Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you wondering if a power of attorney (POA) can gift a car title? Well, the answer is, it depends on the specific circumstances and the state laws where you reside. In this article, we will explore the requirements and limitations of gifting a car title through a power of attorney.

Giving a car as a gift is a generous gesture, but it can be a complicated process. If you are considering gifting a vehicle through a POA, it is important to understand the legal implications and potential risks involved. So, let’s dive into the details and learn more about the rules and regulations governing car title gifting through a power of attorney.

Yes, a Power of Attorney (POA) can gift a car title. However, the POA needs to have specific language granting them the authority to gift assets. The POA needs to sign the title as the seller and the recipient needs to sign as the buyer. It’s important to consult with a lawyer to ensure that the POA is properly executed and that all legal requirements are met.

Can a Poa Gift a Car Title?

When it comes to gifting a car title, there are certain legal procedures that need to be followed to ensure that the transfer of ownership is done properly. One common question that arises in this context is whether a Power of Attorney (POA) can gift a car title. In this article, we will explore the answer to this question and provide you with all the information you need to know about gifting a car title through a POA.

What is a Power of Attorney?

A Power of Attorney (POA) is a legal document that allows an individual or organization to act on behalf of another person or entity. The person who gives the POA is known as the principal, and the person who receives it is known as the agent or attorney-in-fact. The POA can be granted for various reasons, including medical decisions, financial matters, and legal transactions.

Can a POA gift a car title?

The answer to this question is yes, a POA can gift a car title, but only if the POA has been granted the authority to do so. The POA must have specific language in the document that grants them the power to gift the car title. If the POA does not have this authority, they cannot legally gift the car title.

If the POA has been granted the authority to gift the car title, they must follow the legal procedures to ensure that the transfer of ownership is done correctly. This includes completing the necessary paperwork and following the guidelines set forth by the Department of Motor Vehicles (DMV) in their state.

Benefits of gifting a car title through a POA

Gifting a car title through a POA can have several benefits, including:

1. Convenience: If the person who wants to gift the car title is unable to do so in person, they can grant the POA to someone else to complete the transaction on their behalf.

2. Flexibility: The POA can gift the car title at any time, which can be helpful if the person who wants to gift the car title is unable to do so immediately.

3. Legal protection: By using a POA, the transfer of ownership is done legally and protects both parties involved in the transaction.

POA vs. Joint Ownership

Another option for gifting a car title is through joint ownership. Joint ownership means that both parties have equal ownership of the car and can sell or gift the car title without the need for a POA.

While joint ownership can be a simpler option, it does have some drawbacks. If one party wants to sell or gift the car title, they must have the consent of the other party. Additionally, if one party passes away, their share of the car may pass to their estate, which can create complications.

Using a POA to gift a car title can be a more flexible option, as it allows the person who wants to gift the car title to choose who will act on their behalf. Additionally, the POA can be revoked at any time if the person who granted it changes their mind.

Conclusion

In summary, a POA can gift a car title, but only if they have been granted the authority to do so. Gifting a car title through a POA can be a convenient and flexible option, but it is important to follow the legal procedures to ensure that the transfer of ownership is done correctly. If you are considering gifting a car title through a POA, be sure to consult with a legal professional to ensure that you are following all the necessary steps.

Frequently Asked Questions

Can a Poa Gift a Car Title?

Yes, a Power of Attorney (POA) holder can gift a car title. However, the process can be complicated, and it requires specific forms and documentation to be completed correctly. The POA holder must have the authority to act on behalf of the owner of the vehicle, and the gift must be made voluntarily.

To gift a car title, the POA holder must fill out a gift form and provide it to the Department of Motor Vehicles (DMV). The DMV will then process the transfer of ownership and issue a new title in the recipient’s name. It is essential to follow all the necessary steps and procedures to avoid any legal issues or complications.

Can a POA transfer a car title to themselves?

No, a POA holder cannot transfer a car title to themselves. The POA holder must act in the best interest of the owner of the vehicle and cannot use their authority for personal gain. The transfer of ownership must be made to a third party, and the POA holder must follow all the necessary steps and procedures to complete the transfer.

If the POA holder attempts to transfer the car title to themselves, it can be considered a breach of their fiduciary duty. This can result in legal action being taken against them and potential criminal charges.

What documentation is required to gift a car title using a POA?

To gift a car title using a POA, the following documentation is generally required:

– A valid POA document that specifically authorizes the transfer of ownership of the vehicle

– A completed gift form that is signed by both the donor and recipient of the vehicle

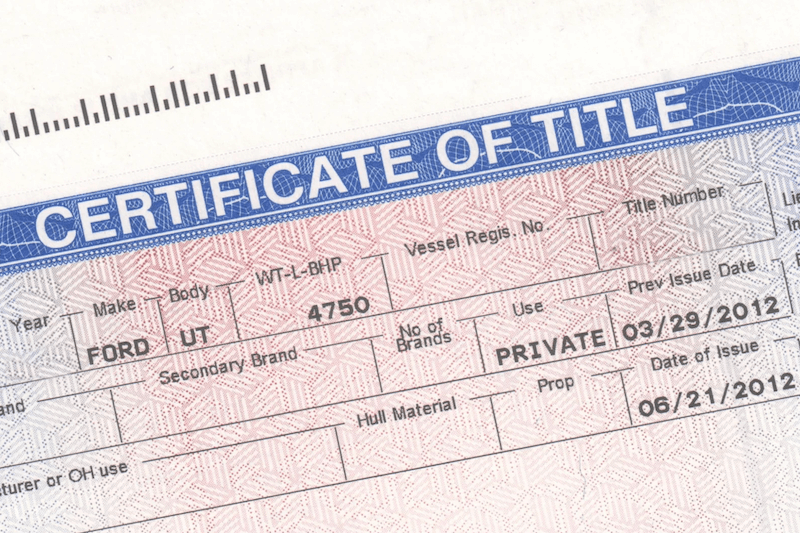

– The original car title, signed by the donor, and properly assigned to the recipient

– Any applicable fees required by the DMV

It is essential to follow all the necessary steps and procedures to ensure that the transfer of ownership is completed correctly.

Can a POA gift a car title to a minor?

Yes, a POA holder can gift a car title to a minor. However, the process can be complicated, and specific rules and regulations must be followed. In most states, a minor cannot legally own a vehicle in their name. Therefore, the POA holder must transfer ownership to a parent or legal guardian of the minor.

To gift a car title to a minor, the POA holder must follow all the necessary procedures and provide the required documentation. The parent or legal guardian must also be present during the transfer of ownership and sign all necessary forms.

Can a POA gift a car title to a non-family member?

Yes, a POA holder can gift a car title to a non-family member. However, the process can be complicated, and specific rules and regulations must be followed. The POA holder must have the authority to act on behalf of the owner of the vehicle, and the gift must be made voluntarily.

To gift a car title to a non-family member, the POA holder must follow all the necessary procedures and provide the required documentation. The recipient must also be present during the transfer of ownership and sign all necessary forms. It is also essential to ensure that the recipient is eligible to own a vehicle and has a valid driver’s license.

Is it better to gift or sell a car to a family member

In conclusion, the answer to whether a POA can gift a car title is yes, but it depends on the specific circumstances. If the POA has been granted the authority to manage the principal’s finances and assets, they may have the ability to gift the car title to another individual. However, it is important to ensure that the POA document specifically grants this power.

It is also crucial to consider any potential legal and tax implications of gifting a car title. It is recommended to consult with a legal professional to ensure that all necessary steps are being taken and that the gift is being made in a legally sound manner.

Ultimately, while gifting a car title through a POA can be a viable option, it is important to proceed with caution and seek professional guidance to ensure that all legal requirements are being met.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts