Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Giving a vehicle as a gift can be a wonderful gesture, but it can also be complicated when it comes to transferring the title. If you are considering giving a vehicle as a gift in Ohio, you may be wondering if it’s possible to transfer the title without any hassles or legal issues. Fortunately, Ohio law does allow for vehicle gifting, but there are specific requirements that you must follow to ensure a smooth transfer of ownership. In this article, we’ll explore the regulations and processes involved in gifting a vehicle in Ohio, so you can give the gift of a car with confidence.

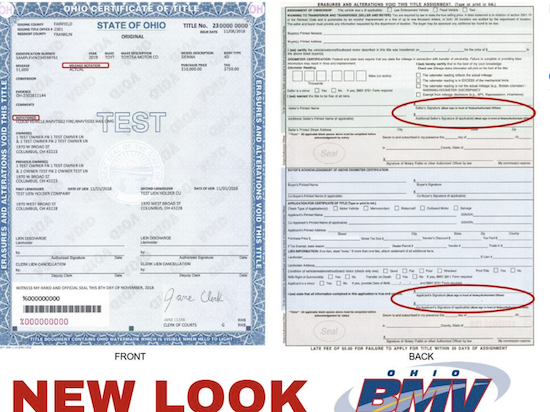

Yes, a vehicle can be given as a gift in Ohio for title purposes. However, the process to transfer ownership of the vehicle to the recipient is slightly different than a typical sale. The donor must complete the title transfer section on the back of the title, and the recipient must complete a Statement of Facts form. Additionally, the recipient must pay the necessary title and registration fees.

Can a Vehicle Be a Gift in Ohio for Title?

If you are planning to give a vehicle as a gift in Ohio, you may be wondering how the transfer of ownership works. The good news is that a vehicle can be gifted in Ohio, but there are certain steps you need to follow to ensure a smooth and legal transfer of ownership. In this article, we will go through the process of gifting a vehicle in Ohio, including the necessary paperwork and requirements.

Step 1: Sign Over the Title

The first step in gifting a vehicle in Ohio is to sign over the title to the recipient. The title should have the seller’s signature, the buyer’s signature, and the date of sale. If the vehicle has more than one owner, all owners must sign the title. Additionally, the title must be notarized or signed in front of a clerk of courts.

Once the title is signed over, the recipient can take it to the Bureau of Motor Vehicles (BMV) to transfer ownership. They will need to bring the signed title, a completed Application for Certificate of Title, and proof of insurance to the BMV.

Step 2: Pay the Transfer Fee

In Ohio, there is a fee for transferring the title of a vehicle. The fee varies depending on the county in which the transfer takes place, but it is typically around $15. The recipient of the gifted vehicle will need to pay this fee when they transfer the title at the BMV.

Step 3: Obtain a Bill of Sale

While a bill of sale is not required in Ohio for the transfer of a vehicle title, it is recommended. A bill of sale serves as proof of the sale and can be helpful in case there are any disputes or issues in the future. The bill of sale should include the vehicle’s make, model, year, VIN, purchase price, and the signatures of both the seller and the buyer.

Step 4: Notify the Insurance Company

If the recipient of the gifted vehicle plans to drive it, they will need to notify their insurance company of the transfer of ownership. The insurance company will need to update the policy to reflect the new owner and may require additional information from the recipient.

Step 5: Consider the Tax Implications

In Ohio, there is no sales tax on the transfer of a vehicle between family members. However, if the recipient is not a family member, they may be subject to the state’s sales tax. It is important to consider the tax implications of gifting a vehicle and to consult with a tax professional if necessary.

Benefits of Gifting a Vehicle

Gifting a vehicle can be a great way to help out a family member or friend who is in need of transportation. It can also be a way to simplify the process of selling a vehicle, as there is no need to find a buyer and negotiate a price.

Additionally, gifting a vehicle can have tax benefits. By gifting a vehicle to a family member, the donor can avoid paying the state’s sales tax on the transfer.

Gifted Vehicle vs. Sold Vehicle

While gifting a vehicle can be a simple and straightforward process, selling a vehicle can be more complex. When selling a vehicle, the seller must find a buyer, negotiate a price, and transfer ownership through the BMV. Additionally, the seller may be responsible for any repairs or maintenance needed on the vehicle before the sale.

With a gifted vehicle, the recipient takes on these responsibilities and the transfer of ownership is typically quicker and easier. However, it is important to consider the tax implications of gifting a vehicle, as there may be sales tax owed if the recipient is not a family member.

Conclusion

Gifting a vehicle in Ohio is a legal and straightforward process, but it does require following certain steps and completing the necessary paperwork. By signing over the title, paying the transfer fee, obtaining a bill of sale, notifying the insurance company, and considering the tax implications, you can ensure a smooth transfer of ownership. Whether you are helping out a family member or simplifying the process of selling a vehicle, gifting a vehicle can be a great option.

Contents

- Frequently Asked Questions

- 1. Can a vehicle be gifted in Ohio for title?

- 2. Do I need to pay tax on a gifted vehicle in Ohio?

- 3. Can I gift a vehicle to someone who is not a member of my family?

- 4. Do I need to notify the DMV if I gift a vehicle in Ohio?

- 5. What if I lost the title of the vehicle I want to gift in Ohio?

- Is it better to gift or sell a car to a family member

Frequently Asked Questions

1. Can a vehicle be gifted in Ohio for title?

Yes, a vehicle can be gifted in Ohio for title. In fact, gifting a vehicle is a common practice in the state. However, there are certain requirements that need to be fulfilled in order to transfer the title of the vehicle.

The person gifting the vehicle needs to fill out the appropriate sections of the title certificate before gifting it. The recipient of the vehicle also needs to fill out their sections of the title certificate. Additionally, both parties need to sign the title certificate in the presence of a notary public.

2. Do I need to pay tax on a gifted vehicle in Ohio?

Yes, you may need to pay tax on a gifted vehicle in Ohio. The amount of tax you need to pay depends on the fair market value of the vehicle at the time of the transfer. If the fair market value of the vehicle is less than $4,000, you may not need to pay any tax.

However, if the fair market value of the vehicle is more than $4,000, you will need to pay tax on the difference between the fair market value and $4,000. The tax rate in Ohio varies depending on the county you live in.

3. Can I gift a vehicle to someone who is not a member of my family?

Yes, you can gift a vehicle to someone who is not a member of your family in Ohio. However, the process of transferring the title of the vehicle may be different if the recipient is not a family member.

If you are gifting the vehicle to someone who is not a member of your family, you will need to fill out a different section of the title certificate. Additionally, the recipient of the vehicle will need to provide proof of insurance and pay any applicable taxes and fees.

4. Do I need to notify the DMV if I gift a vehicle in Ohio?

Yes, you need to notify the DMV if you gift a vehicle in Ohio. The notification needs to be made within 30 days of the transfer of the vehicle. You can notify the DMV by filling out the appropriate section of the title certificate and submitting it to the DMV.

Additionally, you may need to provide proof of insurance and pay any applicable taxes and fees. Failure to notify the DMV of the transfer of the vehicle may result in penalties and fines.

5. What if I lost the title of the vehicle I want to gift in Ohio?

If you lost the title of the vehicle you want to gift in Ohio, you will need to obtain a duplicate title from the DMV. You can do this by filling out the appropriate forms and submitting them to the DMV with the required fee.

Once you have obtained the duplicate title, you can fill out the appropriate sections and gift the vehicle to the recipient. It is important to note that the process of obtaining a duplicate title may take several weeks, so it is best to start the process as soon as possible.

Is it better to gift or sell a car to a family member

In conclusion, gifting a vehicle in Ohio is possible, but it requires some specific steps to ensure that the transfer of ownership is legal and binding. The donor must sign the title to release their ownership, and the recipient must apply for a new title at the local Bureau of Motor Vehicles. Additionally, a gift tax may apply depending on the value of the vehicle, so it’s important to consult with a tax professional to avoid any surprises.

If you’re considering gifting a vehicle to a friend or family member, it’s essential to prioritize the proper documentation to avoid any legal complications down the road. By following the necessary steps, you can ensure that the transfer of ownership is legitimate and that both parties are protected.

Overall, gifting a vehicle can be a generous and thoughtful gesture, but it’s crucial to understand the specific requirements and regulations in Ohio to ensure that the transfer of ownership is successful. With the right preparation and documentation, you can give the gift of a new car with confidence and peace of mind.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts