Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you looking to donate a car to a family member in Louisiana? It’s a generous and thoughtful gesture, but the process can be overwhelming if you don’t know where to start. Fortunately, we’ve got you covered with this comprehensive guide that will walk you through the steps of donating a car to a family member in Louisiana. From understanding the legal requirements to finding reputable organizations to donate to, we’ll help you make the process as smooth and stress-free as possible. So let’s get started and make a difference in someone’s life today!

- Find a charity organization in Louisiana that accepts car donations. You can search online or check with local organizations.

- Contact the charity and ask if they accept car donations from family members. Some charities may only accept donations from the original owner.

- Provide the charity with the car’s title and registration information, and sign the necessary paperwork to transfer ownership.

- Arrange for the car to be picked up or dropped off at the charity’s designated location.

- Keep a copy of the donation paperwork for tax purposes.

How to Donate a Car to Family Member in Louisiana: A Step-by-Step Guide

Step 1: Check the Eligibility

To donate a car to a family member in Louisiana, you must first ensure that you meet the eligibility criteria. The vehicle must be registered in Louisiana, and the donor and recipient must be related by blood, marriage, or adoption.

If you meet the eligibility criteria, you can proceed to the next step.

Step 2: Transfer Ownership

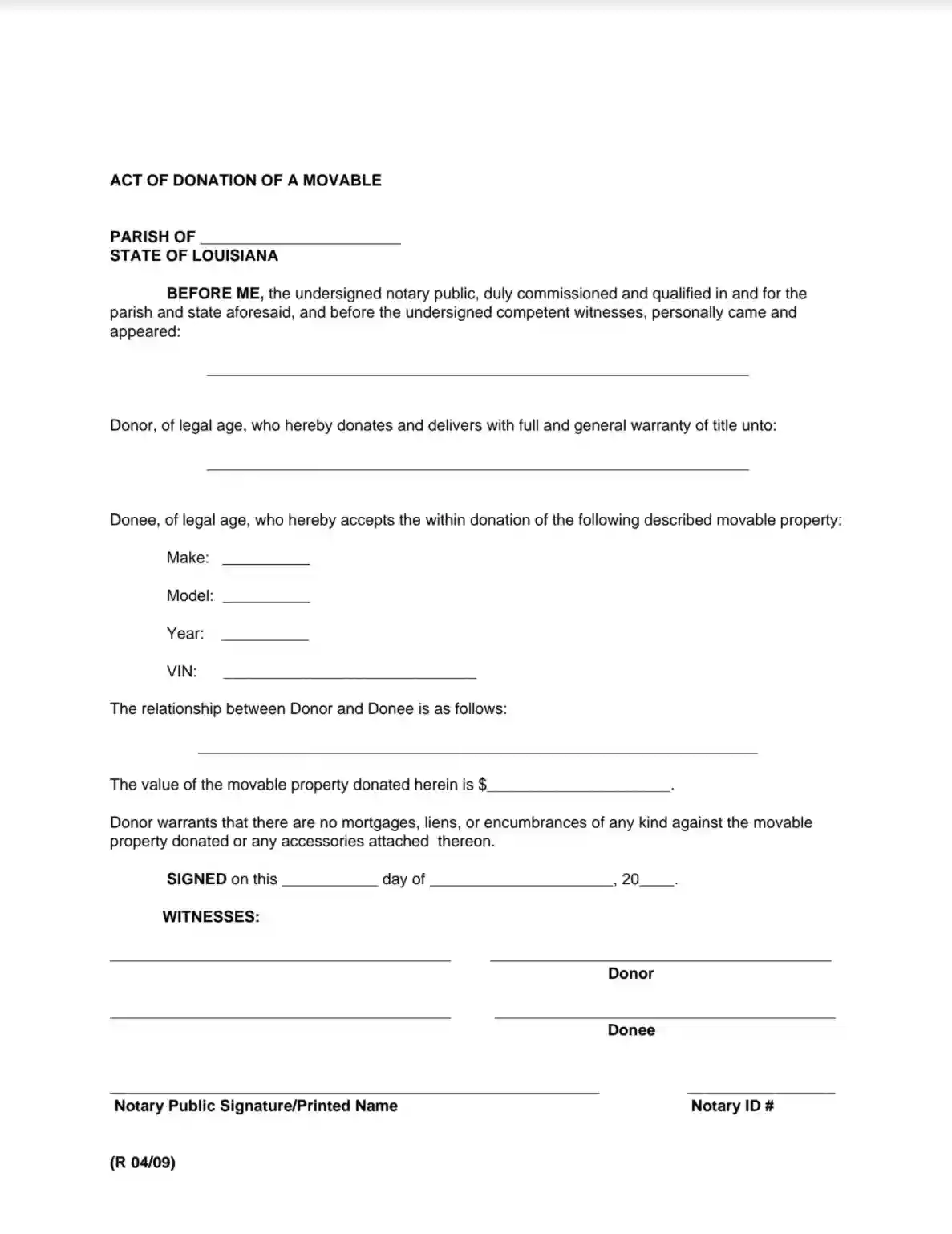

To donate a car to a family member in Louisiana, you must transfer the ownership of the vehicle to the recipient. This can be done by completing the Louisiana Vehicle Application form and submitting it to the Louisiana Office of Motor Vehicles.

The form requires the donor and recipient’s signature, as well as a notary public’s seal. The form must also include the vehicle’s title, registration, and insurance information.

Step 3: Determine the Fair Market Value

To claim a tax deduction on the donated vehicle, you must determine its fair market value. This can be done by using a guide such as the Kelley Blue Book or consulting with a professional appraiser.

You must also obtain a written acknowledgment from the recipient that they received the donated vehicle and did not provide any goods or services in exchange for the donation.

Step 4: Complete the Donation Process

After completing the necessary paperwork and determining the fair market value of the donated vehicle, you can complete the donation process. This may involve delivering the vehicle to the recipient or arranging for a tow truck to transport it.

You should also provide the recipient with all necessary documents, including the title, registration, and insurance information.

Step 5: Claim the Tax Deduction

To claim a tax deduction on the donated vehicle, you must file Form 8283 with your federal tax return. This form requires information about the donated vehicle, including its fair market value and the name and address of the recipient.

You may also need to provide additional documentation, such as an appraisal or written acknowledgment from the recipient.

Benefits of Donating a Car to a Family Member in Louisiana

Donating a car to a family member in Louisiana can provide several benefits, including:

– Helping a family member in need: Donating a car to a family member can help them get back on their feet and improve their quality of life.

– Tax deduction: Donating a car to a family member may qualify you for a tax deduction, which can help offset the cost of the donation.

– Simplifies the process: Donating a car to a family member can be a simpler process than selling the vehicle or donating it to a charity.

Donating a Car to a Family Member vs. Selling the Vehicle

Donating a car to a family member in Louisiana may be a better option than selling the vehicle for several reasons, including:

– Helping a family member: Donating a car to a family member can help them in a time of need and improve their quality of life.

– Tax deduction: Donating a car to a family member may qualify you for a tax deduction, which can help offset the cost of the donation.

– Simplifies the process: Donating a car to a family member can be a simpler process than selling the vehicle, which may involve advertising, negotiating, and completing paperwork.

However, selling the vehicle may be a better option if:

– The family member is not in need of a vehicle.

– The vehicle is worth more than the tax deduction you would receive for donating it.

– You need the cash from the sale of the vehicle.

Conclusion

Donating a car to a family member in Louisiana can be a great way to help a loved one in need and may qualify you for a tax deduction. By following the steps outlined in this guide, you can ensure a smooth donation process and provide a valuable gift to your family member.

Contents

- Frequently Asked Questions

- 1. Can I donate a car to a family member in Louisiana?

- 2. How do I donate a car to a family member in Louisiana?

- 3. Can I claim a tax deduction for donating a car to a family member in Louisiana?

- 4. What are the advantages of donating a car to a family member in Louisiana?

- 5. What are the disadvantages of donating a car to a family member in Louisiana?

Frequently Asked Questions

Donating a car to a family member in Louisiana can be a great way to help them out. However, there are some important things to consider before making the donation. Here are some frequently asked questions about donating a car to a family member in Louisiana.

1. Can I donate a car to a family member in Louisiana?

Yes, you can donate a car to a family member in Louisiana. However, it’s important to keep in mind that there are tax implications to consider. When you donate a car to a family member, it’s treated differently than if you were to donate it to a charity. This means that you may need to pay gift tax on the value of the car. You should consult with a tax professional to understand the tax implications of donating a car to a family member.

It’s also important to keep in mind that if you donate a car to a family member and they sell it, they may be responsible for paying sales tax on the proceeds of the sale.

2. How do I donate a car to a family member in Louisiana?

Donating a car to a family member in Louisiana is similar to donating a car to a charity. You’ll need to transfer the title of the car to the family member and provide them with a bill of sale. It’s also a good idea to have the car appraised to determine its value. This will help you determine whether you need to pay gift tax on the value of the car.

If the car is worth more than $5,000, you’ll need to have it appraised by a qualified appraiser. You’ll also need to fill out IRS Form 8283 if you plan to claim a tax deduction for the donation.

3. Can I claim a tax deduction for donating a car to a family member in Louisiana?

No, you cannot claim a tax deduction for donating a car to a family member in Louisiana. When you donate a car to a charity, you can deduct the value of the car on your taxes. However, when you donate a car to a family member, it’s treated as a gift rather than a charitable donation. This means that you cannot claim a tax deduction for the value of the car.

It’s important to keep in mind that if you donate a car to a family member and they sell it, they may be responsible for paying taxes on the proceeds of the sale.

4. What are the advantages of donating a car to a family member in Louisiana?

Donating a car to a family member in Louisiana can be a great way to help them out. It can also be a way to get rid of a car that you no longer need or want. When you donate a car to a family member, you can rest assured that it’s going to someone you know and trust. You also have the satisfaction of knowing that you’ve helped someone out.

Additionally, if the car is in good condition, your family member may be able to use it for transportation or sell it for a profit.

5. What are the disadvantages of donating a car to a family member in Louisiana?

One of the main disadvantages of donating a car to a family member in Louisiana is the tax implications. When you donate a car to a family member, it’s treated as a gift rather than a charitable donation. This means that you may need to pay gift tax on the value of the car. You should consult with a tax professional to understand the tax implications of donating a car to a family member.

Another disadvantage is that if the car is not in good condition, it may not be worth donating. In this case, it may be better to sell the car for scrap or donate it to a charity.

In conclusion, donating a car to a family member in Louisiana can be a generous and thoughtful gesture. It can help your loved one get back on their feet and provide them with a reliable mode of transportation. However, the process can be complicated, so it’s important to do your research and follow the necessary steps.

First, make sure you have all the necessary paperwork and documentation for both yourself and the recipient of the car. This includes the car’s title, registration, and insurance information. You will also need to fill out the appropriate forms and pay any fees associated with transferring ownership.

Second, consider working with a reputable charity organization to facilitate the donation process. Not only can they help with the paperwork and logistics, but they can also ensure that the car is put to good use and benefits those in need.

Finally, remember that donating a car is a selfless act of kindness that can make a significant impact on someone’s life. By following the proper steps and working with trusted organizations, you can ensure that your donation goes towards a worthy cause and helps your family member in Louisiana thrive.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts