Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Have you ever wondered if you can gift a car in Kansas? Well, the answer is yes! Giving a car as a gift can be a generous and kind gesture, but it’s important to know the legal requirements in Kansas before doing so.

In this article, we’ll explore the ins and outs of gifting a car in Kansas, including the necessary paperwork and steps to take to ensure a smooth transfer of ownership. Whether you’re looking to gift a car to a family member or friend, or just curious about the process, read on to learn more about this exciting topic!

Can You Gift a Car in Kansas?

If you’re looking to give someone a car in Kansas, you may be wondering if it’s possible to gift a car in the state. The good news is, it is possible to gift a car in Kansas, but there are certain steps you need to take to ensure the gift is legal and properly documented.

Step 1: Gather All Required Documents

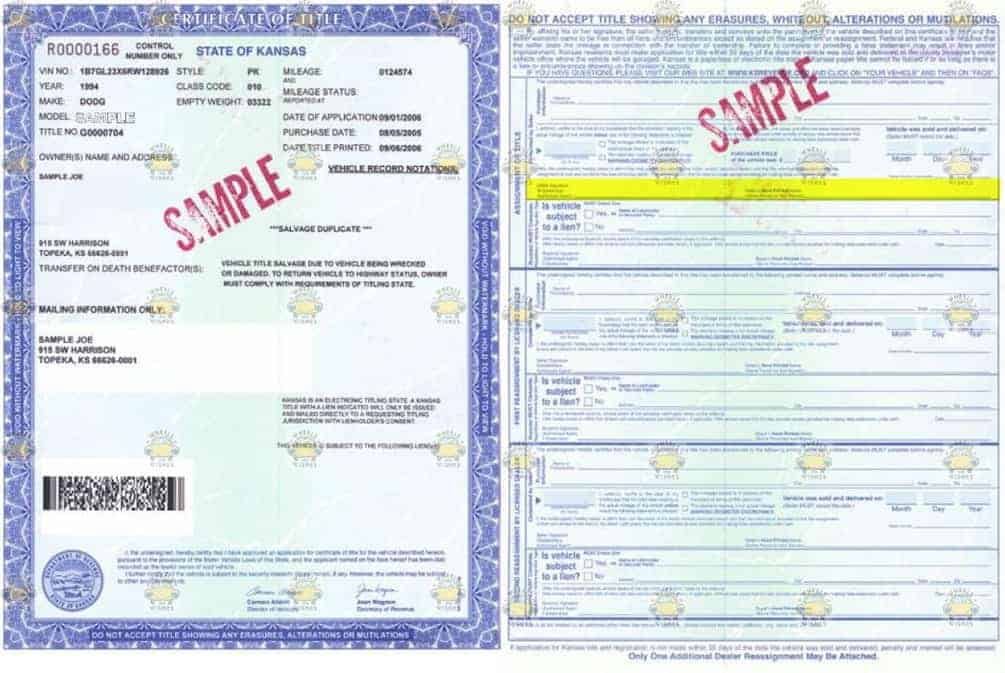

The first step to gifting a car in Kansas is to gather all the required documents. These include the car’s title, registration, and a bill of sale. You’ll also need to fill out a gift affidavit, which is a legal document that verifies that the car is a gift and not being sold.

Once you have all the required documents, you can move on to the next step.

Step 2: Transfer Ownership

To transfer ownership of the car, you’ll need to sign over the title to the recipient. Be sure to include all the necessary information, such as the recipient’s name and address, the date of the transfer, and the car’s make and model.

You’ll also need to have the car’s registration transferred to the recipient’s name. This can be done at the local DMV office.

Step 3: Pay Any Fees

In Kansas, there may be fees associated with transferring ownership of a car. You should be prepared to pay these fees, which can include sales tax, registration fees, and title fees.

It’s important to note that the recipient of the gift is responsible for paying any ongoing fees associated with owning and operating the car, such as insurance and maintenance costs.

Benefits of Gifting a Car

Gifting a car can be a great way to show someone you care, and it can also have some financial benefits. For example, if you’re the owner of the car and you gift it to someone else, you won’t have to pay any sales tax on the transfer.

Additionally, if the car is old and not worth much, you may be able to avoid the hassle of trying to sell it by simply giving it away as a gift.

Gifting a Car vs. Selling a Car

While gifting a car can be a great option, it’s important to consider the differences between gifting a car and selling a car.

When you sell a car, you can usually get a higher price for it than if you were to gift it. However, selling a car can also be time-consuming and stressful, especially if you’re trying to find a buyer.

Gifting a car, on the other hand, can be a quick and easy way to get rid of a car you no longer need. Plus, it can be a great way to show someone you care.

Conclusion

In conclusion, gifting a car in Kansas is possible, but it’s important to follow the proper steps and gather all the required documentation. By doing so, you can ensure that the gift is legal and properly documented, and you can avoid any potential legal issues down the road.

Whether you choose to gift a car or sell it, it’s important to consider all your options and make the decision that’s right for you.

Contents

Frequently Asked Questions

Can you gift a car in Kansas?

Yes, you can gift a car in Kansas. However, there are certain steps that you need to follow in order to transfer the ownership of the vehicle. The process involves completing the necessary paperwork and paying the required fees to the Kansas Department of Revenue.

What documents are required to gift a car in Kansas?

To gift a car in Kansas, you need to provide the title signed by the seller and the buyer, a bill of sale, and a gift affidavit. The gift affidavit should include the names and addresses of the buyer and the seller, the vehicle identification number (VIN), and the date of the transfer.

Do you have to pay taxes when you gift a car in Kansas?

Yes, you may have to pay taxes when you gift a car in Kansas. If the vehicle is gifted to a family member, there is no sales tax. However, if the gift is to a non-family member, the recipient may need to pay a gift tax. It is recommended that you consult with a tax professional to determine the tax implications of gifting a car in Kansas.

Can you gift a car to someone out of state?

Yes, you can gift a car to someone out of state. However, the process may be more complex as you need to follow the transfer requirements of both Kansas and the recipient’s state. It is recommended that you consult with the Department of Revenue in both states to ensure that you complete all the necessary paperwork and pay all the required fees.

Do you need insurance to gift a car in Kansas?

Yes, you need insurance to gift a car in Kansas. Both the buyer and the seller are required to have insurance at the time of the transfer. If the recipient does not have insurance, they must obtain it before registering the vehicle in their name.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, gifting a car in Kansas is definitely possible. However, it is important to follow the state’s regulations and procedures to ensure a successful transfer of ownership. By completing the necessary paperwork, providing proper documentation, and paying any associated fees, you can gift a car to a loved one or friend with ease.

Remember, it is important to notify the Kansas Department of Revenue within 30 days of the transfer to avoid any penalties or fines. Additionally, both the giver and receiver should keep copies of all documentation related to the transfer, including the bill of sale and title.

Overall, gifting a car in Kansas can be a great way to show someone you care. Just be sure to follow the rules and regulations to ensure a smooth and legal transfer of ownership.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts