind.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts