Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Have you ever wondered if you could gift a car in Nebraska? If you’re planning to give a car as a gift to a friend or family member, it’s important to know the rules and regulations in the state of Nebraska. In this article, we’ll explore the process of gifting a car in Nebraska and what you need to know to make it happen.

From understanding the necessary paperwork to transferring the car title, gifting a car can be a complex process. However, with the right information and guidance, you can ensure that the process goes smoothly and your loved one receives the car they deserve. So, let’s dive into the world of car gifting in Nebraska and explore the steps you need to take to make it happen.

Contents

- Can You Gift a Car in Nebraska?

- Frequently Asked Questions

- 1. Can I gift a car to someone in Nebraska?

- 2. Do I need to have the car inspected before gifting it?

- 3. What documents do I need to transfer ownership of the car?

- 4. Can I gift a car to someone who lives out of state?

- 5. Is there a deadline for registering the gifted vehicle with the DMV?

- How To Gift A Vehicle To Someone Without Paying Taxes

Can You Gift a Car in Nebraska?

Giving a car as a gift is a generous act that can bring joy and happiness to the recipient. If you are planning to gift a car in Nebraska, you may have some questions about the process. This article will guide you through the steps of gifting a car in Nebraska, including the legal requirements and practical considerations.

Legal Requirements for Gifting a Car in Nebraska

Gifting a car in Nebraska involves several legal requirements that you must follow. First, you need to make sure that you are the legal owner of the car and have the title in your name. If the title is not in your name, you need to transfer it to your name before you can gift the car.

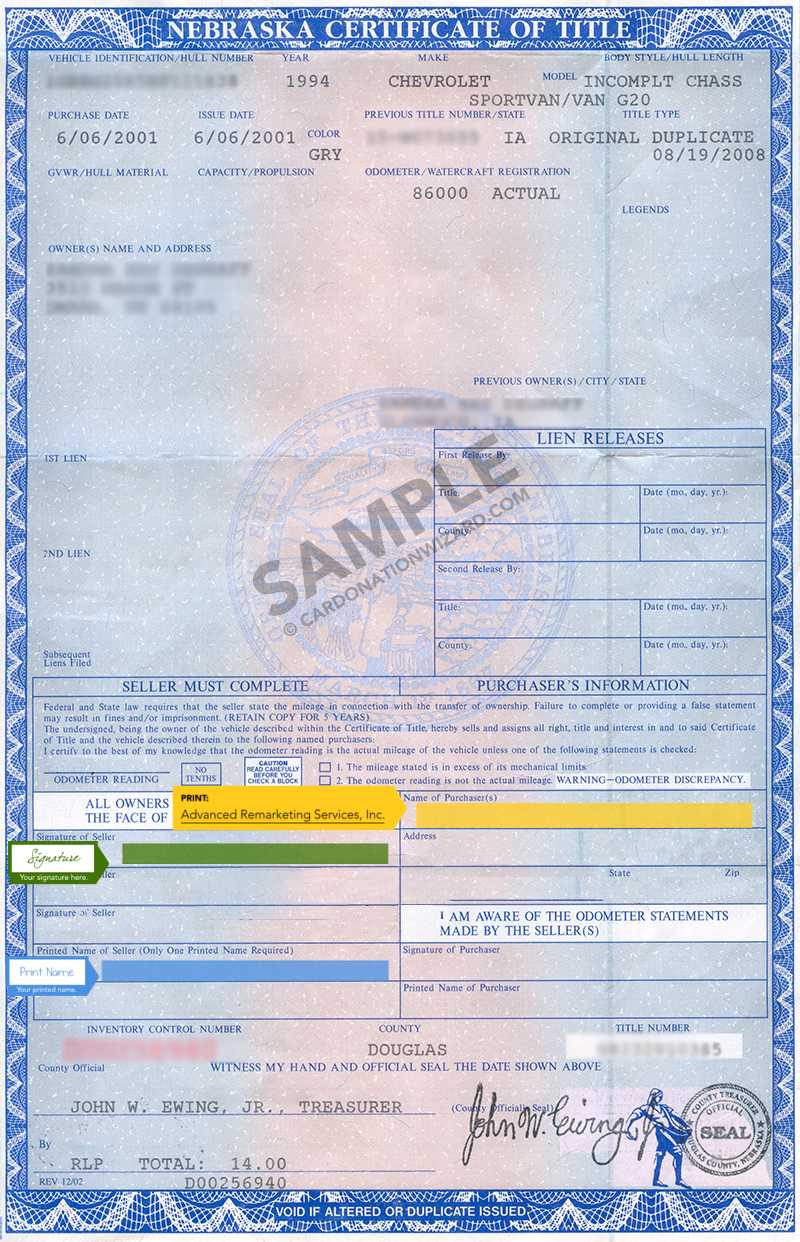

Next, you need to complete the gift section of the title certificate. This section requires the signature of the donor (the person gifting the car) and the recipient (the person receiving the car). Make sure that the information is filled out accurately, including the odometer reading at the time of the transfer.

After completing the gift section of the title certificate, you need to submit it to the Nebraska Department of Motor Vehicles (DMV) along with the registration and payment of any applicable fees. The DMV will then issue a new title and registration in the recipient’s name.

Practical Considerations for Gifting a Car in Nebraska

Besides the legal requirements, there are some practical considerations that you should keep in mind when gifting a car in Nebraska. First, you need to decide whether you want to give the car as a surprise or involve the recipient in the process. If you choose the latter, you can take the recipient with you to the DMV to complete the transfer and avoid any misunderstandings.

Second, you need to consider the tax implications of gifting a car in Nebraska. While there are no sales taxes on gifts, the recipient may be responsible for paying taxes on the value of the car for income tax purposes. To avoid any surprises, you should consult with a tax professional before gifting a car.

Finally, you need to make sure that the car is in good condition and has a clear history. You can check the vehicle history report to make sure that there are no accidents, salvage titles, or other issues that may affect the value of the car. You should also provide the recipient with any maintenance records and warranties that may apply.

Benefits of Gifting a Car in Nebraska

Gifting a car in Nebraska can bring many benefits to both the donor and the recipient. For the donor, it is a way to show generosity and goodwill towards someone they care about. It can also be a way to get rid of a car that they no longer need or want, without the hassle of selling it.

For the recipient, it is a valuable gift that can provide transportation and independence. It can also be a way to save money on a car purchase, as they do not have to pay the sales taxes and other fees associated with buying a car.

Gifting a Car vs Selling a Car in Nebraska

Gifting a car and selling a car in Nebraska are two different processes that involve different legal requirements and practical considerations. When you sell a car, you need to negotiate the price, advertise the car, and complete the sale paperwork. You also need to pay taxes on the sale price and may need to smog the car if it is older than a certain age.

When you gift a car, you do not have to negotiate the price or pay taxes on the gift. However, you still need to complete the gift section of the title certificate and submit it to the DMV. You may also need to provide the recipient with proof of insurance and registration.

In general, gifting a car is a simpler and more straightforward process than selling a car. It is also a great way to show your generosity and goodwill towards someone you care about.

Conclusion

Gifting a car in Nebraska can bring joy and happiness to the recipient, but it also involves legal requirements and practical considerations that you must follow. By following the steps outlined in this article, you can gift a car in Nebraska with confidence and ease. Whether you choose to gift a car or sell a car, make sure to comply with the legal requirements and provide the recipient with all the necessary documents and information.

Frequently Asked Questions

Are you considering gifting a car in Nebraska? Before you do, make sure you understand the legal requirements and process involved. Here are some frequently asked questions about gifting a car in Nebraska:

1. Can I gift a car to someone in Nebraska?

Yes, you can gift a car to someone in Nebraska. However, you need to follow the legal process for transferring ownership of the vehicle. This includes signing over the title and registering the vehicle with the Nebraska Department of Motor Vehicles (DMV).

If the recipient of the gifted vehicle is a family member, you may be exempt from paying sales tax on the transaction. However, if the recipient is not a family member, they will need to pay sales tax based on the fair market value of the vehicle.

2. Do I need to have the car inspected before gifting it?

Yes, if the vehicle is titled in Nebraska, it must pass a safety inspection before it can be registered with the DMV. The inspection must be conducted by an authorized inspection station and includes a check of the vehicle’s lights, brakes, tires, and other essential components.

Keep in mind that the inspection is the responsibility of the seller, not the recipient of the gifted vehicle. However, if the vehicle does not pass inspection, it cannot be registered with the DMV and cannot be legally driven on Nebraska roads.

3. What documents do I need to transfer ownership of the car?

To transfer ownership of a vehicle in Nebraska, you will need the original title signed over to the new owner, a bill of sale, and a completed Application for Certificate of Title. If the vehicle is less than 10 years old, you will also need an odometer disclosure statement.

It is important to ensure that all documents are filled out completely and accurately before submitting them to the DMV. Any errors or missing information can delay the transfer of ownership process.

4. Can I gift a car to someone who lives out of state?

Yes, you can gift a car to someone who lives out of state. However, you will need to follow the same process for transferring ownership as you would for someone who lives in Nebraska. This includes signing over the title and providing all necessary documentation.

The recipient of the gifted vehicle will also need to register the vehicle in their state of residence and pay any applicable taxes or fees.

5. Is there a deadline for registering the gifted vehicle with the DMV?

Yes, there is a deadline for registering a gifted vehicle with the DMV in Nebraska. The recipient of the vehicle must register it within 30 days of taking ownership or face late fees and penalties.

It is important to ensure that all necessary documentation is submitted to the DMV in a timely manner to avoid any issues with the transfer of ownership process.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, gifting a car in Nebraska is a possibility, but it requires some careful consideration and paperwork to ensure a smooth transaction. Whether you are the giver or recipient of the vehicle, it is important to follow the state’s rules and regulations to avoid any legal issues down the road.

Before gifting a car, make sure you have all the necessary documents, including the title, bill of sale, and any other paperwork related to the vehicle. You should also consider any tax implications and consult with a professional if necessary.

Overall, gifting a car in Nebraska can be a thoughtful and generous gesture, but it is important to do it right to avoid any complications. If you are unsure about the process or have any questions, don’t hesitate to reach out to the Nebraska Department of Motor Vehicles for guidance.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts