Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you considering gifting a car to your son in Maine? It’s a great way to help them get around, but it’s important to understand the legal requirements involved in the process. Thankfully, Maine has specific laws regarding car gifting that can make the process simpler and more straightforward. In this article, we’ll explore the ins and outs of gifting a car to your son in Maine, from the legal requirements to the steps involved in making it happen. So, if you’re considering this option, keep reading to learn more!

Contents

- Can I Gift a Car to My Son in Maine?

- Frequently Asked Questions

- Can I Gift a Car to My Son in Maine?

- What Documents Do I Need to Gift a Car to My Son in Maine?

- What is the Process for Transferring Ownership of a Gifted Car in Maine?

- Do I Need to Notify the Maine BMV if I Gift a Car to My Son?

- Can I Gift a Car to My Son Without Paying Taxes in Maine?

- How To Gift A Vehicle To Someone Without Paying Taxes

Can I Gift a Car to My Son in Maine?

If you are a parent thinking of gifting a car to your son in Maine, you might have several questions regarding the process. Transferring the ownership of a car can be a complex process, and it is essential to understand the legal requirements to avoid any inconvenience. In this article, we will discuss the legal aspects of gifting a car to your son in Maine.

Legal Requirements to Gift a Car in Maine

Before gifting a car to your son, you must understand the legal requirements in Maine. The state of Maine has specific laws and regulations that must be followed when transferring the ownership of a car.

Firstly, in Maine, you need to provide a written bill of sale that includes the vehicle identification number (VIN), the date of the sale, and the purchase price. Additionally, the bill of sale should state that the car is a gift and the relationship between the giver and the receiver.

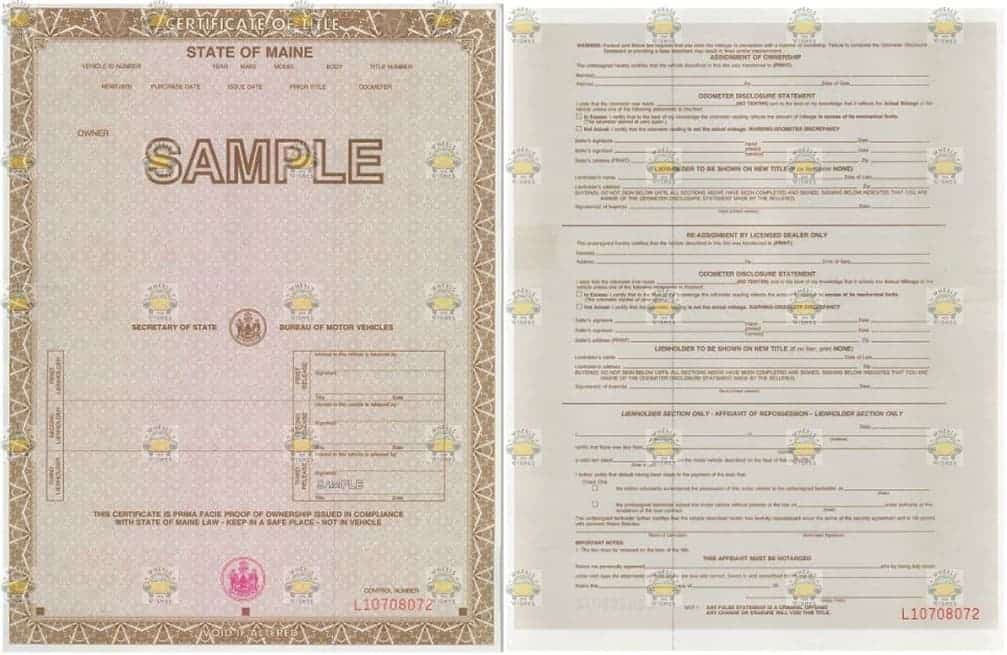

Secondly, you need to transfer the car’s title to your son’s name. To do this, you will need to fill out the back of the original title with the buyer’s name, address, and signature. You will also need to provide the odometer reading and the purchase price.

It is essential to note that if the car is less than 15 years old, you will need to provide a current title with the purchase price listed. However, if the car is over 15 years old, a bill of sale will suffice.

Benefits of Gifting a Car

Gifting a car to your son is an excellent way to show your love and support. It is also a practical gift that can help your son in many ways. Here are some benefits of gifting a car to your son in Maine:

- Convenience: Having a car can make your son’s life more convenient, allowing him to travel to work, school, and other places without relying on public transportation.

- Independence: Owning a car can give your son a sense of independence and responsibility, helping him mature and develop valuable life skills.

- Savings: Gifting a car can help your son save money on transportation costs, such as bus fares, taxi rides, and car rentals.

Gifting a Car vs. Selling a Car

When deciding whether to gift or sell a car, there are several factors to consider. While selling a car might seem like a more practical option, gifting a car can have its advantages.

Here are some differences between gifting a car and selling a car:

| Gifting a Car | Selling a Car |

|---|---|

| Can be a thoughtful and personal gift | Can provide financial benefits |

| Does not require payment or negotiations | Requires pricing negotiations and paperwork |

| Can help avoid taxes and fees | May require taxes and fees to be paid |

Ultimately, whether to gift or sell a car depends on your personal preferences and circumstances. Gifting a car can be a meaningful gesture that can strengthen your bond with your son while providing him with a practical and valuable asset.

Frequently Asked Questions

Can I Gift a Car to My Son in Maine?

Yes, you can gift a car to your son in Maine. However, you need to follow certain procedures to ensure the transfer of ownership is legal and complete. Firstly, you need to sign over the title to your son and provide him with a bill of sale. Additionally, you need to ensure that the vehicle is insured, and that your son has a valid driver’s license and registration before he can legally drive the car.

It’s important to note that if you gift a car to your son in Maine, he will need to pay sales tax on the fair market value of the vehicle. This tax is calculated at a rate of 5.5% of the car’s value and must be paid to the Maine Bureau of Motor Vehicles (BMV) at the time of registration. Your son may also need to pay a title transfer fee and other registration fees, depending on the specifics of the transfer.

What Documents Do I Need to Gift a Car to My Son in Maine?

If you want to gift a car to your son in Maine, you will need to provide him with a signed title and a bill of sale. The title must be signed over to your son and should include his name as the new owner of the vehicle. The bill of sale should include details about the sale, such as the purchase price and date of the transfer.

In addition to these documents, your son will also need to provide proof of insurance, a valid driver’s license, and a completed registration application to the Maine BMV. He will also need to pay any necessary fees, including sales tax on the fair market value of the vehicle and a title transfer fee.

What is the Process for Transferring Ownership of a Gifted Car in Maine?

The process for transferring ownership of a gifted car in Maine involves several steps. Firstly, the person gifting the car must sign over the title to the recipient and provide a bill of sale. The recipient must then provide proof of insurance, a valid driver’s license, and a completed registration application to the Maine BMV.

Once these documents have been provided and any necessary fees have been paid, the Maine BMV will issue a new title and registration to the recipient. It’s important to note that the recipient will also need to pay sales tax on the fair market value of the vehicle at the time of registration.

Do I Need to Notify the Maine BMV if I Gift a Car to My Son?

Yes, if you gift a car to your son in Maine, you will need to notify the Maine BMV of the transfer of ownership. This can be done by completing a Notice of Sale or Transfer of a Vehicle form and submitting it to the BMV within 10 days of the transfer.

The Notice of Sale or Transfer of a Vehicle form should include details about the sale, such as the names and addresses of the buyer and seller, the vehicle identification number (VIN), and the date of the transfer. Once the BMV receives this form, they will update their records to reflect the new owner of the vehicle.

Can I Gift a Car to My Son Without Paying Taxes in Maine?

No, if you gift a car to your son in Maine, he will need to pay sales tax on the fair market value of the vehicle. This tax is calculated at a rate of 5.5% and must be paid to the Maine BMV at the time of registration.

It’s important to note that there are certain situations where sales tax may not apply, such as if the vehicle is gifted to a nonprofit organization or if the transfer is made between spouses. However, if you are gifting a car to your son, he will be required to pay sales tax on the fair market value of the vehicle.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, gifting a car to your son in Maine is possible, but it requires certain steps to be followed. First, you will need to transfer the ownership of the vehicle to your son’s name by completing the necessary paperwork. This will require the payment of taxes and fees, which can vary depending on the value of the car.

Secondly, you will need to obtain a new title certificate in your son’s name, which can be done at the local Bureau of Motor Vehicles. This will ensure that your son is the legal owner of the vehicle and can register it in his name.

Lastly, it is important to note that gifting a car to your son may have implications for his insurance coverage. It is recommended to contact your insurance provider to discuss how this may affect your son’s coverage.

Overall, gifting a car to your son in Maine can be a thoughtful and generous gesture. By following the necessary steps and consulting with the appropriate authorities, you can ensure a smooth and legal transfer of ownership.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts