Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you thinking of gifting a car to your son in Connecticut? If so, you’re probably wondering if it’s possible and what the legal requirements are. The good news is that you can gift a car to your son in Connecticut, but there are a few important things you need to know before you do so.

Firstly, you’ll need to transfer the title of the car to your son’s name. This involves filling out the necessary paperwork and paying a transfer fee. Additionally, you’ll need to make sure that the car meets Connecticut’s emission standards and passes a safety inspection before it can be registered in your son’s name. In this article, we’ll go over the details of gifting a car to your son in Connecticut and what you need to do to ensure a smooth transaction.

Contents

- Can I Gift a Car to My Son in Connecticut?

- Frequently Asked Questions

- Can I gift a car to my son in Connecticut?

- Do I have to pay taxes on a gifted car in Connecticut?

- Can I gift a car to my son if it has a lien on it?

- Can my son drive the car after I gift it to him but before he registers it?

- What happens if my son gets into an accident with the gifted car?

- How To Gift A Vehicle To Someone Without Paying Taxes

Can I Gift a Car to My Son in Connecticut?

If you are considering gifting a car to your son in Connecticut, there are some things you need to know before doing so. While gifting a car may seem like a simple process, there are legal requirements that must be met in order for the transfer of ownership to be valid. In this article, we will explain the steps you need to take in order to gift a car to your son in Connecticut.

Step 1: Obtain the Necessary Documentation

Before you can gift a car to your son, you will need to obtain the necessary documentation. This includes the vehicle’s title and a bill of sale. The title is the legal document that proves ownership of the vehicle, while the bill of sale is a written agreement between the buyer and seller that outlines the terms of the sale.

When filling out the title, you will need to transfer the ownership of the vehicle to your son. This can be done by filling out the “transfer of ownership” section on the back of the title. You will need to include your son’s name, address, and signature, as well as the date of the transfer.

Step 2: Complete a Bill of Sale

Once you have obtained the title, you will need to complete a bill of sale. This document should include the purchase price of the vehicle, as well as any other terms of the sale. Both you and your son should sign the bill of sale, and each of you should keep a copy for your records.

Step 3: Register the Vehicle

After the transfer of ownership has been completed and the bill of sale has been signed, you will need to register the vehicle with the Connecticut Department of Motor Vehicles (DMV). This can be done in person or online, and you will need to provide the following:

– The vehicle’s title

– The bill of sale

– Proof of insurance

– Payment for the registration fee

Once the vehicle is registered, your son will be able to obtain license plates and legally drive the car.

Benefits of Gifting a Car to Your Son

There are several benefits to gifting a car to your son in Connecticut. First and foremost, it can be a great way to help your son get started on the road to independence. Owning a car can provide your son with the freedom and mobility he needs to get to work, school, or other important appointments.

In addition, gifting a car can be a great way to save money on taxes. When you gift a car to a family member, you are exempt from paying sales tax on the transaction. This can result in significant savings, especially if the car is worth a substantial amount of money.

Gift vs. Sale

While gifting a car to your son may seem like the best option, there are some situations in which selling the car may be a better choice. For example, if your son is able to finance the car on his own, he may be able to get a better interest rate than you would be able to offer him. In addition, selling the car to your son can provide you with some extra cash that you can use for other expenses.

Ultimately, the decision to gift or sell a car to your son will depend on your individual circumstances. Consider both options carefully before making a final decision.

Conclusion

Gifting a car to your son in Connecticut can be a great way to help him get started on the road to independence. However, it is important to follow the necessary legal steps in order to ensure that the transfer of ownership is valid. By obtaining the necessary documentation, completing a bill of sale, and registering the vehicle with the DMV, you can gift a car to your son with peace of mind.

Frequently Asked Questions

Here are some frequently asked questions regarding gifting a car to your son in Connecticut:

Can I gift a car to my son in Connecticut?

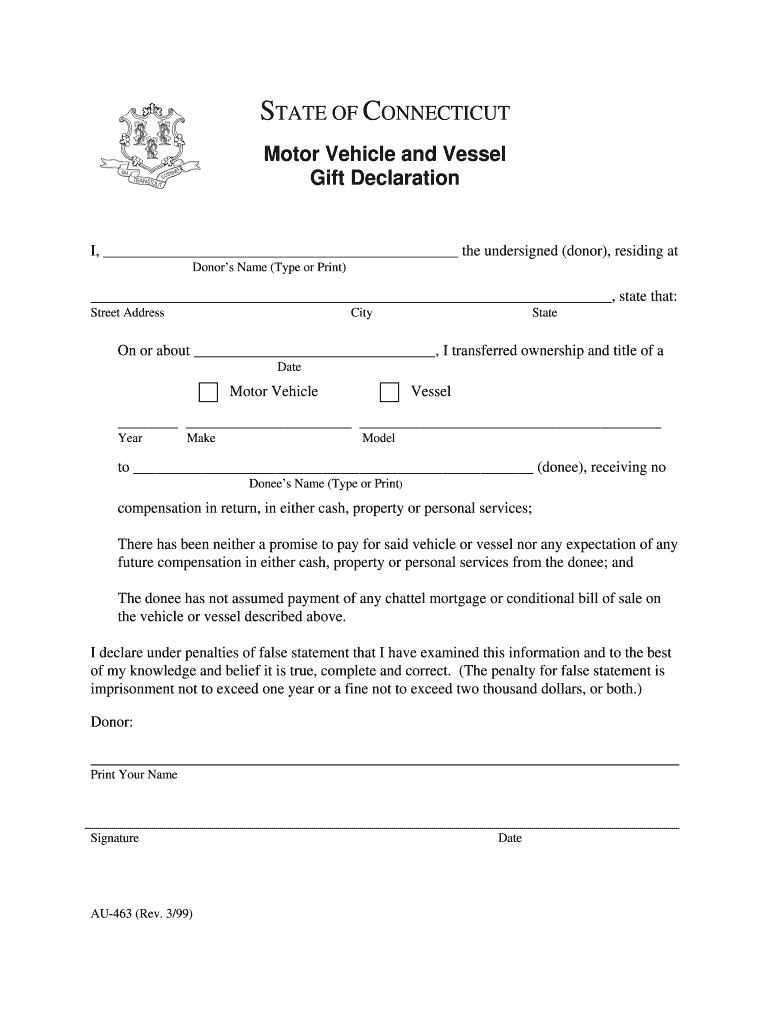

Yes, you can gift a car to your son in Connecticut. However, you need to follow the proper legal procedure to transfer the ownership of the car to your son. To do this, you need to sign the title of the car over to your son and provide him with a bill of sale that lists the purchase price as $0. You will also need to complete a Gift Affidavit form, which will need to be notarized.

Once you have completed these steps, your son will need to register the car in his name with the Connecticut Department of Motor Vehicles (DMV) and pay the necessary fees. Your son will also need to provide proof of insurance to register the car.

Do I have to pay taxes on a gifted car in Connecticut?

Yes, you may have to pay taxes on a gifted car in Connecticut. If the fair market value of the car is more than $2,000, you will need to pay a gift tax based on the value of the car. The tax rate varies depending on the value of the car and can be up to 12% of the fair market value of the car. You will need to complete a Connecticut Gift Tax Return and submit it to the Connecticut Department of Revenue Services along with payment for the gift tax.

It is important to note that if you are gifting a car to a family member, such as your son, you may be able to claim an exemption from the gift tax. You should consult with a tax professional to determine if you qualify for an exemption.

Can I gift a car to my son if it has a lien on it?

Yes, you can gift a car to your son even if it has a lien on it. However, you will need to satisfy the lien before you can transfer ownership of the car to your son. You can do this by paying off the lien or refinancing the car in your son’s name.

If you choose to refinance the car in your son’s name, you will need to work with the lienholder to transfer the loan to your son. Your son will be responsible for making the loan payments and maintaining the required insurance coverage on the car.

Can my son drive the car after I gift it to him but before he registers it?

No, your son cannot legally drive the car after you gift it to him but before he registers it. In Connecticut, it is illegal to drive a car that is not registered and insured. If your son is caught driving the car without registration and insurance, he could face fines and other consequences.

To avoid these issues, it is important to complete the transfer of ownership and registration of the car as soon as possible after you gift it to your son.

What happens if my son gets into an accident with the gifted car?

If your son gets into an accident with the gifted car, he will be responsible for any damages or injuries that result from the accident. This includes any damage to other people’s property or vehicles, as well as any injuries to other people.

It is important to make sure that your son has adequate insurance coverage before he starts driving the gifted car. This will help to protect him and you from any financial liability in the event of an accident.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, gifting a car to your son in Connecticut is possible and can be a wonderful gesture. However, it is important to keep in mind the legal requirements and process involved. By following the necessary steps, such as transferring the title and registering the vehicle, you can avoid any potential legal issues down the line.

Additionally, it is important to consider the financial implications of gifting a car. Your son will be responsible for paying taxes and insurance on the vehicle, so make sure he is prepared for these expenses before gifting the car.

Overall, gifting a car to your son can be a meaningful and generous act, but it is important to approach the process carefully and thoughtfully. By doing so, you can ensure a smooth and enjoyable experience for both you and your son.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts