Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you looking to donate your vehicle to a charitable organization? If so, you’ll need to write a receipt for the sale of your vehicle to ensure you receive the proper tax deduction. Writing a receipt may seem daunting, but with a little guidance, the process can be simple and straightforward.

In this article, we’ll provide you with step-by-step instructions on how to write a receipt for a donated vehicle sale. By following these tips, you’ll be able to complete the process quickly and accurately, allowing you to receive the maximum tax deduction possible for your generous donation. So, let’s get started!

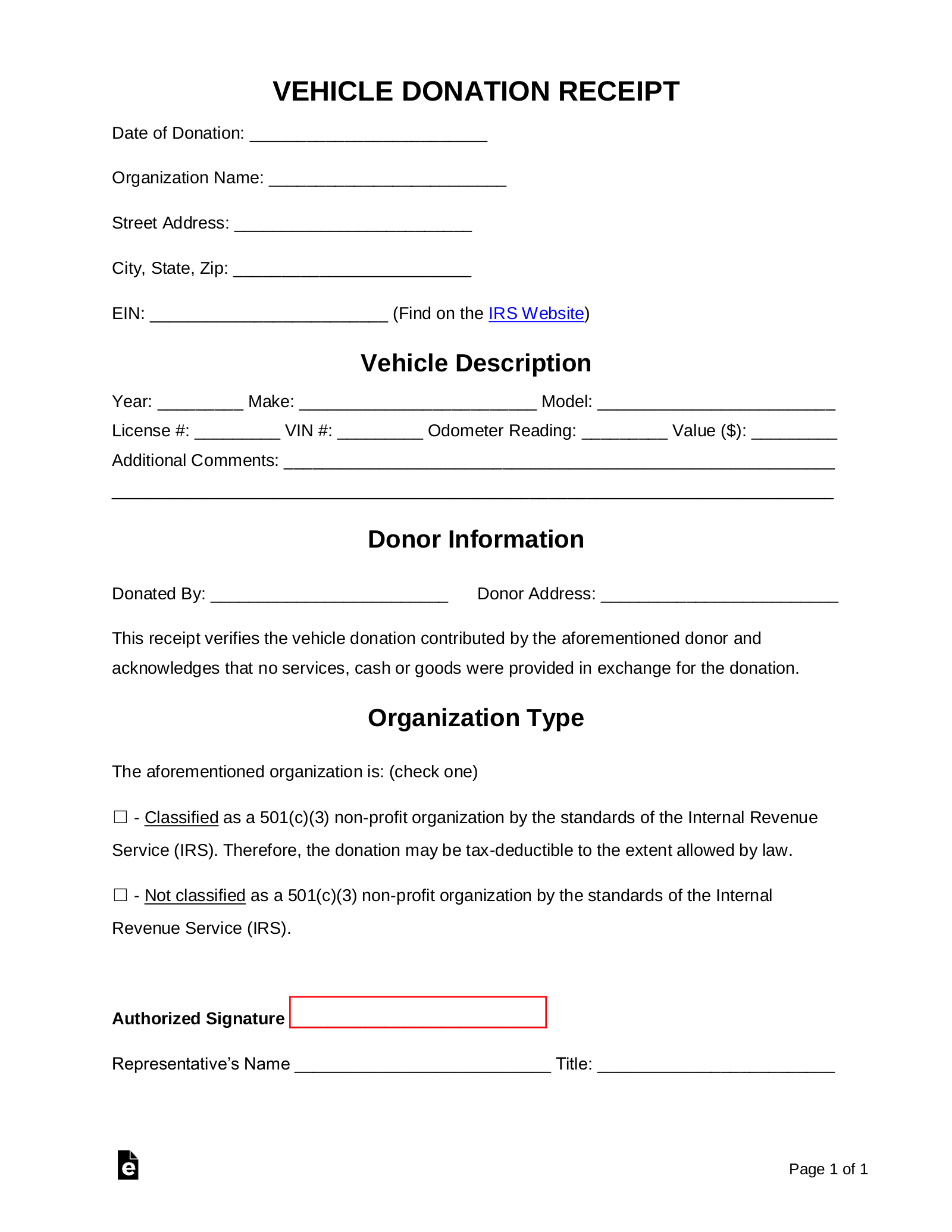

- Include the donor’s name, address, and vehicle information such as make, model, and VIN number.

- State that the vehicle was donated and the date of the donation.

- Include a statement that no goods or services were exchanged for the donation.

- State the estimated value of the vehicle or how it will be used by the organization.

- Include the organization’s name, address, and tax ID number.

- Make sure to sign and date the receipt.

How to Write a Receipt for a Donated Vehicle Sale

When you donate a vehicle to a charitable organization, it not only helps the organization but also entitles you to a tax deduction. However, to claim the tax deduction, you need to have proper documentation. This article will guide you on how to write a receipt for a donated vehicle sale.

Heading 1: Include the Essential Information

The first step in writing a receipt for a donated vehicle sale is to include all the essential information. This includes the name and address of the donor and the charity organization. You should also include the date of the donation, the make, model, and year of the vehicle, and the vehicle identification number (VIN).

It is also important to include a statement that the donor is giving the vehicle as a charitable donation and is not receiving any goods or services in exchange. This statement is necessary to ensure that the donor is eligible for a tax deduction.

Heading 2: Describe the Condition of the Vehicle

When writing a receipt for a donated vehicle sale, it is important to describe the condition of the vehicle. This includes any damages or defects that the vehicle may have. You should also include the mileage of the vehicle at the time of the donation.

If the charity organization plans to sell the vehicle, you should also include a statement that the charity organization will use the proceeds from the sale to further its charitable mission.

Heading 3: Sign and Date the Receipt

The final step in writing a receipt for a donated vehicle sale is to sign and date the receipt. Both the donor and the charity organization should sign the receipt. The donor should also receive a copy of the receipt for their records.

It is important to keep a copy of the receipt on file for at least seven years in case of an audit from the Internal Revenue Service (IRS).

Heading 4: Benefits of Donating a Vehicle

Donating a vehicle to a charitable organization has many benefits. First, it helps the charity organization further its mission. Second, it can entitle the donor to a tax deduction. Finally, it is an easy and convenient way to dispose of an unwanted vehicle.

Heading 5: Tax Advantages of Donating a Vehicle

Donating a vehicle to a charitable organization can also provide tax advantages. The donor can claim a tax deduction for the fair market value of the vehicle. This can be a significant tax deduction, especially for high-value vehicles.

However, the tax deduction is limited to the amount that the charity organization receives from the sale of the vehicle. If the charity organization keeps the vehicle for its own use or gives it away, the donor can only claim a tax deduction for the vehicle’s fair market value at the time of the donation.

Heading 6: Donating a Vehicle vs. Selling a Vehicle

Donating a vehicle to a charitable organization is often a better option than selling the vehicle. When selling a vehicle, the seller may have to deal with the hassle of advertising, negotiating with buyers, and transferring the title.

In contrast, donating a vehicle is a simple and hassle-free process. It also provides the donor with the satisfaction of knowing that they are helping a worthy cause.

Heading 7: Choosing the Right Charity Organization

When donating a vehicle, it is important to choose the right charity organization. The organization should be a qualified 501(c)(3) nonprofit organization, and it should use the proceeds from the sale of the vehicle to further its charitable mission.

It is also important to research the charity organization to ensure that it is reputable and transparent in its operations. The charity organization should be able to provide the donor with a clear understanding of how the proceeds from the sale of the vehicle will be used.

Heading 8: Donating a Vehicle to a Local Charity

Donating a vehicle to a local charity can provide additional benefits. Local charities often have a more direct impact on the community and can provide the donor with a sense of satisfaction in knowing that they are helping their local community.

Local charities may also be more willing to work with the donor to ensure that the donation process is as smooth and hassle-free as possible.

Heading 9: The Environmental Benefits of Donating a Vehicle

Donating a vehicle to a charitable organization can also have environmental benefits. When a vehicle is donated, it is often recycled or sold for parts. This reduces the amount of waste in landfills and conserves natural resources.

Donating a vehicle can also help to reduce carbon emissions. Older vehicles often have lower fuel efficiency and higher emissions. By donating an older vehicle, the donor can help to reduce their carbon footprint.

Heading 10: Conclusion

In conclusion, donating a vehicle to a charitable organization can provide many benefits. It helps the charity organization further its mission, provides the donor with a tax deduction, and is a simple and hassle-free way to dispose of an unwanted vehicle.

When writing a receipt for a donated vehicle sale, it is important to include all the essential information, describe the condition of the vehicle, and sign and date the receipt. By following these steps, the donor can ensure that they have proper documentation for their tax deduction.

Contents

- Frequently Asked Questions

- What information should be included in a receipt for a donated vehicle sale?

- Who should write the receipt for a donated vehicle sale?

- What if the vehicle is not sold by the charity?

- Can a donor claim a deduction for a donated vehicle without a receipt?

- How should the value of a donated vehicle be determined?

- How To Fill Out Receipts For Customers by Hand

Frequently Asked Questions

Donating a vehicle to charity is a great way to support a cause you care about and get a tax deduction. When you donate a vehicle, you’ll need to provide a receipt for the sale. Here are some common questions and answers about how to write a receipt for a donated vehicle sale.

What information should be included in a receipt for a donated vehicle sale?

The receipt for a donated vehicle sale should include the name and address of the charity, the date of the donation, the make and model of the vehicle, the VIN (Vehicle Identification Number), the sale price of the vehicle, and a statement that no goods or services were provided in exchange for the donation. It’s also a good idea to include a statement that the donor is responsible for determining the value of the donated vehicle for tax purposes.

It’s important to keep a copy of the receipt for your records, and to provide a copy to the donor for their records as well. If the vehicle is sold for more than $500, the charity will also need to provide a copy of the receipt to the IRS.

Who should write the receipt for a donated vehicle sale?

The charity that receives the donated vehicle should be responsible for writing the receipt for the sale. The receipt should be signed by a representative of the charity and include their name and title.

If the donor has any special requests or requirements for the receipt, they should discuss these with the charity before making the donation.

What if the vehicle is not sold by the charity?

If the charity is unable to sell the donated vehicle, they should inform the donor of this fact in writing within 30 days of the donation. The donor can then claim a deduction for the fair market value of the vehicle on their tax return.

If the charity sells the vehicle for less than $500, they can provide the donor with a written acknowledgement of the donation. The acknowledgement should include the name and address of the charity, the date of the donation, and a brief description of the vehicle.

Can a donor claim a deduction for a donated vehicle without a receipt?

No. In order to claim a deduction for a donated vehicle, the donor must have a written acknowledgement of the donation from the charity. The acknowledgement should include the information listed above, and should be provided to the donor within 30 days of the donation.

If the donor does not receive a written acknowledgement, they can request one from the charity. If the charity refuses to provide an acknowledgement, the donor should report the charity to the IRS.

How should the value of a donated vehicle be determined?

The donor is responsible for determining the value of the donated vehicle for tax purposes. The value of the vehicle will depend on its condition, mileage, and other factors. The donor can use a guide such as the Kelley Blue Book or NADA to determine the value of the vehicle.

If the vehicle is worth more than $5,000, the donor will need to obtain an independent appraisal of the vehicle’s value. The appraisal should be performed by a qualified appraiser and should be attached to the donor’s tax return.

How To Fill Out Receipts For Customers by Hand

In conclusion, writing a receipt for a donated vehicle sale may seem like a tedious task, but it is an essential one. By following the steps mentioned above, you can ensure that the receipt is legally binding and protects both the donor and the recipient.

Remember to include all necessary information, such as the names and addresses of both parties, the vehicle’s make and model, and the sale price. Don’t forget to obtain signatures and keep copies of the receipt for both parties.

Overall, taking the time to write a proper receipt can save you from potential legal issues down the line and ensure that the transaction is completed smoothly. So, follow the guidelines mentioned above and write a receipt that will serve as a testament to your professionalism and attention to detail.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts