Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Do you want to gift a car to your son in Michigan? Are you wondering if it’s legal and what the process entails? Look no further! In this article, we will discuss the regulations and steps involved in gifting a car to your loved one in the state of Michigan.

Whether you’re planning to surprise your son with a car for his graduation or simply want to help him out, gifting a car can be a great way to show your love and support. However, there are certain rules and procedures that you should be aware of to ensure a smooth and legal transaction. Read on to find out more!

Contents

- Can I Gift a Car to My Son in Michigan?

- Frequently Asked Questions

- Can I gift a car to my son in Michigan?

- What documents do I need to gift a car to my son?

- Do I need to pay taxes when gifting a car to my son in Michigan?

- Can I gift a car to my son who lives out of state?

- What should I do if I want to gift a car to my son, but he hasn’t yet obtained his driver’s license?

- How To Gift A Vehicle To Someone Without Paying Taxes

Can I Gift a Car to My Son in Michigan?

Are you a parent living in Michigan who is considering gifting a car to your son? If so, you may be wondering if it’s legal and what the process entails. In this article, we’ll explore the ins and outs of gifting a car in Michigan, including the legal requirements, the steps involved, and some tips to make the process go smoothly.

Legal Requirements for Gifting a Car in Michigan

Before you gift a car to your son in Michigan, it’s important to understand the legal requirements for doing so. First and foremost, the car must be registered in Michigan, and you must have a title that shows you as the owner. Additionally, you’ll need to complete a gift transfer form and provide proof of insurance.

It’s worth noting that if you sell a car to your son for less than its fair market value, the transaction may be considered a gift, and you’ll still need to follow the legal requirements for gifting a car. Failure to do so could result in legal and financial consequences for both you and your son.

The Steps to Gift a Car in Michigan

Now that you understand the legal requirements, let’s take a closer look at the steps involved in gifting a car in Michigan.

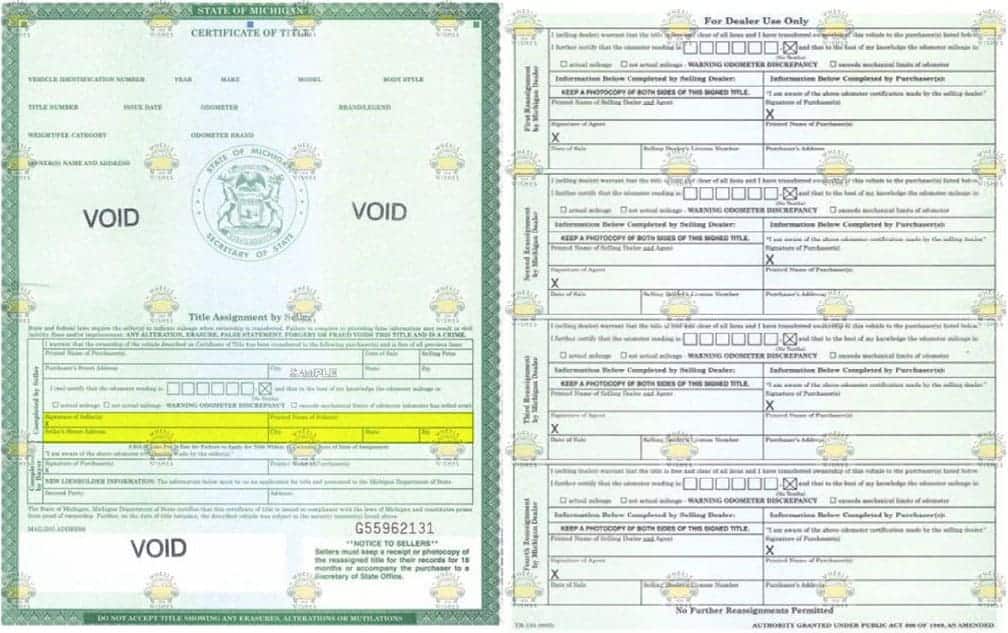

1. Complete the gift transfer form: The first step is to complete the gift transfer form, which is available on the Michigan Secretary of State website. You’ll need to provide the year, make, and model of the car, as well as the VIN number.

2. Provide proof of insurance: You’ll need to show proof of insurance for the car. If your son is already insured, you can add the car to his policy. If not, you’ll need to purchase a separate policy.

3. Pay the necessary fees: You’ll need to pay the necessary fees associated with transferring the title and registering the car in your son’s name. These fees vary depending on the value of the car.

4. Transfer the title: Once you’ve completed the gift transfer form, provided proof of insurance, and paid the necessary fees, you can transfer the title to your son. You’ll need to sign the title over to him and have it notarized.

5. Register the car: Finally, your son will need to register the car in his name with the Michigan Secretary of State. He’ll need to bring the completed gift transfer form, proof of insurance, and proof of identity to a local Secretary of State branch office.

Benefits of Gifting a Car to Your Son

Gifting a car to your son can have several benefits. First and foremost, it can help him get on the road and start building his credit. Additionally, it can be a great way to show your love and support for him as he enters a new phase of his life. Finally, it can be a great way to save money, as you won’t have to pay for the car’s upkeep or insurance.

Gifting a Car vs. Selling a Car to Your Son

While gifting a car to your son can have its benefits, there are also some potential drawbacks to consider. For example, if you gift the car to your son, you won’t receive any money for it, which could be a concern if you’re looking to recoup some of your investment. Additionally, if your son gets into an accident or gets a ticket, you could be held liable since the car is still technically in your name.

On the other hand, if you sell the car to your son, you’ll receive money for it, and you won’t be held liable if your son gets into an accident or gets a ticket. However, you’ll also need to follow the legal requirements for selling a car, which may be more involved than gifting a car.

Conclusion

In conclusion, gifting a car to your son in Michigan can be a great way to show your love and support while helping him get on the road and build his credit. However, it’s important to follow the legal requirements and consider the potential drawbacks before making your decision. With these tips in mind, you’ll be well on your way to gifting a car to your son in Michigan.

Frequently Asked Questions

If you’re considering gifting a car to your son in Michigan, there are a few things you should know. Here are some common questions and answers to help guide you through the process.

Can I gift a car to my son in Michigan?

Yes, you can gift a car to your son in Michigan. However, there are a few things to keep in mind. First, you’ll need to transfer the title of the vehicle to your son’s name. You can do this by visiting a Secretary of State branch office and completing the necessary paperwork. Second, your son will need to register the vehicle and obtain new license plates. Finally, you’ll need to make sure you have the proper insurance coverage for the vehicle.

It’s important to note that if your son is under 18 years old, you’ll need to sign the title transfer forms as the legal guardian. Additionally, if the car is worth more than $14,000, you may need to pay a gift tax. You should consult with a tax professional to determine your specific tax obligations.

What documents do I need to gift a car to my son?

When gifting a car to your son in Michigan, you’ll need to transfer the title of the vehicle to his name. To do this, you’ll need the current title, which should be signed by the seller (you) and the buyer (your son). You’ll also need to complete the Application for Michigan Title and Registration form, which can be obtained from a Secretary of State branch office or downloaded online. Additionally, you’ll need to provide proof of insurance and pay the necessary fees.

If your son is under 18 years old, you’ll need to sign the title transfer forms as the legal guardian. You should also consult with a tax professional to determine if you’ll need to pay a gift tax.

Do I need to pay taxes when gifting a car to my son in Michigan?

If the car you’re gifting to your son is worth more than $14,000, you may need to pay a gift tax. The tax rate varies depending on the value of the car and your relationship to the recipient. You should consult with a tax professional to determine your specific tax obligations.

It’s important to note that even if you don’t have to pay a gift tax, your son will need to pay sales tax when he registers the vehicle in his name. The sales tax rate in Michigan is 6%.

Can I gift a car to my son who lives out of state?

Yes, you can gift a car to your son who lives out of state. However, the process may be a bit more complicated. You’ll need to transfer the title of the vehicle to your son’s name in Michigan, and then he’ll need to register the vehicle in his home state. The specific requirements for registering a vehicle vary by state, so your son should contact the Department of Motor Vehicles in his state for more information.

Additionally, if your son’s state has different rules for transferring titles or registering vehicles, you may need to complete additional paperwork or provide additional documentation. You should consult with a Secretary of State branch office or a tax professional to ensure you’re following all the necessary steps.

What should I do if I want to gift a car to my son, but he hasn’t yet obtained his driver’s license?

If your son hasn’t yet obtained his driver’s license, you can still gift him a car. However, you’ll need to transfer the title of the vehicle to his name and make sure he has insurance coverage. Your son can’t legally drive the car until he obtains his license, but he can still own the vehicle.

Additionally, if your son is under 18 years old, you’ll need to sign the title transfer forms as the legal guardian. You should also consult with a tax professional to determine if you’ll need to pay a gift tax.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, gifting a car to your son in Michigan is possible. However, there are certain steps that need to be taken to ensure that the transfer of ownership is legal and smooth. Firstly, both parties involved in the transaction should visit the Secretary of State office to complete the necessary paperwork. This involves filling out the Title and Registration Application and the Vehicle Bill of Sale.

Secondly, the gift giver should ensure that the car is insured before handing it over to the recipient. This not only protects the recipient but also ensures that the car is in compliance with Michigan’s laws. Additionally, it may be wise to inform the recipient about the costs associated with owning a car, such as maintenance and fuel costs.

Lastly, it is important to keep all the necessary documents, such as the bill of sale and the title, in a safe and easily accessible place. This will come in handy in case of any future legal disputes or issues. Overall, gifting a car to your son in Michigan can be a thoughtful and generous gesture, but it is important to follow the proper procedures to ensure that the transfer of ownership is legal and hassle-free.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts