Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you thinking of giving a car as a gift in Michigan? It’s a generous gesture that can make someone’s day, but before you do, it’s important to understand the legal requirements involved. In Michigan, there are specific rules and regulations you need to follow when gifting a car to someone, so it’s best to be prepared before you make the big gesture. In this article, we’ll take a look at the ins and outs of gifting a car in Michigan, so you can make an informed decision and avoid any legal issues down the line.

Contents

- Can You Gift a Car in Michigan?

- Frequently Asked Questions

- Can You Gift a Car in Michigan?

- Who Can You Gift a Car To in Michigan?

- Do You Have to Pay Taxes When Gifting a Car in Michigan?

- What Documents Do You Need to Gift a Car in Michigan?

- What Happens If You Don’t Transfer the Title When Gifting a Car in Michigan?

- How To Gift A Vehicle To Someone Without Paying Taxes

Can You Gift a Car in Michigan?

If you’re considering gifting a car to a friend or family member in Michigan, you may be wondering if it’s possible to do so legally. Fortunately, the answer is yes. However, there are some guidelines and procedures you’ll need to follow to ensure everything is done properly. In this article, we’ll take a closer look at the process of gifting a car in Michigan.

Understanding the Gift Process

Gifting a car in Michigan is similar to selling a car, but there are some important differences. When you gift a car, the title is transferred to the recipient without any monetary exchange. This means that the recipient won’t need to pay sales tax on the vehicle, but they will still need to pay for registration and license plates.

To gift a car in Michigan, you’ll need to follow these steps:

- Fill out the back of the vehicle title with the recipient’s information.

- Complete a bill of sale (optional, but recommended).

- Remove your license plates from the vehicle.

- Give the recipient the signed title and bill of sale (if applicable).

Who Can Gift a Car in Michigan?

In Michigan, anyone can gift a car as long as they are the legal owner of the vehicle. This means that if you have paid off the vehicle and have the title in your name, you can gift it to someone else. However, if you still owe money on the vehicle, you’ll need to pay off the loan before you can gift the car.

It’s also worth noting that if the vehicle is jointly owned, both owners will need to sign the title when gifting the car. Additionally, if the vehicle is registered in another state, you’ll need to follow that state’s rules for transferring ownership.

Benefits of Gifting a Car

Gifting a car can be a great way to help out a friend or family member in need. It can also be a good option if you’re looking to get rid of a vehicle that you no longer need or want. Additionally, since the recipient won’t need to pay sales tax on the vehicle, gifting a car can be a cost-effective way to transfer ownership.

Gifting a Car vs. Selling a Car

While gifting a car and selling a car may seem similar, there are some key differences to consider. When you sell a car, you’ll typically receive money for the vehicle and the buyer will need to pay sales tax on the purchase. Additionally, you’ll need to complete more paperwork when selling a car, such as a release of liability form.

On the other hand, when you gift a car, there is no monetary exchange and the recipient won’t need to pay sales tax. However, you’ll still need to transfer the title and remove your license plates from the vehicle.

Conclusion

Gifting a car in Michigan is a great way to help out a friend or family member without breaking the bank. By following the proper procedures and guidelines, you can ensure that the transfer of ownership goes smoothly and legally. Whether you’re looking to get rid of a vehicle you no longer need or want to help out someone in need, gifting a car can be a rewarding experience.

Frequently Asked Questions

Michigan laws allow the gifting of cars to family members, friends, or acquaintances. However, there are certain conditions that need to be fulfilled before the transfer of ownership can take place. Here are some common questions and answers about gifting a car in Michigan.

Can You Gift a Car in Michigan?

Yes, you can gift a car in Michigan. However, you need to follow the legal process to transfer the ownership of the vehicle. The process involves a few steps to complete the transaction.

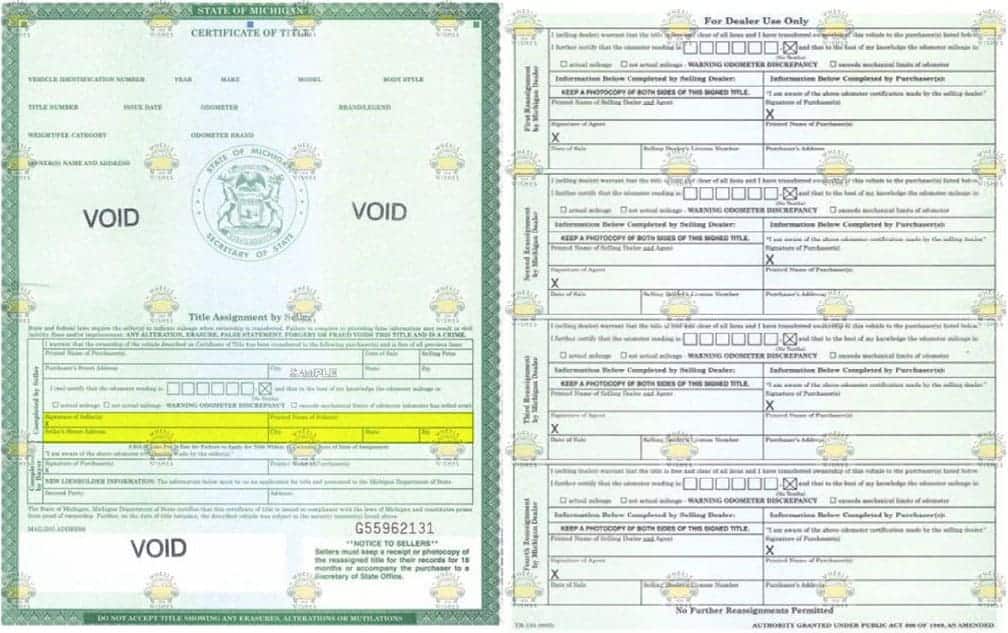

You need to provide the title of the car to the recipient, along with a bill of sale. The bill of sale should include the vehicle identification number (VIN), make, model, year, and the purchase price. You also need to fill out a gift declaration form, which is available on the Michigan Secretary of State website. Once the recipient receives the documents, they need to take them to the Secretary of State office to transfer the title and register the vehicle in their name.

Who Can You Gift a Car To in Michigan?

You can gift a car to anyone in Michigan, including family members, friends, or acquaintances. However, if the recipient is a minor, you need to obtain the consent of their legal guardian or parent. Additionally, the recipient needs to have a valid driver’s license to register the vehicle in their name.

It is important to note that gifting a car to someone who cannot afford to maintain it or does not have the means to pay for the insurance is not recommended. It is essential to ensure that the recipient can afford to maintain the car and has the necessary resources to operate it safely.

Do You Have to Pay Taxes When Gifting a Car in Michigan?

Yes, you have to pay taxes when gifting a car in Michigan. The recipient needs to pay a 6% use tax on the fair market value of the vehicle. The fair market value is determined by the purchase price or the average retail value listed in a nationally recognized pricing guide, whichever is greater.

If the vehicle is gifted to a close family member, such as a spouse, sibling, parent, or child, the recipient is exempt from paying the use tax. However, they need to provide proof of the relationship to the donor.

What Documents Do You Need to Gift a Car in Michigan?

To gift a car in Michigan, you need to provide the title of the vehicle to the recipient, along with a bill of sale. The bill of sale should include the vehicle identification number (VIN), make, model, year, and the purchase price. You also need to fill out a gift declaration form, which is available on the Michigan Secretary of State website.

Additionally, the recipient needs to have a valid driver’s license to register the vehicle in their name. They also need to pay a 6% use tax on the fair market value of the vehicle, unless the vehicle is gifted to a close family member, in which case they are exempt from paying the tax.

What Happens If You Don’t Transfer the Title When Gifting a Car in Michigan?

If you don’t transfer the title when gifting a car in Michigan, you could be held liable for any accidents or tickets the recipient incurs while driving the vehicle. The recipient could also face legal consequences for driving an unregistered vehicle.

To avoid any legal issues, it is essential to follow the legal process for transferring ownership of a vehicle. This involves providing the title of the car to the recipient, along with a bill of sale and gift declaration form. The recipient then needs to take these documents to the Secretary of State office to transfer the title and register the vehicle in their name.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, gifting a car in Michigan can be a thoughtful and generous gesture. However, it is important to follow the proper legal procedures to avoid any complications in the future. By completing the necessary paperwork and ensuring that the transfer of ownership is properly documented, both the giver and receiver can enjoy a smooth and stress-free transaction.

Overall, gifting a car can be a great way to show someone how much you care. It can be a generous gift for a family member or friend who needs reliable transportation, or simply a way to express your gratitude. Just remember to take the necessary steps to ensure that the gift is properly transferred and registered with the state of Michigan.

If you have any questions or concerns about gifting a car in Michigan, don’t hesitate to reach out to the Michigan Secretary of State’s office for guidance. With their help and a little bit of planning, you can make sure that your gift is both meaningful and legally sound.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts