If you’re considering making a donation to Habitat for Humanity, you may be wondering if your contribution is tax-deductible. After all, charitable donations can be a great way to support a cause you believe in while also benefiting from a tax break.

The good news is that yes, donations to Habitat for Humanity are generally tax-deductible. However, there are some important factors to consider when making your donation, including the type of donation you’re making and the documentation you’ll need to keep for tax purposes. In this article, we’ll explore the ins and outs of tax-deductible donations to Habitat for Humanity, so you can make the most of your charitable giving.

Yes, donations made to Habitat for Humanity are tax-deductible. As a registered 501(c)(3) nonprofit organization, Habitat for Humanity is eligible to receive tax-deductible donations under the United States Internal Revenue Code. Donors can claim their donations as charitable contributions on their tax returns.

Are Donations to Habitat for Humanity Tax Deductible?

Understanding Habitat for Humanity

Habitat for Humanity is a global nonprofit organization that seeks to provide affordable housing to those in need. It operates in over 70 countries and has helped millions of people find safe and decent places to live. Habitat for Humanity relies on donations from individuals, corporations, and foundations to support its mission.

How Does Habitat for Humanity Work?

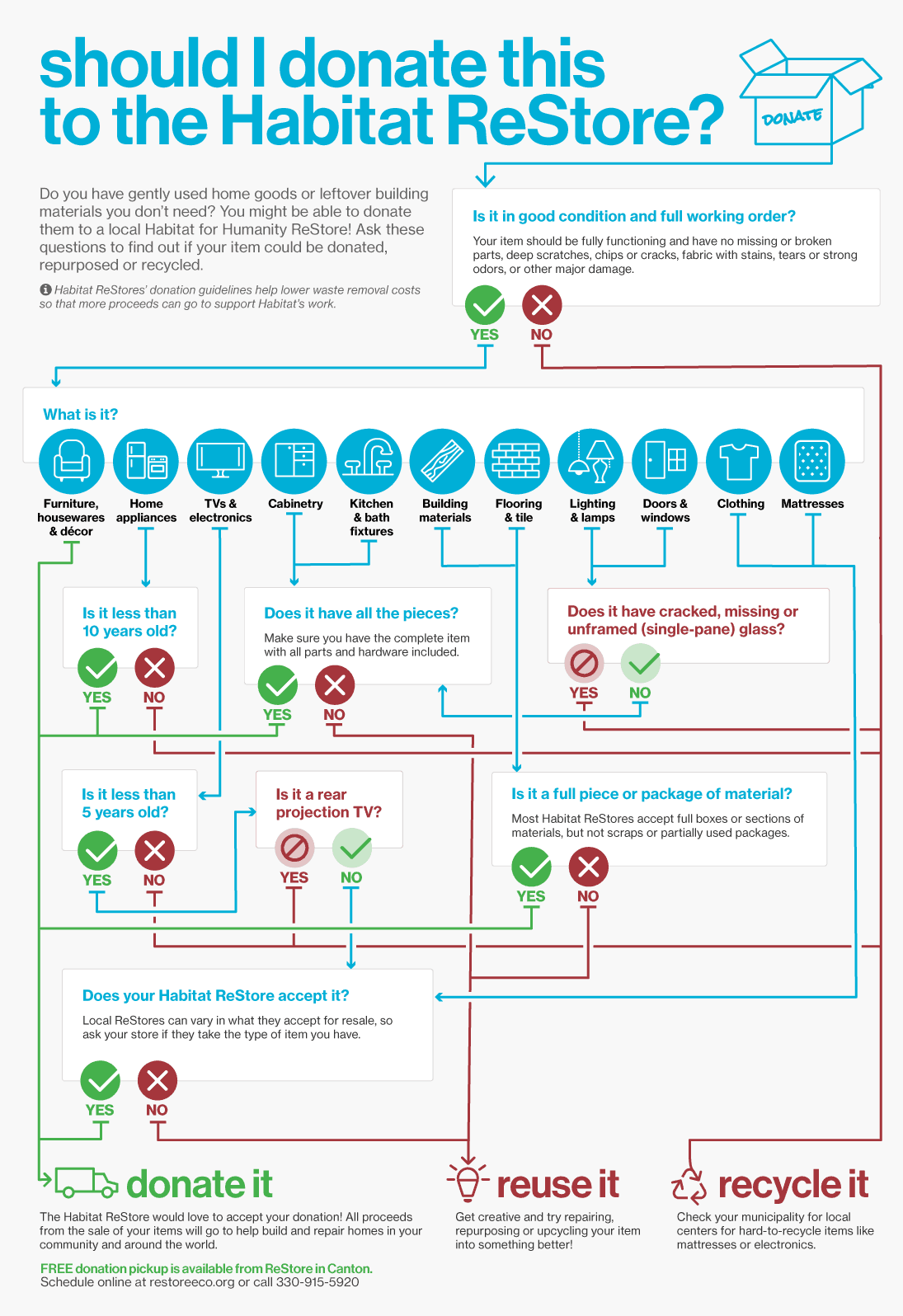

Habitat for Humanity builds and renovates homes for people in need. The organization partners with families and individuals who are willing to put in “sweat equity” by helping to build their own homes or the homes of others. Habitat for Humanity also operates ReStores, which sell new and gently used home furnishings, appliances, and building materials. The proceeds from these sales help fund Habitat for Humanity’s housing programs.

Are Donations to Habitat for Humanity Tax Deductible?

Yes, donations to Habitat for Humanity are tax-deductible. Habitat for Humanity is a registered 501(c)(3) nonprofit organization, which means that donations are tax-exempt to the extent allowed by law. This includes cash donations, as well as donations of goods and services.

How to Claim a Tax Deduction for Your Donation

To claim a tax deduction for your donation to Habitat for Humanity, you will need to itemize your deductions on your tax return using Form 1040. You will also need to keep a record of your donation, such as a receipt or a bank statement. If your donation is over $250, you will need to obtain a written acknowledgement from Habitat for Humanity that specifies the amount of your donation and whether you received any goods or services in exchange.

Other Benefits of Donating to Habitat for Humanity

In addition to the tax deduction, there are other benefits to donating to Habitat for Humanity. By supporting Habitat for Humanity, you are helping to provide affordable housing to those in need. This can have a positive impact on the community by reducing homelessness and improving the overall quality of life. Donating to Habitat for Humanity can also be a way to get involved in your community and make a difference.

Conclusion

Donating to Habitat for Humanity is a way to support a worthy cause while also receiving a tax deduction. As a registered nonprofit organization, Habitat for Humanity relies on donations to fund its housing projects. By donating to Habitat for Humanity, you are helping to provide safe and decent housing to those in need. Remember to keep a record of your donation and to itemize your deductions on your tax return to claim the tax deduction.

Contents [show]

Frequently Asked Questions

Here are some common questions and answers about whether donations to Habitat for Humanity are tax deductible.

1. Are donations to Habitat for Humanity tax deductible?

Yes, donations made to Habitat for Humanity are tax deductible. Habitat for Humanity is a registered 501(c)(3) nonprofit organization, which means that contributions made to the organization are tax deductible to the extent allowed by law. This includes both monetary donations and donations of goods or property.

However, it’s important to keep proper documentation of your donation in order to claim the deduction on your taxes. Make sure to get a receipt or acknowledgement from Habitat for Humanity for any donations you make, and keep this documentation with your tax records.

2. Can I deduct the full amount of my donation?

Not necessarily. While donations to Habitat for Humanity are generally tax deductible, the amount you can deduct depends on a few factors. If you make a donation of cash or property, you can generally deduct the fair market value of the donation. However, if you receive any goods or services in exchange for your donation (such as a t-shirt or other merchandise), the value of those goods or services may need to be subtracted from your deduction.

Additionally, there are certain limits and restrictions on charitable deductions that may apply depending on your income and the type of donation you make. Be sure to consult with a tax professional or refer to IRS guidelines to determine the amount you can deduct.

3. What types of donations can I deduct?

You can generally deduct any donation you make to Habitat for Humanity, whether it’s a monetary donation or a donation of goods or property. This includes donations of furniture, appliances, building materials, and other items that can be used to support Habitat for Humanity’s mission of building affordable housing for those in need.

However, it’s important to keep in mind that there are certain restrictions on what types of donations can be deducted, as well as limits on the amount that can be deducted in a given year. Consult with a tax professional or refer to IRS guidelines for more information.

4. What documentation do I need to claim a deduction for my donation?

In order to claim a deduction for your donation to Habitat for Humanity, you’ll need to have documentation that shows the amount of your donation and the date it was made. This can be in the form of a receipt or acknowledgement from Habitat for Humanity, a cancelled check or credit card statement, or other similar documentation.

If you’re making a donation of goods or property, you’ll also need to have documentation that shows the fair market value of the item at the time of the donation. This can be in the form of a receipt or appraisal from an independent third party.

5. Can I deduct volunteer hours I donate to Habitat for Humanity?

No, you cannot deduct the value of your time or services as a volunteer for Habitat for Humanity. While your time and efforts are greatly appreciated, they are not considered tax deductible contributions.

However, if you incur any expenses as a result of your volunteer work (such as travel expenses or the cost of materials), you may be able to deduct those expenses on your taxes. Consult with a tax professional or refer to IRS guidelines for more information.

In conclusion, donations to Habitat for Humanity are indeed tax deductible. This is because Habitat for Humanity is a registered charity organization that has been approved by the Internal Revenue Service (IRS). As such, donors can claim a deduction on their taxes for any donations made to the organization.

Not only do donations to Habitat for Humanity provide tax benefits, but they also go towards a worthy cause. Habitat for Humanity is dedicated to providing affordable housing for families in need, and relies on donations to fund their projects. By making a donation, you can help make a difference in the lives of those who are struggling to find safe and stable housing.

In summary, donating to Habitat for Humanity is a win-win situation. You can receive tax benefits while also contributing to a worthwhile cause. So why not consider making a donation today and help make a difference in the lives of families in need?

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts