Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you considering donating to the Salvation Army but wondering if you’ll get a tax receipt? The answer is yes! The Salvation Army is a registered charity, and they provide tax receipts for all donations.

Not only can you feel good about supporting a worthy cause, but you can also benefit from claiming your donation on your tax return. With tax season just around the corner, it’s the perfect time to make a difference and receive a tax receipt from the Salvation Army for your generosity.

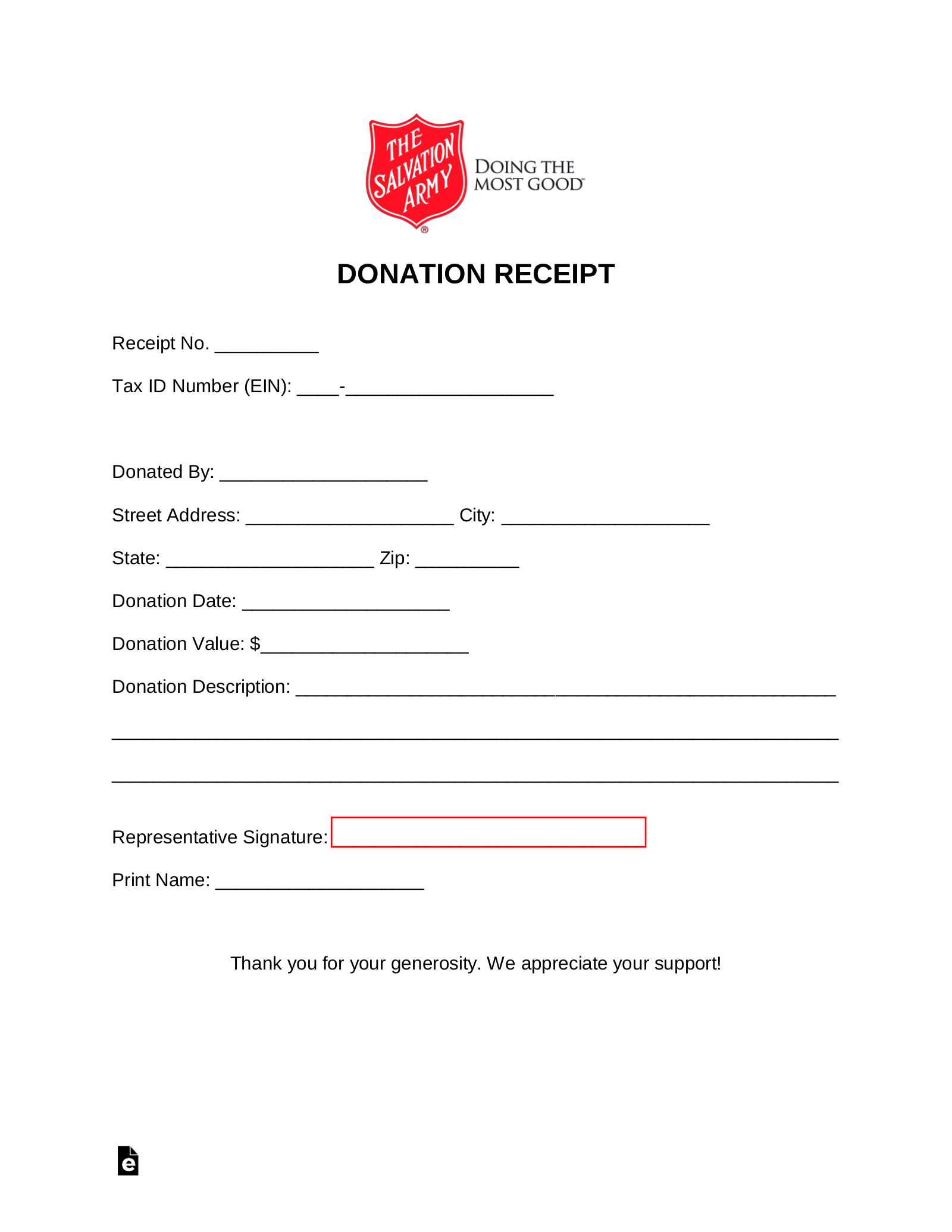

Yes, the Salvation Army provides tax receipts for donations. When you donate to the Salvation Army, you can request a tax receipt to claim your donation as a deduction on your taxes. The receipt will include the date of the donation, the amount donated, and the Salvation Army’s tax identification number. Keep in mind that donations of $250 or more require a written acknowledgement from the charity.

Contents

- Does Salvation Army Give Tax Receipts for Donations?

- Frequently Asked Questions

- Question 1: Does the Salvation Army provide tax receipts for donations?

- Question 2: What types of donations are eligible for tax receipts from the Salvation Army?

- Question 3: How do I obtain a tax receipt from the Salvation Army?

- Question 4: Are there any limits on the amount of tax receipts I can receive from the Salvation Army?

- Question 5: Can I claim a tax deduction for donations I make to the Salvation Army in the United States?

Does Salvation Army Give Tax Receipts for Donations?

When it comes to donating to charities, many people wonder if they can receive tax receipts for their contributions. The Salvation Army is a well-known charitable organization that provides a range of services to those in need. But do they give tax receipts for donations? Let’s find out.

What is the Salvation Army?

The Salvation Army is a Christian organization that was founded in London in 1865. Their mission is to provide social services, disaster relief, and spiritual support to people in need, regardless of their background or beliefs. They operate in over 130 countries and have a presence in almost every major city in the world.

The Salvation Army provides a wide range of services, including food and shelter for the homeless, addiction recovery programs, emergency assistance, and youth programs. They also operate thrift stores, which generate revenue to support their programs.

Do They Give Tax Receipts?

Yes, the Salvation Army does give tax receipts for donations. If you make a donation to the Salvation Army, you can request a tax receipt for the amount donated. This receipt can then be used when filing your taxes to claim a deduction for charitable donations.

It’s important to note that not all donations are tax-deductible. In order to claim a deduction, the donation must be made to a qualifying organization, such as the Salvation Army. Additionally, you must be able to provide documentation of the donation, such as a receipt or cancelled check.

How to Get a Tax Receipt from the Salvation Army?

If you make a donation to the Salvation Army and would like to receive a tax receipt, there are a few things you need to do. First, make sure that you make the donation to a qualifying organization. You can check the IRS website to see if the Salvation Army is on the list of qualifying organizations.

Next, make sure that you request a receipt at the time of the donation. The Salvation Army will provide you with a receipt that includes the date and amount of the donation. If you make a donation online, you will receive an email confirmation that can be used as a receipt.

Benefits of Donating to the Salvation Army

Donating to the Salvation Army can provide a number of benefits, both for the donor and for the community. Here are some of the benefits of donating to the Salvation Army:

- Helping those in need: The Salvation Army provides a range of services to people in need, including food, shelter, and addiction recovery programs.

- Tax deductions: Donations to the Salvation Army are tax-deductible, which can help reduce your tax bill.

- Supporting a reputable organization: The Salvation Army has a long history of providing services to those in need, and is a trusted and reputable organization.

Donating to the Salvation Army vs. Other Charities

While the Salvation Army is a well-known and respected charity, there are many other charitable organizations that also provide important services to those in need. Here are some things to consider when deciding where to donate:

| Salvation Army | Other Charities |

|---|---|

| Provides a range of services, including food and shelter for the homeless, addiction recovery programs, emergency assistance, and youth programs | May specialize in a specific area, such as cancer research or animal welfare |

| Operates thrift stores to generate revenue to support their programs | May rely on donations and grants to fund their programs |

| Has a long history of providing services to those in need | May be a newer organization |

Ultimately, the decision of where to donate is a personal one, and depends on your individual values and priorities.

Conclusion

The Salvation Army is a reputable charitable organization that provides a range of services to those in need. They do provide tax receipts for donations, which can be used to claim a deduction on your taxes. If you’re considering making a donation to the Salvation Army or another charitable organization, be sure to do your research and choose an organization that aligns with your values and priorities.

Frequently Asked Questions

The Salvation Army is a well-known international Christian charitable organization that has been providing assistance to people in need for over 150 years. One of the questions that people often ask is whether the Salvation Army provides tax receipts for donations. This is an important question, as many people want to be able to claim their donations as tax deductions.

Question 1: Does the Salvation Army provide tax receipts for donations?

Yes, the Salvation Army does provide tax receipts for donations. When you make a donation to the Salvation Army, whether it’s in the form of cash or goods, you will be given a receipt that you can use to claim a tax deduction on your income tax return. It’s important to keep these receipts in a safe place, as you will need them when you file your taxes.

It’s worth noting that the Salvation Army is a registered charity with the Canada Revenue Agency (CRA), which means that it is authorized to issue official tax receipts. The CRA has strict rules and regulations in place to ensure that charities are operating in accordance with the law, and that tax receipts are only issued for eligible donations.

Question 2: What types of donations are eligible for tax receipts from the Salvation Army?

The Salvation Army provides tax receipts for a wide range of donations, including cash donations, clothing, household items, and furniture. In order to receive a tax receipt, the donation must be in good condition and have a fair market value of at least $20. It’s important to note that the CRA does not allow charities to issue tax receipts for donations of services or time.

If you’re unsure whether your donation qualifies for a tax receipt, it’s best to contact your local Salvation Army branch for more information. They will be able to provide you with guidance on what types of donations are eligible for tax receipts, and how to go about obtaining one.

Question 3: How do I obtain a tax receipt from the Salvation Army?

When you make a donation to the Salvation Army, whether it’s at a drop-off location or a thrift store, you should receive a tax receipt at the time of the donation. If you make a donation online, you will receive a tax receipt via email. It’s important to keep these receipts in a safe place, as you will need them when you file your taxes.

If you have lost your tax receipt or never received one, you can contact your local Salvation Army branch to request a new one. They may ask you for some information about the donation, such as the date and location, in order to locate your donation record.

Question 4: Are there any limits on the amount of tax receipts I can receive from the Salvation Army?

Yes, there are limits on the amount of tax receipts you can receive from the Salvation Army. The CRA has set limits on the amount of charitable donations that can be claimed as tax deductions each year. For example, in 2021, the federal limit is 75% of your net income. There may also be provincial or territorial limits that apply.

If you donate more than the allowable limit, you can carry forward the excess amount and claim it as a tax deduction in a future tax year. It’s important to keep accurate records of your donations and tax receipts in order to ensure that you are claiming the correct amount of tax deductions.

Question 5: Can I claim a tax deduction for donations I make to the Salvation Army in the United States?

If you are a Canadian resident and make a donation to the Salvation Army in the United States, you may still be able to claim a tax deduction on your Canadian income tax return. However, the rules can be complex, and it’s recommended that you seek professional advice before claiming a tax deduction for donations made outside of Canada.

If you are a U.S. resident and make a donation to the Salvation Army in Canada, you may be able to claim a tax deduction on your U.S. income tax return. Again, it’s recommended that you seek professional advice to ensure that you are following the correct rules and regulations.

In conclusion, the Salvation Army is a well-respected organization that has been helping people in need for over 150 years. Whether you are donating clothing, furniture, or money, the Salvation Army is a great option for those looking to make a difference in their local community. And the best part is that they do offer tax receipts for donations, which can help reduce your taxable income and save you money come tax season.

So, if you have items to donate or are looking to make a financial contribution, consider the Salvation Army. Not only will you be helping those in need, but you’ll also be able to claim a tax deduction for your generosity. And with their commitment to transparency and accountability, you can rest assured that your donations are being put to good use.

In short, supporting the Salvation Army is a win-win situation. You’ll be making a positive impact on the lives of others while also receiving a tax benefit. So, the next time you’re cleaning out your closet or looking for a charitable organization to support, consider the Salvation Army and the good work they do.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts