Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Buying a car can be a dream come true for many people. However, what happens when you need to transfer ownership of your vehicle? In Kansas, there are certain rules and regulations that you need to follow when it comes to gifting a car. So, how many times can you gift a car in Kansas? Let’s explore the ins and outs of gifting a car in the Sunflower State.

Whether you’re gifting a car to a family member or a friend, it’s important to understand the legal requirements to avoid any potential legal issues down the road. From understanding the gift tax laws to completing the necessary paperwork, we’ll provide you with everything you need to know when it comes to gifting a car in Kansas.

In Kansas, there is no limit on how many times you can gift a car. However, each time a vehicle ownership is transferred, the recipient must pay a title transfer fee and registration fees. The donor must sign the back of the title and have it notarized. It’s also recommended to fill out a bill of sale for both parties’ records.

Contents

- How Many Times Can You Gift a Car in Kansas?

- Frequently Asked Questions

- Q: How many times can you gift a car in Kansas?

- Q: Do you need to take the car to the DMV to gift it in Kansas?

- Q: Do you need to pay taxes when gifting a car in Kansas?

- Q: Can you gift a car in Kansas if there is a lien on it?

- Q: What should you do if you lost the car’s title?

- How To Gift A Vehicle To Someone Without Paying Taxes

How Many Times Can You Gift a Car in Kansas?

If you’re a Kansas resident, you may be wondering how many times you can gift a car to someone else. This is an important question to consider if you’re planning to give a vehicle to a family member or friend, or if you’re receiving a gifted car yourself. In this article, we’ll explore the rules and regulations surrounding gifting cars in Kansas.

Rules for Gifting Cars in Kansas

In Kansas, there are specific rules you must follow when gifting a car. First, you must provide the recipient with the vehicle’s title. If the car is less than ten years old, you must also provide a bill of sale. Additionally, you must pay the sales tax on the vehicle based on the purchase price of the car. The current sales tax rate in Kansas is 6.5%, so this can add up to a significant amount depending on the value of the car.

It’s important to note that in Kansas, you can only gift a car to a family member or a charitable organization. The state defines family members as spouses, parents, children, siblings, grandparents, grandchildren, great-grandchildren, and in-laws. If you’re gifting a car to a family member, you’ll need to provide proof of your relationship, such as a birth certificate or marriage license.

Transferring Ownership of a Gifted Car

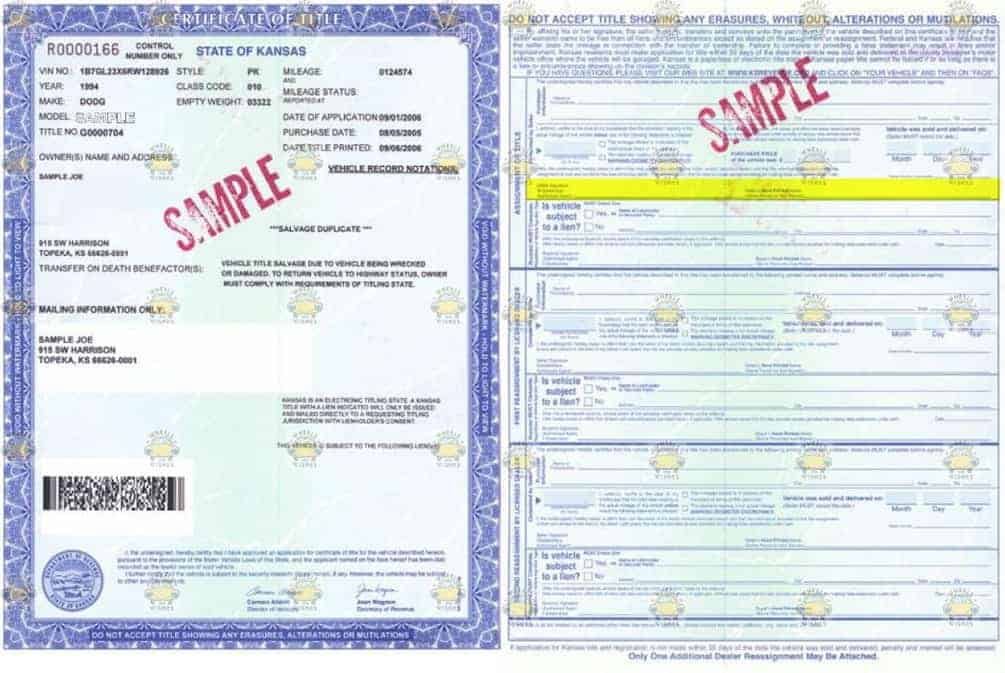

Once you’ve gifted a car to someone, it’s important to transfer ownership of the vehicle. In Kansas, this process involves completing the back of the vehicle’s title with the recipient’s name and address. You’ll also need to sign and date the title, and have it notarized. If the vehicle is less than ten years old, you’ll need to provide a bill of sale as well.

Once the title is properly filled out and notarized, the recipient can take it to the Kansas Department of Revenue to register the vehicle in their name. They’ll need to provide the title, bill of sale (if applicable), and proof of insurance to complete the registration process. They’ll also need to pay the necessary fees, which include a title fee, registration fee, and any applicable taxes.

Benefits of Gifting a Car in Kansas

Gifting a car in Kansas can have several benefits. For one, it can be a great way to help out a family member or friend who needs a car but can’t afford one. It can also be a way to get rid of a car that you no longer need or want. Additionally, gifting a car can help you save money on taxes. In Kansas, if you gift a car to a family member, you don’t have to pay any sales tax on the transaction.

Gifting a Car vs. Selling a Car

If you’re considering gifting a car, you may be wondering how it compares to selling a car. There are several factors to consider when making this decision. First, if you sell a car, you’ll receive money in exchange for the vehicle. This can be beneficial if you need the cash. However, selling a car can also be time-consuming and require a lot of effort on your part.

Gifting a car, on the other hand, can be a relatively simple process. You won’t receive any money for the vehicle, but you’ll be able to help out a family member or friend in need. Additionally, gifting a car can help you avoid paying sales tax on the transaction if you’re gifting it to a family member.

Conclusion

In conclusion, if you’re considering gifting a car in Kansas, it’s important to follow the state’s rules and regulations. You can only gift a car to a family member or charitable organization, and you’ll need to provide the recipient with the vehicle’s title and pay the necessary sales tax. Once the car is gifted, it’s important to transfer ownership of the vehicle by completing the back of the title and having it notarized. Gifting a car can be a great way to help out a family member or friend in need while also saving money on taxes.

Frequently Asked Questions

When it comes to gifting a car in Kansas, there are certain rules and regulations that you need to follow. Here are some frequently asked questions that will help you navigate the process smoothly.

Q: How many times can you gift a car in Kansas?

In Kansas, there is no limit to the number of times you can gift a car. However, you need to keep in mind that each time you transfer ownership of a vehicle, you will need to pay a title transfer fee. Additionally, if the person you are gifting the car to lives in a different state, you will need to follow that state’s rules and regulations for transferring ownership.

It is also important to note that if you gift a car to someone who is not an immediate family member, you may be subject to gift tax. You should consult with a tax professional to determine if you need to pay any taxes on the gift.

Q: Do you need to take the car to the DMV to gift it in Kansas?

Yes, you will need to take the car to the DMV to transfer ownership. You will need to bring the car’s title, a bill of sale, and proof of insurance to the DMV. The person receiving the car will also need to provide their identification and proof of insurance.

Once all the necessary documents have been submitted, the DMV will process the transfer of ownership and issue a new title in the name of the person receiving the car.

Q: Do you need to pay taxes when gifting a car in Kansas?

If the person you are gifting the car to is an immediate family member, you will not need to pay any taxes on the gift. However, if the person is not an immediate family member, you may be subject to gift tax. The gift tax rate in Kansas is 5% of the fair market value of the car.

If you are unsure if you need to pay gift tax, you should consult with a tax professional before gifting the car.

Q: Can you gift a car in Kansas if there is a lien on it?

If there is a lien on the car, you cannot gift it until the lien has been paid off. The lienholder will need to release the lien and provide you with a lien release document. Once you have the lien release document, you can transfer ownership of the car to the person you are gifting it to.

If you are unsure about the lien status of the car, you should check with the DMV or the lienholder before gifting the car.

Q: What should you do if you lost the car’s title?

If you have lost the car’s title, you will need to apply for a duplicate title before you can gift the car. You can apply for a duplicate title at the DMV by filling out the necessary paperwork and paying a fee.

Once you have the duplicate title, you can transfer ownership of the car to the person you are gifting it to.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, gifting a car in Kansas is a fairly simple process. However, it is important to keep in mind the limitations on the number of times you can gift a car. As per state law, you are allowed to gift a car to a family member or friend up to two times in a 12-month period without having to pay sales tax. After that, any subsequent gifting will result in sales tax being due.

It is also important to note that proper documentation and paperwork must be completed during the gifting process. This includes filling out a title transfer form and ensuring the new owner is listed on the car’s insurance policy. Failure to complete these steps could lead to legal issues down the line.

Overall, while there are limitations and requirements to gifting a car in Kansas, it can still be a great option for those looking to help out a loved one or friend in need. Just be sure to follow the guidelines and complete all necessary paperwork to avoid any issues in the future.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts