Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Have you ever wondered if it’s possible to gift a car in New Hampshire? The short answer is yes, but there are certain steps you need to follow to ensure that the gift is legal and properly documented.

If you’re thinking of gifting a car to a family member or friend, it’s important to understand the laws and regulations in New Hampshire. From transferring the title to obtaining insurance, we’ll guide you through the process of gifting a car in the Granite State. So, let’s dive in and explore the ins and outs of gifting a car in New Hampshire!

Contents

- Can You Gift a Car in New Hampshire?

- Frequently Asked Questions

- Can you gift a car in New Hampshire?

- Do you have to pay taxes when gifting a car in New Hampshire?

- Do you need to have insurance when gifting a car in New Hampshire?

- Do you need a bill of sale when gifting a car in New Hampshire?

- Can you gift a car that has a lien in New Hampshire?

- How To Gift A Vehicle To Someone Without Paying Taxes

Can You Gift a Car in New Hampshire?

Are you planning to give a car as a gift to a family member or friend in New Hampshire? If so, you should know that the process of transferring ownership of a vehicle in the state can be a bit different than in other states. In this article, we’ll explore the ins and outs of gifting a car in New Hampshire, including the legal requirements and steps you need to take.

Understanding the Legal Requirements

In New Hampshire, you can gift a car to someone without paying any sales tax, as long as you follow the state’s legal requirements. The first step in gifting a car is to make sure that you are the legal owner of the vehicle. If you still have a lien on the car, you’ll need to pay off the loan before you can transfer the title.

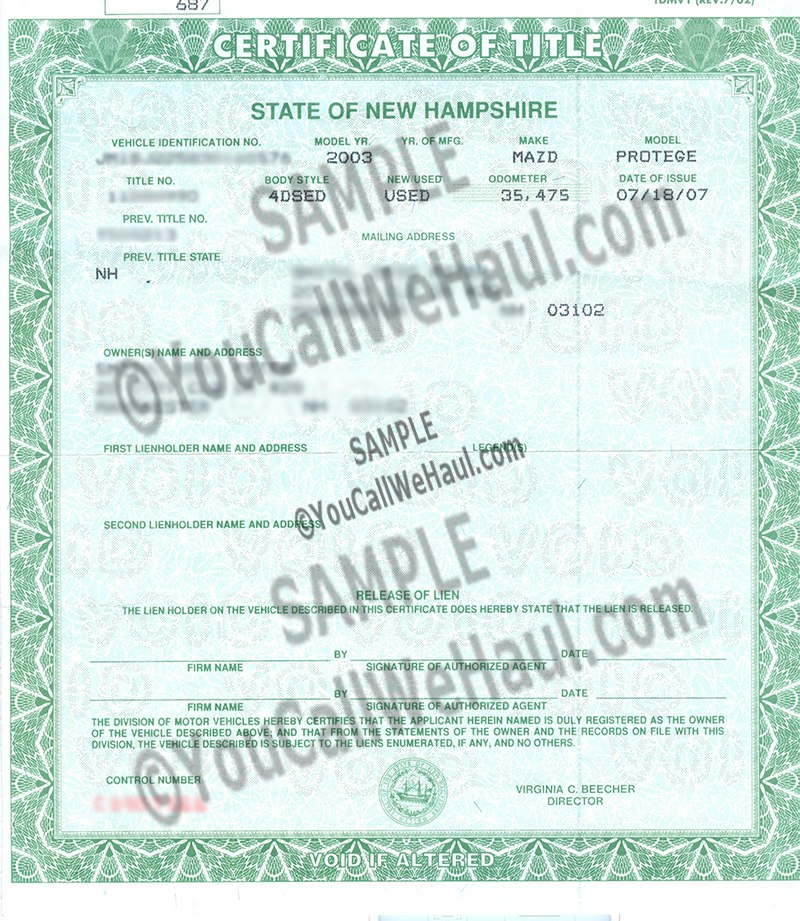

Once you own the vehicle outright, you’ll need to fill out the title transfer form and sign it over to the recipient. You will also need to provide a bill of sale, which includes the sale price, date of sale, and both the buyer and seller’s information. The recipient will need to take these documents to the DMV to register the vehicle in their name.

Steps to Follow for Gifting a Car

If you’re planning to gift a car in New Hampshire, there are a few steps you need to follow to ensure a smooth transfer of ownership. Here’s what you’ll need to do:

Step 1: Get the Title Transfer Form

The first step is to obtain a title transfer form from the DMV. You can download the form from the DMV website or pick one up in person at your local DMV office.

Step 2: Fill Out the Form

Next, you’ll need to fill out the title transfer form with the required information, including the vehicle identification number (VIN), the make and model of the car, and your contact information.

Step 3: Sign Over the Title

Once you’ve filled out the form, you’ll need to sign over the title to the recipient. Make sure to sign your name exactly as it appears on the title, and include the date of the transfer.

Step 4: Provide a Bill of Sale

In addition to the title transfer form, you’ll also need to provide a bill of sale. This document should include the sale price, date of sale, and both the buyer and seller’s information.

Step 5: Transfer Registration and Insurance

The recipient will need to take the title transfer form and bill of sale to the DMV to register the vehicle in their name. They will also need to transfer the car’s insurance policy into their name.

Benefits of Gifting a Car in New Hampshire

Gifting a car in New Hampshire can be a great way to help out a family member or friend in need. It’s also a way to avoid paying sales tax on the transfer of ownership, which can save you a significant amount of money.

Another benefit of gifting a car is that it can help you avoid the hassle of selling the car yourself. By gifting the car, you can transfer ownership quickly and easily, without having to worry about finding a buyer or negotiating a sale price.

Gifting a Car vs. Selling a Car

If you’re trying to decide whether to gift a car or sell it, there are a few factors to consider. Gifting a car can be a good option if you want to help out a family member or friend, or if you want to avoid paying sales tax on the transfer of ownership.

However, if you need the money from the sale of the car, selling it may be a better option. You’ll also need to consider the condition of the car and whether it will be easy to find a buyer.

Conclusion

Gifting a car in New Hampshire can be a straightforward process, as long as you follow the state’s legal requirements. By obtaining the necessary documents and following the steps outlined above, you can transfer ownership of a vehicle quickly and easily. Whether you’re helping out a family member or friend, or simply looking to avoid paying sales tax, gifting a car can be a great option.

Frequently Asked Questions

Are you planning to gift a car in New Hampshire? Here are some frequently asked questions that you might find helpful.

Can you gift a car in New Hampshire?

Yes, you can gift a car in New Hampshire. However, the process is not as simple as just handing over the keys. There are certain steps that you need to follow to ensure that the transfer of ownership is legal and binding.

First, you need to sign the back of the title as the seller, indicating that you are gifting the car to the recipient. Then, the recipient needs to take the signed title to the DMV and apply for a new title in their name. They will also need to pay a title transfer fee and provide proof of insurance.

Do you have to pay taxes when gifting a car in New Hampshire?

Yes, you may have to pay taxes when gifting a car in New Hampshire. If the car is being gifted to a family member, there is no sales tax. However, if the car is being gifted to someone who is not a family member, they will need to pay a 6.25% use tax based on the fair market value of the car.

The recipient can either pay the use tax when they register the car, or you can pay it on their behalf by completing a use tax form and submitting it to the DMV with the title transfer paperwork.

Do you need to have insurance when gifting a car in New Hampshire?

Yes, the recipient of the gifted car will need to have insurance when they register the car in their name. They will need to provide proof of insurance to the DMV along with the title transfer paperwork.

If the recipient already has an existing insurance policy, they can add the gifted car to their policy. Otherwise, they will need to purchase a new insurance policy before registering the car.

Do you need a bill of sale when gifting a car in New Hampshire?

While a bill of sale is not required when gifting a car in New Hampshire, it is recommended. A bill of sale can help protect both the seller and the recipient by providing a record of the transaction.

The bill of sale should include the names and addresses of both the seller and the recipient, the make and model of the car, the VIN number, the date of the transaction, and the sale price (which should be listed as $0 for a gift).

Can you gift a car that has a lien in New Hampshire?

Yes, you can gift a car that has a lien in New Hampshire. However, you will need to pay off the lien before gifting the car to the recipient. Once the lien is paid off, you can sign over the title as the seller and the recipient can take the title to the DMV to apply for a new title in their name.

If the lienholder is not local, you may need to have them send the title to the DMV directly. In this case, it is recommended to contact the DMV beforehand to ensure that all necessary paperwork is submitted correctly.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, gifting a car in New Hampshire is possible and can be a great way to show your appreciation for a loved one. However, it is important to ensure that all legal requirements are met to avoid any potential issues in the future.

By following the necessary steps, such as transferring the title and registration, obtaining a bill of sale, and notifying the DMV, you can gift a car in New Hampshire with ease. Additionally, it is recommended to seek the advice of a legal professional to ensure that all necessary paperwork is completed accurately.

In summary, gifting a car in New Hampshire may take some effort, but it can be a wonderful gesture that brings joy to the recipient. Just be sure to stay organized and follow the proper procedures to make the process as smooth as possible.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts