Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Have you ever wondered if your charitable donations to Goodwill are tax deductible? It’s a common question, and one that can save you money come tax season. The good news is that in most cases, donating to Goodwill is indeed tax deductible. However, there are a few things you should be aware of before claiming your deduction.

Are Goodwill Donations Tax Deductible?

Donating to Goodwill is a great way to give back to your community while also decluttering your home. But did you know that donating to Goodwill can also have tax benefits? In this article, we will explore whether Goodwill donations are tax deductible and what you need to know to maximize your tax benefits.

What is a tax deduction?

Before we dive into whether Goodwill donations are tax deductible, let’s first understand what a tax deduction is. A tax deduction is a reduction in your taxable income that can lower the amount of tax you owe. When you donate to a qualified charitable organization like Goodwill, you may be eligible for a tax deduction.

How to determine if your Goodwill donation is tax deductible?

To determine if your Goodwill donation is tax deductible, you need to consider the following factors:

- Is Goodwill a qualified charitable organization? Yes, Goodwill is a qualified charitable organization recognized by the IRS.

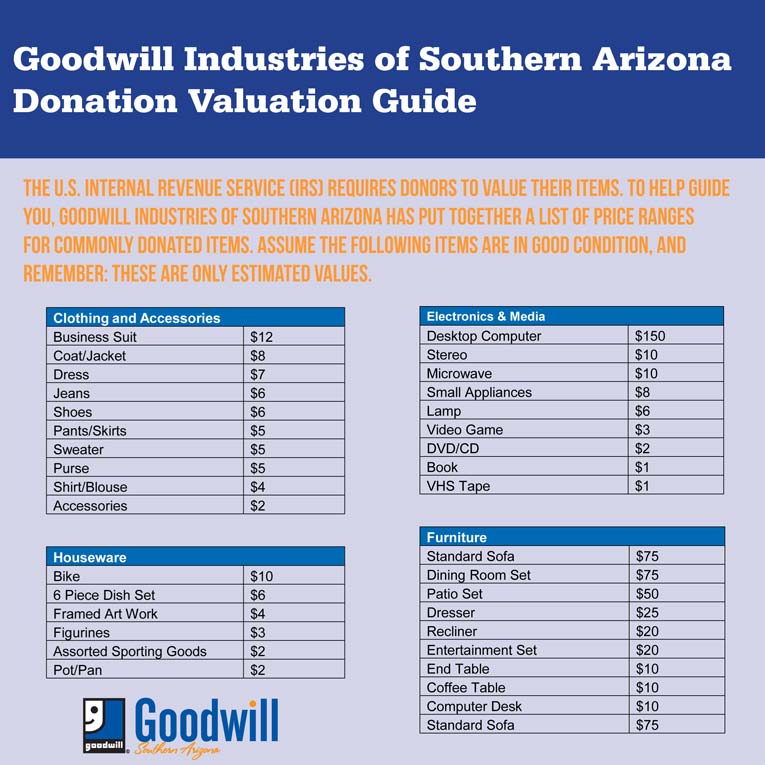

- What did you donate? You can only deduct the fair market value of the items you donated. Goodwill provides a donation value guide to help you determine the fair market value of your items.

- Did you receive anything in return? If you received anything in return for your donation, such as a gift or a service, you may need to reduce your deduction accordingly.

- Did you keep a receipt? You need to keep a receipt or a written acknowledgment from Goodwill for any donation over $250.

The benefits of donating to Goodwill

Donating to Goodwill not only helps those in need but also has several benefits for you, including:

- Declutter your home: Donating to Goodwill is an excellent way to declutter your home and get rid of items you no longer need or use.

- Environmental impact: Donating to Goodwill helps reduce waste by keeping items out of landfills and giving them a second life.

- Tax benefits: As we mentioned earlier, donating to Goodwill can also have tax benefits by reducing your taxable income.

- Feel good: Donating to Goodwill can also give you a sense of satisfaction by knowing that you are helping others in need.

Goodwill vs. other charitable organizations

While Goodwill is a great organization to donate to, there are also many other qualified charitable organizations that you can donate to and receive tax benefits. Some of these organizations may have specific causes that align with your values, such as animal shelters, food banks, or disaster relief organizations. It is essential to research and choose a qualified charitable organization that aligns with your values and goals.

In conclusion

Donating to Goodwill is a great way to give back to your community and also have tax benefits. By following the IRS guidelines and keeping records of your donations, you can maximize your tax benefits and make a positive impact on others. Remember to also consider other qualified charitable organizations that align with your values and goals.

Frequently Asked Questions

Donating to a charitable organization is a great way to give back to your community while also receiving tax benefits. However, not all donations are tax-deductible. In this article, we will answer some common questions about whether goodwill donations are tax-deductible.

Are all Goodwill donations tax-deductible?

Not all donations to Goodwill are tax-deductible. Only donations that are considered to be in “good condition” and are made to a qualified charitable organization are eligible for tax deductions. For example, if you donate a used couch that is in poor condition, it may not be eligible for a tax deduction. However, if you donate a gently used couch that is in good condition, it may be eligible for a tax deduction.

It is important to keep accurate records of your donations, including the date of the donation, the name of the organization, and a description of the items donated. This will help you to properly claim your tax deduction at the end of the year.

How much can I deduct for my Goodwill donations?

The amount that you can deduct for your Goodwill donations will depend on the fair market value of the items donated. Fair market value is the price that the item would sell for in its current condition. Goodwill provides a valuation guide on their website to help you determine the value of your donations.

It is important to note that there are limits to how much you can deduct for charitable donations. The IRS allows you to deduct up to 60% of your adjusted gross income for charitable donations, but this limit may be lower for certain types of donations.

What documentation do I need to claim a deduction for my Goodwill donations?

To claim a deduction for your Goodwill donations, you will need to itemize your deductions on your tax return. You will also need to keep accurate records of your donations, including receipts or other documentation from the charitable organization. If your donations are valued at more than $500, you will need to file Form 8283 with your tax return.

It is important to note that the documentation requirements for charitable donations can be complex, so it may be helpful to consult with a tax professional to ensure that you are properly claiming your deductions.

Can I donate my time to Goodwill and receive a tax deduction?

No, you cannot receive a tax deduction for donating your time to Goodwill or any other charitable organization. However, you may be able to deduct certain expenses related to volunteering, such as mileage or travel expenses. It is important to keep accurate records of your expenses and consult with a tax professional to determine which expenses are deductible.

Donating your time to a charitable organization is a great way to give back to your community, even if you cannot receive a tax deduction for your efforts.

What other types of donations are tax-deductible?

There are many types of donations that are tax-deductible, including cash donations, donations of property, and donations of appreciated assets such as stocks or real estate. It is important to consult with a tax professional to determine the best way to structure your donations to maximize your tax benefits.

In general, donations to qualified charitable organizations are tax-deductible, but there are limits to how much you can deduct and specific documentation requirements that must be met. It is important to keep accurate records of your donations and consult with a tax professional to ensure that you are properly claiming your deductions.

In conclusion, donating to a good cause is not only a selfless act but can also provide tax benefits. Goodwill donations, in particular, are tax-deductible as long as the items donated are in good condition and have a fair market value. However, it’s important to keep accurate records and obtain receipts to claim the deduction on your tax return.

If you’re unsure about the value of the items you’re donating, there are resources available, such as the Goodwill Valuation Guide, to help you determine their worth. Donating to Goodwill not only helps individuals in need but also helps the environment by reducing waste and promoting sustainability.

Overall, donating to Goodwill is a win-win situation. You get to declutter your home, help those in need, and possibly receive a tax deduction. So, the next time you’re considering getting rid of unwanted items, consider donating to Goodwill and reaping the benefits.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts