Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you considering gifting a car to a loved one in Alabama? Before you do, it’s important to understand the state laws regarding car gifting. The number of times you can gift a car in Alabama depends on several factors, including the relationship between the giver and receiver, the value of the car, and the purpose of the gift. In this article, we’ll explore the laws surrounding car gifting in Alabama and answer the question, “How many times can you gift a car in Alabama?”

Contents

- How Many Times Can You Gift a Car in Alabama?

- Frequently Asked Questions

- How Many Times Can You Gift a Car in Alabama?

- What is the Process for Gifting a Car in Alabama?

- Can You Gift a Car to Someone Out of State?

- Do You Have to Pay Taxes When Gifting a Car in Alabama?

- What Happens if the Gifted Car is Involved in an Accident?

- How To Gift A Vehicle To Someone Without Paying Taxes

How Many Times Can You Gift a Car in Alabama?

Gifting a car to a family member or friend can be a generous and thoughtful gesture. However, before you go ahead and transfer ownership of your vehicle, it’s essential to understand the legal requirements and limitations set forth by Alabama law.

What is a Car Gift?

A car gift is a transfer of ownership from one person to another without any exchange of payment. You may choose to give your vehicle as a gift to a family member, friend, or even a charity organization. However, it’s important to note that if you receive something in return for the car, it’s no longer considered a gift but a sale.

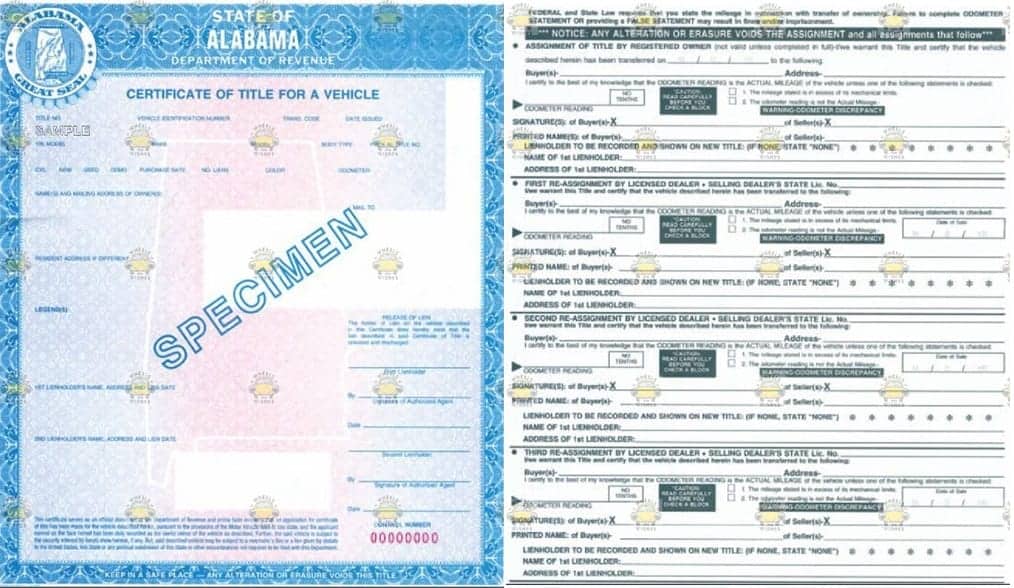

In Alabama, to transfer ownership of a vehicle, you must have a valid title that lists you as the owner. If you plan to gift the car, the recipient must also obtain a new title in their name.

How Many Times Can You Gift a Car in Alabama?

There is no limit to the number of times you can gift a car in Alabama. However, it’s important to note that any gift of a vehicle must be reported to the Alabama Department of Revenue within 15 days of the transfer of ownership.

If you gift more than one vehicle in a calendar year, you may be subject to gift taxes. The gift tax rate is based on the value of the vehicle and ranges from 1% to 3.6%.

What Do You Need to Gift a Car in Alabama?

To gift a car in Alabama, you will need to fill out the car’s title with the recipient’s name as the new owner. You’ll also need to provide the recipient with the vehicle’s current registration, proof of insurance, and a bill of sale if requested.

It’s important to note that if the vehicle is less than 35 years old, it must undergo an emissions test before a new title can be issued.

Benefits of Gifting a Car

Gifting a car can be a great way to help out a family member or friend who may be in need of reliable transportation. Additionally, gifting a car can help reduce the number of vehicles on the road, which can have a positive impact on the environment.

Another benefit of gifting a car is that it can help you avoid paying taxes on the vehicle’s value. If you sell the car, you’ll be required to pay taxes on the sale price. However, gifting the car allows you to transfer ownership without any tax implications.

Gifting a Car Vs. Selling a Car

When it comes to transferring ownership of a vehicle, you have two options: gifting or selling. While both options have their pros and cons, gifting a car is often the better choice if you’re looking to help out a family member or friend.

Gifting a car allows you to transfer ownership without any exchange of payment, which can be beneficial if you’re trying to avoid paying taxes on the sale price. Additionally, gifting a car can be a thoughtful and generous gesture that can help strengthen relationships with loved ones.

On the other hand, selling a car can be a good option if you’re looking to make some extra cash. However, you’ll be required to pay taxes on the sale price, which can significantly reduce your profit.

Conclusion

Gifting a car can be a great way to help out a family member or friend in need. In Alabama, there is no limit to the number of times you can gift a car. However, it’s important to report any gift of a vehicle to the Alabama Department of Revenue within 15 days of the transfer of ownership.

Before gifting a car, it’s essential to understand the legal requirements and limitations set forth by Alabama law. By doing so, you can ensure that the transfer of ownership goes smoothly and that you avoid any potential legal or financial issues.

Frequently Asked Questions

How Many Times Can You Gift a Car in Alabama?

In Alabama, there is no limit to how many times a car can be gifted. However, there are specific rules and regulations that must be followed. The person gifting the car must provide a signed title to the recipient.

It is also important to note that if the car is gifted to a family member, there is no sales tax due. If the car is gifted to someone who is not a family member, sales tax must be paid. It is important to keep accurate records of all gifts and transactions involving the car.

What is the Process for Gifting a Car in Alabama?

To gift a car in Alabama, the person gifting the car must sign over the title to the recipient. This can be done at the local DMV office or through the mail. The recipient will need to register the car and obtain a new title in their name.

It is important to ensure that all information on the title is accurate and up to date. Any mistakes or discrepancies could cause issues with the transfer of ownership. It is also recommended to keep copies of all paperwork and records related to the gift.

Can You Gift a Car to Someone Out of State?

Yes, you can gift a car to someone out of state. However, it is important to follow the proper procedures for transferring ownership. The person gifting the car must sign over the title to the recipient and provide any necessary paperwork.

The recipient will need to register the car in their state and obtain a new title. It is important to research the specific requirements for the recipient’s state before gifting the car. Some states may have different rules or regulations that need to be followed.

Do You Have to Pay Taxes When Gifting a Car in Alabama?

If the car is gifted to a family member, there is no sales tax due in Alabama. However, if the car is gifted to someone who is not a family member, sales tax must be paid. The amount of sales tax depends on the value of the car.

It is important to accurately report the value of the car when filing taxes. Failing to do so could result in penalties or fines. It is also recommended to keep records of all gifts and transactions involving the car.

What Happens if the Gifted Car is Involved in an Accident?

If the gifted car is involved in an accident, the owner of the car at the time of the accident will be held responsible. If the car was gifted and the title was transferred to the recipient, the recipient will be held responsible.

It is important to ensure that all paperwork and records related to the gift are accurate and up to date. This can help avoid any confusion or disputes in the event of an accident. It is also recommended to have adequate insurance coverage for the car.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, gifting a car in Alabama can be a great way to help someone out or simply transfer ownership of a vehicle. However, it is important to keep in mind the limitations set forth by the state. As of 2021, Alabama allows for one vehicle to be gifted per year without incurring any taxes or fees.

If you are looking to gift a car to someone in Alabama, it is important to make sure you follow the proper procedures and have all the necessary paperwork. This includes transferring the title and registering the vehicle in the new owner’s name.

Overall, gifting a car can be a wonderful gesture, but it is important to stay within the guidelines set forth by the state. By doing so, you can ensure a smooth and legal transfer of ownership.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts