Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you considering making a donation to the Salvation Army? If so, you may be wondering whether your donation is tax-deductible. The answer is yes! The Salvation Army is a registered 501(c)(3) nonprofit organization, which means that donations made to them are tax-deductible. In this article, we’ll explore the tax benefits of donating to the Salvation Army and what you need to know to claim your deduction.

Yes, donations made to the Salvation Army are tax deductible. The organization is recognized by the IRS as a 501(c)(3) non-profit, which means that donations made to them are tax-exempt. However, it’s important to note that only donations made to the Salvation Army’s charitable arm are tax deductible, not those made to their thrift stores or other for-profit ventures.

Are Donations to Salvation Army Tax Deductible?

The Salvation Army is a charitable organization that provides various types of assistance to those in need, including food, clothing, and shelter. If you have made a donation to the Salvation Army, you may be wondering if it is tax-deductible. The answer is yes, but there are some guidelines you need to be aware of. Let’s take a closer look at how donations to the Salvation Army can be tax-deductible.

What Types of Donations are Tax-Deductible?

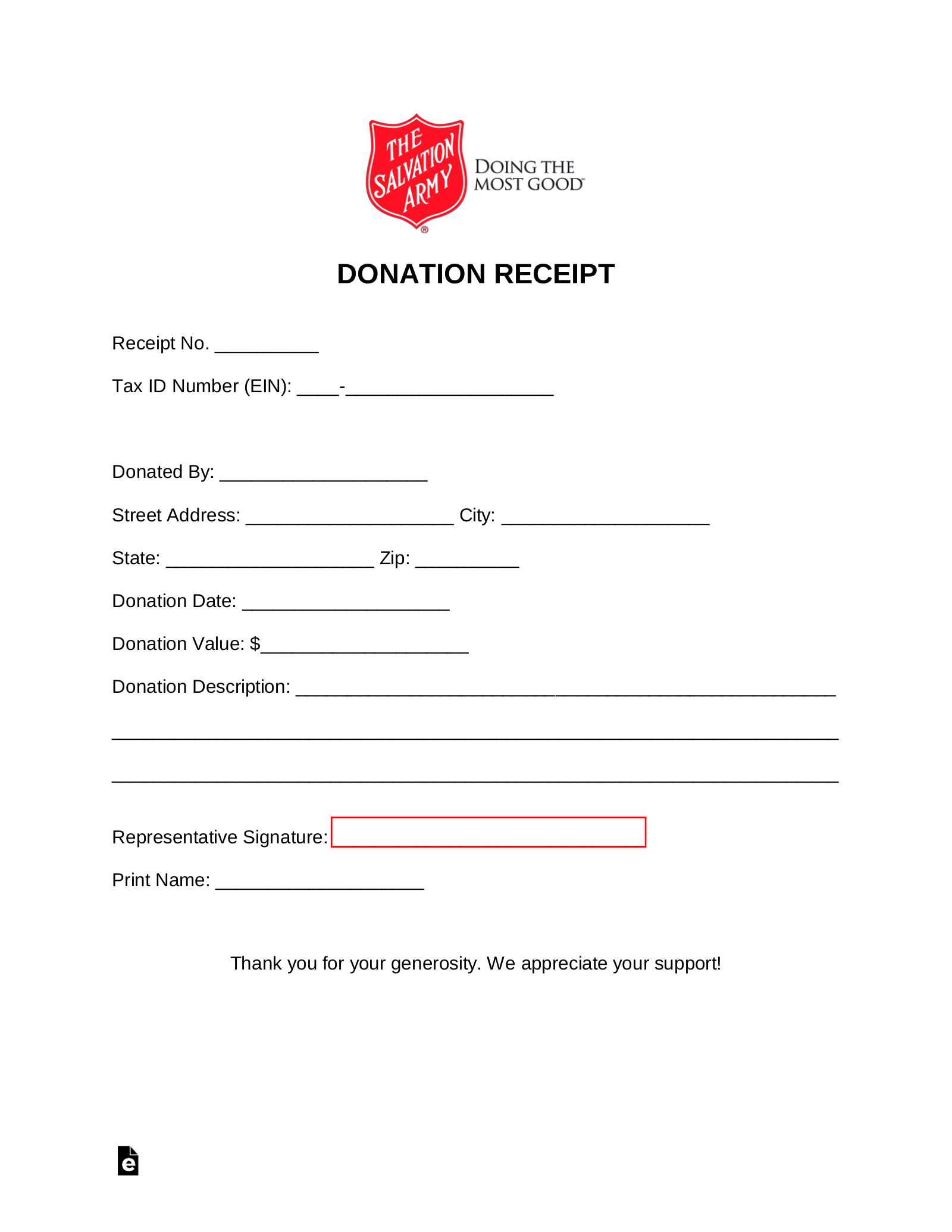

The Salvation Army is a registered 501(c)(3) organization, which means that donations made to the organization can be tax-deductible. This includes cash donations, as well as donations of goods and property. Some examples of items that can be donated include clothing, furniture, and vehicles. In order to claim a tax deduction for your donation, you will need to have proof of the donation, such as a receipt or a written acknowledgment from the Salvation Army.

It’s important to note that not all donations are tax-deductible. For example, if you receive something in return for your donation, such as a gift or a service, then the value of that item cannot be considered a tax-deductible donation. Additionally, if you donate to a specific individual rather than to the organization as a whole, your donation may not be tax-deductible.

How Much Can You Deduct?

The amount you can deduct for your donation to the Salvation Army will depend on the value of the donation and your income level. In general, you can deduct up to 60% of your adjusted gross income for charitable donations. However, if you donate more than this amount, you may be able to carry over the excess amount to future tax years.

It’s also important to note that there are certain limits on deductions for donations of goods and property. If you donate an item that is valued at more than $5,000, you will need to have the item appraised in order to claim a tax deduction for the full value of the item. Additionally, if you donate non-cash items that are not in good condition, you may not be able to claim a tax deduction for the full value of the item.

Benefits of Donating to the Salvation Army

In addition to the tax benefits of donating to the Salvation Army, there are many other benefits to consider. When you donate to the Salvation Army, you are helping to provide assistance to those in need, including the homeless, the hungry, and those facing financial hardship. Your donation can help provide food, clothing, and shelter to those who need it most.

Additionally, donating to the Salvation Army can be a great way to get rid of unwanted items in your home. Instead of throwing away items that are still in good condition, you can donate them to the Salvation Army and help someone else in the process. This can help reduce waste and promote sustainability.

Donating to the Salvation Army vs. Other Charitable Organizations

While there are many charitable organizations to choose from, the Salvation Army has a long-standing reputation for providing assistance to those in need. The organization has been around for more than 150 years and has a presence in more than 130 countries around the world. When you donate to the Salvation Army, you can be confident that your donation is going to a reputable organization that is making a positive impact on the world.

Additionally, the Salvation Army provides a wide range of services beyond just providing food and shelter. The organization also offers counseling services, job training programs, and assistance with addiction recovery. This means that your donation can have a lasting impact on someone’s life, helping them to get back on their feet and become self-sufficient.

Conclusion

Donating to the Salvation Army can be a great way to help those in need while also receiving a tax deduction. However, it’s important to be aware of the guidelines for tax-deductible donations and to keep proper documentation of your donation. By donating to the Salvation Army, you can make a positive impact on the world and help those who need it most.

Frequently Asked Questions

Donating to charity is a way of giving back to society while also enjoying tax benefits. Salvation Army is a renowned charity organization that has been in existence for over a century. One of the questions people often ask is whether donations to Salvation Army are tax-deductible. Here are some frequently asked questions and answers on the topic:

Are donations to Salvation Army tax-deductible?

Yes, donations made to Salvation Army are tax-deductible. The organization is recognized by the IRS as a non-profit organization, and it is exempt from federal income tax. As such, donations made to Salvation Army are tax-deductible as charitable contributions. However, it is important to ensure that you keep proper records of your donations, including any receipts or acknowledgement letters from the organization.

It is also important to note that not all donations to Salvation Army are tax-deductible. For instance, if you receive something in return for your donation, such as a meal, a t-shirt, or any other form of gift, you cannot claim that donation as a tax deduction. Additionally, if you donate to a specific individual, rather than the organization itself, you cannot claim a tax deduction for that donation.

What types of donations are tax-deductible?

Most types of donations made to Salvation Army are tax-deductible. This includes cash donations, donations of clothing and household items, and donations of vehicles. However, it is important to keep accurate records of your donations, including the date, description, and value of the items donated. For non-cash donations, such as clothing or household items, you may need to obtain a receipt from the organization or prepare a written acknowledgement of your donation.

It is also important to note that there are limits to the amount of tax deduction you can claim for charitable contributions. Generally, you can only claim up to 50% of your adjusted gross income in charitable contributions, although there are exceptions for certain types of donations or in special circumstances.

How do I claim a tax deduction for my donation to Salvation Army?

To claim a tax deduction for your donation to Salvation Army, you will need to itemize your deductions on your tax return. This means that you will need to file a Form 1040 and include Schedule A to report your charitable contributions. You will need to provide documentation of your donations, such as receipts, acknowledgement letters, or cancelled checks. If you are unsure about how to claim a tax deduction for your donation, you may wish to consult with a tax professional.

It is also important to note that tax laws change frequently, and the rules for claiming charitable deductions may vary depending on your individual circumstances. As such, it is always a good idea to stay up-to-date on the latest tax laws and regulations to ensure that you are taking full advantage of any tax benefits available to you.

Can I donate to Salvation Army anonymously?

Yes, you can donate to Salvation Army anonymously. The organization respects the privacy of its donors and will not disclose your personal information to anyone without your permission. If you prefer to donate anonymously, you can do so by sending your donation through the mail or dropping it off at a Salvation Army location without providing your name or contact information.

However, if you want to claim a tax deduction for your donation, you will need to provide some documentation of your donation, such as a receipt or acknowledgement letter. In this case, you may need to provide some personal information to the organization, but you can request that they keep your donation anonymous in any public acknowledgements or recognition.

What other benefits can I get from donating to Salvation Army?

Aside from the tax benefits of donating to Salvation Army, there are many other benefits to giving to this organization. For instance, your donation can help support programs and services that provide food, shelter, and other basic needs to people in need. You can also feel good knowing that your donation is making a positive impact in your community and helping to improve the lives of others.

Additionally, donating to Salvation Army can be a great way to declutter your home and get rid of unwanted items. By donating clothing, furniture, and other household items, you can free up space in your home while also doing something good for others. And if you donate a vehicle, you may be able to avoid the hassle of selling it yourself while also getting a tax deduction for your donation.

In conclusion, donations to Salvation Army are tax-deductible in most cases. This means that you can claim a deduction on your tax return for the amount you donated to the organization. However, there are some restrictions to keep in mind.

It’s important to note that only donations made to the Salvation Army’s charitable arm are tax-deductible. Donations made to its thrift stores, for example, are not tax-deductible. Additionally, you must have proof of your donation, such as a receipt or bank statement, in order to claim the deduction on your taxes.

Overall, donating to the Salvation Army can not only help those in need but also provide tax benefits for you. Just be sure to follow the guidelines and keep accurate records to ensure that you receive the deduction you deserve.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts