Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Donating a car is a great way to give back to your community and support a charitable cause. However, the process of donating a car can be confusing, especially when it comes to the necessary forms and paperwork. In Texas, there are specific forms and requirements that you must follow to ensure a smooth and successful donation.

One of the most important forms you will need to donate a car in Texas is the title transfer form. This form must be completed and signed by both you, the donor, and the charity or organization receiving the donation. Additionally, you will need to provide proof of ownership, such as a vehicle registration or bill of sale, to complete the transfer. Understanding these requirements can help you navigate the donation process with ease and confidence.

To donate a car in Texas, you will need to have the vehicle’s title, proof of insurance, and a signed Application for Texas Certificate of Title. In addition to these documents, you may also need to provide a Bill of Sale, Release of Liability, and a Tax Receipt Form. Make sure to consult with the charity or organization you plan to donate to for their specific requirements.

Contents

- What Forms Do I Need to Donate a Car in Texas?

- Form VTR-346: Texas Motor Vehicle Transfer Notification

- Form 130-U: Application for Texas Title and/or Registration

- Form 14-317: Affidavit of Motor Vehicle Gift Transfer

- Benefits of Donating a Car in Texas

- Donating a Car vs. Selling a Car

- Preparing Your Car for Donation

- Choosing a Car Donation Organization

- Conclusion

- Frequently Asked Questions

What Forms Do I Need to Donate a Car in Texas?

Donating a car is a great way to give back to your community and help those in need. When you decide to donate a car in Texas, it’s important to know the forms required for the process. Here are the forms you will need to donate a car in Texas.

Form VTR-346: Texas Motor Vehicle Transfer Notification

The first form you will need to donate a car in Texas is the Texas Motor Vehicle Transfer Notification, also known as Form VTR-346. This form is used to notify the Texas Department of Motor Vehicles that you have transferred ownership of your car to another person or organization.

To complete this form, you will need to provide your name, address, and driver’s license number, as well as the make, model, and year of your car. You will also need to provide the name and address of the person or organization receiving your car.

Once you have completed this form, you will need to submit it to the Texas Department of Motor Vehicles within 30 days of transferring ownership of your car.

Form 130-U: Application for Texas Title and/or Registration

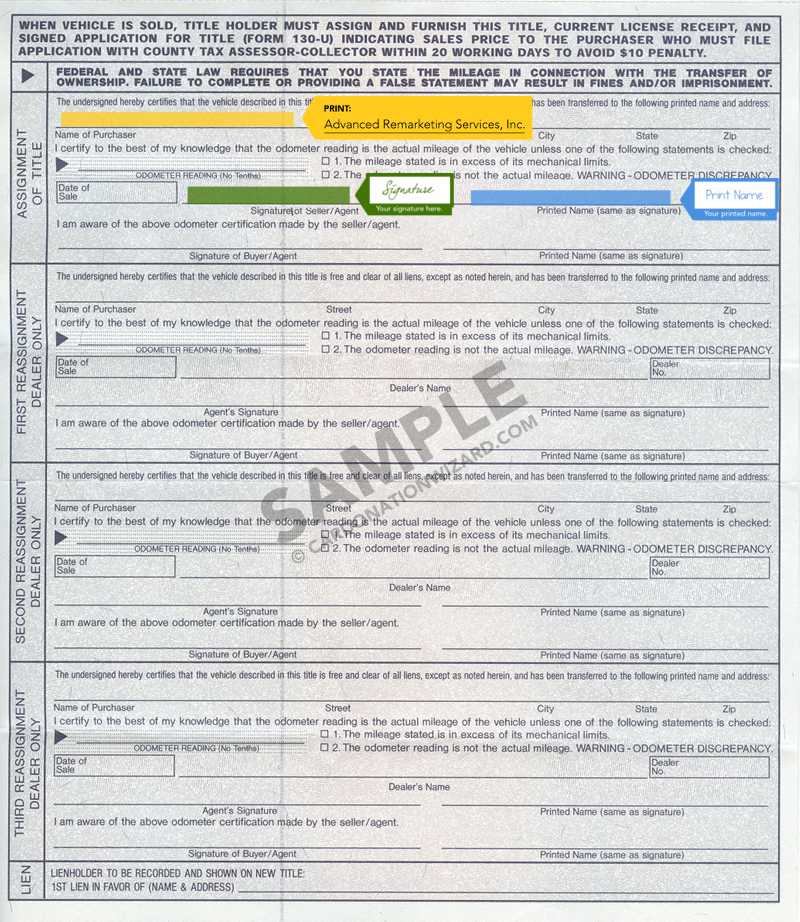

The second form you will need to donate a car in Texas is the Application for Texas Title and/or Registration, also known as Form 130-U. This form is used to apply for a new Texas title and/or registration for your car.

To complete this form, you will need to provide your name, address, and driver’s license number, as well as the make, model, and year of your car. You will also need to provide the vehicle identification number (VIN) and odometer reading for your car.

Once you have completed this form, you will need to submit it to the Texas Department of Motor Vehicles along with any required fees and documentation.

Form 14-317: Affidavit of Motor Vehicle Gift Transfer

The third form you will need to donate a car in Texas is the Affidavit of Motor Vehicle Gift Transfer, also known as Form 14-317. This form is used to certify that you are giving your car as a gift to another person or organization.

To complete this form, you will need to provide your name, address, and driver’s license number, as well as the make, model, and year of your car. You will also need to provide the name and address of the person or organization receiving your car.

Once you have completed this form, you will need to submit it to the Texas Department of Motor Vehicles along with any required fees and documentation.

Benefits of Donating a Car in Texas

There are many benefits to donating a car in Texas. First and foremost, you will be helping those in need in your community. Your car donation can provide transportation to people who might not otherwise have access to it, such as low-income families, seniors, and people with disabilities.

In addition to helping others, donating a car can also be beneficial for you. You can receive a tax deduction for your car donation, which can help reduce your tax burden. You can also free up space in your garage or driveway by getting rid of a car you no longer need.

Donating a Car vs. Selling a Car

If you’re considering getting rid of a car, you might be wondering whether it’s better to donate it or sell it. While both options have their benefits, donating a car can be a better choice in many cases.

When you donate a car, you can help those in need and receive a tax deduction. When you sell a car, you will receive money for it, but you will also need to spend time and effort finding a buyer and negotiating a sale.

If you’re not sure whether to donate or sell your car, consider the value of your time and the impact you want to make in your community.

Preparing Your Car for Donation

Before you donate your car in Texas, it’s important to prepare it for donation. This can help ensure that the donation process goes smoothly and that you get the maximum tax deduction for your donation.

To prepare your car for donation, you should clean it inside and out, remove all personal items, and gather all documentation, such as the title and registration. You should also have your car inspected by a mechanic to make sure it is in good condition.

Choosing a Car Donation Organization

When you donate a car in Texas, you can choose from a variety of car donation organizations. It’s important to choose an organization that is reputable and transparent about how your donation will be used.

Some organizations will use your car donation to provide transportation to those in need in your community, while others will sell your car and use the proceeds to support their programs and services.

Before you donate your car, do your research and choose an organization that aligns with your values and goals.

Conclusion

Donating a car in Texas is a great way to give back to your community and help those in need. To donate your car, you will need to complete several forms, including the Texas Motor Vehicle Transfer Notification, the Application for Texas Title and/or Registration, and the Affidavit of Motor Vehicle Gift Transfer.

When you donate your car, you can receive a tax deduction and free up space in your garage or driveway. You can also choose from a variety of car donation organizations and prepare your car for donation to ensure a smooth and successful donation process.

Frequently Asked Questions

If you’re planning to donate a car in Texas, it’s important to know what forms you need to have in order to complete the process properly. Here are some common questions people have about the forms required for car donations in Texas.

What forms do I need to donate a car in Texas?

In Texas, you’ll need to complete a few different forms to donate a car. First, you’ll need to fill out a Texas title transfer form, which is available through the Texas Department of Motor Vehicles (DMV). This form will need to be signed by both you and the charity to which you’re donating the car. You’ll also need to complete a Form 130-U, which is a vehicle registration application. Once these forms are complete, you can submit them to the DMV to finalize the transfer of ownership.

It’s important to note that the requirements for car donations in Texas can vary depending on the charity you’re working with. Be sure to check with the organization to see if they have any additional forms or requirements that you’ll need to fulfill.

Do I need to notify the Texas DMV when I donate my car?

Yes, you’ll need to notify the Texas DMV when you donate your car. This is typically done by completing the Texas title transfer form and submitting it to the DMV. The DMV will then update their records to reflect the change in ownership. This is important because it protects you from any liability that may arise from the car after it has been donated.

It’s also a good idea to keep a copy of the title transfer form for your records, in case you need to provide proof that you are no longer the owner of the car.

Do I need to provide a receipt for my car donation in Texas?

Yes, you’ll need to provide a receipt for your car donation in Texas. This is important because it serves as proof of your donation for tax purposes. The receipt should include your name, the charity’s name and contact information, the date of the donation, and a description of the car being donated. It should also include a statement indicating that you did not receive any goods or services in exchange for your donation.

Be sure to keep a copy of the receipt for your records, as you’ll need it when you file your taxes.

Can I donate a car in Texas without a title?

No, you cannot donate a car in Texas without a title. The title is proof of ownership, and it’s required in order to transfer ownership to the charity you’re donating to. If you’ve lost your title, you’ll need to apply for a replacement before you can donate the car.

If you’re having trouble obtaining a replacement title, you may be able to work with the charity to find a solution. Some charities have programs that can help donors obtain replacement titles or sell the car for parts without a title.

Are there any tax benefits to donating a car in Texas?

Yes, there are tax benefits to donating a car in Texas. When you donate a car to a qualified charity, you can claim a tax deduction for the fair market value of the car. This can help reduce your tax liability for the year.

It’s important to note that the amount of your tax deduction will depend on a few different factors, such as the condition of the car and the charity you’re donating to. Be sure to consult with a tax professional to understand how car donations will impact your specific tax situation.

In conclusion, donating a car in Texas requires a few necessary forms to be filled out and submitted. The first document you will need is the vehicle title, which proves ownership. The title must be signed over to the charity or organization that you are donating the car to.

Next, you will need to complete a Release of Liability form. This form is essential as it releases you from any future liability after the car has been donated. It is important to keep a copy of this form for your records.

Lastly, if you plan to claim a tax deduction for the donation, you will need to obtain a tax receipt from the charity or organization. This receipt will serve as proof of your donation for tax purposes.

By following these steps and completing the necessary forms, you can donate your car with confidence and ease. Not only will you be supporting a charitable cause, but you may also be eligible for a tax deduction.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts