Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car...Read more

Are you considering gifting a car to someone in Mississippi? Before you do, it’s important to understand the laws and limitations surrounding car gifting in the state. Mississippi has specific rules in place to ensure that the process is legal, safe, and fair for all parties involved. In this article, we’ll explore how many times you can gift a car in Mississippi and what you need to know before doing so.

How Many Times Can You Gift a Car in Mississippi?

In Mississippi, there isn’t a limit on how many times you can gift a car. However, you will need to make sure that the recipient of the vehicle is eligible to receive it. The recipient will need to have a valid driver’s license and insurance coverage, and you’ll need to transfer the title to their name. Additionally, if there’s a lien on the vehicle, you’ll need to get permission from the lienholder before transferring ownership.

Contents

- How Many Times Can You Gift a Car in Mississippi?

- Frequently Asked Questions

- How many times can you gift a car in Mississippi?

- What is the process for gifting a car in Mississippi?

- Do I need to pay taxes on a gifted car in Mississippi?

- Can I gift a car to someone who lives out of state?

- What are the consequences of not properly transferring ownership of a gifted car in Mississippi?

- How To Gift A Vehicle To Someone Without Paying Taxes

How Many Times Can You Gift a Car in Mississippi?

If you’re looking to gift a car in Mississippi, you might be wondering how many times you can do so. The good news is that there is no limit to the number of times you can gift a car in Mississippi. However, there are a few things you should keep in mind before gifting a car.

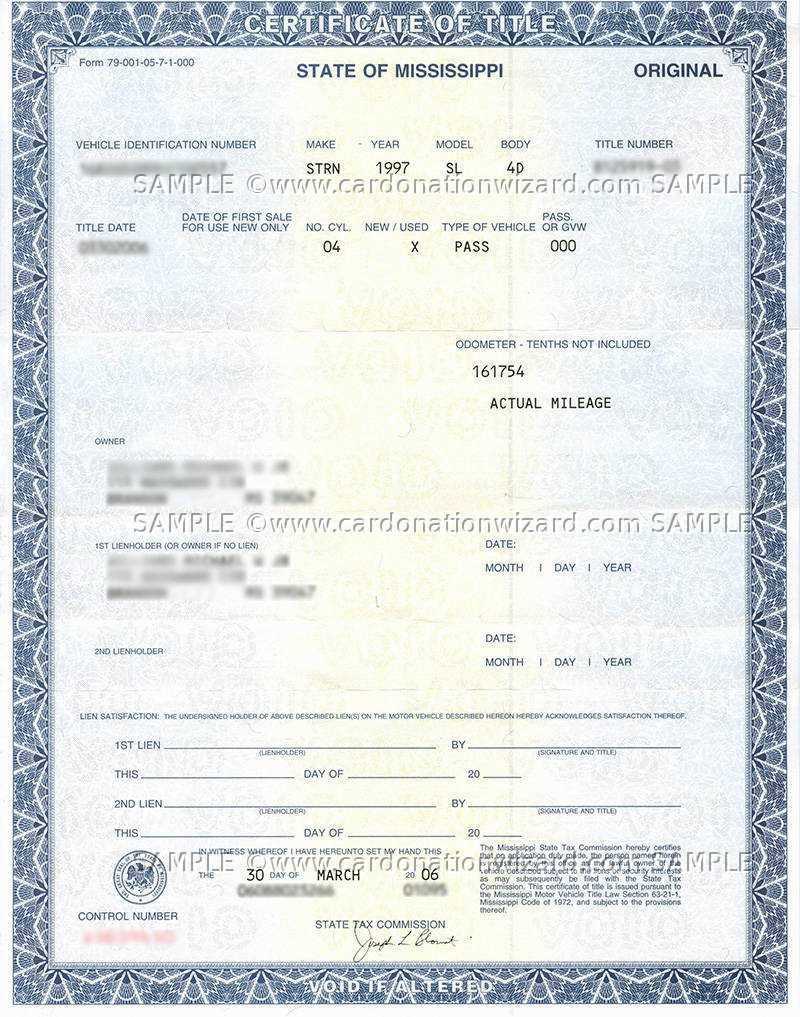

Transferring Ownership of a Car in Mississippi

Before you can gift a car in Mississippi, you need to transfer ownership of the vehicle. This means that the title of the car needs to be transferred from your name to the recipient’s name. To do this, you will need to fill out the transfer section on the back of the title and provide it to the recipient. You will also need to provide a bill of sale, which should include the purchase price of the car.

It’s important to note that if the car is less than 10 years old, the recipient will also need to get a smog check before they can register the car. Additionally, if the recipient is not a family member, they will need to pay sales tax on the car.

Gifting a Car to a Family Member

If you’re gifting a car to a family member in Mississippi, you can do so without paying sales tax. To be considered a family member, the recipient must be your spouse, parent, grandparent, child, grandchild, or sibling.

To gift a car to a family member, you will need to fill out the same transfer section on the back of the title and provide a bill of sale. You will also need to provide a gift affidavit, which can be obtained from the Mississippi Department of Revenue.

Gifting a Car to a Friend or Non-Family Member

If you’re gifting a car to a friend or non-family member in Mississippi, they will need to pay sales tax on the car. To gift a car to a non-family member, you will need to fill out the same transfer section on the back of the title and provide a bill of sale.

It’s important to note that if the car is less than 10 years old, the recipient will also need to get a smog check before they can register the car.

Benefits of Gifting a Car

Gifting a car can be a great way to help out a family member or friend in need. It can also be a way to get rid of a car that you no longer need or want. Additionally, if you gift a car to a family member, you can do so without paying sales tax.

Benefits of Selling a Car

While gifting a car can be a great option, selling a car can also have its benefits. If you sell a car, you can get cash for it, which you can use towards a new car or for other expenses. Additionally, if you sell a car, you don’t have to worry about any of the registration or smog check requirements that come with gifting a car.

Gifting a Car vs Selling a Car

Deciding whether to gift or sell a car can be a tough decision. If you’re gifting a car, you won’t get any money for it, but you can help out a family member or friend in need. If you sell a car, you can get cash for it, but you will need to go through the process of finding a buyer and completing the sale.

Ultimately, the decision of whether to gift or sell a car will depend on your personal situation and preferences.

Conclusion

In Mississippi, there is no limit to the number of times you can gift a car. However, there are requirements that you will need to follow, including transferring ownership of the car and providing a bill of sale. If you’re gifting a car to a family member, you can do so without paying sales tax. If you’re gifting a car to a friend or non-family member, they will need to pay sales tax on the car. Ultimately, the decision of whether to gift or sell a car will depend on your personal situation and preferences.

Frequently Asked Questions

How many times can you gift a car in Mississippi?

In Mississippi, there is no limit to how many times you can gift a car. However, it is important to note that you must follow the proper procedures each time you transfer ownership of a vehicle. This includes properly signing over the title and registering the vehicle with the Mississippi Department of Revenue.

It is also important to keep in mind that if you gift a car to someone who is not a family member, they may be subject to a gift tax. This tax is based on the fair market value of the vehicle and is paid by the recipient of the gift.

What is the process for gifting a car in Mississippi?

To gift a car in Mississippi, the current owner must sign over the title to the recipient. The recipient must then take the signed title to a Mississippi Department of Revenue Office to have it transferred into their name. They will also need to pay any applicable fees and taxes.

It is important to make sure that all information on the title is filled out correctly and that the title is signed and dated by the current owner. Failure to properly transfer ownership can result in legal and financial issues down the line.

Do I need to pay taxes on a gifted car in Mississippi?

If you gift a car to a family member in Mississippi, you are not required to pay any taxes on the transfer. However, if you gift a car to someone who is not a family member, they may be subject to a gift tax based on the fair market value of the vehicle.

It is important to note that the recipient of the gift is responsible for paying any applicable taxes, not the person gifting the car. The recipient will need to provide proof of payment when transferring the title to their name.

Can I gift a car to someone who lives out of state?

Yes, you can gift a car to someone who lives out of state in Mississippi. However, the recipient will need to follow the proper procedures for transferring the title and registering the vehicle in their state of residence.

It is important to check with the recipient’s state of residence to determine their specific requirements for transferring ownership of a vehicle. This may include additional fees and taxes that must be paid.

What are the consequences of not properly transferring ownership of a gifted car in Mississippi?

If you do not properly transfer ownership of a gifted car in Mississippi, you may be held liable for any damages or legal issues that arise with the vehicle. This includes accidents, tickets, and fines.

It is important to make sure that all paperwork is filled out correctly and that the title is properly signed and dated. If you are unsure of the proper procedures for gifting a car in Mississippi, it is recommended that you contact the Mississippi Department of Revenue for guidance.

How To Gift A Vehicle To Someone Without Paying Taxes

In conclusion, the state of Mississippi does not limit the number of times you can gift a car to another person. As long as the proper paperwork is completed and submitted to the Mississippi Department of Revenue, anyone can gift a car to another person as many times as they desire.

It is important to keep in mind that when gifting a car, the new owner will be responsible for registering the vehicle in their name and paying any associated fees. Additionally, it is recommended to have a written agreement between the parties involved to avoid any future misunderstandings.

Overall, gifting a car can be a generous and thoughtful gesture, and Mississippi law does not place any restrictions on how many times it can be done. However, it is essential to follow the proper procedures and document the transfer of ownership to ensure a smooth and legal process.

Rakibul Hasan, the CEO and founder of Autosdonation, is an automotive specialist with over a decade of industry experience. With a distinct mastery in car donations, sponsorships, and gifting, Rakibul combines his passion for automobiles and generosity to revolutionize the car donation landscape. He established Autosdonation to facilitate the car donation and gifting process, making it more accessible and enjoyable for all involved.

More Posts