Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

As a parent, you always want to provide the best for your children, whether it’s giving them a good education or helping them with their first car. If you live in Nebraska and are wondering if you can gift a car to your son, you’re not alone. Many parents have the same question, and luckily, the answer is yes.

In Nebraska, you can gift a car to your son, daughter, or any other family member without any legal issues. However, there are specific steps you need to follow to ensure a smooth transfer of ownership. In this article, we’ll walk you through the process of gifting a car in Nebraska and answer any questions you may have.

Contents

- Can I Gift a Car to My Son in Nebraska?

- Frequently Asked Questions

- Can I gift a car to my son in Nebraska?

- Do I have to pay taxes on a gifted car in Nebraska?

- What documents do I need to gift a car in Nebraska?

- Can I gift a car to someone who does not live in Nebraska?

- What happens if I do not transfer the title when gifting a car in Nebraska?

- How To Gift A Vehicle To Someone Without Paying Taxes

Can I Gift a Car to My Son in Nebraska?

Are you planning to gift your car to your son in Nebraska? Before you do so, it is important to know the legal requirements and regulations that you need to follow. This article will guide you through the process of gifting a car in Nebraska and help you understand the benefits and drawbacks of doing so.

Legal Requirements for Gifting a Car in Nebraska

When it comes to gifting a car to your son in Nebraska, there are certain legal requirements that you need to fulfill. Firstly, you need to make sure that you have the title of the car in your name. If the car is financed, you need to get the permission of the lender to transfer the title to your son.

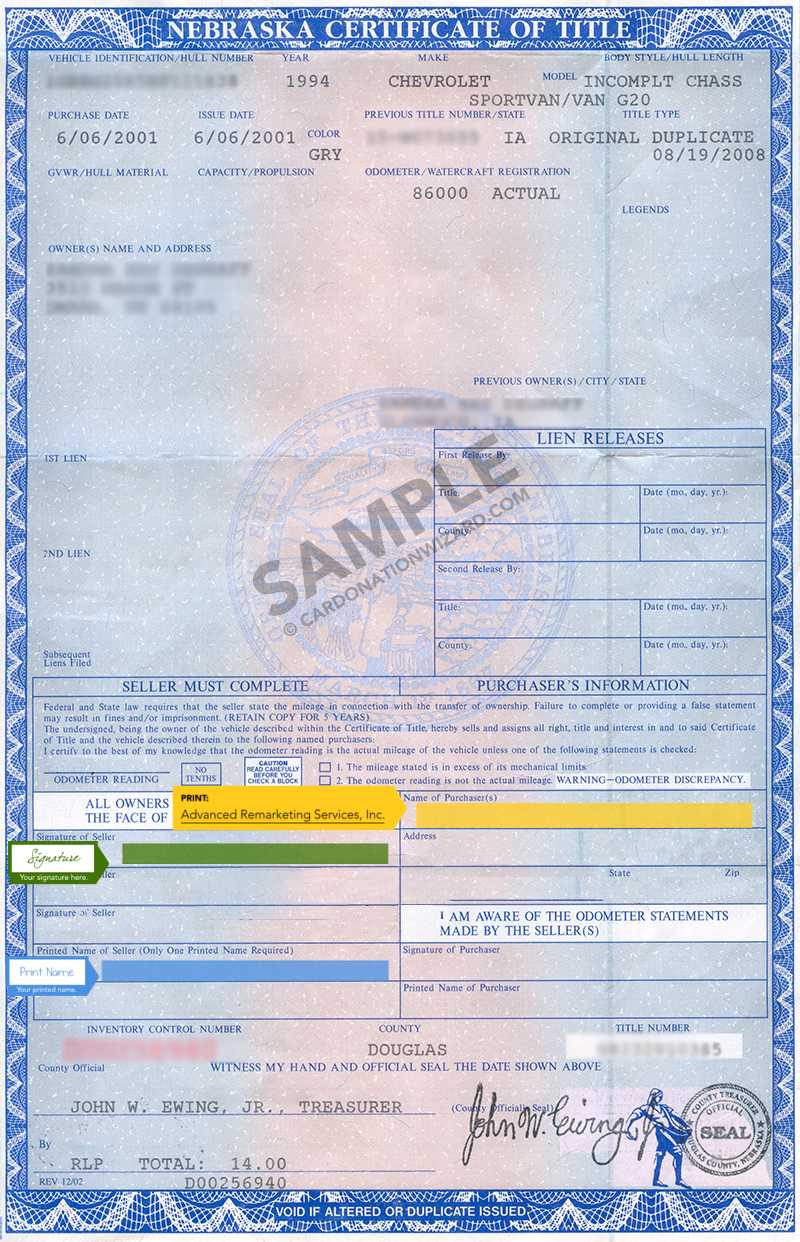

Secondly, you need to fill out the proper paperwork for the title transfer. This includes the Application for Certificate of Title and Registration of a Motor Vehicle form, which can be obtained from the Nebraska Department of Motor Vehicles (DMV). You will also need to pay the necessary fees for the title transfer.

Benefits of Gifting a Car to Your Son

Gifting a car to your son can have several benefits. Firstly, it can help your son establish credit, which can be helpful for future purchases such as a house or a car. Secondly, it can save your son money on transportation costs, especially if he is a student or just starting out in his career.

Moreover, gifting a car to your son can be a great way to show your love and support for him. It can also help strengthen the bond between you and your son and create memories that will last a lifetime.

Drawbacks of Gifting a Car to Your Son

While gifting a car to your son can have several benefits, there are also some drawbacks that you need to consider. Firstly, you will no longer have the car in your possession, which can be a loss of personal property. Secondly, you may be liable for any accidents or damages caused by the car, even if your son is the one driving it.

Additionally, gifting a car to your son can have tax implications, especially if the car is worth a significant amount of money. It is important to consult with a tax professional to understand the tax implications of gifting a car in Nebraska.

Gifting a Car vs Selling a Car to Your Son

When it comes to transferring ownership of a car to your son, you have two options: gifting or selling. While gifting a car may seem like the more sentimental option, selling the car can have its advantages.

When you sell a car to your son, you can set a fair market price and transfer the ownership of the car without any tax implications. This can also help your son understand the value of money and the responsibility of owning a car.

However, if you choose to gift the car, you will not receive any monetary compensation for the car. It is important to weigh the pros and cons of both options before making a decision.

Conclusion

In conclusion, gifting a car to your son in Nebraska can be a great way to show your love and support for him. However, it is important to follow the legal requirements and consider the benefits and drawbacks of gifting a car. Whether you choose to gift or sell the car, make sure to consult with a tax professional and take the necessary steps to transfer ownership legally.

Frequently Asked Questions

Can I gift a car to my son in Nebraska?

Yes, you can gift a car to your son in Nebraska. However, there are some steps you need to follow to ensure that the transfer of ownership is completed correctly. First, you will need to sign the title over to your son and have it notarized. You will also need to complete a bill of sale, which should include the purchase price as $0 since it is a gift.

It is also important to note that your son will need to register the car in his name and pay the necessary fees and taxes. He will need to provide proof of insurance and a valid driver’s license as well.

Do I have to pay taxes on a gifted car in Nebraska?

Yes, you may have to pay taxes on a gifted car in Nebraska. The amount of tax you will owe depends on the value of the car and your relationship to the person who gifted it to you. If the car is worth more than $10,000, you will need to pay a gift tax. However, if you are the parent or grandparent of the person receiving the gift, you may be exempt from paying the tax.

It is important to consult with a tax professional to determine if you are required to pay any taxes on the gifted car.

What documents do I need to gift a car in Nebraska?

To gift a car in Nebraska, you will need to sign the title over to the person receiving the gift and have it notarized. You will also need to complete a bill of sale, which should include the purchase price as $0 since it is a gift. Additionally, you may need to provide a gift letter, which explains that you are giving the car as a gift and that no money is changing hands.

It is important to ensure that all of the necessary documents are completed correctly to avoid any issues with the transfer of ownership.

Can I gift a car to someone who does not live in Nebraska?

Yes, you can gift a car to someone who does not live in Nebraska. However, the process may be slightly different, depending on the state where the recipient of the gift lives. You will need to follow the specific requirements for that state to ensure that the transfer of ownership is completed correctly.

It is also important to note that the recipient of the gift will need to register the car in their state and pay any necessary fees and taxes.

What happens if I do not transfer the title when gifting a car in Nebraska?

If you do not transfer the title when gifting a car in Nebraska, you may still be held liable for any accidents or other incidents involving the car. In addition, the person who received the gift may not be able to register the car in their name, which could lead to legal issues.

It is important to complete the transfer of ownership correctly to ensure that both parties are protected and the transaction is legal.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, gifting a car to a son in Nebraska is possible, but there are certain requirements that must be met. Firstly, the gift must be genuine and not a disguised sale. Secondly, the title of the vehicle must be transferred to the new owner, and the appropriate fees and taxes must be paid. And finally, both parties must sign the necessary documents to complete the transfer of ownership.

While the process may seem daunting, it can be made easier by consulting with a knowledgeable professional, such as an attorney or a licensed dealer. They can guide you through the legal requirements and ensure that the transfer of ownership is done correctly. Additionally, they can help you avoid any potential legal issues that may arise from an improperly executed transfer.

Overall, gifting a car to your son in Nebraska can be a great way to show your love and appreciation. With the right guidance and attention to detail, the process can be smooth and stress-free. So, if you are considering gifting a car to your son, be sure to do your research, consult with the professionals, and enjoy the satisfaction of giving a meaningful gift.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts