Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Donating your old car for a tax return is a great way to give back to your community while also benefiting from a tax deduction. Whether you have a car that’s no longer running or you simply want to upgrade to a newer model, donating your old vehicle can be a smart financial decision that helps support a worthwhile cause.

But before you make the decision to donate your car, it’s important to understand the ins and outs of the process. In this article, we’ll explore the benefits of donating your old car, how the tax deduction works, and what you need to do to ensure a smooth and successful donation experience. So, let’s get started!

Donate Your Old Car for Tax Returns – A Guide

What is Car Donation for Tax Returns?

Donating your old car to a charitable organization is a great way to give back to your community while also getting rid of an unwanted vehicle. But did you know that you can also get a tax deduction for your donation? When you donate your car, the value of the vehicle can be used as a tax write-off on your tax returns. This can be a significant benefit for those who are looking to reduce their taxable income.

When you donate your car, the charitable organization will typically sell the vehicle and use the proceeds to fund their programs. The value of the vehicle is then used as a tax write-off on your tax returns. However, it’s important to note that the amount you can deduct will depend on a few factors, including the value of the vehicle and the organization you donate to.

How to Donate Your Car for Tax Returns?

If you’re interested in donating your car for tax returns, the process is relatively straightforward. Here’s what you need to do:

1. Choose a reputable charity – Before you donate your car, it’s important to research the charitable organization to ensure that they are a legitimate nonprofit.

2. Determine the value of your car – The value of your car will determine your tax deduction, so it’s important to have an accurate estimate of its worth.

3. Transfer ownership – You will need to transfer ownership of the vehicle to the charity.

4. Get a receipt – The charity will provide you with a receipt that you can use for your tax returns.

5. Claim your deduction – When you file your tax returns, you can claim your deduction for the value of the vehicle.

Benefits of Donating Your Car for Tax Returns

There are several benefits to donating your car for tax returns, including:

1. Tax deduction – The value of your vehicle can be used as a tax write-off, which can help to reduce your taxable income.

2. Supporting a good cause – By donating your car to a charitable organization, you can support a cause that you believe in.

3. Freeing up space – If you have an old vehicle sitting in your driveway or garage, donating it can free up valuable space.

4. Avoiding the hassle of selling – Selling an old car can be a hassle, but donating it is a simple and easy process.

Donating Your Car for Tax Returns vs. Selling Your Car

When it comes to getting rid of an old car, you have two options – donate it or sell it. While both options have their benefits, there are some key differences to consider.

Donating your car for tax returns is a great option if you want to support a charitable organization and get a tax deduction. However, you may not receive as much money for your vehicle as you would if you sold it.

Selling your car can be a better option if you’re looking to get the most money for your vehicle. However, the process can be time-consuming and may require some effort on your part.

Ultimately, the decision of whether to donate or sell your car will depend on your personal preferences and circumstances.

Conclusion

Donating your old car to a charitable organization is a great way to give back to your community while also getting a tax deduction. If you’re interested in donating your car for tax returns, be sure to choose a reputable charity, determine the value of your car, transfer ownership, get a receipt, and claim your deduction on your tax returns. While there are benefits to both donating and selling your car, the decision will ultimately depend on your personal preferences and circumstances.

Contents

- Frequently Asked Questions

- Can I donate any car for a tax deduction?

- What kind of documentation do I need to donate my car for a tax deduction?

- How much can I claim as a tax deduction for my donated car?

- Can I donate my car to a family member or friend and still get a tax deduction?

- What happens to my donated car after I donate it?

Frequently Asked Questions

Donating your old car to a charity can be a great way to do something good and get a tax deduction at the same time. However, there are some things you need to know before you donate your car. Here are some frequently asked questions about donating your old car for a tax return.

Can I donate any car for a tax deduction?

Generally, you can donate any car that is in running condition, but some charities may accept cars that are not running. However, the tax deduction you receive for your donation will depend on the value of the car. If the car is worth more than $500, you will need to fill out IRS Form 8283 to claim your deduction.

It’s also important to note that you can only claim a deduction for the fair market value of the car at the time of the donation. If the charity sells the car for less than its fair market value, that is the amount you can claim as a deduction.

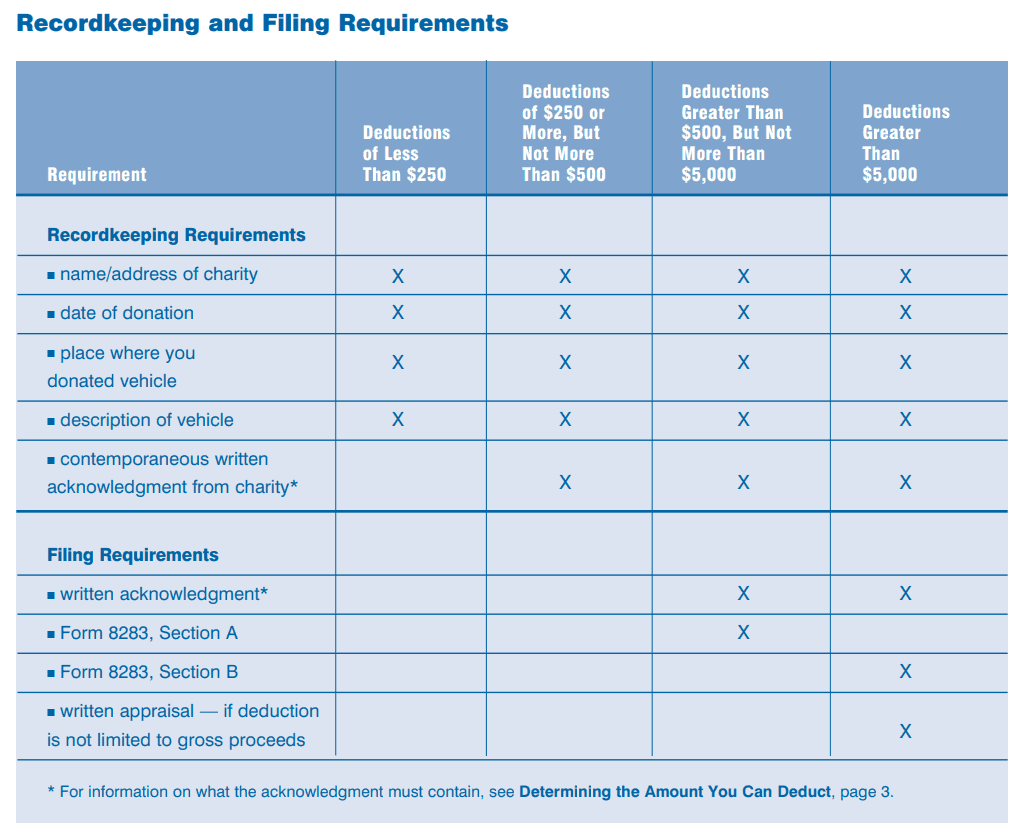

What kind of documentation do I need to donate my car for a tax deduction?

When you donate your car, you will need to receive a receipt from the charity. The receipt should include the name of the charity, the date of the donation, the make and model of the car, and a statement that no goods or services were received in exchange for the donation. If your car is worth more than $500, you will also need to fill out IRS Form 8283 and attach it to your tax return.

If the charity sells your car for more than $500, they will also need to provide you with a copy of IRS Form 1098-C, which will show the sale price of the car. You will need to include this form with your tax return if you plan to claim a deduction for the full sale price of the car.

How much can I claim as a tax deduction for my donated car?

The amount you can claim as a tax deduction will depend on the fair market value of the car at the time of the donation. If the charity sells the car for more than $500, you can claim the full sale price of the car as a deduction. If the car is worth less than $500, you can claim the fair market value of the car.

It’s also important to note that the IRS has specific rules about how much you can claim as a deduction. If you claim a deduction of more than $500, you will need to fill out IRS Form 8283 and have the car appraised by a qualified appraiser.

Can I donate my car to a family member or friend and still get a tax deduction?

No, you cannot donate your car to a family member or friend and still claim a tax deduction. In order to claim a tax deduction for your donation, you must donate your car to a qualified charitable organization. The charity must be recognized by the IRS as a tax-exempt organization.

If you donate your car to a family member or friend, the transaction will be considered a gift and will not be tax-deductible.

What happens to my donated car after I donate it?

After you donate your car, the charity will usually sell it at auction or use it for their own purposes. The proceeds from the sale of the car will go to the charity. If the charity sells the car for more than $500, they will provide you with a copy of IRS Form 1098-C, which will show the sale price of the car.

You will need to include this form with your tax return if you plan to claim a deduction for the full sale price of the car. If the charity uses the car for their own purposes, they will provide you with a receipt showing the fair market value of the car at the time of the donation.

In conclusion, donating your old car for a tax return can be a great way to give back to your community and also receive a tax benefit. By donating to a qualified charity, you can potentially receive a deduction on your taxes and help support a good cause.

However, it’s important to make sure that the charity you choose is qualified and that you understand the requirements for claiming a deduction on your taxes. Additionally, you should also consider the condition of your old car and whether it would be more beneficial to sell it or donate it.

Overall, donating your old car can be a win-win situation for both you and the charity. Not only can you receive a tax benefit, but you can also help support a cause that you care about. So, if you’re looking to get rid of your old car, consider donating it and making a positive impact in your community.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts