Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you planning to transfer a car as a gift to a family member or friend? If so, you may be wondering what form you need to fill out to make the transfer legal. Don’t worry, you’re not alone! The process of transferring a car title can be confusing, but with the right information, it doesn’t have to be. In this article, we’ll explore the different types of forms you may need to complete when transferring a car as a gift, and what information you’ll need to provide. So, let’s get started and simplify the process for you!

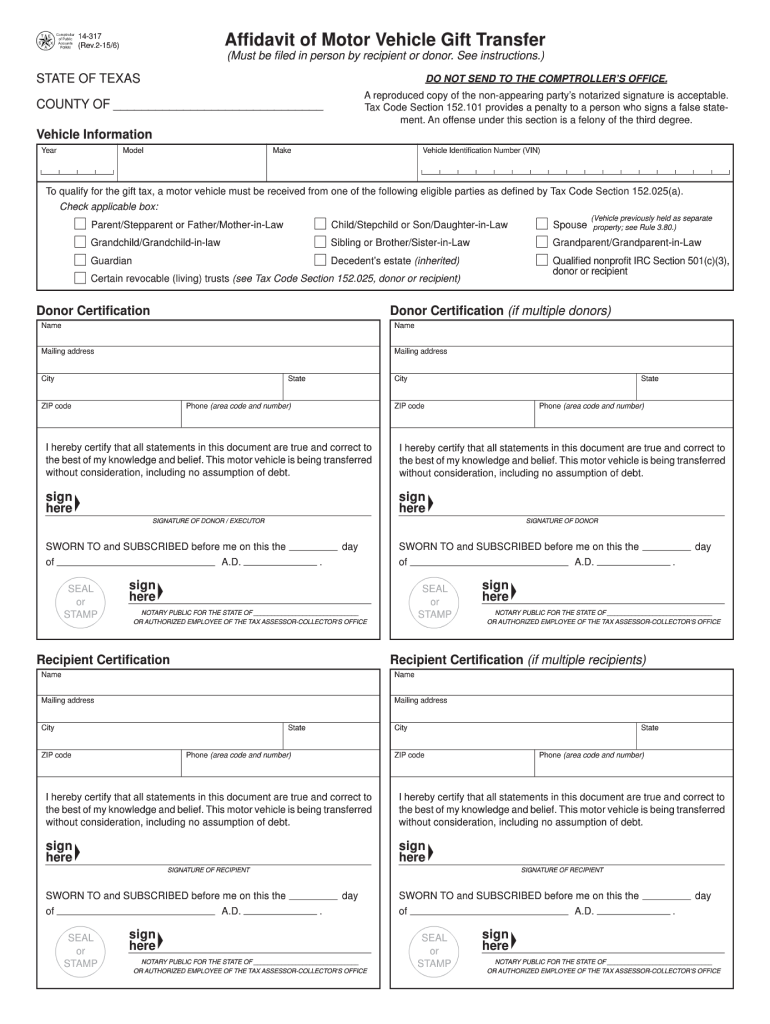

To transfer a car as a gift, you will need to use a title transfer form. Depending on your state, the specific form required may vary. However, most states will require you to complete and submit a gift transfer form, along with the vehicle’s original title, to the Department of Motor Vehicles (DMV). You may also need to pay a gift tax and registration fees. Check with your local DMV for more information.

What Form to Transfer Car for Gift?

If you’ve decided to give your car as a gift to someone, the first thing you need to do is transfer the ownership of the vehicle from your name to the recipient’s name. This process requires you to complete certain forms and submit them to the appropriate authorities. In this article, we’ll discuss the form you need to fill out to transfer a car as a gift.

Form MV-13ST

The form you need to transfer a car as a gift is known as MV-13ST. This form is used to transfer the ownership of a vehicle to another person without exchanging money. It is a simple one-page form that requires you to provide some basic information about the vehicle and the recipient.

The first section of the form asks for the vehicle’s make, model, and year. You also need to provide the vehicle identification number (VIN), which is a unique 17-digit number that identifies the vehicle. If you don’t know the VIN, you can find it on the vehicle registration or insurance documents.

In the second section, you need to provide the recipient’s name, address, and phone number. You also need to indicate the relationship between you and the recipient. For example, if you’re giving the car to your son, you would indicate that he is your child.

Steps to Submit Form MV-13ST

Once you’ve completed the form, you need to submit it to the appropriate authority. The process varies depending on the state where the vehicle is registered. In most states, you need to submit the form to the Department of Motor Vehicles (DMV) or the state’s equivalent agency.

You may also need to provide additional documentation, such as the vehicle’s title or registration, proof of insurance, and a bill of sale. Make sure you check the requirements in your state to ensure you have all the necessary documents.

After you’ve submitted the form and any additional documentation, the DMV will process the transfer of ownership. The recipient will receive a new title in their name, and they will be responsible for registering the vehicle and paying any applicable fees.

Benefits of Transferring a Car as a Gift

Transferring a car as a gift can have several benefits. First and foremost, it’s a great way to show someone that you care about them. It’s also a practical gift that can help someone who needs a car but can’t afford one.

Additionally, transferring a car as a gift can have tax benefits. In many cases, the recipient won’t have to pay sales tax on the value of the vehicle. This can save them hundreds or even thousands of dollars, depending on the value of the car.

Transferring a Car as a Gift vs. Selling a Car

If you’re considering giving your car to someone, you may be wondering whether it’s better to transfer it as a gift or sell it to them. There are several factors to consider when making this decision.

One advantage of transferring a car as a gift is that it can be a tax-free transaction. If you sell the car, the recipient may have to pay sales tax on the value of the vehicle. Additionally, transferring a car as a gift can be a more personal and meaningful gesture than selling it.

On the other hand, selling a car can be a better option if you need the money. If you sell the car, you’ll receive cash that you can use for other expenses. Additionally, selling the car can be a more straightforward process than transferring it as a gift, as there may be fewer forms and requirements involved.

Conclusion

Transferring a car as a gift is a great way to show someone that you care about them. To transfer a car as a gift, you need to complete Form MV-13ST and submit it to the appropriate authority. Make sure you check the requirements in your state to ensure you have all the necessary documents. Transferring a car as a gift can have tax benefits and can be a more personal and meaningful gesture than selling it. However, if you need the money, selling the car may be a better option.

Contents

Frequently Asked Questions

Here are some common questions and answers regarding the transfer of a car as a gift.

What form do I need to transfer a car for a gift?

When gifting a car, you will need to fill out the title transfer section of the car’s title. This will require both the giver and receiver’s information, as well as the vehicle identification number (VIN) and current mileage. You will also need to provide a gift letter stating that the car is being given as a gift, and that no payment is being exchanged.

It is important to note that the requirements for title transfer may vary by state, so be sure to check with your local DMV for specific forms and procedures.

Do I need to pay taxes on a gifted car?

In most cases, you will not need to pay taxes on a gifted car. However, it is important to check with your state’s DMV for any exceptions or specific guidelines. Some states may require that you pay sales tax based on the car’s fair market value, while others may exempt gifts from taxation altogether.

Additionally, if the car is being gifted between family members, there may be additional tax exemptions available. Again, it is best to check with your local DMV or a tax professional for guidance.

Can I gift a car that has a lien on it?

If the car still has a lien on it, you will need to obtain permission from the lienholder to transfer the title to the new owner. The lienholder will need to provide a lien release, which will allow the transfer of ownership to take place. Be sure to check with the lienholder for any specific requirements or procedures.

If the car is being gifted to someone who will be taking over the payments on the loan, it may be possible to transfer the loan to their name as well. However, this will also require approval from the lender.

Do I need to have insurance on a gifted car?

Yes, you will need to have insurance on a gifted car before you can register it in your name. In most cases, the new owner will need to obtain their own insurance policy, as the previous policy may not be transferable. Be sure to shop around and compare rates from different insurance providers before making a decision.

It is also important to note that many states require proof of insurance before you can complete the title transfer process, so be sure to have your insurance policy in place before heading to the DMV.

What is the deadline for transferring a gifted car?

The deadline for transferring a gifted car will vary by state, but it is generally recommended to complete the transfer process as soon as possible. In some states, there may be a specific deadline, such as within 10 days of the sale or transfer of ownership.

It is important to complete the transfer process in a timely manner to avoid any potential issues or complications, such as liability for accidents or parking tickets. Be sure to check with your local DMV for specific guidelines and deadlines.

In conclusion, transferring a car as a gift can be a wonderful gesture, but it’s important to follow the proper procedures to ensure a smooth transfer of ownership. The specific form needed to transfer a car as a gift can vary depending on your state, so it’s important to check with your local DMV or motor vehicle agency to find out which form you need.

Once you have the appropriate form, make sure to fill it out completely and accurately, including all necessary information about the buyer and the seller, as well as the car itself. You’ll also need to provide proof of ownership, such as the car’s title or registration, as well as any other required documents or fees.

By following these steps, you can ensure that the transfer of your car as a gift is legal and hassle-free, allowing you to enjoy the joy of giving and receiving a new vehicle with ease.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts