Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you planning to surprise your loved one with a brand new car in Arkansas? If so, you may be wondering if it’s possible to gift a car in this state. Well, the good news is, yes, it is possible to gift a car in Arkansas, but there are certain requirements and steps that you need to follow.

Firstly, you will need to transfer the vehicle’s ownership by completing the necessary paperwork with the Arkansas Department of Finance and Administration. Additionally, you may need to pay certain fees and taxes depending on the car’s value. Keep reading to learn more about the process of gifting a car in Arkansas and make your loved one’s dream come true!

Can You Gift a Car in Arkansas?

If you’re considering giving away your car to a friend or family member in Arkansas, it’s important to know the legal requirements and regulations surrounding car gifting. In this article, we’ll explore the ins and outs of gifting a car in Arkansas, including the necessary steps and potential benefits.

Step 1: Understanding Arkansas’ Gifting Laws

In Arkansas, gifting a car is a straightforward process, but there are some legal requirements you should be aware of. First and foremost, the person receiving the car must be at least 18 years old and have a valid Arkansas driver’s license. Additionally, the car must be fully paid off, and there should be no liens or outstanding loans against it.

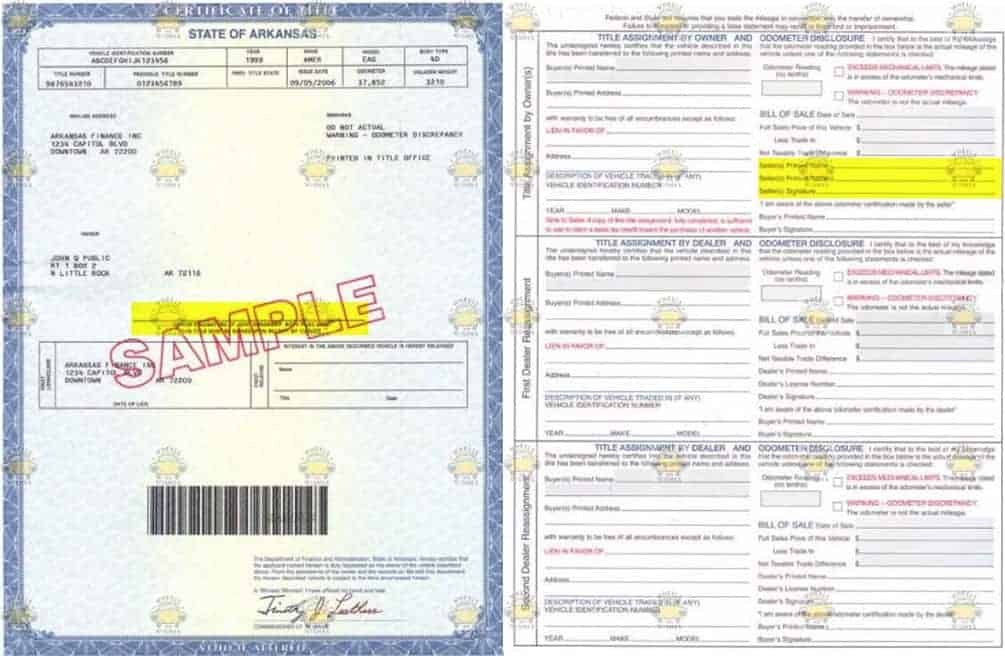

To transfer ownership of the car, both parties will need to complete a Bill of Sale, which is a legal document that outlines the terms of the transaction. The Bill of Sale should include the car’s make, model, year, and Vehicle Identification Number (VIN), as well as the sale price (which can be $0 if you’re gifting the car). You’ll also need to provide a signed and notarized title, which should list the recipient as the new owner of the car.

Step 2: Completing the Transfer Process

Once you have all the necessary documents, you can complete the transfer process by visiting your local Arkansas Department of Finance and Administration (DFA) office. There, you’ll need to pay the appropriate fees and taxes, which will vary depending on the value of the car. You should also bring proof of insurance for the new owner.

After you’ve completed the transfer, the DFA will issue a new title in the recipient’s name, which they can use to register the car and obtain license plates. It’s important to note that the new owner will be responsible for paying any ongoing registration and insurance costs.

Benefits of Gifting a Car in Arkansas

Gifting a car can be a great way to help out a friend or family member in need, but there are also some potential benefits for both parties. For the giver, gifting a car can be a way to get rid of an old or unwanted vehicle without having to sell it or deal with the hassle of trading it in. It can also be a way to reduce your taxable estate and potentially lower your estate tax liability.

For the recipient, receiving a gifted car can be a huge financial relief, especially if they’re in a tight spot or can’t afford to purchase a car on their own. It can also be a way to save money on transportation costs and potentially improve their credit score if they make timely payments on any outstanding loans.

Gifting a Car vs. Selling a Car

While gifting a car can be a great option in certain situations, it’s not always the best choice. If you’re looking to get the most money out of your car, selling it outright may be a better option. You can typically get a higher sale price than if you were gifting the car, which can be especially important if you’re looking to recoup some of your investment.

Additionally, selling a car can be a better option if you’re concerned about liability issues. When you gift a car, you’re essentially transferring all liability for the vehicle to the new owner, which means that if they get into an accident or incur any other costs related to the car, you won’t be responsible. However, if you sell the car and something goes wrong, you may still be liable for any damages or legal issues that arise.

Conclusion

Gifting a car in Arkansas can be a great way to help out a friend or family member in need, but it’s important to understand the legal requirements and potential benefits before making the decision. By following the steps outlined in this article and consulting with a legal professional if necessary, you can ensure a smooth and successful car gifting process.

Contents

- Frequently Asked Questions

- Can you gift a car in Arkansas?

- Do you have to pay taxes on a gifted car in Arkansas?

- Do you need a bill of sale to gift a car in Arkansas?

- What happens if the gifted car is not registered in Arkansas?

- Can you gift a car to a family member in Arkansas?

- How To Gift A Vehicle To Someone Without Paying Taxes

Frequently Asked Questions

Can you gift a car in Arkansas?

Yes, it is possible to gift a car in Arkansas. However, there are certain steps that need to be followed in order to transfer the ownership of the vehicle. The process of gifting a car in Arkansas is relatively simple, but it is important to ensure that all the necessary paperwork is completed correctly.

To gift a car in Arkansas, the first step is to sign over the title of the vehicle to the recipient. This can be done at a local Arkansas Revenue Office. The recipient will then need to take the signed title to the same office, along with proof of insurance and registration. Once all the paperwork is completed and the fees are paid, the recipient will be able to take ownership of the vehicle.

Do you have to pay taxes on a gifted car in Arkansas?

Yes, taxes must be paid on a gifted car in Arkansas. The recipient of the car will need to pay the sales tax on the fair market value of the vehicle at the time of the transfer. The fair market value is determined by the Arkansas Office of Motor Vehicles based on the current market value of similar vehicles.

In addition to the sales tax, the recipient may also need to pay a registration fee and any other applicable fees. It is important to keep in mind that the taxes and fees must be paid in full in order for the transfer of ownership to be complete.

Do you need a bill of sale to gift a car in Arkansas?

While a bill of sale is not required to gift a car in Arkansas, it is recommended. A bill of sale can serve as proof of the transfer of ownership and can be helpful in the event of any disputes or legal issues that may arise. The bill of sale should include the names and addresses of both the giver and the recipient, as well as the make, model, and year of the vehicle.

It is also a good idea to include the purchase price, even if the vehicle is being gifted. This can help to establish the fair market value of the car and can be used to calculate the sales tax that will need to be paid.

What happens if the gifted car is not registered in Arkansas?

If the gifted car is not registered in Arkansas, the recipient will need to register it before they can legally drive it on the roads. In order to register the vehicle, the recipient will need to provide proof of ownership, proof of insurance, and pay any applicable fees.

If the vehicle was previously registered in another state, the recipient may also need to provide a title or registration certificate from that state. It is important to make sure that all the necessary paperwork is completed correctly in order to avoid any legal issues or complications.

Can you gift a car to a family member in Arkansas?

Yes, it is possible to gift a car to a family member in Arkansas. The process for gifting a car to a family member is the same as gifting a car to anyone else. The giver will need to sign over the title of the vehicle to the recipient, who will then need to complete the necessary paperwork to transfer ownership.

The recipient will also need to pay the sales tax on the fair market value of the vehicle at the time of the transfer. However, if the giver and the recipient are immediate family members, such as parents, children, or spouses, they may be eligible for a tax exemption. It is important to check with the Arkansas Office of Motor Vehicles to determine if an exemption applies.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, gifting a car in Arkansas is possible, but it’s important to follow the state’s regulations to avoid any legal issues. With the right documentation, including the title, bill of sale, and gift affidavit, you can transfer ownership of a vehicle to a family member, friend, or charity without paying sales tax.

Whether you’re giving a car as a generous gesture or simply transferring ownership, it’s crucial to follow the rules and regulations set by the Arkansas Department of Finance and Administration. By doing so, you can ensure a smooth process and avoid any complications down the road.

Overall, gifting a car in Arkansas can be a great way to help a loved one or support a charitable cause. Just make sure to do your due diligence and follow the necessary steps to ensure a successful transfer of ownership.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts