Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you looking to gift a car to a loved one in Colorado? The process might seem daunting, but it’s actually quite simple. In this article, we’ll break down the requirements and steps you need to take to gift a car in Colorado. So, grab a cup of coffee and let’s get started!

Giving a car as a gift can be a thoughtful and generous gesture, but it’s important to navigate the legal process correctly. In Colorado, there are specific guidelines and forms you need to follow to transfer ownership of a vehicle as a gift. Whether you’re gifting a car to a family member, friend, or acquaintance, we’ve got you covered with everything you need to know.

Can You Gift a Car in Colorado?

If you’re looking to give a car as a gift in Colorado, you might be wondering about the process. Fortunately, it’s possible to gift a car in Colorado, but there are some important steps to follow. Here’s what you need to know.

Step 1: Make Sure You Have the Required Documents

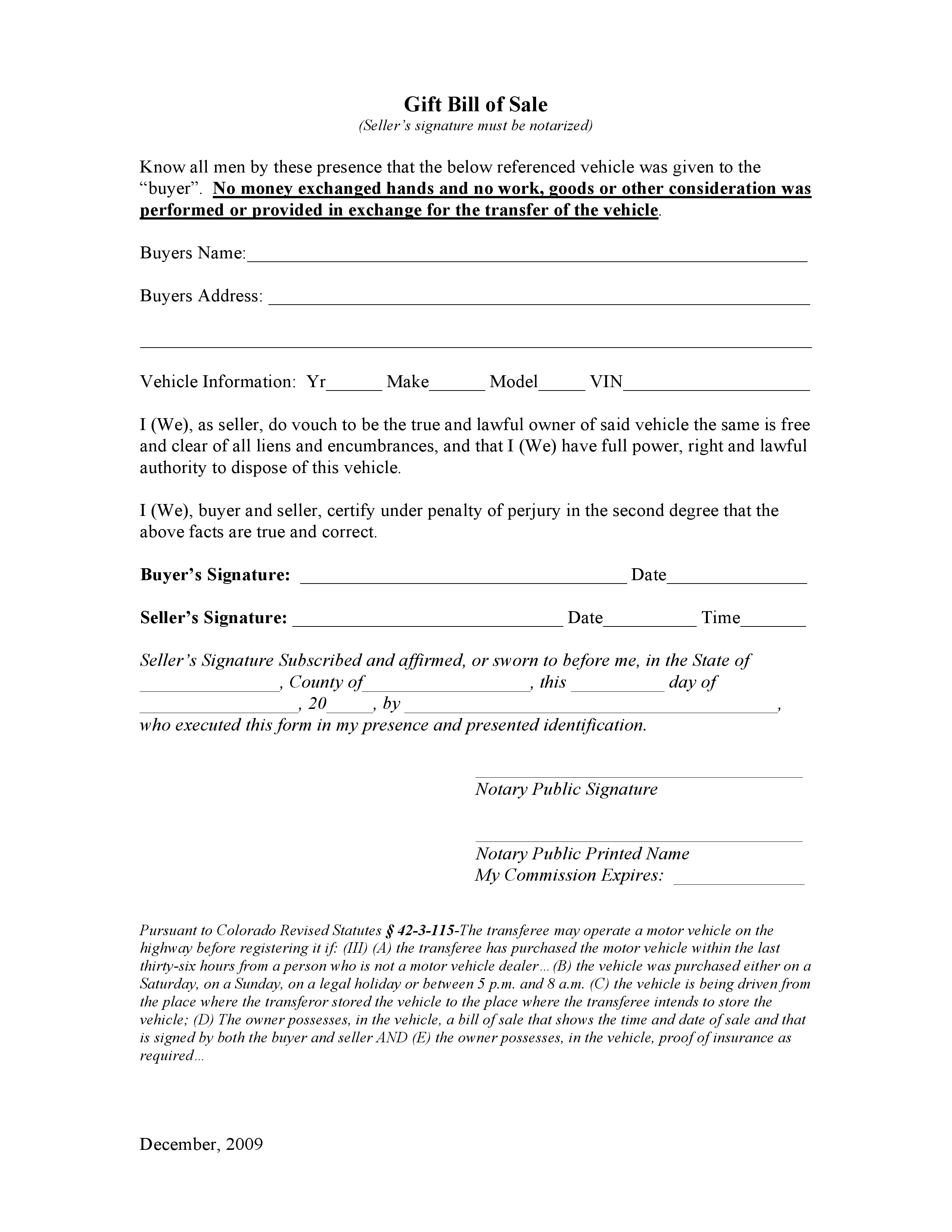

Before you can gift a car in Colorado, you’ll need to make sure you have all the necessary paperwork in order. This includes the car’s title, which must be signed over to the new owner. You’ll also need to provide a bill of sale, which should include the vehicle identification number (VIN), purchase price, and date of sale.

If the car is less than 10 years old, you’ll need to provide an odometer disclosure statement as well. And if you’re gifting the car to a family member, you’ll need to provide a gift letter that states the vehicle is a gift and includes the recipient’s name and relationship to you.

Step 2: Have the Car Inspected

Before the new owner can register the car in Colorado, it will need to pass an emissions inspection. This is required for all cars that are more than seven model years old. You can find a list of inspection stations on the Colorado Department of Public Health and Environment website.

Step 3: Transfer Ownership

Once you have all the necessary paperwork and the car has passed inspection, it’s time to transfer ownership. You’ll need to visit your local Colorado Division of Motor Vehicles (DMV) office and fill out the appropriate forms. You’ll need to provide the car’s title, bill of sale, and any other required documents.

You’ll also need to pay a fee to transfer the title to the new owner. This fee varies depending on the age of the car and the county in which it is registered.

Benefits of Gifting a Car

Gifting a car can be a great way to help out a friend or family member who needs a vehicle. It can also be a good way to avoid paying taxes on the sale of a car. In Colorado, there is no sales tax on a vehicle that is gifted to a family member. However, if you gift a car to someone who is not a family member, they will need to pay sales tax on the fair market value of the car.

Gifting vs. Selling a Car

If you’re considering gifting a car, you might be wondering how it compares to selling a car. One advantage of gifting a car is that you don’t have to worry about negotiating a price or dealing with potential buyers. However, you will need to make sure you have all the necessary paperwork in order and that the car is in good condition.

If you sell a car, you’ll need to negotiate a price and may need to deal with potential buyers who try to lowball you. However, you’ll receive money for the car, which can be helpful if you’re looking to buy a new vehicle or pay off debts.

Conclusion

Gifting a car in Colorado is a straightforward process, but it’s important to make sure you have all the necessary paperwork in order and that the car is in good condition. By following these steps, you can help ensure a smooth transfer of ownership and provide a valuable gift to a friend or family member.

Contents

- Frequently Asked Questions

- Question 1: Can I gift a car to anyone in Colorado?

- Question 2: Do I need to pay sales tax on a gifted car in Colorado?

- Question 3: What documents do I need to gift a car in Colorado?

- Question 4: Can I gift a car to someone who lives out of state?

- Question 5: What if I don’t have the car’s title?

- How To Gift A Vehicle To Someone Without Paying Taxes

Frequently Asked Questions

In Colorado, gifting a car is a common practice among family members and friends. However, there are certain legal requirements that need to be followed to ensure a smooth transfer of ownership. Here are some frequently asked questions about gifting a car in Colorado.

Question 1: Can I gift a car to anyone in Colorado?

Yes, you can gift a car to anyone you choose in Colorado, including family members, friends, or acquaintances. However, it is important to ensure that the person receiving the car is legally allowed to own and operate a vehicle. This means that they must have a valid driver’s license and meet the state’s minimum age requirements.

Additionally, if the person receiving the car is not a family member, you will need to provide proof of insurance and have them sign a bill of sale to transfer ownership.

Question 2: Do I need to pay sales tax on a gifted car in Colorado?

No, you do not need to pay sales tax on a gifted car in Colorado. However, the person receiving the car will need to pay a one-time ownership tax based on the value of the vehicle. This tax must be paid within 30 days of the transfer of ownership.

If the car is gifted to a family member, they may be eligible for a Family Gift Tax Exemption, which allows them to avoid paying the one-time ownership tax.

Question 3: What documents do I need to gift a car in Colorado?

To gift a car in Colorado, you will need the car’s title, signed over to the person receiving the car. You will also need a bill of sale, which should include the vehicle’s make, model, and VIN, as well as the purchase price (if any) and the date of the transfer of ownership.

If the car is more than ten years old, you will not need to provide a separate odometer disclosure statement. However, if the car is less than ten years old, you will need to provide a separate statement verifying the vehicle’s mileage.

Question 4: Can I gift a car to someone who lives out of state?

Yes, you can gift a car to someone who lives out of state. However, the requirements for transferring ownership may vary depending on the state where the person lives. In general, you will need to provide the person with the car’s title, bill of sale, and any other required documents, such as an emissions test certificate or a smog check.

You may also need to contact the Department of Motor Vehicles (DMV) in the person’s state of residence to find out about their specific requirements for transferring ownership of a vehicle.

Question 5: What if I don’t have the car’s title?

If you do not have the car’s title, you will need to contact the Colorado DMV to obtain a duplicate title. This process may take several weeks, so it is important to plan ahead if you are planning to gift a car. In some cases, you may also need to provide additional documentation to prove your ownership of the vehicle.

It is important to note that gifting a car without a title is illegal in Colorado, and can result in fines or legal penalties.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, gifting a car in Colorado is possible, but it requires following certain legal procedures to ensure that the transfer of ownership is done correctly. The process may vary depending on the relationship between the giver and receiver, and whether the car is paid off or has an outstanding loan.

If you are considering gifting a car, it’s important to consult with a lawyer or the Colorado Department of Revenue to make sure you are completing all necessary paperwork and avoiding any potential legal issues.

Overall, with the right preparation and guidance, gifting a car in Colorado can be a thoughtful and generous gesture that can help someone in need or simply bring joy to a loved one.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts